Driving home from Bourke Accounting, I was stuck behind a bus at a red light. Attorney T.J. Smith looked down on me from the back of the bus, his face determined, but friendly: he wore a tie, so you know he’s a pro. He wasn’t wearing a suit jacket, which means he’s down to earth. He had his shirtsleeves rolled up, so he’s ready to get to work for you. His tag line read, “T.J. Will Make ‘Em Pay,” so you know he’s…vindictive? T.J. Smith rounded the corner to reassuringly stare at someone else.

Not two minutes later, a self-satisfied Attorney Darryl Isaacs inquired, from a billboard, if I have been injured in an accident. If so, I have to call “The Hammer.” Like a threat from an inept Bob the Builder, ol’ Darryl was even awkwardly holding a hammer. This, in turn, reminded me of the Kaufman & Stigger commercial where Attorney Carla Wells Stigger turns into a poorly animated tiger to intimidate an insurance company bad guy.

While the sad production quality is amusing in personal injury advertisements, the inherent aggression contained within is confusing. Can you imagine if the same belligerent nicknames and rhetoric were used in ads for proctologists (if this were the case, I bet ad execs would suggest something along the lines of “The Shovel Will Get it Done”)? I understand that scared and hurt people want a lawyer who is tenacious enough to fight for a fair settlement, but things are getting a little out of control.

Almost every attorney commercial promises that their firm is the toughest on the block; they never quit, they fight for your rights, they’ll get you the money you deserve, yadda, yadda. When law firms aren’t portraying themselves as the Chuck Norris of litigation, they use scare tactics to imply that insurance companies are villains who want to keep us from our rightful money (while they’re laughing at us and smoking big cigars).

Besides the scare tactics and pugnacious guarantees, I think the worst are the actual client testimonials. These come in two flavors: the wired blonde woman and the average Joe who looks like he hasn’t bathed in a week. The wired blonde’s eyes dart wildly as she tells of the hundreds of thousands she won after being hit by a tractor. The unbathed Joe doesn’t seem to know where he is, pauses to stare blankly at the camera and eventually mumbles that he won big. And these were your most palatable clients?

These commercials are undignified. I have nothing but respect for lawyers and the education, time and hard work it takes to become one. However, these ads are akin to Aphrodite dancing at the Bada Bing – purely bad form. Former State Bar President Harvey I. Saferstein was also disgusted when he warned that “too many of the ads give the justice system a wrong image and a bad image” (LATimes.com). He further cautioned that if something wasn’t done to curtail these ludicrous promotions, the public would eventually totally distrust the legal profession (LATimes.com). He’s got a point: if someone introduces her/himself as a personal injury lawyer, a lot of us automatically think, “Ambulance Chaser.”

Everyone’s gotta make a buck. I simply think that a serious and highly regarded occupation should show more decorum across the board regarding advertisement. If you’re a good enough lawyer, you don’t need a penitentiary moniker and bad computer graphics.

Bourke Accounting doesn’t run commercials during The Jerry Springer Show. In fact, Bourke Accounting doesn’t run commercials at all. Our Bourke Accounting bookkeepers and tax preparers know that one happy client is worth 70 catchy jingles. Meet with a Bourke Accounting pro today and see why, even without nicknames and props, our experts are the best in Louisville.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

The unofficial motto at Bourke Accounting is “Pay Attention.” While this is true for most companies, it’s really important here, as we’re dealing with your money. If there’s one slip of the keyboard and you receive a letter from the IRS, Bill becomes angry – and just like certain big green superheroes, no one likes Bill very much when he’s angry. So, we pay attention and we double and triple check to make sure that everything is 5 by 5.

Unfortunately, while I’m conscientious at work, it doesn’t carry over to my civilian life. Since I am nothing if not a helpful little monkey, here are a few things that I’ve learned deserve attention:

1) Your pay stub and W-4 allowances. Before Bourke, I worked somewhere else. I filled out my W-4 and, when I filed my tax return the first year, I received my refund. However, by the next year, I ended up owing the IRS a few hundred bucks. It seems that someone had changed my marital status without my permission, which is illegal (unless, that is, the employer receives an official IRS “lock-in letter” requesting a change in allowances). Our corporate HR department skeptically asked if I was sure that I hadn’t gotten married (if I did, it was an unmemorable wedding night), but ultimately denied making the change. While I could have made a stink and written to the IRS, I realized that it was my own fault. Since I received direct deposit and never looked at my pay stub online, I didn’t notice that I was getting a little extra money on my check each week. I learned the hard way that stupid, unexplainable things happen and no one has a lot of sympathy for obliviousness. Don’t be me: check your pay stubs and W-4 regularly.

