Average football player salary = $2.1 million per year

Average teacher salary = $39,249 per year

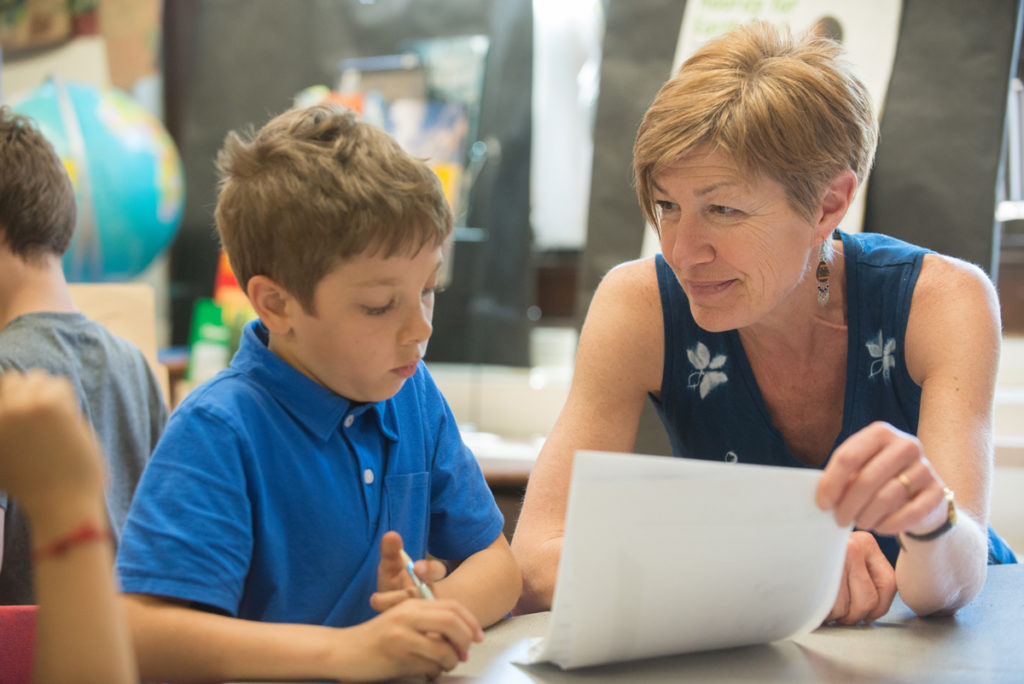

My ma used to be a receptionist (much like your Bourke Accounting narrator), but, as she had always wanted to be a teacher, she earned her degree. When I say that she was good, she was really good. I was envious of her high school students; her projects were creative, she was firm, but fair and she enjoyed her job.

Then, things changed. My ma was no longer able to fail kids who didn’t do the work; she was no longer able to create her own lesson plans. If a kid acted up, there were no repercussions – even if the kid was threatening. Her principal always sided with the parents, especially if they screamed “lawsuit” loud enough. My mom could have taught well for another decade, but she said, “life’s too short” and retired.

Sadly, my mom is not the only teacher chased out of the profession. Thebestschools.org reports that about “one third of teachers quit teaching within three years; around half quit within five years.” So, what seems to be the problem here? As we know, pay has always been an issue for teachers. However, it seems that the problem has gotten worse. For example, “the average pay rate for teachers has actually decreased since 2000 – in some states…by 17 percent” (Swingeducation.com).

A certain governor wanted to cut teacher pensions, implying that educators weren’t very important. However, when teachers went on strike, governor man painted a horrid picture of what most likely befell the children on account of missing teachers. Wait. Teachers keep the wolves at bay, but they’re not worthy of a living wage or retirement? I can’t blame new graduates for not seeking out teaching posts.

Another problem plaguing teachers is unruly kids combined with no disciplinary recourse. Cinque Henderson, former educator and author of Sit Down and Shut Up: How Discipline Can Set Students Free, relates how he was no longer able to send children to the office for bad behavior. Mr. Henderson was reprimanded by his principal when he tried because, “sending students to the office takes away the student’s autonomy” (NYPost.com). Instead, disorderly kids were given the option to “decide when they want[ed] to take a break” (NYPost.com). I hate to say that the inmates are running the asylum, but…

I am not saying parents are bad. I’m not saying kids are bad. I am saying that teachers are responsible for preparing children for the next step in life and should be respected for that. I’m saying that teachers, besides caregivers, are the most influential people to children. Why don’t we start appreciating them like we mean it?

