Bourke Accounting professionals are practical and they are ethical. If you forget to include some extra income, your Bourke Accounting tax preparer will quietly fix the problem; they won’t report you to the IRS for attempted tax fraud. While I consider myself a pretty ethical person, I wonder if maybe I’m just a touch too practical compared to my Bourke co-workers.

For example, earlier in May, rapper Tekashi 6ix9ine earned about $2 million in less than a week from his newly released single, “Gooba” (Billboard.com). So, 6ix9ine decided to donate 10% of that to No Kid Hungry, a charity fighting childhood hunger (Billboard.com). That’s right, this weird little facially tattooed guy was willing to give $200,000 to make sure that, even during the pandemic, kids would be able to eat. Let’s say the average cost of a Kraft Lunchables is about $1.48 (not the best food choice, I know). That means that $200,000 would provide about 135,135 kids with at least one meal.

However, Laura Washburn (No Kid Hungry’s director of strategic communications), said “thanks, but no thanks.” While she announced that the charity was grateful for the offer, she said that it is the policy of No Kid Hungry to “decline funding from donors whose activities do not align with our mission and values” (Billboard.com). Tekashi 6ix9ine is not a good, law-abiding citizen. He has been trouble in the law for a vast host of reasons – assault, weapons charges, racketeering and even something to do with a 13-year-old girl when he was 18. He is no one’s role model, he is a criminal.

I wonder though, does a hungry child care if the hands that are providing clean food are dirty?

Another example of denied charity happened in Pennsylvania last July. Hundreds of parents received letters from the Wyoming Valley West School district regarding unpaid school lunch debts that amounted to $22,000 (CNN.com). The letters threatened parents that the district might be forced to report them to Child Protective Services and, most likely, the children would end up in foster care” (CNN.com). Todd Carmichael, co-founder and CEO of locally based La Colombe Coffee, offered to pay the entire debt (CNN.com). However, the school board president, Joseph Mazur, said no, citing that “the parents who owe the money can afford to pay it” (MSN.com). Mazur simply stated that it wasn’t Carmichael’s responsibility. Thankfully, the backlash from this refusal made the papers and the board finally relented and allowed Carmichael to carry on with his good deed.

Some people complain that, if parents can’t afford children, they shouldn’t have children. That’s a fair argument, Captain Hindsight, but, what is your suggestion for the kids who are already here? Children won’t understand that, because their parents aren’t good at budgeting, they don’t get to eat today. Honestly, these kids are going to be our doctors and attorneys – have you ever tried concentrating when you’re really hungry? As Americans, yeah, sorry, it’s our responsibility to protect our most vulnerable citizens.

Bourke Accounting bookkeepers and tax preparers are practical and ethical. Bourke Accounting won’t engage in fraud with you, but they will definitely protect you to the best of their abilities if you find yourself in a sticky situation. And really, since our Bourke Accounting experts are so talented, they can offer you – legal – advice to help you throughout all of your financial journeys.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I have received my stimulus payment. Yes, I got that “big fat beautiful check” with someone’s name on it (actually, it was direct deposited). Even though I feel guilty about receiving money when so many are out of work, I’m not as altruistic as I’d like. Instead of donating it, I am saving it for rainier days. I think I misunderstood the point of my stimulus check.

Since I had already received the payment, imagine my surprise when I also received a letter from the commander in chief himself! Strange, though, the envelope proclaimed that it was from the Internal Revenue Service…oh! The IRS was probably just doing the president a favor, right? But, wait, that’s kind of bizarre as the IRS is supposed to be nonpartisan. Wouldn’t a letter from a president, with an IRS envelope sort of be at odds with that stance?

Now here’s just one more weird thing: the notice on the envelope says that both postage and fees were paid for by the IRS (Click2houston.com). This is just getting a little too tangled for my poor little taxpayer mind to unravel. All right, but let’s do the math here:

.55 (First Class Postage) + .09 (Per #10 Envelope) X A Whole Lotta People = Nearly $42 Million (NBCnews.com)

So. The IRS spent about $42 million dollars (of our money) for a “Buck up, Lil’ Camper/I’m Just Gonna Pat Myself on the Back Here!” note provided by another party. I see. Wait, I’m not being completely fair here. Part of the CARES Act legislation does require that a notice be sent to each eligible taxpayer regarding the amount that they can expect (this letter came about four days after most of us had received payment) and a handy number to call if the taxpayer needs more information (like if the payment was incorrect).