2) Your bank account and credit report. When my friend tried to pay for his bagel and smokes, he was surprised when his card was declined. He stopped at his bank and, yup, his balance was confirmed at 0 dollars. The representative printed out his statement and questioned why he hadn’t contested the two charges of $1 from the day before. He had no idea what she was talking about, as he never bothered looking at his online bank statement. Scammers never fail to amaze me, they really don’t. A scammer, once they have your information, will “’ping’ the account first, to make sure it’s valid, before making a major purchase with it” (Consumeraffairs.com). While the bank eventually gave him his money back, my friend suffered through 10 lean days and checks his statement daily now.

Regarding credit reports, in my ill-spent youth, it didn’t occur to me to check mine. However, after being denied my first apartment due to credit issues, I looked and found an open credit card balance of $20,000. The credit card had been opened when I was 10 years old and was, obviously, not mine. I had to send copies of my birth certificate, along with a slew of forms in triplicate, to the credit card company and it still took a year for the charge to get off my report. Now, I check my report regularly with a site online (there are many that are free now and don’t affect credit scores) and so far, so good, knock wood, I haven’t had an issue since.

Have you noticed that the world doesn’t gently hold your hand while guiding you away from trouble? I have. Human and computer glitches happen, scammers happen. However, if we’re not vigilant, an inconvenience has the potential of turning into something worse. Pay attention, friends and neighbors.

Bourke Accounting experts pay attention, and not just to avoid the Wrath of Bill; Bourke Accounting bookkeepers and tax preparers want to make your life easier. Bourke Accounting pros want you to trust that you are receiving quality and accurate work every single time you walk through the door. Bourke Accounting pays attention so you don’t have to (but, yeah, you should really keep an eye on what’s going on, too).

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

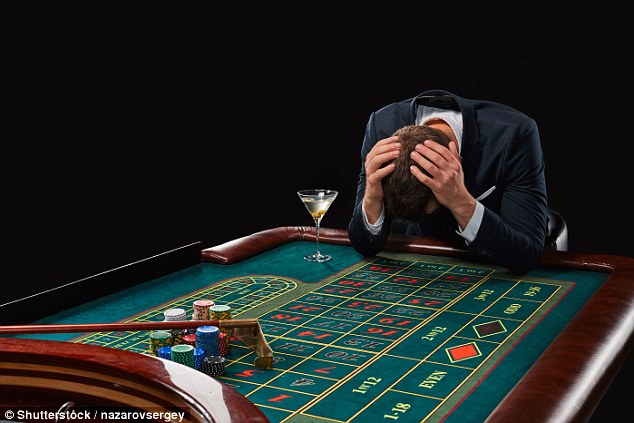

Randomly, someone will ask for my Facebook username. When I respond that I’m not on Facebook, I am met with a look that suggests that I might be a visitor from another dimension. Likewise, people find it odd that I work for Bourke Accounting and distrust the stock market. To me, there is no difference between high stakes Vegas roulette and stock trading. Even if you know a company and have tracked its progress for years, it’s still a gamble; all it takes is a CEO’s indictment or a natural disaster and the stock is worthless.

Much like my distaste for Facebook (and the broken relationships and altercations caused by the platform), I realize that my avoidance of the stock market isn’t completely logical. Generally, if you know what you’re doing, have a good financial professional in your corner and don’t do anything too risky, it’s possible to create an impressive portfolio. However, that important detail of understanding what stock trading entails is ignored by some new investors.

Studies have discovered that Millennials have gotten involved in the market in a big way, with nearly seven in ten currently invested in something (NYPost.com). While it’s great that this generation is planning ahead, it doesn’t always end with young investors sailing off into the sunset on a brand-new yacht.

On June 12th, the parents of 20-year old Alexander Kearns found a post-it note inviting them to turn on his computer. On the computer, they found a suicide note. Kearns had been using Robinhood, a trading app, and, when he saw a negative cash balance of $730,165 (CNBC.com), he did something very rash. In his note, Kearns questioned why Robinhood would allow a kid with no income to become so heavily in debt. Kearns also admitted that he had no idea what he was doing (Businessinsider.com). To make a tragic story worse, Kearns didn’t understand what he was looking at. While Robinhood can’t give the details of Kearns’ account, he didn’t owe almost a million dollars; his balance was “due to complex options trades,” which would have settled over the following days, but left a temporary balance in the meantime (Businessinsider.com).

