Things fall apart; the center cannot hold. – W.B. Yeats, “The Second Coming”

I used to cough to hide a fart. Now I fart to hide a cough. – Internet Meme, 2020

Last night was one of the first times that my neighbors didn’t throw a party that ended with shattered glass and people fighting in the street at 3 AM. The guy asking for change outside my local gas station is wearing latex gloves and a mask. The kids, who roam my neighborhood as soon as the weather is nice, are peeking apprehensively through tattered blinds. Most of my server friends are unemployed and scared.

It only took me ten minutes to get to work this morning because there was barely anyone on the streets.

Everything is different. Everything is in flux and we’re all sort of wandering in the dark right now.

The one thing I thought we could always count on was a concrete tax return filing deadline. After all, there are only two certainties in life, and one of them is taxes. But now our deadline isn’t until July 15th. I think the extended tax deadline is wrong for two reasons:

1) We need money. Last year, “the IRS collected nearly $3.5 trillion” (IRS.gov) as a result of tax season. During good years, this money goes towards all manner of social services, roadwork, police, we all know the drill. However, during a really bad time like our current situation, this money could be used to help the newly laid off, small businesses and hungry school kids. It seems that, since the factions of our government can’t come to an agreement regarding a stimulus bill, all that tax return money would really come in handy. And, while I have a liberal arts degree, I still believe that 3.5 trillion is more than the 1 trillion the stimulus package had asked for (NBCnews.com).

2) We need to hold on to some semblance of normalcy. For example, Bill over here at Bourke Accounting gave his employees the option, with no fear of job loss, to go home if any of us were fearful. We all sort of looked at each other and shrugged. No, we’re not cowboys or feeling invincible; we’re simply used to working. In uncertain times, maybe we’re also stacking up cash while we can. The beauty of working for accountants is that it’s a low-impact sort of job: clients can send tax material in and we can send completed tax returns out. Obviously, this industry isn’t the same as nail salons (or my newly closed tanning bed). I think we all just decided to keep as normal as possible.

What is more normal than an April 15th tax deadline? Besides the money being delayed, I also think this sends a bad message of impermanence that we really can’t afford right now. Perhaps I’m being melodramatic, but if taxes aren’t an important aspect of American life, what can we depend on and what else might be changed or lost?

Well, your friendly Bourke Accounting tax preparers and bookkeepers are still working and (fairly normal). Like I mentioned, if you don’t want to meet in an enclosed space with your Bourke Accounting expert, you are more than welcome to mail your information to us. And if you do want to have a good, old fashioned face to face encounter, we practice social distancing, hand washing and practical hygiene. Your Bourke Accounting pro considers your comfort of the upmost importance. Stay safe out there, guys. Remember: this too shall pass!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Before Bourke Accounting, I worked with a 70-year old, Vietnam vet, ex-firefighter from Texas. He had tried retirement and found that he hated it. I asked, “Why are you working when you don’t have to?” He gave me a sardonic – oh, you silly, little thing – stare and responded, “What? Ah’m supposed ta sit around the house with Her for the rest of my life?” Her was his wife. I never found out her proper name.

I have to admit, this sort of mentality is lost on me. As a Gen Xer, I won’t get my full Social Security benefits until I hit 67 (Money.USNews.com). When I drag myself from the cocoon of sleep to shut off my highly annoying alarm, the idea of decades filled with more work makes me cringe. When I hit retirement age, and if I don’t have to work, I promise you, I won’t.

Not counting those of retirement age who must work, why are more and more older people choosing to stay in the workforce? The U.S. Bureau of Labor Statistics reported that, “between 1977 and 2007, the employment of workers age 65 and older rose by 101 percent” (Money.USNews.com). While this percentage doesn’t differentiate between people who work out of necessity and those who work for “fun,” I tend to think that 101 percent includes a high number of the latter. As with most things, there are reasons for this.

When considering jobs such as lawyers, accountants and doctors (pretty much all of our “white collar” occupations), it seems that older people might fear the loss of the “greater social prestige” (AARP.org) they enjoy while working in these arenas. When you think of the high levels of education and experience that went into achieving their particular status, this is understandable. Also, since these jobs aren’t, generally, physically taxing, people can work these jobs much longer than someone who relies on bodily strength.