Bourke Accounting specialists love teachers. They know that you guys are teaching their kids not only to read, but that it’s not nice to rub boogers on each other. Just as you are the best at what you do, your Bourke Accounting pros are the best at what they do. Teacher or non-teacher, your Bourke Accounting expert wants to provide you with the best and most accurate service.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon and hug a teacher today!

Written by Sue H.

If you wish to live and thrive, let a spider run alive – Anonymous, English Nursey Rhyme (maybe)

Back in the long ago, before Bourke Accounting, I was an admin in a warehouse. During a meeting, a cockroach appeared on my boss’ desk (PSA: Keep Your Break Room Clean!). Before my boss could crush her, I scooped her up and carried her outside (I know she was a she, I studied entomology).

Yes, I have rocked out to “Sugar Magnolia,” but I’m not a hippie; I simply don’t believe in killing small things because they happen to interrupt a boring meeting.

For a lot of people, swatting a fly or crushing a creepy crawly is almost second nature. Here is a weird and incomprehensible alien creature invading your safe space and it’s frightening! But. Just because you can, does that mean you should?

Before you squish Charlotte, here are a few things to remember:

1) Spiders are good for your home. Spiders are the Vito Corleone of the bug world. Your spider sits there, waiting to make an earwig an offer he can’t refuse. You get rid of that spider and you get rid of your biggest bug hitman. In addition, spiders are not “destructive, do not spread disease [and] do not create allergens” (Jcehrlich.com). Also, scientists are working on using spider venom for “the treatment of conditions such as strokes and Alzheimer’s disease” (Jcehrlich.com). Finally, in a lot of cultures, a spider in your house is a harbinger of good luck. Are you willing to roll them bones by killing a spider?

2) Children learn by watching. If you capture a bug and take it outside, that sends a message to kids that even itty-bitty guys are worth something. Sure, it might be annoying, but you will be teaching your kids, by example, that it’s “important to respect all living creatures” (Sheildmypet.com). Not killing bugs will also teach kids that bullying isn’t a good look – the big should protect the small.

3) Haven’t we done enough to the Earth?! We’re messing up here, guys. Take, for example, the bumblebee. These cute little fuzzy-butted fellas are leaving. According to The Week, we have lost 46% of bumblebees since 1974 (Vol. 20, Issue 964). If you didn’t know, these are some of the most consequential pollinators we have. Obviously, this is caused by climate change and not sociopaths running around gardens with flyswatters (I don’t think), but the same rules apply. As The Week suggests, start planting flowers and leave out “fallen logs to create shade” for our black and yellow pals.

I’m not going to say that every insect is awesome. Yes, mosquitos transmit malaria. It is also true that fleas graced us with the Bubonic Plague. However, humans and our many-legged cohabiters have a lot invested in each other. All I’m asking is that you think before you squish.

You are not a bug. However, crushing debt or issues with the IRS can make you feel that way. If you have a Bourke Accounting professional on your side, you have an ally who will stop anyone who comes at you with a shoe. Your Bourke Accounting specialist will guide you out of any financial Roach Motel you might find yourself in and give you the tools to avoid such situations in the future.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I love spin-offs. As a kid, watching Mork & Mindy, I was taken aback when my dad remarked that Mork from Ork had originally appeared on an episode of Happy Days. At that point, I still wasn’t totally convinced that TV actors weren’t tiny people living inside that box, so the idea that they could go back and forth to other shows was even more astounding.

There are some spin-offs that are useful, although not quite as fun as watching Fonzie save Richie from an Orkan. Take, for example, the way a tax attorney is a spin-off from a tax preparer when a citizen is forced to file for bankruptcy.

Real quick, there are two ways an individual can approach bankruptcy: Chapter 7 and Chapter 13. With Chapter 7, “you either pay for or give up your property for secured debts” (Legalzoom.com). Basically, you liquidate as much of your stuff as possible to pay the debt (Legalzoom.com). Chapter 13 is a payment plan to pay off your debts. The plan “can last up to five years” (Legalzoom.com) and you’d better believe that everyone involved is watching closely to make sure that you keep up with payments.