Kearns’ family has vilified Robinhood for not offering an explanation or customer service options when Kearns received the negative balance notification (Businessinsider.com). In addition, Robinhood has been accused of making an app that resembles a video game as opposed to a stock trading tool with real-life repercussions. For example, every time a trade is completed, users get a little party, complete with confetti shooting all over (Kiplinger.com). Regarding customer service, users say that they’ve waited weeks for an answer in the Help section, it’s nearly impossible to get a person on the phone and emails go unanswered (Businessinsider.com). While a seasoned trader could probably get by with this level of customer service, rookies like Kearns are left to flounder in the dark.

People shouldn’t expect to get rich overnight with the stock market. People should also know the very real risks associated with trading. Finally, new traders shouldn’t try to learn by trial and error – it never hurts to contact a professional with any problems. Perhaps the most disturbing factor of Alexander Kearns’ story is that, had he just asked questions, he wouldn’t be a cautionary tale now.

Bourke Accounting experts are no strangers to the stock exchange. While Bourke Accounting pros aren’t stockbrokers, they can explain the terms and implications to those just starting to invest. In addition, your Bourke Accounting tax preparer can help you to choose the right investment product for your unique situation. And, no matter what, remember that you’re a lot more important than the numeric value on your bank statement.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

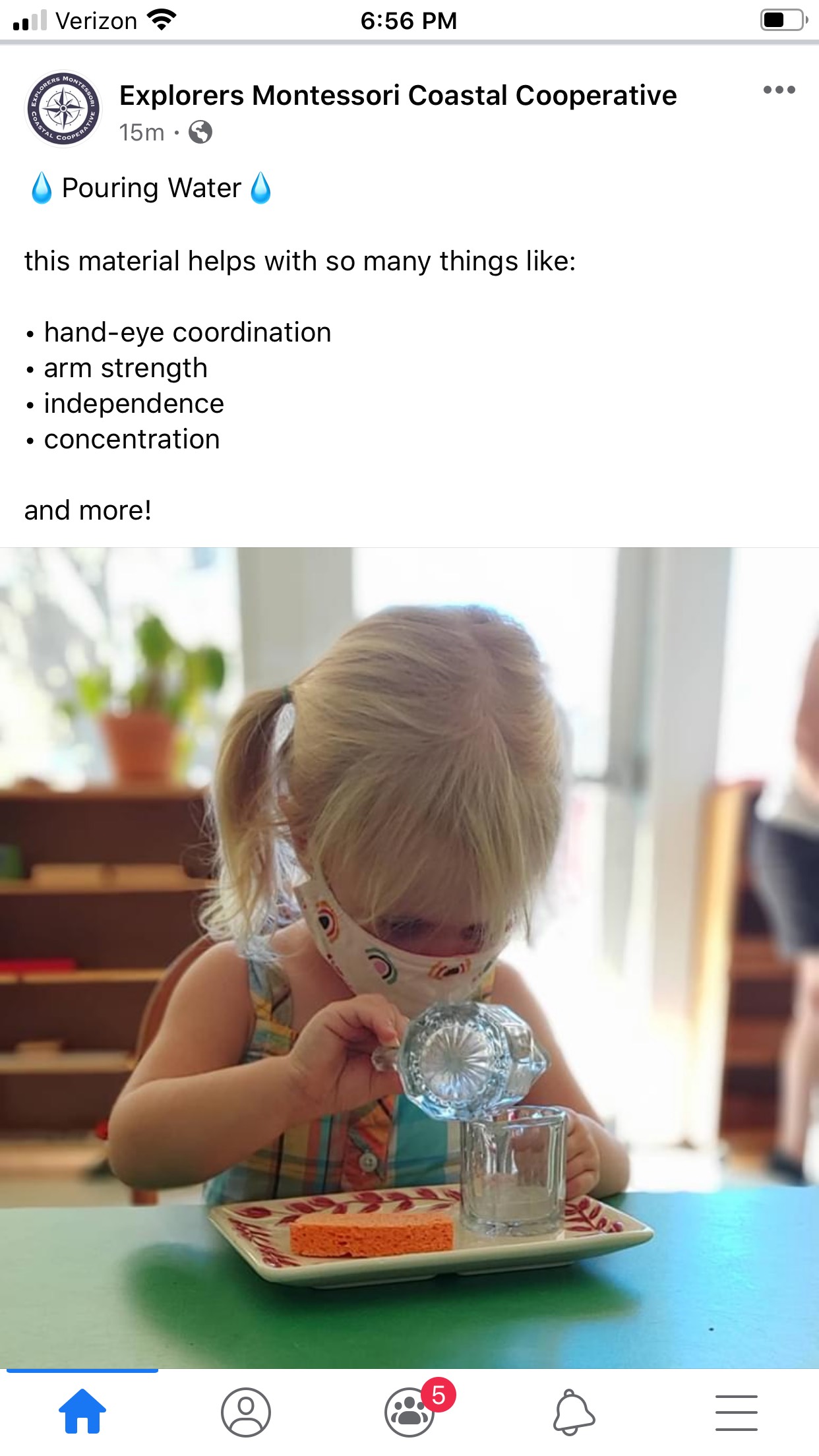

At Bourke Accounting, Bill’s granddaughter started in-person pre-school this week. While I’m leery about school openings, the kid didn’t have a problem with it. Her mother instructed her to keep her mask on all day and showed her the extras packed in her little bookbag. The kid accepted it with a “meh, I guess this is what we’re doing now” mentality. Judging from the picture (above), the child was more interested in her weird water assignment than the implications of masks (I thought she was manufacturing drugs, but Bill says pre-schools don’t engage in child labor).

At Bourke Accounting, Bill’s granddaughter started in-person pre-school this week. While I’m leery about school openings, the kid didn’t have a problem with it. Her mother instructed her to keep her mask on all day and showed her the extras packed in her little bookbag. The kid accepted it with a “meh, I guess this is what we’re doing now” mentality. Judging from the picture (above), the child was more interested in her weird water assignment than the implications of masks (I thought she was manufacturing drugs, but Bill says pre-schools don’t engage in child labor).

Recently, I’ve been hearing stories on the news and from friends about the heavy toll the virus is taking on children. The disruption of normal life has led to an increase in depression, anxiety and behavioral problems among the young. While we can blame coronavirus and lockdowns all day long, the true culprit is us. We, as adults, aren’t holding up our end of things.

