Bourke Accounting’s Bookkeeper Christina was giving me assignments the other day. After glancing at the clock, which read “11:11,” I knocked wood three times, made a wish and thanked the universe. As my Bourke Accounting co-workers know that I’m superstitious, Christina simply ignored my ritual and carried on.

I never fold sheets indoors. I have never “played” with a Ouija board and I have certainly never repeated “Bloody Mary” in a darkened room. Do I truly believe that Mary is going to reach out and touch me? No, not truly, but why risk it? While I don’t know if I believe in ghosts, I do believe in dignity and respect.

As any newcomer to Kentucky can attest, one of the first things locals like to share is the history of Waverly Hills Sanatorium. According to friends and hokey ghost hunting shows, the former tuberculous hospital is one of the most haunted places on earth. Adding to the already sad history, after being a TB hospital, the space was reincarnated as the Woodhaven Geriatric Center, a nursing home that was closed amid allegations of patient abuse (En.Wikipedia.org). It’s no wonder that with such a storied past, visitors swear that they’ve played ball with a little ghost kid and have seen the specter of a nurse who committed suicide. One friend told me that, after investigating “The Death Tunnel” (an underground walkway employees used to transport supplies and deceased patients), his apartment became so haunted that he was forced to move.

Call it self-preservation or superstition, but humans naturally fear locations where people have died. Whether you believe in an afterlife or not, there is something sobering about standing in the spot where others have breathed their last (of course, it doesn’t hurt that we also enjoy gruesome narratives). However, one of the saddest stories of Waverly is the way it is currently being used.

When Charlie and Tina Mattingly bought the Waverly, they had a notion to turn the space into a hotel and convention center. However, unable to get a loan, the Mattinglys came up with the idea of raising money by opening the space to the public (WDRB.com). For example, for $25, Waverly offers a two-hour paranormal guided tour (TheWaverlyHills.com). But wait, there’s more! For $1,000, visitors can roam freely and even spend the night (Eventbrite.com). And let’s not forget the annual Halloween haunted house! For a nominal fee, peanut-munching, mouth breathers can stomp unceremoniously through a space that should be shown reverence. After demonstrating nothing but disdain for lost lives, don’t forget to stop at the gift shop for a tee-shirt.

It’s not charming when a place of immeasurable heartbreak is used for nothing more than cheap entertainment. What’s next? A Lizzie Borden Bed and Breakfast…oh, never mind, that already exists (and, for $250, you can sleep where a woman was murdered). I’m not suggesting that we should wander in perpetual mourning, but tragic locations shouldn’t be treated as low-rent freak shows, either. We ought to honor our lost with dignity, not insult their memories with fake blood and spectacle.

Showing respect is free; perpetrating the disregard of our fellows actually costs money. The next time you’re touring a “haunted” location, spare a thought for our fallen brothers and sisters. They’re not just fictional characters designed to give us a thrill, they were people.

The Bourke Accounting office is not haunted. Bourke Accounting bookkeepers and tax preparers are so level-headed and focused that it wouldn’t matter if it were. Regardless of what is going on, when you sit down with Bourke Accounting pros, the only thing they care about is giving you the best service in Louisville.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Sarah: That’s not fair!

Jareth, The Goblin King: You say that so often. I wonder what your basis for comparison is.

Labyrinth, 1986

At Bourke Accounting, Bill has a sort of hands-off, trial by fire, mentoring approach. Consistent with this philosophy, he handed me a book chock full of the new tax changes birthed by the Tax Cut and Jobs Act of 2017. While Bill is, no doubt, charmed by my blogging abilities, I believe he is serious in his request that I learn a thing or two about taxation in general. More importantly, I have a suspicion that there will be questions later. So, I am reading The Book and taking notes.

Having worked for accountants in the past, one of my jobs was chasing down people with home offices and employee expenses. I was that chirping nuisance asking for square footage used, percentage of utilities, meals and entertainment, etc. So, imagine my surprise when The Book told me that W-2 employees are no longer able to deduct unreimbursed work-related expenses, including home office expenses, on their returns.