The relationship between tax preparers and tax attorneys is something that I just learned about the other day: bankruptcy filings increase during, and right after, tax season. According to USAtoday.com, filings “in March were 26% to 34% higher than the monthly average…[and] April’s filings were 15% to 25% higher.” The main reason for the surge is that, after individuals receive their tax refunds, they now have the funds to hire a tax attorney for their bankruptcy cases.

Filing for bankruptcy can be rather expensive, as it turns out. When considering a Chapter 7 bankruptcy filing, individuals can be looking at a charge of around $1,500: filing and fees can amount to about $335, in addition to attorney fees for about $1,200 (USAtoday.com). This news does not help the more than 46% of Americans who “who wouldn’t be able to cover an emergency of $400” (USAtoday.com).

In addition, bankruptcy laws passed in 2005 made things a bit more complex. One change, for example, is that Chapter 7 isn’t as easy for “filers with higher incomes” (Nolo.com) as it used to be. Because of the increased difficulties in bankruptcy filing, “attorney fees for even the simplest type…rose 48% from 2003 to 2009” (USAtoday.com).

But do filers really need a tax attorney? Pretty much. While UScourts.gov supplies resources for individuals filing for themselves, it is “strongly recommended [using a professional] because bankruptcy has long-term financial and legal outcomes.” In addition, UScourts.gov points out that judges and clerks are legally prohibited from holding a filer’s hand. They can’t help if a filer gets confused or has questions.

Bourke Accounting hopes that you never have to file for bankruptcy. However, if you must, make sure that you use the expert tax preparers and bookkeepers at Bourke Accounting. Bourke Accounting can offer guidance to ease you through your tough time. You want your spin-off to be Mork & Mindy, not Joey (remember? The spin-off after Friends? That’s okay, no one else does either).

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Bourke Accounting tax preparers and bookkeepers keep up with the latest tax laws and continuing education. Yes, yes, yes, I’m aware that I’ve told you that many times. However, the further training of Bourke Accounting’s employees doesn’t just apply to management. No, ma’am and no, sir. Bourke Accounting extends the opportunity to all employees to better themselves.

So, last Thursday, I was sent to a 6-hour seminar focused on Social Media. This was important to me because, while I didn’t believe that I was behind the times, I wasn’t exactly walking hand-in-hand with the times.

Enter Raechelle Rae Johnson. Ms. Johnson is the proprietor of Kreative Ink, LLC and an educator for Fred Pryor Seminars. She has blue hair and a laugh that seems to originate from somewhere around the soles of her feet. Ms. Johnson is a Solution Architect. Eh, what’s that title mean again?

A solution architect is “responsible for the design of one or more applications or services within an organization” (Careerexplorer.com). Care for a simpler definition? These folks figure out why you’re not getting business and give you the tools to do something about it. For example, Ms. Johnson started Kreative Ink, LLC in 1999 as a graphic designer and as a side project. She had experienced a change in her domestic life and wanted extra money to keep her child in a good school (conversation, 3/2/20). Because there were a lot of graphic designers out there and she wasn’t interested in solely designing logos, Ms. Johnson changed her emphasis to “visual communication” (conversation, 3/20/20).

While both graphic design and visual communication offer something for the audience to look at, “visual communication is somewhat less concerned with aesthetics, in favor of the communication aspect of the discipline” (Toptal.com). Basically, this is the difference between seeing the Coca-Cola logo by itself on a billboard and seeing the Coca-Cola logo during a fun party scene. Same logo, but one has an enhanced message: Drink Coke and be surrounded by half-dressed people.

As I have learned, we are not living in the 1950s of advertising and business promotion. When I asked Ms. Johnson what the difference was, really, between a magazine ad and a social media ad, she was patient. Besides the expense of production, a business must also get that magazine into the hands of the population. With a social media ad, we’re generally already holding onto the means of communication (conversation, 3/2/20).

We are living in interesting times. We are learning new words and new ways in which to promote ourselves. Small businesses are realizing that, for nominal expense, they can reach more people. More importantly, they can reach a specific set of people who would be more likely to use their services (Pryor Seminar, Johnson, 2/27/20).