Don’t believe me? Stop me when I’m wrong, then: last weekend, a couple beat the holy bejeezus out of a 17-year-old worker at the Sesame Place theme park. This poor kid, an attendant at Captain Cookie’s High C’s Adventure, had his jaw dislocated after telling the couple (for the second time) that they needed to wear masks. Obviously, these people are savages, but the really extra-for-special part was that they assaulted this teenager in front of a lot of kids (NBCNews.com). How can we expect the children to be all right when not even Captain Cookie’s High C’s Adventure is safe?

Kids are still other-worldly enough to tune in to their caregivers’ emotions. When my little cousin was littler, she smacked her head on the concrete. She looked at me to see how she should react. When I told her that she just knocked out how to tie her shoes, she laughed and demonstrated that, no, she had not (I made sure she wasn’t bleeding). While it’s incredibly difficult to remain calm when we don’t know what’s going on or how long it’s going to last, we have to. That’s it. We have to be calm so that we don’t drive these half-baked creatures even more insane.

Another issue that parents and caregivers have to consider is that kids are getting away with murder right now. I hear parents lament that their children are talking back, defiantly disobeying and aren’t keeping up with schoolwork. Instead of repercussions, these kids are given passes, as “they’re going through so much.” Yeah, welcome to life, here’s a shovel. By not holding children accountable for their actions, we’re effectively hamstringing them; the prospective education gap that everyone is worried about will have its origin at home. It’s important to encourage children to talk about what’s making them act like evil monkeys – sensitivity to a kid’s obvious distress is not coddling. However, anxiety is no excuse for kicking a sibling or burning down the neighbor’s house.

Disasters change us. Fear, uncertainty and all the other good things give us the chance to behave like drooling maniacs or like superheroes. Your kid might not remember the cake you bought for her/his 5th birthday party, but I promise, that kid will remember the day you beat down Cookie Monster. Let’s be better.

Bourke Accounting bookkeepers and tax preparers are always calm (Bill isn’t even freaking about his grandkid going to school). Bourke Accounting experts know that if they allow their emotions to run wild, they are absolutely useless to their customers. If you are going through a financial tragedy, your Bourke Accounting specialist is here to solve your problems and alleviate your fears with the peaceful guidance you’ve come to expect.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

On July 17, I wrote a Bourke Accounting blog about Kanye West and his interesting bid for the presidency. On July 19, West held a campaign rally in South Carolina, where he unveiled equally interesting concepts. While he has more records, companies and money than most of us, West is basically a civilian with no lawmaking experience or ability. So, when West suggested that “everybody that [sic] has a baby gets a million dollars” (ABCNews.go.com), I realized that I, too, have some great ideas for the country!

