Have you ever had to leave the table while having dinner with someone because of the sounds h/she made while eating? Have you considered committing grievous bodily harm upon your co-worker for clicking a pen over and over? Has a baby crying in the next aisle ever made you feel like fleeing the scene?

If so, you might be suffering from misophonia. I should know, as I happen to be misophonic myself.

Misophonia is a disorder “in which certain sounds trigger emotional or physiological responses” (Webmd.com) that other people might consider a little crazy. For a misophonic person, some sounds cause anger, anxiety or an almost unstoppable urge to leave the room.

I first became aware of this condition when a friend mentioned it after hearing about it on NPR. I thought he was messing with me when he suggested I had this; when pronounced, misophonia sounds like “Me-So-Phony-A.” I honestly thought it was a bad Full Metal Jacket reference. Then I did some reading.

In May of 2019, Nature.com announced the results of a recent study. In this study, people with and without misophonia were shown video clips with different sounds (while their brains were being scanned). When it got to clips with “lip smacking or heavy breathing, people with misophonia felt intense anger and disgust, and their heart rates spiked” (Livescience.com). The non-misos were A-OK. In addition, it seems that the miso-affected experienced “heightened activity in the part of the brain which determines what we pay attention to” (Graziadaily.co.uk). Finally, the parts of the brain that control emotional regulation went a bit hinky when the misos heard the really icky sounds (Graziadaily.co.uk). Basically, you hear whispering (that’s a big one for us) and go about your day, while we hear whispering and get nutty.

For some reason, when misophonics hear certain sounds, the “survival part of the brain thinks…it’s being attacked or it’s in danger” (NPR.org). Evidence suggests that mental illness and past traumas don’t cause this condition, which is rather unexpected. The Misophonia Institute mentions research that could possibly link genetic factors to misophonia, but it doesn’t seem like anything really concrete is understood about it.

According to Webmd.com, misophonia is also not caused by problems with the ears. It’s not like misophonics have hyper hearing and are freaked out because they can hear the frat boys down the street chewing with their mouths open. At this point, it’s just a mysterious brain thing for us.

But be of good cheer, my fellow Misophonics: we are not crazy! We now have a name for our affliction and research (to back up what we knew all along) that misophonia is real. Also, around 15% of Americans have misophonia, so we’re not even alone (Misophonianinstitute.org)!

Besides being the best tax preparers and bookkeepers in Louisville, Bourke Accounting professionals are a joy to eat around. Bourke Accounting experts don’t whisper and you never hear those awful nasal whistles that drive us to distraction. While you’re receiving the most knowledgeable financial advice, your Bourke Accounting associates will never cause anxiety by breathing through their mouths. All in all, an appointment with a Bourke Accounting specialist is a misophonic’s dream come true.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Have you ever started your day by stepping in dog poop on the way to the bathroom (but Fluffy is housebroken!)? Maybe you fought with your significant other, got yelled at by the boss and had your co-worker insult your new pants. In short, have you ever had a bad day? Did you ever consider just faking your own death, running away to a secluded place and living peacefully forever?

If you are one of the over 6,000 people mistakenly declared dead by the Social Security Administration each year (CNBC.com), you could have your wish without the effort! That’s right, because of a clerical error, you could be living your best zombie life without the hassle of faking a car crash (and, I guess, finding a body double). All of this can be yours as a result of a mistake made by one of the most powerful organizations in the US.

The Social Security Administration has a database that records deaths in America. This list, the Electronic Death Registration (or the Death Master File, depending on who you ask) is intended, for one thing, as a “measure taken to prevent fraud” (NPR.org). This list stops the baddies from stealing identities or taking out credit cards in a dead person’s name. Once a name ends up on this list, the SSA sends the information to “nine benefit-paying Federal agencies, including the Internal Revenue Service and the Centers for Medicare and Medicaid Services” (OIG.SSA.gov). Not only these guys, but banks, credit card companies – pretty much everyone and their brother – share in the sad news.

This database is useful if the person is legitimately deceased. However, if you are still among the quick, ending up on this list is a nightmare. Accounts are frozen, health insurance suspended and Veteran benefits go “poof.” So how can this happen? Seriously, it is simply a matter of human error. The SSA gets their death information from funeral directors, hospitals and family members. Okay, that sounds like a good start. These guys should know, right? But, this can turn into a really terrible game of Telephone. According to NPR.org, inputting errors on the part of SSA workers are responsible for 90 percent of accidental death declarations. It only takes one wrong digit to transport you, the innocent bystander, into a confusing new un-life.

