Have you ever started your day by stepping in dog poop on the way to the bathroom (but Fluffy is housebroken!)? Maybe you fought with your significant other, got yelled at by the boss and had your co-worker insult your new pants. In short, have you ever had a bad day? Did you ever consider just faking your own death, running away to a secluded place and living peacefully forever?

If you are one of the over 6,000 people mistakenly declared dead by the Social Security Administration each year (CNBC.com), you could have your wish without the effort! That’s right, because of a clerical error, you could be living your best zombie life without the hassle of faking a car crash (and, I guess, finding a body double). All of this can be yours as a result of a mistake made by one of the most powerful organizations in the US.

The Social Security Administration has a database that records deaths in America. This list, the Electronic Death Registration (or the Death Master File, depending on who you ask) is intended, for one thing, as a “measure taken to prevent fraud” (NPR.org). This list stops the baddies from stealing identities or taking out credit cards in a dead person’s name. Once a name ends up on this list, the SSA sends the information to “nine benefit-paying Federal agencies, including the Internal Revenue Service and the Centers for Medicare and Medicaid Services” (OIG.SSA.gov). Not only these guys, but banks, credit card companies – pretty much everyone and their brother – share in the sad news.

This database is useful if the person is legitimately deceased. However, if you are still among the quick, ending up on this list is a nightmare. Accounts are frozen, health insurance suspended and Veteran benefits go “poof.” So how can this happen? Seriously, it is simply a matter of human error. The SSA gets their death information from funeral directors, hospitals and family members. Okay, that sounds like a good start. These guys should know, right? But, this can turn into a really terrible game of Telephone. According to NPR.org, inputting errors on the part of SSA workers are responsible for 90 percent of accidental death declarations. It only takes one wrong digit to transport you, the innocent bystander, into a confusing new un-life.

So, now you’re a pulse-challenged American. How do you fix it? The SSA suggests you go to your local Social Security office with at least one piece of identification (who are we kidding, bring every piece of identification you have ever acquired). After the SSA corrects your record, “you’ll be issued an ‘erroneous death case – third party contact’ notice” (Denverpost.com) that you can show to the nice agencies who have all your money. If, for some reason, you don’t get satisfaction from the SSA, Denverpost.com suggests that you call in the big dogs by “contacting your local congressional representative’s constituent services office.” If you yell loud enough, someone has got to believe you’re still alive, right?

Like a lot of weird occurrences, this probably won’t happen to you. But if it does, consider that nice secluded place one more time before visiting the Social Security office.

Bourke Accounting specialists don’t discriminate based on color, gender, religion or anything else. However, if you’re dead on paper, it might be a little difficult to prepare your tax returns. Although, just like during an IRS audit, your Bourke Accounting professional will stand by you until you are reborn and financially solvent again. Even if you are undead, your Bourke Accounting bookkeeper and tax preparer will still offer you the best service anywhere.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I like my Bourke Accounting co-workers – because of this, I really hope none of them choke, have a cardiac episode or experience any incident that requires first aid. My first aid skills consist of poking the victim with a stick until he wakes up or until someone takes my stick (I am good at sewing, so I might be able to, fashionably, help with a cut).

I like my Bourke Accounting co-workers – because of this, I really hope none of them choke, have a cardiac episode or experience any incident that requires first aid. My first aid skills consist of poking the victim with a stick until he wakes up or until someone takes my stick (I am good at sewing, so I might be able to, fashionably, help with a cut).

We’ve all heard horror stories about people who have been sued after providing lifesaving first aid. Sometimes, a rib is cracked when CPR is administered; personally, I would forgo litigation if I could trade a cracked rib for my life. There are some cases of victims suing would-be saviors, however, that leave us totally confused.

For example, in 2004, Lisa Torti was following co-worker Alexandra Van Horn home from a party. The driver of Van Horn’s car hit a pole. Torti believed that an explosion was imminent when she saw liquid and smoke pouring from the vehicle. So, Torti pulled a barely responsive Van Horn from the car. The accident left Van Horn a paraplegic. However, Van Horn sued Torti, “asserting Torti worsened her injury by…yanking her out of the car ‘like a rag doll’” (Reviewjournal.com). The California Supreme Court decided that Van Horn could sue “because Good Samaritan protection was only for those administering medical care” (People.howstuffworks.com). As a result of this ruling, however, the state legislature ended up changing the law to protect non-medical people providing aid (Reviewjournal.com).