Last year, the average tax refund for someone with children was around $3,000 (CNBC.com). While I realize that kids are expensive, it occurred to me that childless Americans should be given a little monetary pat on the back for not having kids. Here is my plan:

1) $3,000 – Reduced Resource Use Refund (RRUR). This refund would recognize childless people’s mitigation of their bloodline’s carbon footprint. For example, every year, 20 billion disposable diapers end up in landfills, “creating about 3.5 million tons of waste” (PRNewswire.com). Besides the waste, about 200,000 trees are used to make all of these diapers (PRNewswire.com). Since a family of five logically creates more trash and consumes more water, space and food, child-free Americans should be rewarded for having cut down their consumption of resources.

2) $2,500 – Public Nuisance Compensation (PNC). This amount would be used as remuneration for childless persons walking into elevators after giggling 7-year-olds have pressed every button. This is also to be used as acknowledgement for tantrums thrown by irritable kids at the next table during romantic dinners. For back of airplane seat kicking, see Subsection 8, Paragraph 4, Jarring and Unexpected Motion Compensation. NOTE: PNC is contingent on the behavior of the childless individual. No monies will be disbursed should the individual in question retaliate/yell/throw items. Eye-rolling and muttering will be allowable within reason (however, the use of obscenities is prohibited).

3) School Tax increase. A 5% school tax increase will be implemented to be paid by all citizens (with or without kids). Since the little ankle biters are the future of our world, they should be supplied with as many advantages as possible. This is nonnegotiable.

4) $1,500 – Impulse Buy Encouragement (IBE). It is well-known that baby-less people spend more money on stupid and expensive things. In addition, the childless spend about 75% more than their child-full counterparts on an average night on the town (statistic may have been fabricated). This money is in appreciation of childless Americans singlehandedly saving the economy by commissioning multiple oil paintings of cats/dogs/guinea pigs.

So, there you have it. Now, I’m not saying that I’m going to run for president, but with ideas like the above, I’d be the one to watch. Our country is being built on innovative ideas and good, solid social change. With me in the White House, we would definitely be guaranteed some interesting times. Vote for Sue in ’32!

You can bet that Bourke Accounting will be the most well-versed in the new tax laws when my ideas come to fruition. Until that time, Bourke Accounting experts have to content themselves with knowing all of the deductions and quickly changing regulations available now. Bourke Accounting specialists don’t miss much and are more than ready to explain tax incentives you might be eligible to receive.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

A friend of a friend called the other day after learning that I work for Bourke Accounting. She wanted to know why she only received $1,200 as her stimulus payment and not $2,400. As a single mother of a 25-year-old son (with a family of his own), Facebook told her that she’s entitled to double the money. She didn’t believe me when I told her that this simply wasn’t the case. I invited her to visit IRS.gov for information. She snorted, said, “Who believes the IRS?” and hung up. Rude.

I trust the IRS website more than Facebook, but I, too, have been guilty of believing rumors. For example, when I was a kid, my friends and I heard we shouldn’t drink Snapple because the company was owned by the Ku Klux Klan. Need proof? Look at that little “K” in the circle on the label! When I admonished a friend for drinking the stuff, she stared at me like I was a mentally damaged puppy and carefully (and slowly) explained what that little “K” actually meant. You know that subtle and awful symbol of hate? Yeah, well, it actually means that Snapple is kosher. I like the Peach Tea.

While the rumor mill didn’t topple Snapple, the same sort of smear campaign almost destroyed Brooklyn Bottling in 1991. Eric Miller, who inherited the small company from his father, decided that the only way to compete with the Big Cola Boys was to offer a good, cheaper priced drink. So, Miller created Tropical Fantasy, increased the bottle size to 20 ounces and sold the stuff for the low, low price of 49 cents. Within a few months, this barely known company enjoyed a 50% rise in sales and netted 12 million dollars (LATimes.com).

Things were going great! That is, until the pamphlets started mysteriously showing up all over New York City. These pamphlets advised consumers in lower income areas that Tropical Fantasy was manufactured by the KKK and included “stimulants to sterilize” minorities (Snopes.com). In no time, sales plummeted by 70%, delivery vans were attacked, stores that carried Tropical Fantasy were vandalized and store owners were brutalized (Snopes.com). The rumor was so widely believed that one of the leaders of the KKK told a magazine that they were “not in the bottling business” (LATimes.com). As an aside and answer for anyone wanting to know who could possibly believe a random flyer: The Tuskegee Study was a real thing.

