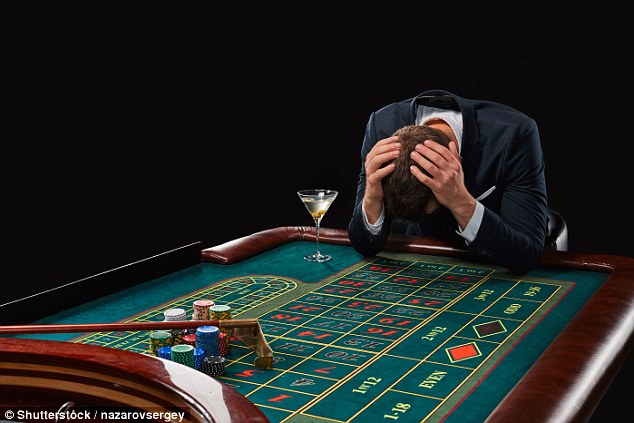

Randomly, someone will ask for my Facebook username. When I respond that I’m not on Facebook, I am met with a look that suggests that I might be a visitor from another dimension. Likewise, people find it odd that I work for Bourke Accounting and distrust the stock market. To me, there is no difference between high stakes Vegas roulette and stock trading. Even if you know a company and have tracked its progress for years, it’s still a gamble; all it takes is a CEO’s indictment or a natural disaster and the stock is worthless.

Much like my distaste for Facebook (and the broken relationships and altercations caused by the platform), I realize that my avoidance of the stock market isn’t completely logical. Generally, if you know what you’re doing, have a good financial professional in your corner and don’t do anything too risky, it’s possible to create an impressive portfolio. However, that important detail of understanding what stock trading entails is ignored by some new investors.

Studies have discovered that Millennials have gotten involved in the market in a big way, with nearly seven in ten currently invested in something (NYPost.com). While it’s great that this generation is planning ahead, it doesn’t always end with young investors sailing off into the sunset on a brand-new yacht.

On June 12th, the parents of 20-year old Alexander Kearns found a post-it note inviting them to turn on his computer. On the computer, they found a suicide note. Kearns had been using Robinhood, a trading app, and, when he saw a negative cash balance of $730,165 (CNBC.com), he did something very rash. In his note, Kearns questioned why Robinhood would allow a kid with no income to become so heavily in debt. Kearns also admitted that he had no idea what he was doing (Businessinsider.com). To make a tragic story worse, Kearns didn’t understand what he was looking at. While Robinhood can’t give the details of Kearns’ account, he didn’t owe almost a million dollars; his balance was “due to complex options trades,” which would have settled over the following days, but left a temporary balance in the meantime (Businessinsider.com).

Kearns’ family has vilified Robinhood for not offering an explanation or customer service options when Kearns received the negative balance notification (Businessinsider.com). In addition, Robinhood has been accused of making an app that resembles a video game as opposed to a stock trading tool with real-life repercussions. For example, every time a trade is completed, users get a little party, complete with confetti shooting all over (Kiplinger.com). Regarding customer service, users say that they’ve waited weeks for an answer in the Help section, it’s nearly impossible to get a person on the phone and emails go unanswered (Businessinsider.com). While a seasoned trader could probably get by with this level of customer service, rookies like Kearns are left to flounder in the dark.

People shouldn’t expect to get rich overnight with the stock market. People should also know the very real risks associated with trading. Finally, new traders shouldn’t try to learn by trial and error – it never hurts to contact a professional with any problems. Perhaps the most disturbing factor of Alexander Kearns’ story is that, had he just asked questions, he wouldn’t be a cautionary tale now.

Bourke Accounting experts are no strangers to the stock exchange. While Bourke Accounting pros aren’t stockbrokers, they can explain the terms and implications to those just starting to invest. In addition, your Bourke Accounting tax preparer can help you to choose the right investment product for your unique situation. And, no matter what, remember that you’re a lot more important than the numeric value on your bank statement.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

A friend of a friend called the other day after learning that I work for Bourke Accounting. She wanted to know why she only received $1,200 as her stimulus payment and not $2,400. As a single mother of a 25-year-old son (with a family of his own), Facebook told her that she’s entitled to double the money. She didn’t believe me when I told her that this simply wasn’t the case. I invited her to visit IRS.gov for information. She snorted, said, “Who believes the IRS?” and hung up. Rude.

I trust the IRS website more than Facebook, but I, too, have been guilty of believing rumors. For example, when I was a kid, my friends and I heard we shouldn’t drink Snapple because the company was owned by the Ku Klux Klan. Need proof? Look at that little “K” in the circle on the label! When I admonished a friend for drinking the stuff, she stared at me like I was a mentally damaged puppy and carefully (and slowly) explained what that little “K” actually meant. You know that subtle and awful symbol of hate? Yeah, well, it actually means that Snapple is kosher. I like the Peach Tea.