I called the number. After three different menu options – each one encouraging me to visit IRS.gov to see Frequently Asked Questions – I completed the Circle of Life and ended up right back in the main menu. Sadly, I was given no option to speak with a carbon-based lifeform.

There have been economic stimulus programs before, of course. In 2008, George W. Bush “gave” individuals about $600 each. I don’t seem to remember seeing his name in the memo line of my check or getting an IRS notice with his signature on it. Oh, right, because neither of those things happened. These Corona checks mark “the first time in history that a president’s name appeared on disbursements from the IRS” (Thehill.com). Well, that’s just freaky deaky, don’t you think?

Before anyone gets the wrong idea, these stimulus payments are going to cost us. Whether it’s next year or the year after, ain’t nuthin’s for free. Batten down the hatches, fam, we’re in for a wild ride.

Your Bourke Accounting bookkeepers and tax preparers know that we are embarking on trying times. When everything else is in a state of confusion, it’s nice to know that your Bourke Accounting specialist is still standing and willing to give you the best and most up-to date advice. In an uncertain world, you can count on your Bourke Accounting pro to not let you to fall out of the Tilt A Whirl.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Since I fill in for Phil as Phil Jr. at Bourke Accounting, I’ve been fielding a couple of calls here and there. Naturally, the most common caller right now has questions about their Coronavirus Stimulus check.

First, there’s the inquiry regarding when it will come. I hip everyone to the IRS’ website – coming in mid-April, under “Economic Impact Payments” there will be an app available to track your payment. The second question is generally asking about the amount that can be expected. Since I’m not going to speak of that which I know naught about, I – you guessed it – encourage the use of the IRS website and guidelines. Also, Kiplinger offers a stimulus calculator, so there’s that…

However, there was one caller who asked a question, for a friend of a friend, regarding child support. The gentleman wanted to know if his “friend” was still eligible for his check if he owed back child support. I didn’t have an answer for him, so I decided to find out.

The answer is no. If you owe back child support, your stimulus check might not be all your own. According to Nolo.com, “if you’re on the Treasury Offset list for unpaid child support, your stimulus check will be reduced by the amount you owe.” After the IRS takes the check, they’ll send it on over to the appropriate state support agency (Nolo.com). No one knows if you’ll receive an IRS notice first, but, come on, if you haven’t paid child support for the last few years, this shouldn’t come as a surprise. However, if you don’t know if you’re on this list or not, Nolo.com suggests calling the IRS to find out: 1-800-304-3107. Be prepared to wait. And wait and wait. And wait.

Oddly enough, if you owe any other sort of taxes or student loan debt, your check will not be affected (Forbes.com). Even if you’ve owned back taxes for years, the IRS isn’t going to make this time rougher on you. I like that.

Another reason you might not receive a stimulus check is if you’re living in the US without a Social Security number. I don’t want to talk about people being here illegally, so I’ll just say that some people who are here, maybe the opposite of legally, shouldn’t expect a check; after all, the IRS is sending checks based on tax returns and it’s hard to file without a valid Social. However, people with green cards or work visas are eligible for checks (USAtoday.com).

Young adults are also in a certain sort of limbo. If you claim your working 17-year-old as a dependent on your return, that kid will not receive a stimulus check. However, you, as the parent or guardian, will also not receive the $500 per kid check, as the dependent is over the age of 16 (USAtoday.com). Neat, huh?

Now here’s another question I had, but honestly, couldn’t find anything about: do incarcerated people get a stimulus check? What happens if you filed a return for 2018, got arrested and are currently serving a sentence? I suppose you would still be eligible, since a return was filed, but I’m not sure how the IRS views inmates and stimulus relief checks. I will find out because now I want to know.