So, now you’re a pulse-challenged American. How do you fix it? The SSA suggests you go to your local Social Security office with at least one piece of identification (who are we kidding, bring every piece of identification you have ever acquired). After the SSA corrects your record, “you’ll be issued an ‘erroneous death case – third party contact’ notice” (Denverpost.com) that you can show to the nice agencies who have all your money. If, for some reason, you don’t get satisfaction from the SSA, Denverpost.com suggests that you call in the big dogs by “contacting your local congressional representative’s constituent services office.” If you yell loud enough, someone has got to believe you’re still alive, right?

Like a lot of weird occurrences, this probably won’t happen to you. But if it does, consider that nice secluded place one more time before visiting the Social Security office.

Bourke Accounting specialists don’t discriminate based on color, gender, religion or anything else. However, if you’re dead on paper, it might be a little difficult to prepare your tax returns. Although, just like during an IRS audit, your Bourke Accounting professional will stand by you until you are reborn and financially solvent again. Even if you are undead, your Bourke Accounting bookkeeper and tax preparer will still offer you the best service anywhere.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

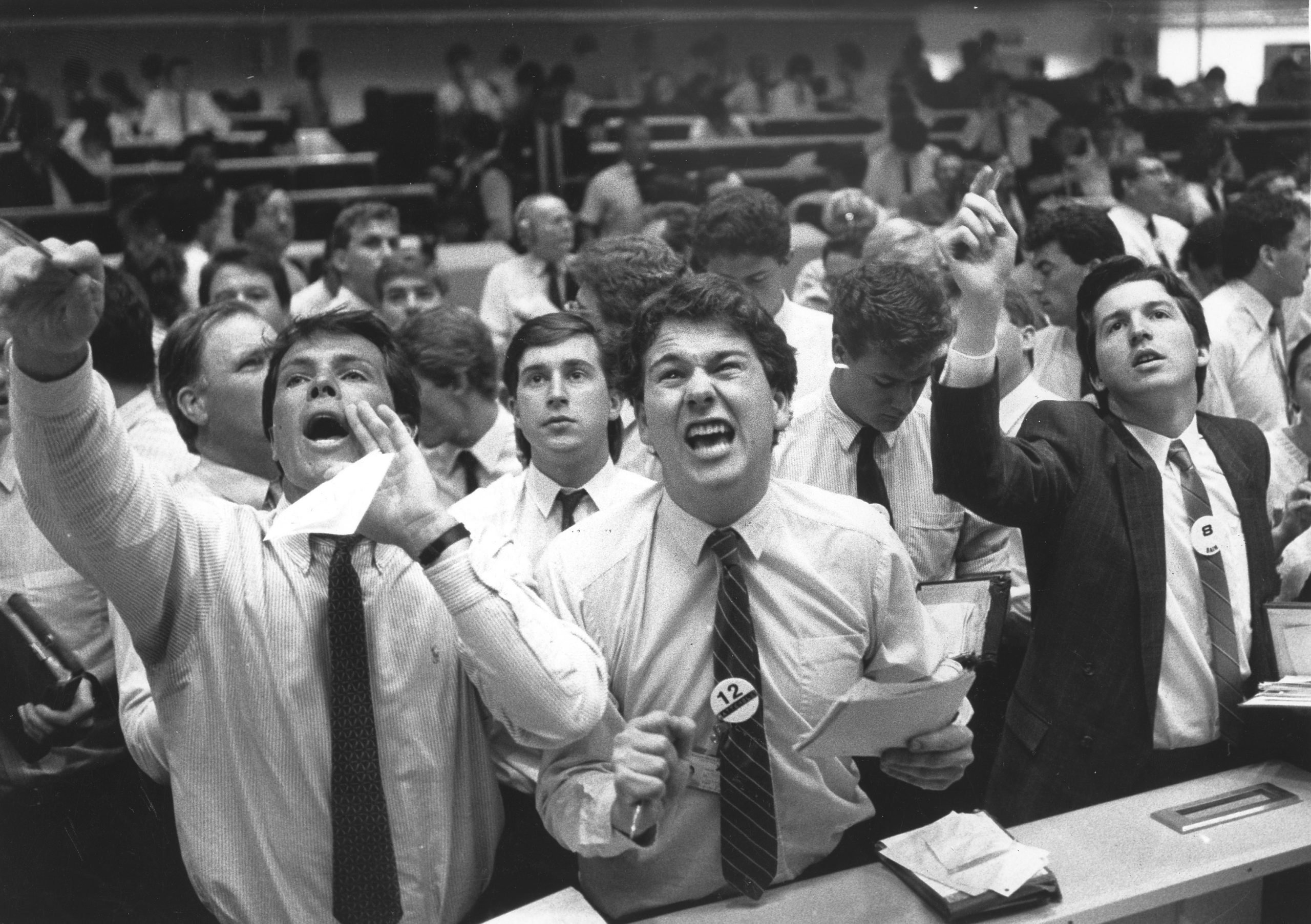

Years before Bourke Accounting, I worked for an attorney. He told an anecdote about someone who was in a coma for a couple of months. During this time, her stock portfolio lost a lot of money as a result of some very risky investments. The broker claimed that he had received requests for every one of the trades and approvals for every one of his commissions. The stockbroker was punished when it was unequivocally proven that his client was less than conscious during this period.

Films like Boiler Room (2000) and The Wolf of Wall Street (2013) show us the shady side of stockbrokers and investing. Even with these stylized cautionary tales, we convince ourselves that security abuses, while terrible, could only happen to the other guy. No one wants to believe that they could ever be the victim of an unscrupulous broker. However, in 2016, “59 Ponzi schemes were uncovered, totaling more than $2.4 billion in losses” (Superlawyers.com). Furthermore, between 2017 and 2018, suits “against investment advisers were up nearly 38% and those against broker-dealers were up 17%” (Cov.com). So, yeah, it could happen to you.

The only difference between these white-collar scams and the guy mugging you on a dark street is presentation. So, here are a few ways to protect yourself against a gentler mugging:

1) Out of the blue, a broker calls you with a can’t miss, limited time investment offer. S/he regales you with promises of making twice your money back in a ridiculously short period. Much like the Nigerian prince scam, you must ask yourself: why am I so important today? Quick answer: you’re not. Also, if this person uses “high-pressure sales tactics…or refuse[s] to send written information about an investment” (Investopedia.com), you can just go ahead and hang up.

2) So, you have a new broker, congrats! Suddenly, you’re asked to start making checks out to him/her personally and not to the firm. Since this is a “common way brokers…fraudulently pocket investors’ money” (Millerlawgroupnc.com), it should be a very red flag to you. If this is a legitimate broker working for a legitimate firm, all payments should be made to that firm.

3) You found your reputable broker, checks go the firm, everything is going great. And then, you notice an “unusual increase in transactions without any gains” (Investopedia.com) to your portfolio. You could be a victim of churning. This is a cute little practice of making tons of trades that bad brokers engage in to “increase their commissions” (Investopedia.com). These guys aren’t interested in what trades will benefit you, they just want to make their car payment on your dime. And yes, there are laws against this.

There are a lot of honest and conscientious stockbrokers out there. Thankfully, with the amount of information at our disposal, making an informed choice has become easier. For example, the Better Business Bureau website (BBB.org) offers four pages of Louisville brokerage firms with reviews. It’s also not a bad idea to get recommendations from friends and family. When you’re ready to invest, it pays to take the time to seek out an established and well-respected firm.

Bourke Accounting professionals won’t offer advice regarding which specific stocks you ought to invest in. However, Bourke Accounting bookkeepers and tax preparers will advise you if it makes sense, in your current situation, to invest right now. Your Bourke Accounting expert won’t tell you what to do, but they can keep you safe and grounded in a get rich quick modern society.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

You know how you can say anything you want about your brother, but if anyone else says something, them’s fighting words? That’s how I feel about the IRS. I understand the necessity of the Internal Revenue Service, I understand the necessity of taxes in general, but I like to make fun of Feds because they’re the big dogs (and I have a place in my heart for the little dogs).

You know how you can say anything you want about your brother, but if anyone else says something, them’s fighting words? That’s how I feel about the IRS. I understand the necessity of the Internal Revenue Service, I understand the necessity of taxes in general, but I like to make fun of Feds because they’re the big dogs (and I have a place in my heart for the little dogs).