Eric Miller was mad. He hired a private investigator to find out where the rumor came from. No dice. He gave Tropical Fantasy to the FDA for testing; when they released their findings that Tropical Fantasy was safe, people still weren’t buying. Finally, Mayor David Dinkins, NYC’s first Black mayor, drank a bottle on television (Newsone.com) and the company rebounded. Dinkins, a respected and trusted figure, saved Tropical Fantasy with 20 ounces.

So where did this rumor start? Pepsi and Coke denied any involvement. Social psychologists maintain that not only had they never heard of a “commercial rumor being started by a competitor,” but that the repercussions wouldn’t be worth it if it were ever discovered (LATimes.com). Miller finally conceded that it may have been started by a disgruntled ex-employee (Snopes.com). That is some nuclear revenge and I never want to be on the wrong side of that guy.

It’s very important not to believe everything we hear. If we happen to hear something that’s totally Crazy Town, it also very important to talk to professionals to learn the facts. Let’s face it, most of us would not be described as the leading minds of the world, so talk to the people who are.

Bourke Accounting doesn’t start rumors about our competitors. At Bourke Accounting, our experts want you to know how great they are the old-fashioned way: by showing you. So, the next time you hear a too good to be true financial rumor, pop open a Tropical Fantasy Cherry Blue Lemonade and call your knowledgeable Bourke Accounting tax preparer or bookkeeper.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

At Bourke Accounting, we’re allowed to have personal items on our desks. Pictures of family, funky bits of art, flowers – as long as it’s not offensive, it’s permitted. However, we are not allowed clutter; if a worker’s “World’s Best Mom” mug collection is stacked three deep on her desk with more on the floor, Bill is going to schedule a little talk.

I see his point. Obviously, an organized space makes finding important documents easy and leads to greater productivity. As we are not hoarders at Bourke, we’re not included in the five to 14 million Americans who are (ScientificAmerican.com). Because of reality television shows, most people know what it means to be a hoarder. Just in case, a hoarder is a person who fills up her/his house with – what appears to be – junk. Most of those afflicted have suffered some sort of traumatic experience or varying degrees of abandonment. They find comfort in being surrounded by stuff.

Most of the time, hoarders keep pretty innocuous things: too many pictures of clowns or angel figurines. However, sometimes the hoarder keeps dangerous weirdness. For example, in 2013, a woman was found to have 67 dead cats in her freezer and 100 live ones in crates crammed to the ceiling (NYDailyNews.com). She wasn’t an evil animal abuser; she was simply very damaged and did not realize the harm she was causing these creatures.

While not all of us hoard physical items, a lot of us are mental hoarders. Some of us take old memories out of the closet to examine over and over. Just like physical hoarders, some of these ancient things are harmless and some are insanely detrimental. Not opening an umbrella indoors because your grandma said it was bad luck doesn’t affect your life (and might save a vase by the door). However, it’s when we relive negative experiences that we hurt ourselves. Remembering harsh words screamed by a friend or berating ourselves for losing the love of our life is not at all beneficial unless we learned something from it. If we simply relive a very bad memory thoughtlessly and automatically, we will never find happiness.

These negative thoughts are especially true when considering self-esteem. The things that are said to us as children stick. While we might be the most capable person in the world, some of us cling so desperately to damaging assessments given to us while young that we constantly doubt ourselves.

Right now, it’s very apparent that our mental hoarding is doing damage. For instance, I know someone who doesn’t like a particular group of people. He has never had any disastrous dealings with said group, yet he still feels that they’re vaguely out to get him and, somehow, beneath him. Wouldn’t you know it? His father was part of a club that enjoyed wearing pointy hats and dresses at night. While this man, logically, knows that we’re all the same, he still can’t totally clean out the mental storage unit that was filled by his father. We have to be better.

So how do we avoid cutting ourselves on the broken glass of bad memories and early indoctrination? Think of a pink elephant. The next time you’re remembering something that you wish you could throw away, think of a pink elephant. If it’s a seriously terrible memory, put some glitter on that beast. You lived the experience and you examined the memory endlessly. Now it’s time to call 1-800-GOTJUNK and get rid of it.

Besides continuing education lessons, Bourke Accounting experts don’t hoard memories. You won’t be tortured with reminders of past financial missteps by your Bourke Accounting expert. Bourke Accounting bookkeepers and tax preparers understand that every day is a new day and there’s no percentage in living in the past.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

At this point, we know that the IRS is back to work. We also know that, after a scathing report by the TIGTA regarding the IRS’ negligence in auditing the super-wealthy, the IRS is here to crack some well-heeled skulls. Well, the TIGTA wasn’t quite done with the mathematically inclined – off-the-rack – suits. It seems that the TIGTA has a big issue with the IRS’ handling of marijuana dispensaries.