Things are getting weird. Your Bourke Accounting bookkeeper or tax preparer can handle it, though. Your Bourke Accounting expert might not know all the answers, but they can find out. No one knows exactly when you’re getting your check. However, drop off your 2019 tax information and your Bourke Accounting pro can definitely tell you how much your refund is going to be. Hey, some things don’t change because of a virus.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Unpopular Opinion Time: I don’t believe The Coronavirus Aid, Relief, and Economic Security Act is a good idea. Just in case you aren’t aware, this stimulus package is the “biggest fiscal stimulus in American history” (NewYorker.com) at $2 trillion. This has been introduced as relief for the millions of Americans out of work as a result of the coronavirus. And I don’t think it’s going to do us any favors. However, before you get out the torches and pitchforks, hear me out first.

Bill and I were talking over here at Bourke Accounting the other day. I reiterated that I thought it was a bad idea for the government to include pretty much all taxpayers in the new stimulus package. Bill looked at me as if I had declared that Bambi’s mother had it coming. I’m liberal, but Bill is LIBERAL. Like I said, though, I have a few reasons for this belief.

First and foremost is the fact that those Americans lucky enough to still be working could be eligible, depending on their income, for this payment. While the standard check amount for a single person with no children is about $1,200, this amount could be higher or lower – Kiplinger.com offers a quick calculator here, if you’re curious. Since we have no idea how long our current situation will last, I believe that we ought to conserve resources while we can. To launch a scattershot relief act that benefits the needy, as well as the okay-for-now citizens, equally, seems wasteful. Don’t get me wrong, I would enjoy receiving a check, but when I need it, not when I’m still floating (somewhat) peacefully along.

Of course, it would be extremely difficult for the IRS to be able to differentiate who really needs relief; as we’ve discussed before, the Internal Revenue Service is dangerously understaffed. So right now, not only do we have a virus going around, but, as we were also in the middle of tax season, this skeleton crew agency must figure out who gets checks – both refund and relief? I hear great and thunderous hiccups in the distance.

Another issue is that the IRS will be using 2018 and 2019 tax returns to calculate the taxpayer’s relief amount. This is fine if one has been religiously filing every year, but what about those who haven’t filed. For example, groups like “low-income taxpayers, senior citizens [and] Social Security recipients” (NBCnews.com) generally aren’t obligated to file. So, now those who haven’t filed in years, are scrambling to find a tax preparer amid a very truncated workforce in order to be eligible for their relief check.

Obviously, I love that our country is trying to alleviate some of the suffering with this new legislation – these relief checks could represent the difference between food on the table and empty refrigerators. Not only that, but I believe it will act as a morale booster for a scared and confused populace. While no one is going to be able to survive indefinitely on $1,200, at least an effort is being made to try and stop the financial bloodletting (and fear) to a certain degree.

Your Bourke Accounting bookkeepers and tax preparers have left the light on for you; we’re trying to make this frightening time a little easier to get through. A Bourke Accounting professional, while not being able solve every problem, can offer you the best in service and advice. At the end of the day, we must remember: We will get through this, we will help each other and we will show the world that, as a country, we care.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