So, because of my loving hatred for the IRS, when I read about Operation Snow White, I got angry (and a little scared). Real quick: Operation Snow White “refers to the program written by Scientology founder L. Ron Hubbard in 1973 for the purpose of legally correcting and expunging the plethora of false governmental reports about the church of Scientology” (Standleague.org) and getting these corrections out to the public. All very legal, according to STAND (this is an acronym for Scientologists Taking Action Against Discrimination. Where did the “N” come from?)

And just what is Scientology? Easy answer is that it’s a religion created by a failed sci-fi writer with no concept of character development or dialogue. I’m not going into detail about Scientology as a pyramid scheme that forces people to spend thousands of dollars. Or the abuse of members. Or the murders of defectors. Or the fact that Charles Manson considered himself “Clear” (pretty high up in the Scientology hierarchy) and used Hubbard’s teachings to indoctrinate The Family. Nope. Let’s stick with the Snow White Program.

While Scientology members can pretty up this “program” all they’d like, the church of Scientology sent members to infiltrate “high-security agencies [including] the Department of Justice and the Internal Revenue Service to find what they had on Hubbard and the church” (LAtimes.com). For example, there was the IRS clerk typist who photocopied documents harmful to Scientology in the middle of the night. Also, there was the spy who bugged an IRS conference room “before a crucial meeting on Scientology was to be convened” (LAtimes.com).

These guys weren’t just photocopying papers, however. They were also stealing documents that they believed made Scientology look bad. Generally, these had to do with member complaints and Scientology’s tax-exempt status. Not only were they photocopying and stealing, they were slipping in weird little bits of misinformation in order to make governmental agencies look stupid (Wikipedia.com). But didn’t Scientology say that the “program” was completely legal?

When everything was said and done, 11 defendants were “ordered to serve five years in prison,” one of whom was Hubbard’s wife, Mary Sue. Their offenses ranged from “obstructing justice, burglary of government offices and theft of documents” (Wikipedia.org). As of 1990, all 11 were free. L. Ron went out for cigarettes, never to return, when he was “named by federal prosecutors as an ‘unindicted co-conspirator’” (Wikipedia.com). Way to stand by your woman, Ron.

I don’t have a problem with religion, but I can’t stand anyone who takes advantage of scared and, perhaps, broken people. And I don’t dig nasty sci-fi writers messing with cute little IRS auditors.

Bourke Accounting professionals don’t care what religious flavor you prefer. Bourke Accounting bookkeepers and tax preparers want to ensure that your financial stability is protected. You won’t have to tell your deepest and darkest secrets to your Bourke Accounting expert to gain salvation, just bring your receipts and W2s and let them do the rest.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

You’re walking down a deserted street. The streetlamps above you flicker, throwing the world into stark relief before plunging you into darkness. You’re 2,000 light years from home. A shadowy figure appears in front of you. He has been waiting for you. “You got the money?” he asks, his voice confident, but his eyes wary and apprehensive. “You g-got the stuff?” you stutter, hating the hesitation. He scans the empty street and moves forward. You exchange money for the bottle in his latex-covered hand. You look up and down the street. When you turn back to him, he’s gone like cigarette smoke on a windy day. You shove the sealed bottle of Purell down your pants and hurry down the street, feeling triumphant and filthy.

Hey, this scenario could happen, you know. I mean, it sort of is happening. Here in Louisville, everyone seems to be obsessed with toilet paper. I have been asked by numerous clients if I have toilet paper at home. Um, yeah, man, I have toilet paper, do you have a mop? Are we playing an uninteresting game of Household Go Fish? I’m simply not understanding this new fixation on toilet paper. I don’t go to the grocery store (I find it boring, I hate the lighting and, since they got rid of Muzak, the grocery store is just nowhere), but people who do go tell me that toilet paper and hand sanitizer are in pretty short supply right now. All right, that’s fine. What are those leaves outside for anyway?

I sort of understand the hand sanitizer compulsion. Even before the Coronavirus, people were crazy for the stuff. You couldn’t walk into any office without seeing the cheery little bottles perched on multiple desks. Much like grocery stores, I hate hand sanitizer. Maybe I’ve been using it wrong, but it always makes me feel like I have some sort of weird film on my hands. I guess that’s The Film of Good Health and Protection, but I hate it anyway. So, even if I had it (which I don’t – don’t try mugging me for that fresh, bacteria fighting, viscous grossness), I wouldn’t be using it anyway.