I had never given much thought to Good Samaritan laws. However, after, the insanely cool, Marianna Perry of AEDs & Safety Services, LLC gave a seminar at Bourke Accounting and mentioned these laws, I became curious. Because people had become leery of helping each other, lawmakers acted to protect well-meaning bystanders. For example, in Kentucky, under KRS § 311.668 (2009), anyone who uses, in good faith, an AED on a victim “shall be immune from civil liability for any personal injury” (Recreation-law.com).

Now, there are some limits to this law. This law doesn’t apply if the victim is injured from “the gross negligence or willful…misconduct” (Answers.uslegal.com) of the person giving aid. Basically, if the guy next to you is choking and you stab him 7 times in the legs to dislodge that potato stuck in his throat, you might have to chat with some people in authority.

Good Samaritan laws have been modified to also protect drug abusers in many states. This law, called 911 Good Samaritan law, “prioritize[s] the victim’s safety and resuscitation over arresting drug users” (KYHRC.org). What this means is, that after a heavy night of partying, if someone happens to turn blue, the rest of the partygoers are protected from arrest when calling for medical care for their azure pal. No one likes the idea of drug abuse, but I think we all appreciate second chances.

I like Good Samaritan laws. Once, in Colorado, I choked on a piece of steak. The guy next to me jumped up and performed the Heimlich. Little buddy saved my life and wouldn’t even accept a drink in return (I believe I was drooling at the time). Had this guy worried about litigation, rather than the life of a fellow human, would he have been so eager to help? I like to think he would have, but it’s nice to know he was protected, too.

I am in the minority when it comes to first aid knowledge at Bourke Accounting. If you choke on chips during an appointment with your Bourke Accounting bookkeeper or tax preparer, you better believe they’ll save your life. Not only do Bourke Accounting experts provide you with the best in financial advice and guidance, they can also do the Heimlich without shattering your ribcage.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I love spin-offs. As a kid, watching Mork & Mindy, I was taken aback when my dad remarked that Mork from Ork had originally appeared on an episode of Happy Days. At that point, I still wasn’t totally convinced that TV actors weren’t tiny people living inside that box, so the idea that they could go back and forth to other shows was even more astounding.

There are some spin-offs that are useful, although not quite as fun as watching Fonzie save Richie from an Orkan. Take, for example, the way a tax attorney is a spin-off from a tax preparer when a citizen is forced to file for bankruptcy.

Real quick, there are two ways an individual can approach bankruptcy: Chapter 7 and Chapter 13. With Chapter 7, “you either pay for or give up your property for secured debts” (Legalzoom.com). Basically, you liquidate as much of your stuff as possible to pay the debt (Legalzoom.com). Chapter 13 is a payment plan to pay off your debts. The plan “can last up to five years” (Legalzoom.com) and you’d better believe that everyone involved is watching closely to make sure that you keep up with payments.

The relationship between tax preparers and tax attorneys is something that I just learned about the other day: bankruptcy filings increase during, and right after, tax season. According to USAtoday.com, filings “in March were 26% to 34% higher than the monthly average…[and] April’s filings were 15% to 25% higher.” The main reason for the surge is that, after individuals receive their tax refunds, they now have the funds to hire a tax attorney for their bankruptcy cases.

Filing for bankruptcy can be rather expensive, as it turns out. When considering a Chapter 7 bankruptcy filing, individuals can be looking at a charge of around $1,500: filing and fees can amount to about $335, in addition to attorney fees for about $1,200 (USAtoday.com). This news does not help the more than 46% of Americans who “who wouldn’t be able to cover an emergency of $400” (USAtoday.com).