Before the TCJA, besides home office deductions, if employees had expenses in excess of 2% of their adjusted gross income, well, they could just write those right off (Barrons.com). It’s been argued that, since the TCJA increased standard deductions, most people wouldn’t be affected by this change, so it was nothing more than an academic argument anyway. Uh, yeah, sure, that might have been true – at least, before the virus made the scene.

Even with the relaxation of lockdown rules, there are still a lot of people working from home now. Whether commandeering playrooms or kitchen tables, out-of-pocket expenses have been incurred; after all, Special Princess Palace Kingdoms don’t just magically transform into 9-5 professional workspaces. Many employees have had to upgrade internet service, buy chairs that won’t destroy their backs and incidentals like printer ink. Would all these expenses top their standard deduction? Maybe, maybe not, but these employees are still using their own money to outfit a workable, satellite office. The standard deduction is great for a future tax return, but what about right now?

One option for these homebound employees is an accountable plan. With this sort of an agreement, employees can bill employers for their expenses. The employers can then deduct for expenses they pay back to the employees (Investopedia.com). However, there are no federal rules saying a company has to do this, unless these expenses push a “worker’s income to below the minimum wage” (Barrons.com). Another option would be for Congress to allow W-2 employees to specially deduct employee expenses for a limited time, separately and in addition to the standard deduction. It could happen…

The world is more unfair than usual these days and it’s up to the powers that be to do what they can to level the field a bit. Hey, Congress, let’s get creative and funky! As the workers are the economy, there should be incentives and rewards put into play.

With changes coming fast and heavy these days, it’s nice to know that your Bourke Accounting bookkeepers and tax preparers are keeping up. No matter what insane alterations are on the horizon, Bourke Accounting experts will have the answers to all of your questions. It’s probably a sick obsession, but – lucky you – Bourke Accounting specialists live for this stuff.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Driving home from Bourke Accounting, I was stuck behind a bus at a red light. Attorney T.J. Smith looked down on me from the back of the bus, his face determined, but friendly: he wore a tie, so you know he’s a pro. He wasn’t wearing a suit jacket, which means he’s down to earth. He had his shirtsleeves rolled up, so he’s ready to get to work for you. His tag line read, “T.J. Will Make ‘Em Pay,” so you know he’s…vindictive? T.J. Smith rounded the corner to reassuringly stare at someone else.

Not two minutes later, a self-satisfied Attorney Darryl Isaacs inquired, from a billboard, if I have been injured in an accident. If so, I have to call “The Hammer.” Like a threat from an inept Bob the Builder, ol’ Darryl was even awkwardly holding a hammer. This, in turn, reminded me of the Kaufman & Stigger commercial where Attorney Carla Wells Stigger turns into a poorly animated tiger to intimidate an insurance company bad guy.

While the sad production quality is amusing in personal injury advertisements, the inherent aggression contained within is confusing. Can you imagine if the same belligerent nicknames and rhetoric were used in ads for proctologists (if this were the case, I bet ad execs would suggest something along the lines of “The Shovel Will Get it Done”)? I understand that scared and hurt people want a lawyer who is tenacious enough to fight for a fair settlement, but things are getting a little out of control.

Almost every attorney commercial promises that their firm is the toughest on the block; they never quit, they fight for your rights, they’ll get you the money you deserve, yadda, yadda. When law firms aren’t portraying themselves as the Chuck Norris of litigation, they use scare tactics to imply that insurance companies are villains who want to keep us from our rightful money (while they’re laughing at us and smoking big cigars).

Besides the scare tactics and pugnacious guarantees, I think the worst are the actual client testimonials. These come in two flavors: the wired blonde woman and the average Joe who looks like he hasn’t bathed in a week. The wired blonde’s eyes dart wildly as she tells of the hundreds of thousands she won after being hit by a tractor. The unbathed Joe doesn’t seem to know where he is, pauses to stare blankly at the camera and eventually mumbles that he won big. And these were your most palatable clients?