Bourke Accounting wants your business to prosper. Besides offering you unparalleled tax preparation and bookkeeping services, they can help you design a budget so that you’ll be able to hire your own Kreative Ink, LLC consultant. While the concept of accounting stays pretty much the same, the rules are changing for everything else – make an appointment with your Bourke Accounting specialist and join us as we walk hand-in-hand with the times.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I can’t wear my favorite shirt to work at Bourke Accounting. It’s a Richard Hell and The Voidoids t-shirt that I acquired about 20 years ago. When I say this shirt is broken in, I mean it’s one step away from being indecent. But I love it. It’s paper thin and as soft as Charmin and, since I gave up stitching the holes years ago, it’s hole-y. It is my favorite shirt.

Obviously, I keep things around for a very long time. I rather assumed that everyone else did, too. So, can you imagine my shock when someone told me about this new trend of renting clothing? I don’t mean renting a tux for a fundraiser or a wedding; these people are renting “everyday clothing, handbags, even [sneakers]” (TheGuardian.com) for a monthly subscription fee.

Clothing rental companies, like Rent the Runway (with a fee of $159 per month) (TheGuardian.com), are becoming popular as more people are attempting to cut down on waste and environmental repercussions. The fashion industry is responsible for “about 10% of global greenhouse gas emissions and consumes more energy than aviation and shipping combined” (LATimes.com). In addition, high end designers don’t want to “dilute [their] garments’ value by allowing discounts” (LATimes.com), so they burn what they don’t sell. Recently, the U.N. reported that “every second, one trash truck’s worth of textiles is either burned or sent to a landfill” (LATimes.com). Sad, right? Not only is it wasteful, it’s not great for the air or water.

Another reason for the rise in clothing rental companies are quickly changing fashion trends. This concept is lost on me, as I pretty much have the same style that I did when I was playing in bands (much to my mother’s chagrin). I just don’t understand the need to keep up with the latest fashion manias. However, as life coach Jane Evans told Euronews.com, the rise of social media has put pressure on people to never wear the same thing twice. Instagram trends like “’Outfit of the Day’ compel young people to be consuming constantly” (Euronews.com). With this in mind, renting 7 or 8 outfits that you’ll never wear again makes more sense than hoarding them in your closet.

Finally, it seems that Millennials are becoming known as “Generation Rent” (Euronews.com). This generation is more apt to rent a home than to buy one and they’re more likely to rent movies rather than invest in the purchase of one. Maybe it’s because of the housing market collapse, maybe it’s because technology, trends and everything else changes second to second. For whatever reason, Millennials don’t tend to have the same ownership desire as other generations.

I don’t want to rent clothes. From all I’ve read, the clothes arrive perfectly cleaned and in brand new shape (because of my insane phobia of bedbugs, this is a plus). And, if you really like an item, there’s the option of buying it for a fraction of the price. Perhaps I don’t like the ephemeral concept of renting clothes. When I go shopping, I look for things that I’ll keep forever.

Bourke Accounting has nothing in common with clothing rentals. Your Bourke Accounting specialist is in it for the long haul with you. While our Bourke Accounting tax preparers and bookkeepers keep up with changing laws and continuing education, flash in the pan trends don’t affect the superb services you’ll receive from your Bourke Accounting professional. Make an appointment today and keep an eye out for my favorite t-shirt (I’ll convince Bill to let me wear it someday).

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

It’s been gloomy in Louisville. So sometimes, after a busy Bourke Accounting tax season day, I go to the tanning salon (I know, I know, it’s not great for me, but I’m not going full-tilt George Hamilton here). The subject of taxes came up while I was speaking with the young woman behind the counter. She was very excited that this was the first year that she had filed by herself, without her parents claiming her. Then she remarked, offhandedly, that her fiancé’s mother claimed her as a dependent on her own return.

Fiancé’s mother, dependent, uh, what? I had a few questions.

Her fiancé’s mother claimed her as a dependent foster child. No, the young woman is not a foster child. No, the young woman has neither lived with nor been supported by the prospective mother-in-law. The young woman explained that, since mother-in-law’s little chicks left the nest, mother-in-law hasn’t been enjoying her tax refunds very much. Hence, mother-in-law got the awesome idea to claim the young woman.

Something is very much amiss. The young woman didn’t know how her mother-in-law obtained her social security number, which, as we know, is needed to claim a dependent. The young woman also didn’t know what sort of evidence mother-in-law could have possibly provided to show that she was a foster parent. Finally, what proof was the tax preparer furnished with that reflected the young woman’s residence in the “foster” home?