In addition, bankruptcy laws passed in 2005 made things a bit more complex. One change, for example, is that Chapter 7 isn’t as easy for “filers with higher incomes” (Nolo.com) as it used to be. Because of the increased difficulties in bankruptcy filing, “attorney fees for even the simplest type…rose 48% from 2003 to 2009” (USAtoday.com).

But do filers really need a tax attorney? Pretty much. While UScourts.gov supplies resources for individuals filing for themselves, it is “strongly recommended [using a professional] because bankruptcy has long-term financial and legal outcomes.” In addition, UScourts.gov points out that judges and clerks are legally prohibited from holding a filer’s hand. They can’t help if a filer gets confused or has questions.

Bourke Accounting hopes that you never have to file for bankruptcy. However, if you must, make sure that you use the expert tax preparers and bookkeepers at Bourke Accounting. Bourke Accounting can offer guidance to ease you through your tough time. You want your spin-off to be Mork & Mindy, not Joey (remember? The spin-off after Friends? That’s okay, no one else does either).

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I can’t wear my favorite shirt to work at Bourke Accounting. It’s a Richard Hell and The Voidoids t-shirt that I acquired about 20 years ago. When I say this shirt is broken in, I mean it’s one step away from being indecent. But I love it. It’s paper thin and as soft as Charmin and, since I gave up stitching the holes years ago, it’s hole-y. It is my favorite shirt.

Obviously, I keep things around for a very long time. I rather assumed that everyone else did, too. So, can you imagine my shock when someone told me about this new trend of renting clothing? I don’t mean renting a tux for a fundraiser or a wedding; these people are renting “everyday clothing, handbags, even [sneakers]” (TheGuardian.com) for a monthly subscription fee.

Clothing rental companies, like Rent the Runway (with a fee of $159 per month) (TheGuardian.com), are becoming popular as more people are attempting to cut down on waste and environmental repercussions. The fashion industry is responsible for “about 10% of global greenhouse gas emissions and consumes more energy than aviation and shipping combined” (LATimes.com). In addition, high end designers don’t want to “dilute [their] garments’ value by allowing discounts” (LATimes.com), so they burn what they don’t sell. Recently, the U.N. reported that “every second, one trash truck’s worth of textiles is either burned or sent to a landfill” (LATimes.com). Sad, right? Not only is it wasteful, it’s not great for the air or water.

Another reason for the rise in clothing rental companies are quickly changing fashion trends. This concept is lost on me, as I pretty much have the same style that I did when I was playing in bands (much to my mother’s chagrin). I just don’t understand the need to keep up with the latest fashion manias. However, as life coach Jane Evans told Euronews.com, the rise of social media has put pressure on people to never wear the same thing twice. Instagram trends like “’Outfit of the Day’ compel young people to be consuming constantly” (Euronews.com). With this in mind, renting 7 or 8 outfits that you’ll never wear again makes more sense than hoarding them in your closet.

Finally, it seems that Millennials are becoming known as “Generation Rent” (Euronews.com). This generation is more apt to rent a home than to buy one and they’re more likely to rent movies rather than invest in the purchase of one. Maybe it’s because of the housing market collapse, maybe it’s because technology, trends and everything else changes second to second. For whatever reason, Millennials don’t tend to have the same ownership desire as other generations.

I don’t want to rent clothes. From all I’ve read, the clothes arrive perfectly cleaned and in brand new shape (because of my insane phobia of bedbugs, this is a plus). And, if you really like an item, there’s the option of buying it for a fraction of the price. Perhaps I don’t like the ephemeral concept of renting clothes. When I go shopping, I look for things that I’ll keep forever.

Bourke Accounting has nothing in common with clothing rentals. Your Bourke Accounting specialist is in it for the long haul with you. While our Bourke Accounting tax preparers and bookkeepers keep up with changing laws and continuing education, flash in the pan trends don’t affect the superb services you’ll receive from your Bourke Accounting professional. Make an appointment today and keep an eye out for my favorite t-shirt (I’ll convince Bill to let me wear it someday).