Whether you think marijuana is the Devil’s lettuce or God’s most generous gift, it can’t be argued that there’s a lot of money involved surrounding the blameless little herb; in 2017, $4.7 billion was collected in Federal taxes from 29 states (QZ.com). That seems like a nice chunk of Chronic change, so what problem could the TIGTA possibly have?

The TIGTA doesn’t think that the IRS is giving enough guidance to Mary Jane manufacturers. The TIGTA’s biggest complaint is that the IRS isn’t explaining Section 280E of the tax code properly. Section 280E was introduced in the 1980s “as a way to block cartel kingpins from writing off yachts and fancy cars” (Marijuanamoment.net). This section says that businesses are not eligible for most tax deductions if they make their money from a drug that falls under Schedule I, which weed does (Marijuanamoment.net). As an aside, marijuana and heroin are in the same category. Really. Now, 280E makes sense when dealing with kingpins, but state-legal dispensaries, while reporting all of their income, aren’t allowed to deduct rent, wages and the normal expenses that come with a brick and mortar shop (Wecannca.com). Since the indica industry can’t deduct, this means that their tax rate is somewhere near 70 percent (Marijuanamoment.net).

The fact that sativa stores can’t use banks also has the TIGTA demanding assistance from the IRS. Since marijuana is still considered naughty under Federal law, “banks risk charges of aiding and abetting a federal crime or money laundering” (Publicfindlaw.com) if they decide to work with dispensaries. Because of this, it’s almost a completely cash industry. Incidentally, since these businesses have to pay taxes in cash, the IRS has had to build “cash rooms” to hold these payments (Marijuanamoment.com). While the IRS demands total transparency from dispensaries, a lot of mistakes can happen when dealing strictly with cash. At this point, the IRS is offering no education regarding how to keep things legal in a folding money world.

When the TIGTA recommended that the IRS work with the Small Business commissioner to “develop…specific guidance…for taxpayers that report Schedule I related activities” (Marijuanamoment.net), the IRS said, “Nah, we’re not gonna do that.” The IRS disagreed with the suggestion and said it had other priorities that needed to be addressed before “developing that specific guidance” (Marijuanamoment.net). I don’t blame the TIGTA for getting a bit snarky. Every agency wants every business to follow the law, but that’s sort of hard for taxpayers when they don’t know what’s required.

Quasi-legal weed is still in its infancy and there are bound to be some problems. Section 280E should be abolished to allow dispensaries to act as any other corporations. Barring that, the IRS owes it to these very lucrative cash cows to at least provide the rule book.

Bourke Accounting bookkeepers and tax preparers know all about small business and self-employment. While weed isn’t legal in KY yet, just like with all new changes, your Bourke Accounting pros already know the rules to keep you in compliance. Whether it’s new standard deductions or reefer returns, your Bourke Accounting specialists never stop learning for you.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

The Bourke Accounting Book Club is back in session with JD Salinger’s Franny and Zooey keeping us company. JD is my favorite nonprolific reclusive writer of all time, so I’m digging it. Yesterday, we delved into the subtleties of literature over Panera Bread. My co-workers ate salads ladened with mysterious fruits and little-known vegetables as I left buttery fingerprints from my Classic Grilled Cheese (with extra cheese) on my book. While my co-workers argued points of dialogue, I thought about malnutrition.

When we think about malnutrition, we generally think of faraway countries and pallid Oliver Twist extras, begging in the streets for a shilling. We think of the 37 million Americans who aren’t getting enough to eat as a result of limited money and inaccessibility to food banks. At the grocery store, we don’t label a well-appointed, fit young person or a larger store clerk as people suffering from malnutrition. However, as obesity and lower-nutritional food choices become ever more rampant in this country, we’re embarking on yet another crisis.

Just like you can’t judge a book by its cover, you can’t judge a malnourished person by a waistline. If you’ll remember 8th grade health class, malnutrition means that not enough of the right foods are eaten (we had the food pyramid, but I think they use a plate graphic these days). As of right now, 85% of Americans aren’t getting the proper, FDA recommended, vitamins and minerals from food for healthy living (TheGuardian.com). In addition, vast amounts of children are suffering from “hidden hunger,” or micronutrient deficiency, which means that the foods they are eating “are calorie dense, but nutritionally poor” (TheGuardian.com). As a kid, I was told that if I didn’t finish my vegetables, I wouldn’t grow up to be big and strong – what are these kids being told?