Obviously, I am not attempting to disparage another tax preparer. I’ll allow that this particular tax preparer may be guilty of nothing more than honest ignorance and naivete. However, tax preparers have a lot to answer for when it comes to filing your taxes. For example, if your tax preparer (knowingly) files a fraudulent tax return or uses false statements and is found guilty, s/he is subject to a “fine of not more that $100,000, imprisonment…or both” (IRS.gov). Eeek.

As we’ve talked about before, the IRS is closely watching returns with Earned Income Credit and Child Tax Credit. If a tax preparer doesn’t carry out the due diligence required, s/he is in danger of a “penalty of over $500” (Gregorytaxlaw.com) per violation. This could really add up. According to the IRS, “due diligence” pretty much amounts to common sense. For example, if the client’s information “appears to be incorrect, inconsistent or incomplete” (IRS.gov), it is the legal responsibility of the tax preparer to find out what’s going on. Failing that, the tax preparer could have their preparer tax identification number revoked (IRS.gov), which is sort of like disbarment for an attorney.

Thankfully, my tanning salon friend filed her return first and has received her refund. She’ll probably receive a notice from the IRS, but I’m not worried about her. I wonder how mother-in-law will do. Eh, I’m guessing the IRS will be in touch.

I know you guys would never intentionally provide false information to your Bourke Accounting tax preparer or bookkeeper. However, while our Bourke Accounting experts’ first concern is providing you with the best and most accurate service, we should remember that they have a lot riding on this. Our Bourke Accounting specialists have gotten so used to handing out the best financial solutions and advice, there is no way they’d be satisfied (or capable) of doing anything else!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

So, I pitched my Beach Blanket Bingo – Antarctica Edition! teambuilding vacation idea to Bill. He looked at me with an expression that said: did I really hire you? Then, he shook his head slowly, left, right and then left again. He walked away to do something else. Something that didn’t necessitate Annette Funicello, beaches or Antarctica, I’m guessing.

But his completely comprehensible and nonverbal communication got me thinking. Probably like you, I have vague memories of being potty trained. As a kid, when my parents took my brother and I to a new place, I visited the bathroom. Was I avoiding an accident or did I just like checking out new bathrooms? I couldn’t tell you, but I remember doing it. However, while I can sort of remember potty training, I have no recollection of learning that a shake of the head meant “no”. I don’t know how I learned that a nod meant, “yes” or “go on, you’re doing it right.” Do you?

Thanks to pop psychology, we know that if someone is standing with arms crossed, that’s an indication of defensiveness or some sort of discomfort. But how do little kids understand body language before they can even understand Dr. Phil? Universalclass.com suggests that “from the time they are babies, children imitate what you do.” You smile, they smile. Essentially, babies are damp little mirrors. When does the actual understanding come in?

In the 1950s, there was an anthropologist named Ray Birdwhistell. Birdwhistell had a theory that “no more than 30 to 35 percent of the social meaning of a conversation…is carried by the words” (Wikipedia.org). His concept was that most of what we get out of an interaction is gleaned from the way the other person moves. Birdwhistell called his concept “Kinesics” and it is made up of “facial expression, gestures, posture…and visible arm and body movements” (Edge.sagepub.com). Birdwhistell further believed that these movements are as “systemic and socially learned as verbal language” (Edge.sagepub.com). Furthermore, because these “nonverbal signs…are learned” (Edge.sagepub.com) from a very young age, we didn’t even notice that we were learning them.

I have a friend who tells me not to lie to children because children always know. Oh, right, little onesie wearing polygraph machines? Sadly, this is true (and creepy). According to Raisingchildren.net.au, “when your nonverbal communication sends a different message from your words, your child is more likely to believe the nonverbal communication.” This does makes sense, as kids are still part of that visceral, natural world. I have to say, it makes me wholly uncomfortable: you can’t figure out where your head goes when putting on a shirt, but you know I’m lying when I say I believe in Santa? Get outta here…

Final proof that Birdwhistell was on to something regarding body language: text messages. How many times have you had to send an apology text because someone didn’t understand that you were joking? This is a daily occurrence for me. The man knew what he was talking about.