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

So, I pitched my Beach Blanket Bingo – Antarctica Edition! teambuilding vacation idea to Bill. He looked at me with an expression that said: did I really hire you? Then, he shook his head slowly, left, right and then left again. He walked away to do something else. Something that didn’t necessitate Annette Funicello, beaches or Antarctica, I’m guessing.

But his completely comprehensible and nonverbal communication got me thinking. Probably like you, I have vague memories of being potty trained. As a kid, when my parents took my brother and I to a new place, I visited the bathroom. Was I avoiding an accident or did I just like checking out new bathrooms? I couldn’t tell you, but I remember doing it. However, while I can sort of remember potty training, I have no recollection of learning that a shake of the head meant “no”. I don’t know how I learned that a nod meant, “yes” or “go on, you’re doing it right.” Do you?

Thanks to pop psychology, we know that if someone is standing with arms crossed, that’s an indication of defensiveness or some sort of discomfort. But how do little kids understand body language before they can even understand Dr. Phil? Universalclass.com suggests that “from the time they are babies, children imitate what you do.” You smile, they smile. Essentially, babies are damp little mirrors. When does the actual understanding come in?

In the 1950s, there was an anthropologist named Ray Birdwhistell. Birdwhistell had a theory that “no more than 30 to 35 percent of the social meaning of a conversation…is carried by the words” (Wikipedia.org). His concept was that most of what we get out of an interaction is gleaned from the way the other person moves. Birdwhistell called his concept “Kinesics” and it is made up of “facial expression, gestures, posture…and visible arm and body movements” (Edge.sagepub.com). Birdwhistell further believed that these movements are as “systemic and socially learned as verbal language” (Edge.sagepub.com). Furthermore, because these “nonverbal signs…are learned” (Edge.sagepub.com) from a very young age, we didn’t even notice that we were learning them.

I have a friend who tells me not to lie to children because children always know. Oh, right, little onesie wearing polygraph machines? Sadly, this is true (and creepy). According to Raisingchildren.net.au, “when your nonverbal communication sends a different message from your words, your child is more likely to believe the nonverbal communication.” This does makes sense, as kids are still part of that visceral, natural world. I have to say, it makes me wholly uncomfortable: you can’t figure out where your head goes when putting on a shirt, but you know I’m lying when I say I believe in Santa? Get outta here…

Final proof that Birdwhistell was on to something regarding body language: text messages. How many times have you had to send an apology text because someone didn’t understand that you were joking? This is a daily occurrence for me. The man knew what he was talking about.

Bourke Accounting professionals are fluent in both verbal and nonverbal language. However, even if our Bourke Accounting experts know you’re uncomfortable about something, they won’t call you out. Bourke Accounting tax preparers and bookkeepers will listen until you’re ready to share. After a few gentle head nods, you’ll know that you’re getting the best (and most welcoming) financial service in the business.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Normal is an illusion. What is normal for the spider is chaos for the fly. – Morticia Addams

Are you normal? Am I normal? How do we even know? While my Bourke Accounting employers and co-workers are capable, knowledgeable and efficient (and very cool), I think they’re a pretty weird crew. However, I’m pretty weird, too, so I know whence I speak.

For example, every morning when I get out of the shower, I kiss my fingers and then touch the shower head. Why? I have no idea. I don’t know if I’m thanking the water, the water company or the universe. This is something I’ve done since I was tall enough to reach and I thought this was completely normal. I happened to mention it to someone and she looked at me like I was a full-on psycho.

So, I guess not everyone thanks the water after washing their pits. Good to know.

There are some things we know are kinda out of the norm. For example, if you walk into a friend’s house, find him sitting in the corner, eating flies and repeating the counties of New Jersey in alphabetical order over and over, you might want to have a little sit-down with him (preferably with an interventionist). Most of us have some issue with authority, intimacy, abandonment or public speaking. We’ve all met people who are so defensive that even the most innocuous of comments invokes a vicious response. All of these are the kind of normal weirdness that we’re used to.