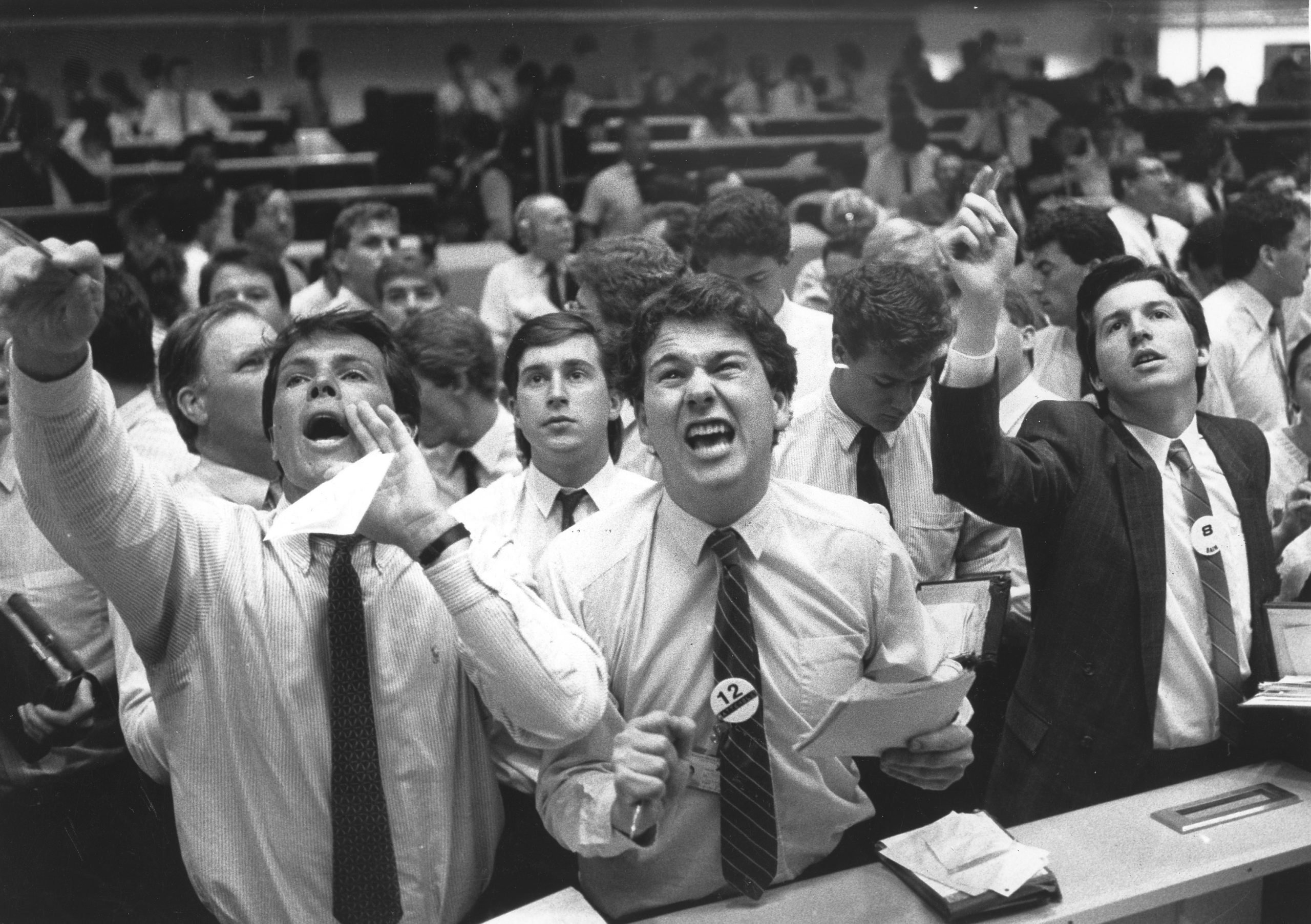

Years before Bourke Accounting, I worked for an attorney. He told an anecdote about someone who was in a coma for a couple of months. During this time, her stock portfolio lost a lot of money as a result of some very risky investments. The broker claimed that he had received requests for every one of the trades and approvals for every one of his commissions. The stockbroker was punished when it was unequivocally proven that his client was less than conscious during this period.

Films like Boiler Room (2000) and The Wolf of Wall Street (2013) show us the shady side of stockbrokers and investing. Even with these stylized cautionary tales, we convince ourselves that security abuses, while terrible, could only happen to the other guy. No one wants to believe that they could ever be the victim of an unscrupulous broker. However, in 2016, “59 Ponzi schemes were uncovered, totaling more than $2.4 billion in losses” (Superlawyers.com). Furthermore, between 2017 and 2018, suits “against investment advisers were up nearly 38% and those against broker-dealers were up 17%” (Cov.com). So, yeah, it could happen to you.