Bourke Accounting professionals are fluent in both verbal and nonverbal language. However, even if our Bourke Accounting experts know you’re uncomfortable about something, they won’t call you out. Bourke Accounting tax preparers and bookkeepers will listen until you’re ready to share. After a few gentle head nods, you’ll know that you’re getting the best (and most welcoming) financial service in the business.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

When I was ten years old, my parents, being very permissive in terms of literature, handed me a copy of Stephen King’s The Stand. I found it absolutely interesting/terrifying that, because of a few wrong moves, the population of this fictional Earth was virtually decimated. Of course, this book focused on supernatural concepts of good vs. evil, but the main storyline was that “the government” created a superbug that took out almost everyone in the world. Cheerful summer reading for a 5th grader, to be sure.

However, thanks to reading this book (and the fatalistic pals I’ve met in the intervening years), I am not scared of the current coronavirus outbreak. Should I be? Meh.

First, what is a coronavirus? Quick answer is that “coronaviruses are a family of hundreds of viruses that can cause fever [and] respiratory problems” (Wired.com). Coronaviruses also come from animals. Considering our coronavirus (Covid-19), “many of those initially infected either worked or frequently shopped in the Huanan seafood wholesale market” (TheGuardian.com). In addition, our current nasty little buddy is “the third in the past three decades to jump from animals to humans” (Wired.com).

I am not downplaying the seriousness of this situation. While numbers change constantly, The Week reported that more than 75,200 people have been infected and 2,006 people have passed away (Vol. 20, Issue 964). Obviously, these are upsetting numbers. What’s even more disturbing are the ridiculous “cures” being promoted on the internet. For example, The Daily Beast reports that some folks are suggesting that consuming cow poop will treat corona. That doesn’t sound right. The Daily Beast also mentions that some are pushing the need to stay away from dogs (as they believe dogs are carriers), gargling salt water and spraying alcohol on your head.

Perhaps the most dangerous remedy comes from America: drinking bleach. There’s a group out there that is encouraging the use of a bleach mixture called “Miracle Mineral Solution” that is meant to cure common colds, HIV and, now, the coronavirus (Thedailybeast.com). It’s bleach, guys, so, no. Don’t do this. Don’t drink bleach. Just…just don’t.

Of course, we should have a healthy fear of new viruses. We don’t know what they do, where they’re going, etc. However, I don’t feel the need to spend that much time stressing over corona. Healthline.com tells us that “if you’re in the US, the odds of getting the virus are almost zero.” I like those odds. Also, as a friend who walked away from 7 significant car wrecks told me: when it’s your time, it’s your time.

Obviously, I’m not saying that you should go lick an airport sink. Certain precautions right now wouldn’t be a bad idea: don’t travel out of the country if you don’t have to, wash your hands, get enough rest. Things we should be doing anyway, in other words. However, we shouldn’t make ourselves crazy until there’s enough evidence that tells us that we should make ourselves crazy. I don’t think we’re living The Stand just yet.

Bourke Accounting professionals won’t advise you to eat cow poop. Your head will not be sprayed with anything when you meet with your Bourke Accounting tax preparer or bookkeeper. Your Bourke Accounting specialist will offer you coffee (maybe Red Bull, if you’re nice to Bill), but we don’t supply bleach. Worry about the things you have control over, like your finances. And face it, if you have a Bourke Accounting expert across the table from you, you won’t even have to worry about that.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Normal is an illusion. What is normal for the spider is chaos for the fly. – Morticia Addams

Are you normal? Am I normal? How do we even know? While my Bourke Accounting employers and co-workers are capable, knowledgeable and efficient (and very cool), I think they’re a pretty weird crew. However, I’m pretty weird, too, so I know whence I speak.

For example, every morning when I get out of the shower, I kiss my fingers and then touch the shower head. Why? I have no idea. I don’t know if I’m thanking the water, the water company or the universe. This is something I’ve done since I was tall enough to reach and I thought this was completely normal. I happened to mention it to someone and she looked at me like I was a full-on psycho.

So, I guess not everyone thanks the water after washing their pits. Good to know.

There are some things we know are kinda out of the norm. For example, if you walk into a friend’s house, find him sitting in the corner, eating flies and repeating the counties of New Jersey in alphabetical order over and over, you might want to have a little sit-down with him (preferably with an interventionist). Most of us have some issue with authority, intimacy, abandonment or public speaking. We’ve all met people who are so defensive that even the most innocuous of comments invokes a vicious response. All of these are the kind of normal weirdness that we’re used to.