Another reason to work after retirement seems to be avoidance of boredom. I read a couple of different interviews with retired people that seem to travel along the same trajectory: I loved retirement for the first month, then I got bored, then I got depressed, then I went back to work. Obviously, older people want to contribute to, and engage with, the world around them. Sitting on the porch with a Mint Julep and a good book doesn’t appeal to everyone.

Finally, working past 65 can actually increase your lifespan. Oh, come on, that can’t be true. If it isn’t, the University of Oregon is lying to us. While conducting a study, they found that, “working just one year past 65 can lower your risk of death by 11%” (Statefarm.com). The study concluded that early retirement “may be a risk factor for mortality and a prolonged working life may provide survival benefits” (Jechc.bmj.com). Again, this is probably related to a person’s mental wellbeing. Feeling needed, feeling viable and having a set schedule might very well make for a happy and healthier individual.

Don’t care, don’t care. Just give me my Mint Julep and my Stephen King already! You know, although I say that now, I’m not sure how I’ll feel when I get to retirement age. Daytime is worktime, after all.

Your Bourke Accounting professionals aren’t going to retire any time soon. Chances are that your Bourke Accounting professionals won’t retire ever. But, if you’re not a crazy Bourke Accounting tax preparer or bookkeeper and The Call of Porch is upon you, why don’t you come and discuss your retirement future with one of our experts. Your Bourke Accounting specialist can help to make this the best time of your life.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

It is now 7:59 AM (this will be kind of important later). It has occurred to me that I have made writing blogs harder than it should be. You don’t want to know about the second guessing and the endless editing (I’m surprised that there are any words left when I’m done!). So. I have entered into a $5 wager with Bill here at Bourke Accounting. I am pushing myself to get this done in two hours. Barring an unforeseen catastrophe, I think I have this.

Because of my newfound revelation, I got to thinking about how we push ourselves and the different ways in which we go about it. I believe that there are three major ways that we push ourselves: the good, the mildly questionable and the flat-out bad.

For example, let’s say you want to quit smoking (I am seriously thinking about thinking about quitting) and 3 o’clock rolls around. You haven’t had a smoke for an hour, but instead of smoking at 3 o’clock, you decide to push it until 3:30. Well, once you get to 3:30, you decide to just wait until 3:45. Eventually – I’ve never tried this operation, but I’m told it works – a smoker becomes a non-smoker. Small, baby steps can create an entire new way of living and thinking that benefits the protagonist. There is no cold turkey (and shattered friendships), there is no outlandish disruption of the person’s life; there is just a very gradual and very real change for the better. I consider this a gentle way in which people push themselves.

The perfect example of the mildly questionable can be illustrated by our Bourke Accounting bookkeepers and tax preparers. When I left the office yesterday, there were three people working overtime (two out of the three indulged in fast food, so I’m guessing some of that overtime was, most likely, spent in the bathroom). Because these guys are old hands at the tax season game, they’re used to this. However, with our current and uncertain situation, I believe that our Bourke Accounting experts are trying harder than ever to accommodate you. To me, there is nothing more civilized than a completed tax return; even if we all end up on lock-down, at least you know that one stressor is off your table. I call this mildly questionable because, even though they’re used to this, our bookkeepers and tax preparers are still sacrificing time with family and friends to meet deadlines.

And finally, we have the flat-out bad ways in which we push ourselves. Changing your life for the better is good, working long hours for a temporary period is all right, but then, then there are the people who hurt themselves by pushing to the extreme. These are the people who start out by wanting to get into shape but take it too far. Once they’ve lost ten pounds and have been working out an hour a day, they push for more. All of a sudden, they’re working out three hours a day and eating limited quantities. This also applies to working; instead of a 40-hour week, these guys are working 80 hours. They miss milestones in their children’s lives (a’ la Cats in the Cradle), anniversaries and basically life itself. Being dedicated is all well and good, but there must be a balance. More importantly, there’s got to be a little fun or else, really, none of it’s worth it anyway.

Pushing for self-betterment is a great thing. We all know how wonderful it feels to overcome an obstacle and prepare ourselves for the next. However, the most important thing to remember is that moderation is pretty great, too.