Besides causing us to look like a Dickens’ refugee, malnutrition does incredible internal damage. By simply eating the wrong things, we are afflicted with tiredness, inability to concentrate, depression, immune system problems and, eventually, difficulty breathing and heart failure (Medicalnewstoday.com). As issues create a sicker, weaker population, it affects the US economy, as well. The productivity of malnourished workers isn’t as high as nourished ones and sick workers don’t go to work. Also, undernourished folks cost the country $157 billion per year in medical expenses (Mediaroom.com). While it won’t kill us to eat a carrot, not eating one could.

With our busy lives and bizarre new world, we want comfort. Unfortunately, this desire for comfort doesn’t end with a fluffy sweater. Research has shown that “70% of fast food meals consumed in the US are of poor nutritional value” (USNews.com). Since almost half of all Americans eat fast food every day (USNews.com), we are paying for the privilege of being poisoned. People say that eating healthy is too expensive. That’s true. A Harvard study has discovered that healthy meals cost $1.50 more a day than fast food (HSPH.Harvard.edu). But what about the hours needed to cook healthy, cheap meals at home? I Goggled cheap, healthy, fast meals and found 643,000,000 entries in .59 seconds. I think it’s possible to avoid McDonald’s, I really do.

We aren’t good for anything if we’re not good to ourselves. Our mental and physical health are being damaged by the plastic foods we’re ingesting. It’s time to put down the spork and pick up real food.

Bourke Accounting bookkeepers and tax preparers know that they can’t meet your needs with clogged arteries. Bourke Accounting pros also know that their cognitive abilities are lessened with a brain full of additives. Sit down with a Bourke Accounting expert and see how their clean living can benefit you. Also, they’re not shy about sharing their secret, healthy recipes!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I’m no fortunate one or anything like that, but my parents sent me to horseback riding summer camp when I was younger. Their thinking was that I could either waste a few months with the pyromaniac kid down the street or learn to ride at a working farm. After all, the prospect of a broken leg was way more attractive than juvie and a mark on my permanent record.

Horseracing in general – the Kentucky Derby in particular – has seen a fair share of controversy over the years. While I understand that abuses occur, I would be lying if I said that I never feel a jolt of excitement when the horses take off. Unexpectedly missing the Derby, I’ve been thinking about horses and what we can learn from working with them:

1. It’s all right to let go sometimes. Before I even sat on a horse, it was heavily emphasized that a horse is not a car. Horses have bad days, horses can be moody and, above all, horses are living creatures who must be treated with respect. While it’s the rider’s job to exert a certain amount of control, there is nothing wrong with allowing the horse to have her/his way, too. After a trek through the woods, if a horse wants to stop and have a drink or chew on the undergrowth, the rider should allow it. Just like non-riding life, not everything revolves around our own desires; those around us have needs, too. Sometimes, let the horse lead and remember that every relationship is give and take.

2. Don’t get mad at the world for being the world. I rode a horse named English Dolly for years. She could be violent and she could be vicious, but once we figured each other out, we got along great. I was warned that, while saddling, she tended to hold her breath so that her saddle fit looser. I didn’t double-check my work or Dolly and fell right off when the saddle did. Tending to my injuries (at Duke’s Ranch, the lessons were painful, but they stuck), my counselor asked what I had done wrong. He was silent as I blamed Dolly, the saddle and the terrain. I was rewarded with a smile when I finally recognized that the accident was caused by own shoddy workmanship. We don’t live in a nicey, nicey Disney world and when we do something silly, reality is there to slap our noses. If we’re taken advantage of by an internet scam or a too good to be true investment opportunity, we must take responsibility for our own missteps. It’s up to us to protect ourselves because, while “they” aren’t necessarily out to get us, it doesn’t pay to make it too easy for them.

3. If you’re offered the chance to ride without a saddle, take it. After I fell off Dolly, my counselor decided that I had almost ridden bareback and asked if I’d like to do it the right way. I couldn’t have busted my lip any worse, so I agreed. Galloping with a temperamental, unfettered horse was better than mixing Pop Rocks and Coke. Just because something is scary and out of our comfort zone, doesn’t mean it isn’t worthwhile. Of course, I fell off that time, too, but by the end, I was a pro. Learning how to fall is just as important as learning how to stay on.

Education doesn’t end when the school door shuts. The neat thing about living is that, no matter what, everything we experience teaches us something. We just have to pay attention.

Bourke Accounting bookkeepers and tax preparers are always willing to learn from their experiences and they’re always paying attention. Whether it’s a new tax law or an esoteric bookkeeping procedure, you can count on a Bourke Accounting expert to be a never-ending font of knowledge.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.