The only difference between these white-collar scams and the guy mugging you on a dark street is presentation. So, here are a few ways to protect yourself against a gentler mugging:

1) Out of the blue, a broker calls you with a can’t miss, limited time investment offer. S/he regales you with promises of making twice your money back in a ridiculously short period. Much like the Nigerian prince scam, you must ask yourself: why am I so important today? Quick answer: you’re not. Also, if this person uses “high-pressure sales tactics…or refuse[s] to send written information about an investment” (Investopedia.com), you can just go ahead and hang up.

2) So, you have a new broker, congrats! Suddenly, you’re asked to start making checks out to him/her personally and not to the firm. Since this is a “common way brokers…fraudulently pocket investors’ money” (Millerlawgroupnc.com), it should be a very red flag to you. If this is a legitimate broker working for a legitimate firm, all payments should be made to that firm.

3) You found your reputable broker, checks go the firm, everything is going great. And then, you notice an “unusual increase in transactions without any gains” (Investopedia.com) to your portfolio. You could be a victim of churning. This is a cute little practice of making tons of trades that bad brokers engage in to “increase their commissions” (Investopedia.com). These guys aren’t interested in what trades will benefit you, they just want to make their car payment on your dime. And yes, there are laws against this.

There are a lot of honest and conscientious stockbrokers out there. Thankfully, with the amount of information at our disposal, making an informed choice has become easier. For example, the Better Business Bureau website (BBB.org) offers four pages of Louisville brokerage firms with reviews. It’s also not a bad idea to get recommendations from friends and family. When you’re ready to invest, it pays to take the time to seek out an established and well-respected firm.

Bourke Accounting professionals won’t offer advice regarding which specific stocks you ought to invest in. However, Bourke Accounting bookkeepers and tax preparers will advise you if it makes sense, in your current situation, to invest right now. Your Bourke Accounting expert won’t tell you what to do, but they can keep you safe and grounded in a get rich quick modern society.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I love spin-offs. As a kid, watching Mork & Mindy, I was taken aback when my dad remarked that Mork from Ork had originally appeared on an episode of Happy Days. At that point, I still wasn’t totally convinced that TV actors weren’t tiny people living inside that box, so the idea that they could go back and forth to other shows was even more astounding.

There are some spin-offs that are useful, although not quite as fun as watching Fonzie save Richie from an Orkan. Take, for example, the way a tax attorney is a spin-off from a tax preparer when a citizen is forced to file for bankruptcy.

Real quick, there are two ways an individual can approach bankruptcy: Chapter 7 and Chapter 13. With Chapter 7, “you either pay for or give up your property for secured debts” (Legalzoom.com). Basically, you liquidate as much of your stuff as possible to pay the debt (Legalzoom.com). Chapter 13 is a payment plan to pay off your debts. The plan “can last up to five years” (Legalzoom.com) and you’d better believe that everyone involved is watching closely to make sure that you keep up with payments.

The relationship between tax preparers and tax attorneys is something that I just learned about the other day: bankruptcy filings increase during, and right after, tax season. According to USAtoday.com, filings “in March were 26% to 34% higher than the monthly average…[and] April’s filings were 15% to 25% higher.” The main reason for the surge is that, after individuals receive their tax refunds, they now have the funds to hire a tax attorney for their bankruptcy cases.

Filing for bankruptcy can be rather expensive, as it turns out. When considering a Chapter 7 bankruptcy filing, individuals can be looking at a charge of around $1,500: filing and fees can amount to about $335, in addition to attorney fees for about $1,200 (USAtoday.com). This news does not help the more than 46% of Americans who “who wouldn’t be able to cover an emergency of $400” (USAtoday.com).

In addition, bankruptcy laws passed in 2005 made things a bit more complex. One change, for example, is that Chapter 7 isn’t as easy for “filers with higher incomes” (Nolo.com) as it used to be. Because of the increased difficulties in bankruptcy filing, “attorney fees for even the simplest type…rose 48% from 2003 to 2009” (USAtoday.com).