Like I said, your Bourke Accounting bookkeepers and tax preparers are pushing themselves to meet your needs. Bourke Accounting experts are also trying to take care of themselves and not push themselves over the precipice out of dedication to duty. Come drop off your paperwork to your favorite Bourke Accounting specialist today and show them some love (from six feet away, of course).

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

P.S. It is now 9:27 AM. Yeah, I got this.

Written by Sue H.

I’ve told you that my medical expertise is limited to poking the afflicted with a stick. So, imagine my surprise when my brother (casually) informed me that, when/if my parents can no longer care for themselves, I’m being tagged in for the job. And my parents think this is a great idea! My parents made sure I didn’t put anything too metallic into sockets, they wiped my tears and my butt – I’m okay with the concept, but the execution of the concept leaves me a bit flummoxed.

How can a family member provide care while also holding an outside job? Seniorlink.com reports that “31.3% of caregivers…have financial difficulties” when caring for a loved one. In addition, there is a greater likelihood that the caregiver “will experience poverty or rely on public assistance” (Seniorlink.com). Is caring for a family member even feasible for a working, would-be caregiver?

There are a few reasons why caring for loved ones at home could work. First, care at home is a lot less expensive than care in a nursing home (Payingforseniorcare.com). For example, instead of using hard-saved cash for a $15 Tylenol, Mom will be able to buy soup cozies on Etsy. Also, and obviously, most people prefer to stay home rather than to be placed in an institutional setting. Nothing against nursing homes, but home is where the bourbon is.

Even lost income can be addressed with help provided by state organizations. For example, here in Kentucky, there’s the Kentuckiana Regional Planning & Development Agency (KIPDA). This agency offers two waiver programs through Medicaid to help people stay at home. The Participant Directed Services program lets individuals “hire providers of their choosing” (KIPDA.org), including friends and family. This program also offers support groups, help with modifying the home and training (which I will need. A lot). The other program, The National Family Caregiver Program, “provides vouchers for medical supplies and equipment” (KIPDA.org) so that caregivers are not out of pocket when procuring must have items. This agency is certainly trying to make the transition from family member to caregiver as seamless as possible.

Now, no one is going to get filthy rich taking care of Aunt Edna (the hardest workers get paid the least, after all). Depending on the state, these Medicaid waivers generally pay between “$9.00-$19.25 per hour” (Payingforseniorcare.com). Also, there’s a good chance that the caregiver is looking at more than a 40-hour week. However, at least caregivers can afford to keep themselves and the home afloat for as long as necessary.

Another benefit regarding at home care is that the person who needs help “may not owe employment taxes” (IRS.gov) when paying their relative. Also, since the afflicted person has to provide a W2 to the caregiver, the caregiver doesn’t have to worry about self-employment tax that would come up if it were a 1099 gig. Much like KIPDA, it seems that the IRS is trying to make it simpler for the disabled to stay in their homes.

I like my parents. I wish them many more years of wandering around casinos, wearing their matching fanny packs (seriously, they have them), but if the time comes, I’m going to take care of them.

Bourke Accounting professionals know how quickly life can change. That’s why a Bourke Accounting specialist is here to support and help you through every new development you encounter. Whether it’s elder care, tax preparation or bookkeeping, your Bourke Accounting expert is available for you. Oh, and if you see two people meandering about with windmill covered fanny packs, say “hi” to my parents. Windmills, yeah. I don’t know why either.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I’ve learned a lot during my few months at Bourke Accounting. One of the most important things has to do with excuses. The first time I made a mistake, Bill asked me why it happened. I rabbited on with a litany of excuses. Annnd…I watched his eyes slowly glaze over. As it turns out, Bill didn’t really care why the mistake occurred. What he was really asking was: how are you going to fix it and how are you going to make sure it doesn’t happen again? He wanted this in 20 seconds or less.

That 20 seconds is important. In my case, I forgot to do something Bill asked me to do. I first responded with, “I’m sorry, I forgot.” But I didn’t end it there. I continued: I forgot because this person came in and then my computer went down and, and, and, and…and I’m learning to just own up and move along.