These commercials are undignified. I have nothing but respect for lawyers and the education, time and hard work it takes to become one. However, these ads are akin to Aphrodite dancing at the Bada Bing – purely bad form. Former State Bar President Harvey I. Saferstein was also disgusted when he warned that “too many of the ads give the justice system a wrong image and a bad image” (LATimes.com). He further cautioned that if something wasn’t done to curtail these ludicrous promotions, the public would eventually totally distrust the legal profession (LATimes.com). He’s got a point: if someone introduces her/himself as a personal injury lawyer, a lot of us automatically think, “Ambulance Chaser.”

Everyone’s gotta make a buck. I simply think that a serious and highly regarded occupation should show more decorum across the board regarding advertisement. If you’re a good enough lawyer, you don’t need a penitentiary moniker and bad computer graphics.

Bourke Accounting doesn’t run commercials during The Jerry Springer Show. In fact, Bourke Accounting doesn’t run commercials at all. Our Bourke Accounting bookkeepers and tax preparers know that one happy client is worth 70 catchy jingles. Meet with a Bourke Accounting pro today and see why, even without nicknames and props, our experts are the best in Louisville.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

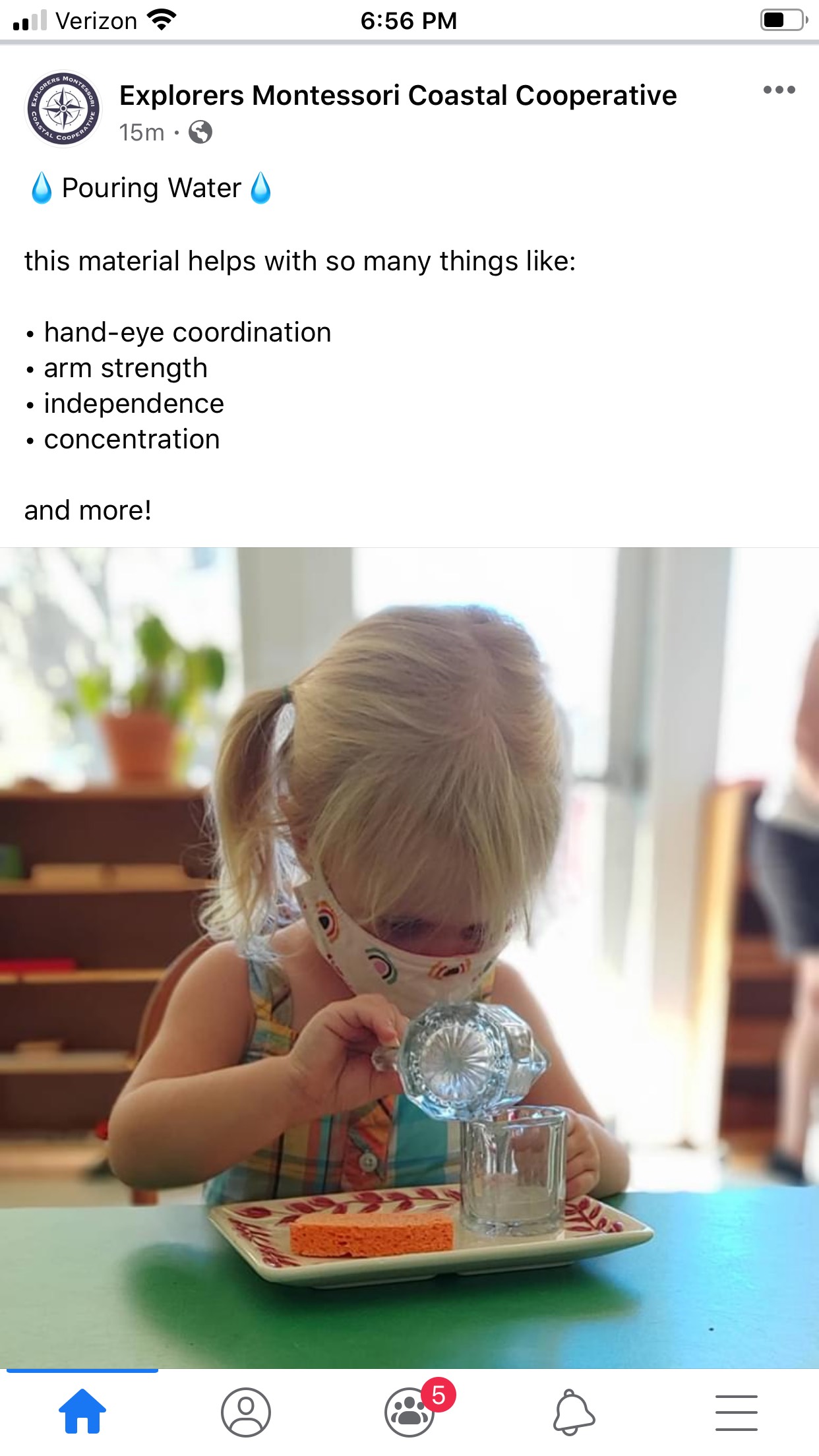

At Bourke Accounting, Bill’s granddaughter started in-person pre-school this week. While I’m leery about school openings, the kid didn’t have a problem with it. Her mother instructed her to keep her mask on all day and showed her the extras packed in her little bookbag. The kid accepted it with a “meh, I guess this is what we’re doing now” mentality. Judging from the picture (above), the child was more interested in her weird water assignment than the implications of masks (I thought she was manufacturing drugs, but Bill says pre-schools don’t engage in child labor).

At Bourke Accounting, Bill’s granddaughter started in-person pre-school this week. While I’m leery about school openings, the kid didn’t have a problem with it. Her mother instructed her to keep her mask on all day and showed her the extras packed in her little bookbag. The kid accepted it with a “meh, I guess this is what we’re doing now” mentality. Judging from the picture (above), the child was more interested in her weird water assignment than the implications of masks (I thought she was manufacturing drugs, but Bill says pre-schools don’t engage in child labor).

Recently, I’ve been hearing stories on the news and from friends about the heavy toll the virus is taking on children. The disruption of normal life has led to an increase in depression, anxiety and behavioral problems among the young. While we can blame coronavirus and lockdowns all day long, the true culprit is us. We, as adults, aren’t holding up our end of things.