But do filers really need a tax attorney? Pretty much. While UScourts.gov supplies resources for individuals filing for themselves, it is “strongly recommended [using a professional] because bankruptcy has long-term financial and legal outcomes.” In addition, UScourts.gov points out that judges and clerks are legally prohibited from holding a filer’s hand. They can’t help if a filer gets confused or has questions.

Bourke Accounting hopes that you never have to file for bankruptcy. However, if you must, make sure that you use the expert tax preparers and bookkeepers at Bourke Accounting. Bourke Accounting can offer guidance to ease you through your tough time. You want your spin-off to be Mork & Mindy, not Joey (remember? The spin-off after Friends? That’s okay, no one else does either).

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

It’s been gloomy in Louisville. So sometimes, after a busy Bourke Accounting tax season day, I go to the tanning salon (I know, I know, it’s not great for me, but I’m not going full-tilt George Hamilton here). The subject of taxes came up while I was speaking with the young woman behind the counter. She was very excited that this was the first year that she had filed by herself, without her parents claiming her. Then she remarked, offhandedly, that her fiancé’s mother claimed her as a dependent on her own return.

Fiancé’s mother, dependent, uh, what? I had a few questions.

Her fiancé’s mother claimed her as a dependent foster child. No, the young woman is not a foster child. No, the young woman has neither lived with nor been supported by the prospective mother-in-law. The young woman explained that, since mother-in-law’s little chicks left the nest, mother-in-law hasn’t been enjoying her tax refunds very much. Hence, mother-in-law got the awesome idea to claim the young woman.

Something is very much amiss. The young woman didn’t know how her mother-in-law obtained her social security number, which, as we know, is needed to claim a dependent. The young woman also didn’t know what sort of evidence mother-in-law could have possibly provided to show that she was a foster parent. Finally, what proof was the tax preparer furnished with that reflected the young woman’s residence in the “foster” home?

Obviously, I am not attempting to disparage another tax preparer. I’ll allow that this particular tax preparer may be guilty of nothing more than honest ignorance and naivete. However, tax preparers have a lot to answer for when it comes to filing your taxes. For example, if your tax preparer (knowingly) files a fraudulent tax return or uses false statements and is found guilty, s/he is subject to a “fine of not more that $100,000, imprisonment…or both” (IRS.gov). Eeek.

As we’ve talked about before, the IRS is closely watching returns with Earned Income Credit and Child Tax Credit. If a tax preparer doesn’t carry out the due diligence required, s/he is in danger of a “penalty of over $500” (Gregorytaxlaw.com) per violation. This could really add up. According to the IRS, “due diligence” pretty much amounts to common sense. For example, if the client’s information “appears to be incorrect, inconsistent or incomplete” (IRS.gov), it is the legal responsibility of the tax preparer to find out what’s going on. Failing that, the tax preparer could have their preparer tax identification number revoked (IRS.gov), which is sort of like disbarment for an attorney.

Thankfully, my tanning salon friend filed her return first and has received her refund. She’ll probably receive a notice from the IRS, but I’m not worried about her. I wonder how mother-in-law will do. Eh, I’m guessing the IRS will be in touch.

I know you guys would never intentionally provide false information to your Bourke Accounting tax preparer or bookkeeper. However, while our Bourke Accounting experts’ first concern is providing you with the best and most accurate service, we should remember that they have a lot riding on this. Our Bourke Accounting specialists have gotten so used to handing out the best financial solutions and advice, there is no way they’d be satisfied (or capable) of doing anything else!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Before starting at Bourke Accounting, I worked with a felon. He shot a guy in the butt with a .22. He maintained that shooting little buddy in the butt was his intention, but I tend to think it wasn’t. He was a good guy, wasn’t any more dangerous than our non-felonious crew and was a seriously hard worker. He was so thankful that he finally got a job that he was willing to go any number of extra miles for us.

It’s mercenary, but his gratitude made him a great employee. It’s not surprising that he was grateful, considering that every year, “650,000 inmates are released from prison [and] a study showed that fewer than 45% were employed after eight months” (Jobsforfelonshub.com). Why employers are a little disinclined to hire felons is also probably not surprising: employers worry that the hiring of felons would “increase the potential risk of crime at work” (Jobsforfelonshub.com) because, they feel, that not all ex-bad guys are really ex. Furthermore, employers are concerned about the rest of their staff and how comfortable they’d be with this new addition to their department.