We have all experienced those who can’t admit that a mistake was their fault. I’ve worked with people who, when I pointed out a mistake, blamed everyone else with such vehemence, that I started to believe that perhaps it wasn’t their fault, after all. According to Psychologytoday.com, this is a common tactic used by extremely fragile people. Because admitting fault is “fundamentally too threatening for their egos to tolerate” (Psychologytoday.com) they must shift blame in order to continue living in their own heads. Not only do these people blame others, they actively change the facts – even when presented with incontrovertible evidence that proves them wrong (Psychologytoday.com).

Sometimes, we don’t admit to making a mistake because we fear getting fired or yelled at. We often think that if we spread just enough blame evenly, we’ll only be sort of yelled at. Sure, we are, at bottom, the main cause of the problem, but look how many other people helped! I’m sure there’s some sort of fancy psychological word for this, but really, we’re all just little kids at heart. No one wants to get in trouble, whether it’s our fault or not. If this wasn’t the case, shows like Cops wouldn’t still be on the air (have you seen how these guys run from the police? We could have a gold Olympic track team if we only tapped them).

Then, we have the polar opposite of those who can’t admit a mistake (how many sides does this weird, little mistake/blame coin have?): those who blame themselves for everything. These are the people who, no matter what, will try to take all the blame for their own selves. Instead of saying that they couldn’t finish a report because a department didn’t give them information, they’ll cry that it’s their fault because they only called/emailed that department 4 times today. These guys are almost as bad as the ones who can’t admit any mistakes (almost). Sometimes, when dealing with people like this, we feel like we’re being had. They take the bullet for everyone else and then it’s our job to soothe them and tell them they’re great. Of course, just like not accepting blame, accepting too much blame is still a matter of low self-esteem and psychological fragility. We can’t win!

Mistakes are awful little goblins that, as humans, we’re going to create. However, the best way to handle a mistake is to admit it, apologize, fix it and never mention it again. Take responsibility, but don’t take too much. Like I’m learning here, own up and move along.

If a Bourke Accounting professional makes a mistake, chances are that you’ll never know about it. Bourke Accounting bookkeepers and tax preparers take the quality of their work very seriously. Even though Bourke Accounting specialists are the best around, they’re still human; before anything leaves our office, there are a lot of quality control measures in place. Bourke Accounting pros don’t just doublecheck, they obsessively check to make sure not one typo ever ends up in your hands.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Have you ever had to leave the table while having dinner with someone because of the sounds h/she made while eating? Have you considered committing grievous bodily harm upon your co-worker for clicking a pen over and over? Has a baby crying in the next aisle ever made you feel like fleeing the scene?

If so, you might be suffering from misophonia. I should know, as I happen to be misophonic myself.

Misophonia is a disorder “in which certain sounds trigger emotional or physiological responses” (Webmd.com) that other people might consider a little crazy. For a misophonic person, some sounds cause anger, anxiety or an almost unstoppable urge to leave the room.

I first became aware of this condition when a friend mentioned it after hearing about it on NPR. I thought he was messing with me when he suggested I had this; when pronounced, misophonia sounds like “Me-So-Phony-A.” I honestly thought it was a bad Full Metal Jacket reference. Then I did some reading.

In May of 2019, Nature.com announced the results of a recent study. In this study, people with and without misophonia were shown video clips with different sounds (while their brains were being scanned). When it got to clips with “lip smacking or heavy breathing, people with misophonia felt intense anger and disgust, and their heart rates spiked” (Livescience.com). The non-misos were A-OK. In addition, it seems that the miso-affected experienced “heightened activity in the part of the brain which determines what we pay attention to” (Graziadaily.co.uk). Finally, the parts of the brain that control emotional regulation went a bit hinky when the misos heard the really icky sounds (Graziadaily.co.uk). Basically, you hear whispering (that’s a big one for us) and go about your day, while we hear whispering and get nutty.

For some reason, when misophonics hear certain sounds, the “survival part of the brain thinks…it’s being attacked or it’s in danger” (NPR.org). Evidence suggests that mental illness and past traumas don’t cause this condition, which is rather unexpected. The Misophonia Institute mentions research that could possibly link genetic factors to misophonia, but it doesn’t seem like anything really concrete is understood about it.

According to Webmd.com, misophonia is also not caused by problems with the ears. It’s not like misophonics have hyper hearing and are freaked out because they can hear the frat boys down the street chewing with their mouths open. At this point, it’s just a mysterious brain thing for us.