Beyond hand sanitizer, what I hate even more are people who take advantage of confusion in uncertain times. I was reading an article on Theatlantic.com about this guy who realized that his fellows were going to want Purell. So, he goes to The Dollar Tree, buys up a bunch of the stuff and was selling it on Ebay.com for about $138 a pop. Good looking out, brother. Way to help the world amid a pandemic. Both Amazon and Ebay have come out recently saying that they don’t condone price gouging and won’t allow it on their platforms. I hope this is true because being a facilitator for vultures is a really bad promotional angle. When I looked for Purell on Ebay, I was told that the pages were missing, so at least Ebay was serious.

Whew! That was a lot of my opinion. Look, we don’t know when everything is going to return to our dysfunctional normal. In the meantime, don’t hoard stuff, don’t take advantage of your fellow human and just do the best you can to make it through this with a little class.

Your Bourke Accounting professionals are feeling pretty good. But. If you feel ill (no, you don’t have Corona), don’t worry if you need to reschedule your appointment. Your Bourke Accounting tax preparers and bookkeepers will rearrange their days to accommodate you and your needs. The bottom line is that you guys are the most important aspect of Bourke Accounting and we really appreciate you.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I like my Bourke Accounting co-workers – because of this, I really hope none of them choke, have a cardiac episode or experience any incident that requires first aid. My first aid skills consist of poking the victim with a stick until he wakes up or until someone takes my stick (I am good at sewing, so I might be able to, fashionably, help with a cut).

I like my Bourke Accounting co-workers – because of this, I really hope none of them choke, have a cardiac episode or experience any incident that requires first aid. My first aid skills consist of poking the victim with a stick until he wakes up or until someone takes my stick (I am good at sewing, so I might be able to, fashionably, help with a cut).

We’ve all heard horror stories about people who have been sued after providing lifesaving first aid. Sometimes, a rib is cracked when CPR is administered; personally, I would forgo litigation if I could trade a cracked rib for my life. There are some cases of victims suing would-be saviors, however, that leave us totally confused.

For example, in 2004, Lisa Torti was following co-worker Alexandra Van Horn home from a party. The driver of Van Horn’s car hit a pole. Torti believed that an explosion was imminent when she saw liquid and smoke pouring from the vehicle. So, Torti pulled a barely responsive Van Horn from the car. The accident left Van Horn a paraplegic. However, Van Horn sued Torti, “asserting Torti worsened her injury by…yanking her out of the car ‘like a rag doll’” (Reviewjournal.com). The California Supreme Court decided that Van Horn could sue “because Good Samaritan protection was only for those administering medical care” (People.howstuffworks.com). As a result of this ruling, however, the state legislature ended up changing the law to protect non-medical people providing aid (Reviewjournal.com).

I had never given much thought to Good Samaritan laws. However, after, the insanely cool, Marianna Perry of AEDs & Safety Services, LLC gave a seminar at Bourke Accounting and mentioned these laws, I became curious. Because people had become leery of helping each other, lawmakers acted to protect well-meaning bystanders. For example, in Kentucky, under KRS § 311.668 (2009), anyone who uses, in good faith, an AED on a victim “shall be immune from civil liability for any personal injury” (Recreation-law.com).

Now, there are some limits to this law. This law doesn’t apply if the victim is injured from “the gross negligence or willful…misconduct” (Answers.uslegal.com) of the person giving aid. Basically, if the guy next to you is choking and you stab him 7 times in the legs to dislodge that potato stuck in his throat, you might have to chat with some people in authority.

Good Samaritan laws have been modified to also protect drug abusers in many states. This law, called 911 Good Samaritan law, “prioritize[s] the victim’s safety and resuscitation over arresting drug users” (KYHRC.org). What this means is, that after a heavy night of partying, if someone happens to turn blue, the rest of the partygoers are protected from arrest when calling for medical care for their azure pal. No one likes the idea of drug abuse, but I think we all appreciate second chances.

I like Good Samaritan laws. Once, in Colorado, I choked on a piece of steak. The guy next to me jumped up and performed the Heimlich. Little buddy saved my life and wouldn’t even accept a drink in return (I believe I was drooling at the time). Had this guy worried about litigation, rather than the life of a fellow human, would he have been so eager to help? I like to think he would have, but it’s nice to know he was protected, too.