Our government realizes that the best possible way to avoid recidivism in former offenders is to get them into the workplace and making an honest living. With this in mind, a program called the Work Opportunity Tax Credit has been put in place. This program makes a “federal tax credit available to employers who hire and retain individuals from target groups” (Hiringthing.com) who might have difficulties finding employment. Examples of target groups are veterans, TANF (temporary assistance for needy families) recipients, food stamp receivers and, of course, felons (IRS.gov).

This tax credit allows employers to “earn a tax credit equal to 25% (if the employee works 120 hours) or 40% (if the employee works 400 hours) of a new employee’s first-year wages” (Hiringthing.com). Employers can claim about “$9,600 per employee in tax credits per year…[and] there is no set limit to the number of individuals an employer can hire” (Hiringthing.com).

But does the program work? Since the WOTC is “split between the IRS and state-level labor agencies, no unified dataset exists” (Taxfoundation.org), so the studies are a bit fractured. For example, one study says that the WOTC has “increased employment rates…by around 12.6 percentage points” (Taxfoundation.org). However, another study found no indication that the program had any “positive impact on either employment rates or wages…in the long term” (Taxfoundation.org).

I believe that people deserve second chances. My former co-worker was a dumb kid who found his significant other in a compromising position with a gentleman who was not his own good self. Depending on the odiousness of the offense, though, we sometimes can’t separate the person from the transgression. I say that we hire felons on a person to person basis and go from there.

If you’re considering giving an ex-offender a chance, why not see your Bourke Accounting professional to discuss the possible advantages of such an endeavor? Your Bourke Accounting specialist can lead you through the paperwork and discuss a viable plan of action to get the most out of your good deed in hiring. Just like your Bourke Accounting pro might be your new best friend, your ex-offender employee might be the best and most trustworthy worker you’ve ever had.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I’ve mentioned before that some of us don’t have retirement plans. Because of this, a few members of our elite demographic may not be aware of the difference between a Traditional IRA and a Roth IRA (I’m not even getting into backdoor, SEP or SIMPLE IRAs here). In case you don’t know (and this will be vaguely important later), let’s get real quick and dirty:

An individual retirement account (IRA) allows you to save money for retirement in a tax-advantaged way. – Fidelity.com

Traditional IRA: you pay taxes when you retire and withdraw the funds. – Theblance.com

Roth IRA: you pay the taxes now, before you contribute to your plan. – Thebalance.com

What these two retirement plans have in common is that, while you can withdraw your cash at any time, you could get dinged with a “10% penalty and a tax bill if you take out your money before age 59-1/2” (Nerdwallet.com). Like every rule in the book, there are certain exceptions. For example, you might be able to avoid penalties for early withdrawal if you use the cash for medical bills, higher education, first time home buying and disabilities (Thebalance.com). However, to claim an exemption for a disability, you must “have your doctor certify that you are completely and permanently disabled” (Thebalance.com) and unable to work enough to support yourself.

In 2018, Kathryn Gillette tried to test out the disability exception with the US Tax Court. Ms. Gillette had been a soldier, worked as a firefighter, owned rental properties and was married to a cop. Kind of seems like an upstanding, law-abiding couple, right? And they probably would have stayed that way, but then Ms. Gillette was diagnosed with Restless Leg Syndrome. To combat her affliction, she was put on medication (Accountingweb.com). According to The Mayo Clinic, these medications “increase dopamine in the brain.” One of the short-term side effects of the increase causes “impulse control disorders, such as compulsive gambling.”

And did Ms. Gillette gamble? Let’s just say she was worse than Worm in the 1998 film, “Rounders”. For example, early one day, she won $162,000. By the end of that day, it was gone. Her rental property fees went to casinos, she hit up friends (and didn’t pay them back), she stole from her husband and, finally, she withdrew money from her IRA in 2012 (Accountingweb.com).