But be of good cheer, my fellow Misophonics: we are not crazy! We now have a name for our affliction and research (to back up what we knew all along) that misophonia is real. Also, around 15% of Americans have misophonia, so we’re not even alone (Misophonianinstitute.org)!

Besides being the best tax preparers and bookkeepers in Louisville, Bourke Accounting professionals are a joy to eat around. Bourke Accounting experts don’t whisper and you never hear those awful nasal whistles that drive us to distraction. While you’re receiving the most knowledgeable financial advice, your Bourke Accounting associates will never cause anxiety by breathing through their mouths. All in all, an appointment with a Bourke Accounting specialist is a misophonic’s dream come true.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Have you ever started your day by stepping in dog poop on the way to the bathroom (but Fluffy is housebroken!)? Maybe you fought with your significant other, got yelled at by the boss and had your co-worker insult your new pants. In short, have you ever had a bad day? Did you ever consider just faking your own death, running away to a secluded place and living peacefully forever?

If you are one of the over 6,000 people mistakenly declared dead by the Social Security Administration each year (CNBC.com), you could have your wish without the effort! That’s right, because of a clerical error, you could be living your best zombie life without the hassle of faking a car crash (and, I guess, finding a body double). All of this can be yours as a result of a mistake made by one of the most powerful organizations in the US.

The Social Security Administration has a database that records deaths in America. This list, the Electronic Death Registration (or the Death Master File, depending on who you ask) is intended, for one thing, as a “measure taken to prevent fraud” (NPR.org). This list stops the baddies from stealing identities or taking out credit cards in a dead person’s name. Once a name ends up on this list, the SSA sends the information to “nine benefit-paying Federal agencies, including the Internal Revenue Service and the Centers for Medicare and Medicaid Services” (OIG.SSA.gov). Not only these guys, but banks, credit card companies – pretty much everyone and their brother – share in the sad news.

This database is useful if the person is legitimately deceased. However, if you are still among the quick, ending up on this list is a nightmare. Accounts are frozen, health insurance suspended and Veteran benefits go “poof.” So how can this happen? Seriously, it is simply a matter of human error. The SSA gets their death information from funeral directors, hospitals and family members. Okay, that sounds like a good start. These guys should know, right? But, this can turn into a really terrible game of Telephone. According to NPR.org, inputting errors on the part of SSA workers are responsible for 90 percent of accidental death declarations. It only takes one wrong digit to transport you, the innocent bystander, into a confusing new un-life.

So, now you’re a pulse-challenged American. How do you fix it? The SSA suggests you go to your local Social Security office with at least one piece of identification (who are we kidding, bring every piece of identification you have ever acquired). After the SSA corrects your record, “you’ll be issued an ‘erroneous death case – third party contact’ notice” (Denverpost.com) that you can show to the nice agencies who have all your money. If, for some reason, you don’t get satisfaction from the SSA, Denverpost.com suggests that you call in the big dogs by “contacting your local congressional representative’s constituent services office.” If you yell loud enough, someone has got to believe you’re still alive, right?

Like a lot of weird occurrences, this probably won’t happen to you. But if it does, consider that nice secluded place one more time before visiting the Social Security office.

Bourke Accounting specialists don’t discriminate based on color, gender, religion or anything else. However, if you’re dead on paper, it might be a little difficult to prepare your tax returns. Although, just like during an IRS audit, your Bourke Accounting professional will stand by you until you are reborn and financially solvent again. Even if you are undead, your Bourke Accounting bookkeeper and tax preparer will still offer you the best service anywhere.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