I am in the minority when it comes to first aid knowledge at Bourke Accounting. If you choke on chips during an appointment with your Bourke Accounting bookkeeper or tax preparer, you better believe they’ll save your life. Not only do Bourke Accounting experts provide you with the best in financial advice and guidance, they can also do the Heimlich without shattering your ribcage.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

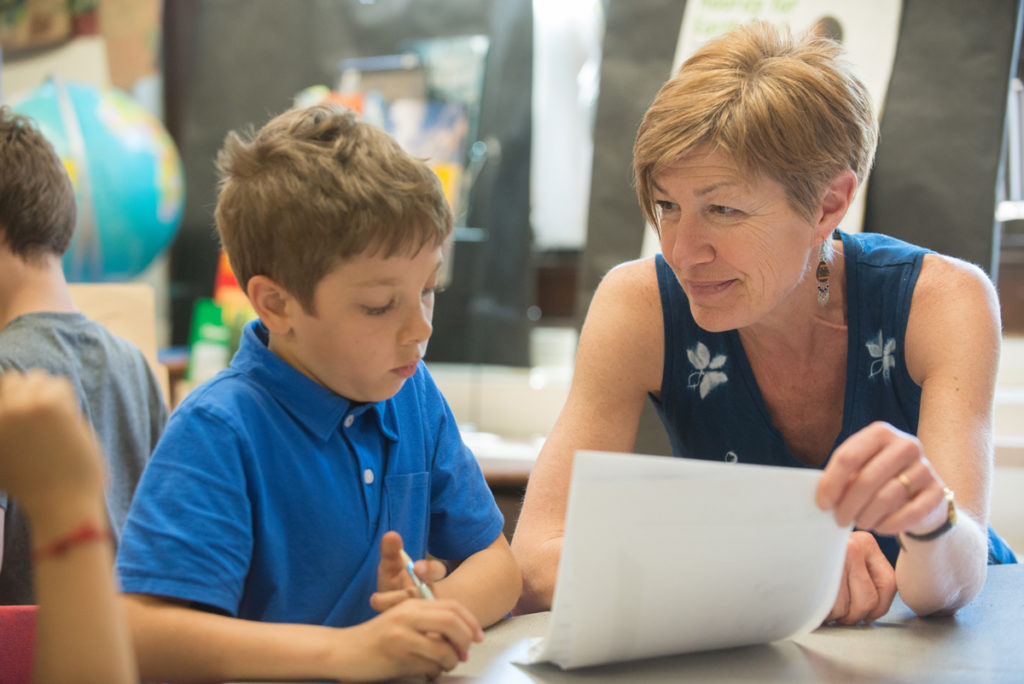

Average football player salary = $2.1 million per year

Average teacher salary = $39,249 per year

My ma used to be a receptionist (much like your Bourke Accounting narrator), but, as she had always wanted to be a teacher, she earned her degree. When I say that she was good, she was really good. I was envious of her high school students; her projects were creative, she was firm, but fair and she enjoyed her job.

Then, things changed. My ma was no longer able to fail kids who didn’t do the work; she was no longer able to create her own lesson plans. If a kid acted up, there were no repercussions – even if the kid was threatening. Her principal always sided with the parents, especially if they screamed “lawsuit” loud enough. My mom could have taught well for another decade, but she said, “life’s too short” and retired.

Sadly, my mom is not the only teacher chased out of the profession. Thebestschools.org reports that about “one third of teachers quit teaching within three years; around half quit within five years.” So, what seems to be the problem here? As we know, pay has always been an issue for teachers. However, it seems that the problem has gotten worse. For example, “the average pay rate for teachers has actually decreased since 2000 – in some states…by 17 percent” (Swingeducation.com).

A certain governor wanted to cut teacher pensions, implying that educators weren’t very important. However, when teachers went on strike, governor man painted a horrid picture of what most likely befell the children on account of missing teachers. Wait. Teachers keep the wolves at bay, but they’re not worthy of a living wage or retirement? I can’t blame new graduates for not seeking out teaching posts.

Another problem plaguing teachers is unruly kids combined with no disciplinary recourse. Cinque Henderson, former educator and author of Sit Down and Shut Up: How Discipline Can Set Students Free, relates how he was no longer able to send children to the office for bad behavior. Mr. Henderson was reprimanded by his principal when he tried because, “sending students to the office takes away the student’s autonomy” (NYPost.com). Instead, disorderly kids were given the option to “decide when they want[ed] to take a break” (NYPost.com). I hate to say that the inmates are running the asylum, but…

I am not saying parents are bad. I’m not saying kids are bad. I am saying that teachers are responsible for preparing children for the next step in life and should be respected for that. I’m saying that teachers, besides caregivers, are the most influential people to children. Why don’t we start appreciating them like we mean it?