While the rumor mill didn’t topple Snapple, the same sort of smear campaign almost destroyed Brooklyn Bottling in 1991. Eric Miller, who inherited the small company from his father, decided that the only way to compete with the Big Cola Boys was to offer a good, cheaper priced drink. So, Miller created Tropical Fantasy, increased the bottle size to 20 ounces and sold the stuff for the low, low price of 49 cents. Within a few months, this barely known company enjoyed a 50% rise in sales and netted 12 million dollars (LATimes.com).

Things were going great! That is, until the pamphlets started mysteriously showing up all over New York City. These pamphlets advised consumers in lower income areas that Tropical Fantasy was manufactured by the KKK and included “stimulants to sterilize” minorities (Snopes.com). In no time, sales plummeted by 70%, delivery vans were attacked, stores that carried Tropical Fantasy were vandalized and store owners were brutalized (Snopes.com). The rumor was so widely believed that one of the leaders of the KKK told a magazine that they were “not in the bottling business” (LATimes.com). As an aside and answer for anyone wanting to know who could possibly believe a random flyer: The Tuskegee Study was a real thing.

Eric Miller was mad. He hired a private investigator to find out where the rumor came from. No dice. He gave Tropical Fantasy to the FDA for testing; when they released their findings that Tropical Fantasy was safe, people still weren’t buying. Finally, Mayor David Dinkins, NYC’s first Black mayor, drank a bottle on television (Newsone.com) and the company rebounded. Dinkins, a respected and trusted figure, saved Tropical Fantasy with 20 ounces.

So where did this rumor start? Pepsi and Coke denied any involvement. Social psychologists maintain that not only had they never heard of a “commercial rumor being started by a competitor,” but that the repercussions wouldn’t be worth it if it were ever discovered (LATimes.com). Miller finally conceded that it may have been started by a disgruntled ex-employee (Snopes.com). That is some nuclear revenge and I never want to be on the wrong side of that guy.

It’s very important not to believe everything we hear. If we happen to hear something that’s totally Crazy Town, it also very important to talk to professionals to learn the facts. Let’s face it, most of us would not be described as the leading minds of the world, so talk to the people who are.

Bourke Accounting doesn’t start rumors about our competitors. At Bourke Accounting, our experts want you to know how great they are the old-fashioned way: by showing you. So, the next time you hear a too good to be true financial rumor, pop open a Tropical Fantasy Cherry Blue Lemonade and call your knowledgeable Bourke Accounting tax preparer or bookkeeper.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

It’s a hot and sticky summer night. The stagnant air is alive with the buzzing of cicadas. Oh, no! What’s that slithering through the grass? It’s a venomous copperhead! You’ve never seen a copperhead in your yard before! Why is it here? Oh, right, those cicadas. As it turns out, copperheads very much enjoy cicadas, so if you have these lumbering buzz-machines hanging around, watch where you walk at night.

Yes, the predators of the natural world are drawn to the vulnerable, the oblivious and the protein dense. When you stop to think about it, copperheads share a lot of the same qualities as a certain type of human. Although we’ve talked about scammers before, it pays to remember that they are constantly lurking and evolving. While the end result of befriending scammers is always the same – your money in their wallet – the ways in which they achieve this change minute by minute.

The most important goal of a predator is survival. It’s because of this that the current group of thieves have discovered gift cards in a big way; halfway through 2019, $74 million was already lost to gift card scammers (AARP.org). While talking victims out of credit card numbers was never problematic, the traceability of the endeavor was (Againstscammers.com). Gift cards shield the perpetrator from identification and ensures that the victim will never see their money again. The best part, for the scammer, is that it’s just so blessed easy.

For instance, this year Katrina Whitaker needed a car. As luck would have it, she found one on Facebook at an amazing price. The seller asked for $1,400 to be paid in eBay gift cards, claiming it was for the safety of both of them. Whitaker then received an email from “eBay,” requesting the card codes so that the money could be held in trust; if Whitaker didn’t like the car (which was being shipped), she’d get her money back. By the time Whitaker understood that the car wasn’t coming, it was too late. The cards had been used and Whitaker’s bank informed her that, since the gift cards had been bought legitimately, there was nothing they could do (Courier-journal.com). If Whitaker had realized that she’d been cheated before the cards were used (how could she not have realized?), the funds could have been frozen. However, once that money’s gone, it doesn’t leave a forwarding address.