But how do you know if you’re normal normal? Scientificamerican.com has a few guidelines to help us. For example, you have a healthy personality if you have “more positive than negative emotions in daily life” (Scientificamerican.com). Negative people are a downer for the rest of us, however, it must be even worse for the negative person. These guys are forced to live in their own little pessimistic and dismal noggins. Of course, they’re sort of depressing, but they still fall within the “normal” spectrum, I think. Another way to tell if you’re normal is if you are able to cultivate a “warm, authentic connection to others” (Scientificamerican.com). In order to accomplish this, one must be empathetic and sympathetic enough to view others as fellow living creatures with emotions and needs. Yup, that sounds about normal to me (although, I’ve admitted that I’m weird, so take my opinion with some salt on top).

The good thing is that the old adage that goes something like, “if you think you’re crazy, you’re not,” is actually true. According to Gerald Goodman, PhD and emeritus professor of psychology at UCLA, “believing that you are going crazy is a good clue that you are sane” (Webmd.com). Dr. Goodman believes that really unbalanced people have no idea that they’ve lost the thread. They simply think that they are the only sane one in a world full of crazy people. Of course, in these chaotic times, it’s easy to decide that we’re going a little squirrely. Because “there is more stress today than in previous generations” (Psychcentral.com), we’re all susceptible to “depression and mood disorders” (Psychcentral.com). This is especially true if you happen to be someone who has a genetic predisposition to these afflictions.

Are you normal? Maybe, maybe not. Your Bourke Accounting professional, as I’ve said, isn’t a shrink. However, if you have a Bourke Accounting expert working for you, you will sleep better, eat better and be kinder to small animals with the knowledge that all of your finances are being well taken care of by the best in the business. Make an appointment and share your weird, little habits with a Bourke Accounting specialist today!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Before starting at Bourke Accounting, I worked with a felon. He shot a guy in the butt with a .22. He maintained that shooting little buddy in the butt was his intention, but I tend to think it wasn’t. He was a good guy, wasn’t any more dangerous than our non-felonious crew and was a seriously hard worker. He was so thankful that he finally got a job that he was willing to go any number of extra miles for us.

It’s mercenary, but his gratitude made him a great employee. It’s not surprising that he was grateful, considering that every year, “650,000 inmates are released from prison [and] a study showed that fewer than 45% were employed after eight months” (Jobsforfelonshub.com). Why employers are a little disinclined to hire felons is also probably not surprising: employers worry that the hiring of felons would “increase the potential risk of crime at work” (Jobsforfelonshub.com) because, they feel, that not all ex-bad guys are really ex. Furthermore, employers are concerned about the rest of their staff and how comfortable they’d be with this new addition to their department.

Our government realizes that the best possible way to avoid recidivism in former offenders is to get them into the workplace and making an honest living. With this in mind, a program called the Work Opportunity Tax Credit has been put in place. This program makes a “federal tax credit available to employers who hire and retain individuals from target groups” (Hiringthing.com) who might have difficulties finding employment. Examples of target groups are veterans, TANF (temporary assistance for needy families) recipients, food stamp receivers and, of course, felons (IRS.gov).

This tax credit allows employers to “earn a tax credit equal to 25% (if the employee works 120 hours) or 40% (if the employee works 400 hours) of a new employee’s first-year wages” (Hiringthing.com). Employers can claim about “$9,600 per employee in tax credits per year…[and] there is no set limit to the number of individuals an employer can hire” (Hiringthing.com).

But does the program work? Since the WOTC is “split between the IRS and state-level labor agencies, no unified dataset exists” (Taxfoundation.org), so the studies are a bit fractured. For example, one study says that the WOTC has “increased employment rates…by around 12.6 percentage points” (Taxfoundation.org). However, another study found no indication that the program had any “positive impact on either employment rates or wages…in the long term” (Taxfoundation.org).

I believe that people deserve second chances. My former co-worker was a dumb kid who found his significant other in a compromising position with a gentleman who was not his own good self. Depending on the odiousness of the offense, though, we sometimes can’t separate the person from the transgression. I say that we hire felons on a person to person basis and go from there.

If you’re considering giving an ex-offender a chance, why not see your Bourke Accounting professional to discuss the possible advantages of such an endeavor? Your Bourke Accounting specialist can lead you through the paperwork and discuss a viable plan of action to get the most out of your good deed in hiring. Just like your Bourke Accounting pro might be your new best friend, your ex-offender employee might be the best and most trustworthy worker you’ve ever had.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.