Bourke Accounting specialists love teachers. They know that you guys are teaching their kids not only to read, but that it’s not nice to rub boogers on each other. Just as you are the best at what you do, your Bourke Accounting pros are the best at what they do. Teacher or non-teacher, your Bourke Accounting expert wants to provide you with the best and most accurate service.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon and hug a teacher today!

Written by Sue H.

I love spin-offs. As a kid, watching Mork & Mindy, I was taken aback when my dad remarked that Mork from Ork had originally appeared on an episode of Happy Days. At that point, I still wasn’t totally convinced that TV actors weren’t tiny people living inside that box, so the idea that they could go back and forth to other shows was even more astounding.

There are some spin-offs that are useful, although not quite as fun as watching Fonzie save Richie from an Orkan. Take, for example, the way a tax attorney is a spin-off from a tax preparer when a citizen is forced to file for bankruptcy.

Real quick, there are two ways an individual can approach bankruptcy: Chapter 7 and Chapter 13. With Chapter 7, “you either pay for or give up your property for secured debts” (Legalzoom.com). Basically, you liquidate as much of your stuff as possible to pay the debt (Legalzoom.com). Chapter 13 is a payment plan to pay off your debts. The plan “can last up to five years” (Legalzoom.com) and you’d better believe that everyone involved is watching closely to make sure that you keep up with payments.

The relationship between tax preparers and tax attorneys is something that I just learned about the other day: bankruptcy filings increase during, and right after, tax season. According to USAtoday.com, filings “in March were 26% to 34% higher than the monthly average…[and] April’s filings were 15% to 25% higher.” The main reason for the surge is that, after individuals receive their tax refunds, they now have the funds to hire a tax attorney for their bankruptcy cases.

Filing for bankruptcy can be rather expensive, as it turns out. When considering a Chapter 7 bankruptcy filing, individuals can be looking at a charge of around $1,500: filing and fees can amount to about $335, in addition to attorney fees for about $1,200 (USAtoday.com). This news does not help the more than 46% of Americans who “who wouldn’t be able to cover an emergency of $400” (USAtoday.com).

In addition, bankruptcy laws passed in 2005 made things a bit more complex. One change, for example, is that Chapter 7 isn’t as easy for “filers with higher incomes” (Nolo.com) as it used to be. Because of the increased difficulties in bankruptcy filing, “attorney fees for even the simplest type…rose 48% from 2003 to 2009” (USAtoday.com).

But do filers really need a tax attorney? Pretty much. While UScourts.gov supplies resources for individuals filing for themselves, it is “strongly recommended [using a professional] because bankruptcy has long-term financial and legal outcomes.” In addition, UScourts.gov points out that judges and clerks are legally prohibited from holding a filer’s hand. They can’t help if a filer gets confused or has questions.

Bourke Accounting hopes that you never have to file for bankruptcy. However, if you must, make sure that you use the expert tax preparers and bookkeepers at Bourke Accounting. Bourke Accounting can offer guidance to ease you through your tough time. You want your spin-off to be Mork & Mindy, not Joey (remember? The spin-off after Friends? That’s okay, no one else does either).

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

The management of Bourke Accounting is very generous. Case in point: for a co-worker’s birthday, there was specialty pizza, Bill-bought gifts and a Phil-baked cake. The birthday girl hadn’t asked for any of this; Bourke management simply took it upon themselves to make the lady feel special.

That being said, one thing the management of Bourke Accounting can’t abide is an employee, three weeks after being hired, badgering for a raise. Do you know your job? Sort of. Have you missed any days? Only five. Like most places, Bourke raises are based on merit, not the loudest haranguing.

I think this could be used as a very (very) loose analogy for good and bad charities. There are some charities that are so well-established, we don’t even think twice about donating to them. I can’t walk past a Salvation Army Santa without throwing cash into that weird little cauldron. As the Salvation Army gives 83% of donations “toward helping the needy” (Scholastic.com), they’re a pretty safe charity bet.

So, what about GoFundMe? According to their website, people who have started fundraisers on GoFundMe have raised more money on that platform than anywhere else. In addition, GoFundMe touts the fact that “over 10,000 people start a GoFundMe every day.” Craig Fugate, former FEMA Administrator (I seem to remember reading about FEMA), is quoted as promising that there are a lot of people ready “to ensure that funds raised on the platform are verified and they go to the cause for which the money is being raised” (GoFundMe.com). I don’t know about you, but I sure feel secure about giving donations to folks on GoFundMe now.