While I don’t want to blame the victims of gift card fraud, I’m going to. Since when are gift cards better than good old cash money? A mixture of greed and mad dog dumb decisions are keeping scammers fat. Speaking of greed and the certifiably stupid, “sugar babies” are now being targeted, too. If you don’t know, a sugar baby is a person who receives support from a wealthier patron. In exchange, the sugar baby offers nothing more than platonic companionship all the way up to…um…intimate adult fun time. With this scam, the patron offers to pay off the sugar baby’s credit cards. Once the baby provides their account information, it would appear that the debt has been paid. Then, the patron demands gift cards in appreciation; for some reason, the baby complies and provides the codes. The accounts used to pay off the credit cards are fake, the money disappears from the gift cards and now the baby is in a lot of debt (Fraud.org). While no one deserves to be a victim, isn’t a sugar baby just a prospective scammer in the first place?

There is no such thing as getting something for nothing. Don’t trust strangers on the internet and certainly don’t give out information or money. Easy as that.

Bourke Accounting experts don’t want you to meet a scammer. If you suffer a momentary lapse of judgement, however, your Bourke Accounting specialist can create a plan to help get you back on track again. In a world lousy with nefarious con artists, your Bourke Accounting pro is honest and dedicated – and they’ll never ask you for gift cards.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I’m pretty sure that this has happened to you: you are attempting to buy something at the corner store. Annnnd…the cashier is more entranced by the cellphone than the live and paying customer who is standing right here. I mean, it’s great that you made it to level 400 of Candy Crush, but could you take my money, please?

I’m pretty sure that this has happened to you: you are attempting to buy something at the corner store. Annnnd…the cashier is more entranced by the cellphone than the live and paying customer who is standing right here. I mean, it’s great that you made it to level 400 of Candy Crush, but could you take my money, please?

At Bourke Accounting, we’re allowed to have our cellphones. During my original interview, Bill told me that, as we’re all adults, responding to a text every once in a while isn’t a big deal. But, he emphasized, if the phone usage became excessive, there was going to be a problem and we’d have to revisit the subject. That sounded fair to me. From 8-5 (8-7 during tax season!), I realize that my priority is my job and I don’t need to see funny puppy videos right now. Admittedly, I am not as pure as the driven snow over here, but so far, no one has had to smack my nose.

At this point, most workers have cellphones. I don’t have to tell you how convenient this invention is, but, as with everything, there’s a downside. For example, “19% of employers think their workers are productive for less than five hours a day and more than half believe that cellphones are to blame” (SBA.thehartford.com). In addition, according to The New York Post, a study claims that, because of electronic devices, there is “$15 billion in lost productivity” annually.

Of course, that one guy playing Minecraft in his cubicle is bad enough; what I truly hate, though, is someone else’s loud conversation that I can’t escape (this doesn’t happen at Bourke). I’m trying to work and someone else is engaged in a very personal dialogue with their doctor. No, no, I don’t want to know what the rash looks like, I don’t want to know where on your body it’s located and I sure as anything don’t want to know what colors are coming out of it. Am I the only one who wants to bring back phonebooths?

There seems to be two schools of thought regarding what to do about the cellphone issue. Cathy Hotka (of Cathy Hotka and Associates) says that, if your employees aren’t being productive, “your response isn’t to complain – just fire them” (Forbes.com). Maybe it’s my bleeding heart again, but this seems a bit harsh. However, if a worker is reprimanded more than once and the behavior remains unchanged, there might not be any other option.

The other school of thought leans toward the restriction, not banning, of cellphones. While there is no law actively stating that an employer “cannot implement a policy prohibiting cellphones” (Paycore.com), Paycor.com warns that completely banning phones “would likely decrease employee morale.” They suggest that phones be kept in lockers or drawers except during breaks. Also, they suggest setting up another phone line in the reception area that is strictly for employee emergencies in order to circumvent arguments from concerned employees with children.

Our Bourke Accounting professionals know how to stay focused. You will not be interrupted, mid-appointment, by Bill or Tim stepping out to take a friend request. When you see a Bourke Accounting expert, you will have their 100% dedication and attention. Eh, you might want to turn your phone off, though. You can always watch cute kitties doing cute things after you’ve received the best in accounting and bookkeeping services, right?

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

There are many “Words of wisdom” out there: Don’t run with scissors. Don’t take a bath with a toaster. Don’t eat green chicken. These all make a lot of sense. In these new and interesting times, I think one really important concept is overlooked: Don’t Tattle on Yourself. This is pretty similar to don’t air your dirty laundry in public. Or even, to a lesser extent, ol Ben Franklin’s: Three can keep a secret if two of them are dead. Considering the advent of social media, I think we all need a second to reflect on what we shouldn’t offer up to the world.

When social media first came out, it was fairly harmless. People were posting about sitting in Starbucks, how they bought new shoes and, oh, look, here’s a picture of a baby! Now, it seems that folks are being way too open about other, perhaps naughty, activities that they might be engaged in. For example, Dr. Phil had an episode a while ago that featured a woman who lost a job at ESPN before she even started because of what was discovered on her Facebook page. Let’s just say that what she posted did not exactly align with ESPN’s concepts.