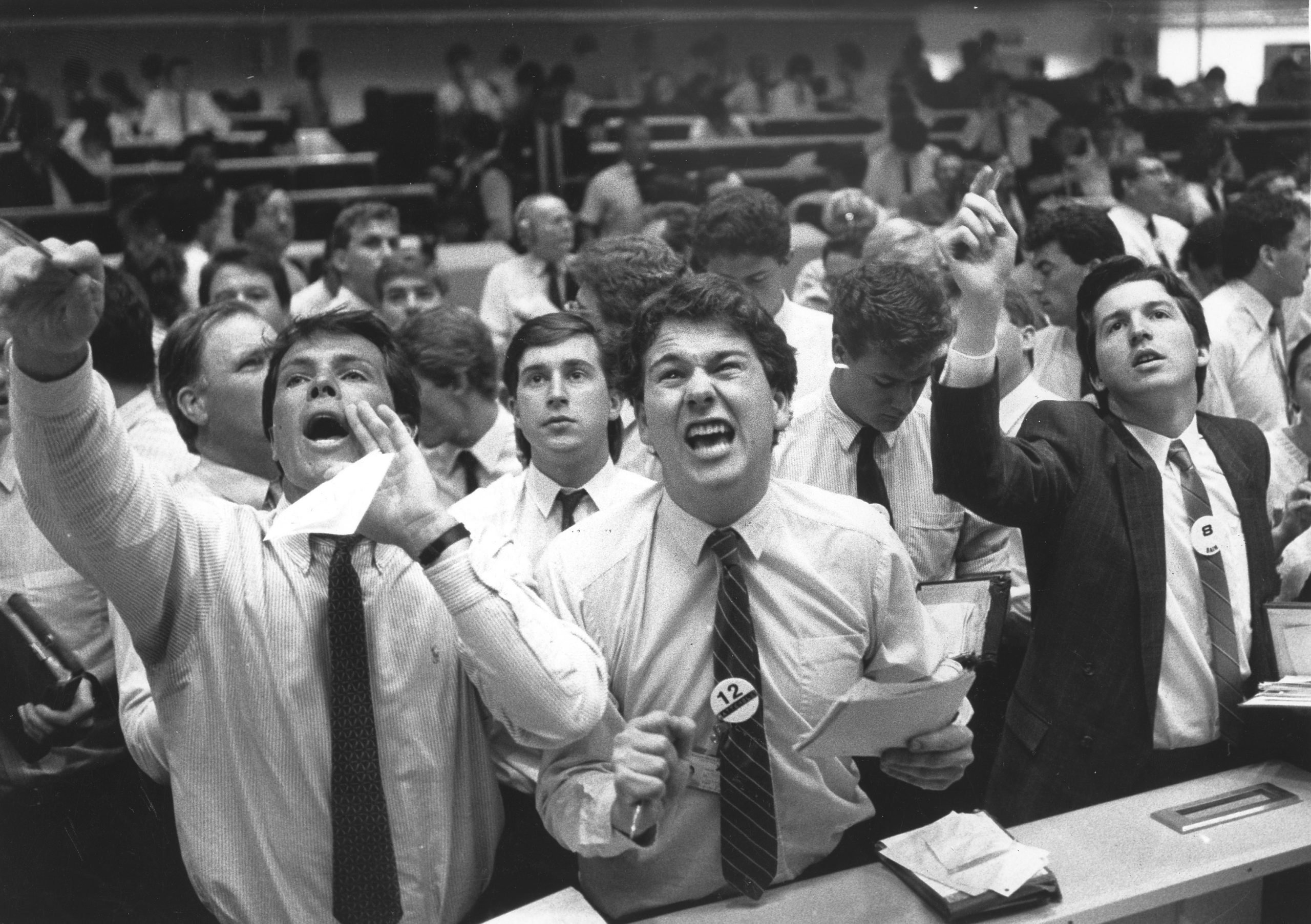

Years before Bourke Accounting, I worked for an attorney. He told an anecdote about someone who was in a coma for a couple of months. During this time, her stock portfolio lost a lot of money as a result of some very risky investments. The broker claimed that he had received requests for every one of the trades and approvals for every one of his commissions. The stockbroker was punished when it was unequivocally proven that his client was less than conscious during this period.

Films like Boiler Room (2000) and The Wolf of Wall Street (2013) show us the shady side of stockbrokers and investing. Even with these stylized cautionary tales, we convince ourselves that security abuses, while terrible, could only happen to the other guy. No one wants to believe that they could ever be the victim of an unscrupulous broker. However, in 2016, “59 Ponzi schemes were uncovered, totaling more than $2.4 billion in losses” (Superlawyers.com). Furthermore, between 2017 and 2018, suits “against investment advisers were up nearly 38% and those against broker-dealers were up 17%” (Cov.com). So, yeah, it could happen to you.