Oh, but wait. Here’s an interesting little website called Gofraudme.com. It seems that this site has over 28 pages devoted to documenting GoFundMe scams. No, there can’t possibly be that many; Craig Fugate promised! Let’s see…Victoria Morrison pretended her son had cancer (now serving 5-12.5 years for “child neglect or endangerment”), Ginny and Robert Long pretended their son had cancer (they even convinced the poor kid), Candace Streng, pretended to have cancer (at least no child was involved). Like I said, there are 28 pages of these scams.

If the above wasn’t a reason enough to be wary of GoFundMe, I’ll add another: “donations made to a personal GoFundMe campaign…are generally considered to be personal gifts and are not guaranteed to be tax-deductible” (Gofundme.com). However, if the donation is made to a proper charity that is a 501(c)(3) organization, meaning “registered with and recognized by the government” (Thebalance.com), then you can deduct. I wish you luck finding one of those among the people begging for extravagant honeymoons and ridiculously expensive gaming chairs on GoFundMe.

In a world where some people have to decide between food and medication, I think there are charities out there more deserving of our support (I know, my inner hippie is showing).

Bourke Accounting gives to charity. They wouldn’t mind if you did, too. However, your Bourke Accounting specialist wants you to give responsibly to trusted organizations. This is not just so you can claim deductions; your Bourke Accounting expert cares about your well-being and don’t want anyone taking advantage of you. Charity is a beautiful thing. Scam artists are not.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Bourke Accounting tax preparers and bookkeepers keep up with the latest tax laws and continuing education. Yes, yes, yes, I’m aware that I’ve told you that many times. However, the further training of Bourke Accounting’s employees doesn’t just apply to management. No, ma’am and no, sir. Bourke Accounting extends the opportunity to all employees to better themselves.

So, last Thursday, I was sent to a 6-hour seminar focused on Social Media. This was important to me because, while I didn’t believe that I was behind the times, I wasn’t exactly walking hand-in-hand with the times.

Enter Raechelle Rae Johnson. Ms. Johnson is the proprietor of Kreative Ink, LLC and an educator for Fred Pryor Seminars. She has blue hair and a laugh that seems to originate from somewhere around the soles of her feet. Ms. Johnson is a Solution Architect. Eh, what’s that title mean again?

A solution architect is “responsible for the design of one or more applications or services within an organization” (Careerexplorer.com). Care for a simpler definition? These folks figure out why you’re not getting business and give you the tools to do something about it. For example, Ms. Johnson started Kreative Ink, LLC in 1999 as a graphic designer and as a side project. She had experienced a change in her domestic life and wanted extra money to keep her child in a good school (conversation, 3/2/20). Because there were a lot of graphic designers out there and she wasn’t interested in solely designing logos, Ms. Johnson changed her emphasis to “visual communication” (conversation, 3/20/20).

While both graphic design and visual communication offer something for the audience to look at, “visual communication is somewhat less concerned with aesthetics, in favor of the communication aspect of the discipline” (Toptal.com). Basically, this is the difference between seeing the Coca-Cola logo by itself on a billboard and seeing the Coca-Cola logo during a fun party scene. Same logo, but one has an enhanced message: Drink Coke and be surrounded by half-dressed people.

As I have learned, we are not living in the 1950s of advertising and business promotion. When I asked Ms. Johnson what the difference was, really, between a magazine ad and a social media ad, she was patient. Besides the expense of production, a business must also get that magazine into the hands of the population. With a social media ad, we’re generally already holding onto the means of communication (conversation, 3/2/20).

We are living in interesting times. We are learning new words and new ways in which to promote ourselves. Small businesses are realizing that, for nominal expense, they can reach more people. More importantly, they can reach a specific set of people who would be more likely to use their services (Pryor Seminar, Johnson, 2/27/20).

Bourke Accounting wants your business to prosper. Besides offering you unparalleled tax preparation and bookkeeping services, they can help you design a budget so that you’ll be able to hire your own Kreative Ink, LLC consultant. While the concept of accounting stays pretty much the same, the rules are changing for everything else – make an appointment with your Bourke Accounting specialist and join us as we walk hand-in-hand with the times.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.