Don’t believe me? Stop me when I’m wrong, then: last weekend, a couple beat the holy bejeezus out of a 17-year-old worker at the Sesame Place theme park. This poor kid, an attendant at Captain Cookie’s High C’s Adventure, had his jaw dislocated after telling the couple (for the second time) that they needed to wear masks. Obviously, these people are savages, but the really extra-for-special part was that they assaulted this teenager in front of a lot of kids (NBCNews.com). How can we expect the children to be all right when not even Captain Cookie’s High C’s Adventure is safe?

Kids are still other-worldly enough to tune in to their caregivers’ emotions. When my little cousin was littler, she smacked her head on the concrete. She looked at me to see how she should react. When I told her that she just knocked out how to tie her shoes, she laughed and demonstrated that, no, she had not (I made sure she wasn’t bleeding). While it’s incredibly difficult to remain calm when we don’t know what’s going on or how long it’s going to last, we have to. That’s it. We have to be calm so that we don’t drive these half-baked creatures even more insane.

Another issue that parents and caregivers have to consider is that kids are getting away with murder right now. I hear parents lament that their children are talking back, defiantly disobeying and aren’t keeping up with schoolwork. Instead of repercussions, these kids are given passes, as “they’re going through so much.” Yeah, welcome to life, here’s a shovel. By not holding children accountable for their actions, we’re effectively hamstringing them; the prospective education gap that everyone is worried about will have its origin at home. It’s important to encourage children to talk about what’s making them act like evil monkeys – sensitivity to a kid’s obvious distress is not coddling. However, anxiety is no excuse for kicking a sibling or burning down the neighbor’s house.

Disasters change us. Fear, uncertainty and all the other good things give us the chance to behave like drooling maniacs or like superheroes. Your kid might not remember the cake you bought for her/his 5th birthday party, but I promise, that kid will remember the day you beat down Cookie Monster. Let’s be better.

Bourke Accounting bookkeepers and tax preparers are always calm (Bill isn’t even freaking about his grandkid going to school). Bourke Accounting experts know that if they allow their emotions to run wild, they are absolutely useless to their customers. If you are going through a financial tragedy, your Bourke Accounting specialist is here to solve your problems and alleviate your fears with the peaceful guidance you’ve come to expect.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.