The only difference between these white-collar scams and the guy mugging you on a dark street is presentation. So, here are a few ways to protect yourself against a gentler mugging:

1) Out of the blue, a broker calls you with a can’t miss, limited time investment offer. S/he regales you with promises of making twice your money back in a ridiculously short period. Much like the Nigerian prince scam, you must ask yourself: why am I so important today? Quick answer: you’re not. Also, if this person uses “high-pressure sales tactics…or refuse[s] to send written information about an investment” (Investopedia.com), you can just go ahead and hang up.

2) So, you have a new broker, congrats! Suddenly, you’re asked to start making checks out to him/her personally and not to the firm. Since this is a “common way brokers…fraudulently pocket investors’ money” (Millerlawgroupnc.com), it should be a very red flag to you. If this is a legitimate broker working for a legitimate firm, all payments should be made to that firm.

3) You found your reputable broker, checks go the firm, everything is going great. And then, you notice an “unusual increase in transactions without any gains” (Investopedia.com) to your portfolio. You could be a victim of churning. This is a cute little practice of making tons of trades that bad brokers engage in to “increase their commissions” (Investopedia.com). These guys aren’t interested in what trades will benefit you, they just want to make their car payment on your dime. And yes, there are laws against this.

There are a lot of honest and conscientious stockbrokers out there. Thankfully, with the amount of information at our disposal, making an informed choice has become easier. For example, the Better Business Bureau website (BBB.org) offers four pages of Louisville brokerage firms with reviews. It’s also not a bad idea to get recommendations from friends and family. When you’re ready to invest, it pays to take the time to seek out an established and well-respected firm.

Bourke Accounting professionals won’t offer advice regarding which specific stocks you ought to invest in. However, Bourke Accounting bookkeepers and tax preparers will advise you if it makes sense, in your current situation, to invest right now. Your Bourke Accounting expert won’t tell you what to do, but they can keep you safe and grounded in a get rich quick modern society.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

You’re walking down a deserted street. The streetlamps above you flicker, throwing the world into stark relief before plunging you into darkness. You’re 2,000 light years from home. A shadowy figure appears in front of you. He has been waiting for you. “You got the money?” he asks, his voice confident, but his eyes wary and apprehensive. “You g-got the stuff?” you stutter, hating the hesitation. He scans the empty street and moves forward. You exchange money for the bottle in his latex-covered hand. You look up and down the street. When you turn back to him, he’s gone like cigarette smoke on a windy day. You shove the sealed bottle of Purell down your pants and hurry down the street, feeling triumphant and filthy.

Hey, this scenario could happen, you know. I mean, it sort of is happening. Here in Louisville, everyone seems to be obsessed with toilet paper. I have been asked by numerous clients if I have toilet paper at home. Um, yeah, man, I have toilet paper, do you have a mop? Are we playing an uninteresting game of Household Go Fish? I’m simply not understanding this new fixation on toilet paper. I don’t go to the grocery store (I find it boring, I hate the lighting and, since they got rid of Muzak, the grocery store is just nowhere), but people who do go tell me that toilet paper and hand sanitizer are in pretty short supply right now. All right, that’s fine. What are those leaves outside for anyway?

I sort of understand the hand sanitizer compulsion. Even before the Coronavirus, people were crazy for the stuff. You couldn’t walk into any office without seeing the cheery little bottles perched on multiple desks. Much like grocery stores, I hate hand sanitizer. Maybe I’ve been using it wrong, but it always makes me feel like I have some sort of weird film on my hands. I guess that’s The Film of Good Health and Protection, but I hate it anyway. So, even if I had it (which I don’t – don’t try mugging me for that fresh, bacteria fighting, viscous grossness), I wouldn’t be using it anyway.

Beyond hand sanitizer, what I hate even more are people who take advantage of confusion in uncertain times. I was reading an article on Theatlantic.com about this guy who realized that his fellows were going to want Purell. So, he goes to The Dollar Tree, buys up a bunch of the stuff and was selling it on Ebay.com for about $138 a pop. Good looking out, brother. Way to help the world amid a pandemic. Both Amazon and Ebay have come out recently saying that they don’t condone price gouging and won’t allow it on their platforms. I hope this is true because being a facilitator for vultures is a really bad promotional angle. When I looked for Purell on Ebay, I was told that the pages were missing, so at least Ebay was serious.