When it came time to file her tax return, Gillette maintained she wasn’t responsible for the IRA penalty because of her affliction (Accountingweb.com). The Tax Court decided that “her condition didn’t prevent her from doing regular activities” (The Kiplinger Tax Letter, Vol. 95, No. 3). Earning and losing $162,000 in a day isn’t exactly regular, but I get their point. Also, the Tax Court said that her “disability” was of a short-term nature: stop with the drugs and you’re A-OK, basically.

Chances are, you won’t suffer from drug-induced impulse control issues this year. However, emergencies happen and you might be tempted to cash out your IRA early. Before facing penalties, why not meet with your Bourke Accounting tax preparer or bookkeeper? Bourke Accounting doesn’t have a magic word to make your troubles disappear, but they can offer knowledgeable insight into ways to avoid touching your retirement.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

If you or someone you know has a gambling problem, please call the Nation Problem Gambling Helpline at 800-522-4700.

You know, as a self-proclaimed rebel, I am actually very conservative when it comes to working. I like being at Bourke Accounting because, if I show up every week and do my job, there’s a paycheck in my account come Friday. Same hours, same pay, no surprises. How did I become so boring?

This is also exactly why I couldn’t be a server. Servers often bust their butts for hours, do everything right and still walk away with an 80-cent tip and a snarky smirk when the transaction is completed (reminder: tip your servers well). No, sir, that is not the life for me. This, of course, is also why I couldn’t be a part of the gig economy.

Remember that holiday office party when you had a little too much joy and had to call an Uber? That Uber driver was part of the gig economy. The gig economy is “based on flexible, temporary, or freelance jobs, often involving connecting with clients…through an online platform” (Investopedia.com). Why am I always surprised when a new term is introduced to define something familiar? I guess “gig economy” sounds fancier than freelancer.

Gig economy workers have steadily increased over the past few years. According to Naco.org, the number increased “by over 19 percent from 2005 to 2015.” In addition, it is expected that people involved in the gig economy will grow “from 3.9 million Americans in 2016 to 9.2 million by 2021” (Naco.org). Naco.org explains that these freelancers get involved with this sort of work for the “flexibility, freedom and personal fulfillment” they experience. They are able to set their own hours, set their own workload and avoid being tethered to a timeclock.

If you’re the adventurous, free-spirited type, this seems like a pretty good deal. However, and problematically, the business that hired you isn’t responsible for withholding your taxes. For example, a survey from Taxfoundation.org reported that “34 percent [of gig economy workers] did not know that they may be required to make quarterly estimated payments to the IRS.” Also, while it’s recommended that these workers plan on “paying 25-30 percent of each of their paychecks for taxes in order to not owe the IRS” (WGU.edu) at tax time, a lot of them aren’t doing it. Whether it’s out of ignorance or believing that underreporting will go unnoticed, they’re causing themselves quite a few problems.

Another feature of the gig economy that people don’t think about is the social aspect. First, there’s the isolation. “Some workers may find the remote, removed life of the gig economy a problem” (WGU.edu), as there are no shared weekend stories or banter around the copier. In addition, gig economy is self-employment. If no one is calling for your services, well, you’re not exactly employed. Finally, the hiring companies don’t provide benefits, so, unless you’re a good budgeter, you “may end up consuming more county social services” (Naco.org).

Depending on what sort of person you are, being a freelancer might be a great option for you. For a lot of us, though, there are too many moving and mysterious parts to make for a peaceful work experience. As a personal aside, I also don’t want a stranger losing his lunch in Henrietta (my car) no matter how expensive that lunch might have been.

I’m not trying to talk anyone out of working the gig economy, there are just a few things to consider. The initial step should be speaking with your Bourke Accounting bookkeeper or tax preparer. They can set up a quarterly tax payment schedule for you and keep you from owing thousands at the end of the year. They can also help you sort out a budget to keep you fed through lean times. Finally, a Bourke Accounting pro can recommend a good car detailer if the extremely icky happens to your leather interior.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.