Paradoxically, I almost didn’t get a job a few years back because I had (and still have) no presence on social media. Seriously, my prospective employer thought that I must have been hiding something, as I didn’t have a Facebook page. I explained, no, I’m not hiding anything, I simply don’t believe last night’s dinner needs validation from strangers. I was met with a wary and suspicious stare.

So, in such interesting times as these, I am offering three tips regarding social media:

1) DON’T post anything that you wouldn’t want your grandmother to read. This includes how you had [redacted] with a stranger Friday, how you smoked [redacted] Saturday night, how you would like to [redacted] your neighbor with a crowbar. Family functions are difficult enough. Don’t make it worse.

2) DON’T post any pictures of yourself doing anything illegal, don’t talk about doing anything illegal on social media. In 2017, abc7chicago.com reported that “50 [were] arrested after Chicago police infiltrate[ed] Facebook groups selling guns, drugs.” One of those detained happened to be a school teacher. This is not the only instance of arrests made because of social media. I found around 20 articles with titles like “7 People Sent to Prison because of Social Media.” So. Don’t do that.

3) DO have social media. I know, right? We can’t win here. If you have social media, you will be judged. If you don’t have social media, you will be judged. Have a public page with lots of friends from your knitting circle and pictures of bunnies. Have a private page (if you really must) about your thoughts regarding the Zombie Apocalypse.

So what happens if you posted something ill-advised on social media and now have the IRS rap, rap, rapping on your door? Well, a good accountant would be a handy asset. I’m not promising that the experts at Bourke Accounting can save you from yourself, but they can offer you valuable insight and advice. The associates at Bourke Accounting are here to help, even if it appears to be a Sisyphean endeavor. Bourke Accounting won’t give up on you.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I landed my first job at 13. I worked every day after school and on Saturdays for $5.00 an hour at a dry-cleaners. Looking back, I don’t know why I was so anxious to join the workforce. Looking back, with a bit more experience, I’m fairly certain that my employers and I were engaged in something illegal. Child labor and whatnot.

I have always liked the concept of work. “Daytime is work time,” I’ve espoused numerous times. I rather thought everyone felt the same way. But. If everyone felt the same way, why am I reading horror stories about hiring Millennials?

First, let me say that I don’t have a problem with Millennials. Honestly, I don’t know enough of them, personally, to have any sort of feeling at all. All I know about Millennials is that my outdated computer didn’t recognize “Millennials” as a properly spelled word. Also, ad execs feature them in order to peddle deodorant and energy drinks to me on my television. Apparently, if I apply the right deodorant, while drinking the right energy drink, I will be a sexy 20-something.

Doing some cursory research, it seems that there are two schools of thought regarding Millennials in the workplace. According to Forbes.com, “the great thing about Millennials is that they bring fresh ideas and fresh perspectives to your workplace.” What’s more, Millennials are generally more open to a diverse workplace environment. These are two great qualities. From what I’ve been reading, office drama will be cut down as Millennials are less likely to discriminate based on gender, sexual orientation, race, etc.

Let’s sign ’em up!

Oh, but wait. There’s a dark side.

According to thebalancecarreers.com, you should avoid trying to keep Millennials away from social media during work hours. According to them, “a no Facebook rule in the office is a death sentence [for Millennials]. One-third considers social media freedom a higher priority than salary.” Look, I like reading trashy romance novels, but I realize that I probably shouldn’t do that at work.

An even greater indictment comes from Michael Levin, a Daily News contributor, when he states “As God is my witness, I will never hire a millennial again as long as I live.” Eeeee. I was even uncomfortable retyping that. However, Levin shares some Millennial-hire experience which gives some credence to his statement. It seems that his biggest complaint is that Millennials grew up in a time “where everyone was made to feel special. You didn’t have to put forth an effort to win a ribbon…showing up was good enough.” Levin cites laziness, entitlement, wanting too much without paying one’s dues, and on and on. Okay, you get it. He really doesn’t like Millennials.

My thought is that you shouldn’t base your entire opinion, on an entire generation, on a few bad experiences. If you do, wouldn’t you be engaged in stereotyping? There are lazy and entitled folks in every generation. Simply because the lady at the grocery store failed to hold the door for me, doesn’t mean that every Baby Boomer is selfish.

If you’re an HR exec or a business owner, evaluate every applicant on their merit, not by their date of birth.

Here at Bourke Accounting, you won’t be judged. I was going to expand regarding race, religion, age, but I can stop with: Here at Bourke Accounting, you won’t be judged. Our associates want to help you with your financial endeavors, your IRS issues and your future well-being. Gen X-er, Millennial, Baby Boomer, all are welcome at Bourke.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.