Whew! That was a lot of my opinion. Look, we don’t know when everything is going to return to our dysfunctional normal. In the meantime, don’t hoard stuff, don’t take advantage of your fellow human and just do the best you can to make it through this with a little class.

Your Bourke Accounting professionals are feeling pretty good. But. If you feel ill (no, you don’t have Corona), don’t worry if you need to reschedule your appointment. Your Bourke Accounting tax preparers and bookkeepers will rearrange their days to accommodate you and your needs. The bottom line is that you guys are the most important aspect of Bourke Accounting and we really appreciate you.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I like my Bourke Accounting co-workers – because of this, I really hope none of them choke, have a cardiac episode or experience any incident that requires first aid. My first aid skills consist of poking the victim with a stick until he wakes up or until someone takes my stick (I am good at sewing, so I might be able to, fashionably, help with a cut).

I like my Bourke Accounting co-workers – because of this, I really hope none of them choke, have a cardiac episode or experience any incident that requires first aid. My first aid skills consist of poking the victim with a stick until he wakes up or until someone takes my stick (I am good at sewing, so I might be able to, fashionably, help with a cut).

We’ve all heard horror stories about people who have been sued after providing lifesaving first aid. Sometimes, a rib is cracked when CPR is administered; personally, I would forgo litigation if I could trade a cracked rib for my life. There are some cases of victims suing would-be saviors, however, that leave us totally confused.

For example, in 2004, Lisa Torti was following co-worker Alexandra Van Horn home from a party. The driver of Van Horn’s car hit a pole. Torti believed that an explosion was imminent when she saw liquid and smoke pouring from the vehicle. So, Torti pulled a barely responsive Van Horn from the car. The accident left Van Horn a paraplegic. However, Van Horn sued Torti, “asserting Torti worsened her injury by…yanking her out of the car ‘like a rag doll’” (Reviewjournal.com). The California Supreme Court decided that Van Horn could sue “because Good Samaritan protection was only for those administering medical care” (People.howstuffworks.com). As a result of this ruling, however, the state legislature ended up changing the law to protect non-medical people providing aid (Reviewjournal.com).

I had never given much thought to Good Samaritan laws. However, after, the insanely cool, Marianna Perry of AEDs & Safety Services, LLC gave a seminar at Bourke Accounting and mentioned these laws, I became curious. Because people had become leery of helping each other, lawmakers acted to protect well-meaning bystanders. For example, in Kentucky, under KRS § 311.668 (2009), anyone who uses, in good faith, an AED on a victim “shall be immune from civil liability for any personal injury” (Recreation-law.com).

Now, there are some limits to this law. This law doesn’t apply if the victim is injured from “the gross negligence or willful…misconduct” (Answers.uslegal.com) of the person giving aid. Basically, if the guy next to you is choking and you stab him 7 times in the legs to dislodge that potato stuck in his throat, you might have to chat with some people in authority.

Good Samaritan laws have been modified to also protect drug abusers in many states. This law, called 911 Good Samaritan law, “prioritize[s] the victim’s safety and resuscitation over arresting drug users” (KYHRC.org). What this means is, that after a heavy night of partying, if someone happens to turn blue, the rest of the partygoers are protected from arrest when calling for medical care for their azure pal. No one likes the idea of drug abuse, but I think we all appreciate second chances.

I like Good Samaritan laws. Once, in Colorado, I choked on a piece of steak. The guy next to me jumped up and performed the Heimlich. Little buddy saved my life and wouldn’t even accept a drink in return (I believe I was drooling at the time). Had this guy worried about litigation, rather than the life of a fellow human, would he have been so eager to help? I like to think he would have, but it’s nice to know he was protected, too.

I am in the minority when it comes to first aid knowledge at Bourke Accounting. If you choke on chips during an appointment with your Bourke Accounting bookkeeper or tax preparer, you better believe they’ll save your life. Not only do Bourke Accounting experts provide you with the best in financial advice and guidance, they can also do the Heimlich without shattering your ribcage.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.