But how do you know if you’re normal normal? Scientificamerican.com has a few guidelines to help us. For example, you have a healthy personality if you have “more positive than negative emotions in daily life” (Scientificamerican.com). Negative people are a downer for the rest of us, however, it must be even worse for the negative person. These guys are forced to live in their own little pessimistic and dismal noggins. Of course, they’re sort of depressing, but they still fall within the “normal” spectrum, I think. Another way to tell if you’re normal is if you are able to cultivate a “warm, authentic connection to others” (Scientificamerican.com). In order to accomplish this, one must be empathetic and sympathetic enough to view others as fellow living creatures with emotions and needs. Yup, that sounds about normal to me (although, I’ve admitted that I’m weird, so take my opinion with some salt on top).

The good thing is that the old adage that goes something like, “if you think you’re crazy, you’re not,” is actually true. According to Gerald Goodman, PhD and emeritus professor of psychology at UCLA, “believing that you are going crazy is a good clue that you are sane” (Webmd.com). Dr. Goodman believes that really unbalanced people have no idea that they’ve lost the thread. They simply think that they are the only sane one in a world full of crazy people. Of course, in these chaotic times, it’s easy to decide that we’re going a little squirrely. Because “there is more stress today than in previous generations” (Psychcentral.com), we’re all susceptible to “depression and mood disorders” (Psychcentral.com). This is especially true if you happen to be someone who has a genetic predisposition to these afflictions.

Are you normal? Maybe, maybe not. Your Bourke Accounting professional, as I’ve said, isn’t a shrink. However, if you have a Bourke Accounting expert working for you, you will sleep better, eat better and be kinder to small animals with the knowledge that all of your finances are being well taken care of by the best in the business. Make an appointment and share your weird, little habits with a Bourke Accounting specialist today!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Before starting at Bourke Accounting, I worked with a felon. He shot a guy in the butt with a .22. He maintained that shooting little buddy in the butt was his intention, but I tend to think it wasn’t. He was a good guy, wasn’t any more dangerous than our non-felonious crew and was a seriously hard worker. He was so thankful that he finally got a job that he was willing to go any number of extra miles for us.

It’s mercenary, but his gratitude made him a great employee. It’s not surprising that he was grateful, considering that every year, “650,000 inmates are released from prison [and] a study showed that fewer than 45% were employed after eight months” (Jobsforfelonshub.com). Why employers are a little disinclined to hire felons is also probably not surprising: employers worry that the hiring of felons would “increase the potential risk of crime at work” (Jobsforfelonshub.com) because, they feel, that not all ex-bad guys are really ex. Furthermore, employers are concerned about the rest of their staff and how comfortable they’d be with this new addition to their department.

Our government realizes that the best possible way to avoid recidivism in former offenders is to get them into the workplace and making an honest living. With this in mind, a program called the Work Opportunity Tax Credit has been put in place. This program makes a “federal tax credit available to employers who hire and retain individuals from target groups” (Hiringthing.com) who might have difficulties finding employment. Examples of target groups are veterans, TANF (temporary assistance for needy families) recipients, food stamp receivers and, of course, felons (IRS.gov).

This tax credit allows employers to “earn a tax credit equal to 25% (if the employee works 120 hours) or 40% (if the employee works 400 hours) of a new employee’s first-year wages” (Hiringthing.com). Employers can claim about “$9,600 per employee in tax credits per year…[and] there is no set limit to the number of individuals an employer can hire” (Hiringthing.com).

But does the program work? Since the WOTC is “split between the IRS and state-level labor agencies, no unified dataset exists” (Taxfoundation.org), so the studies are a bit fractured. For example, one study says that the WOTC has “increased employment rates…by around 12.6 percentage points” (Taxfoundation.org). However, another study found no indication that the program had any “positive impact on either employment rates or wages…in the long term” (Taxfoundation.org).

I believe that people deserve second chances. My former co-worker was a dumb kid who found his significant other in a compromising position with a gentleman who was not his own good self. Depending on the odiousness of the offense, though, we sometimes can’t separate the person from the transgression. I say that we hire felons on a person to person basis and go from there.

If you’re considering giving an ex-offender a chance, why not see your Bourke Accounting professional to discuss the possible advantages of such an endeavor? Your Bourke Accounting specialist can lead you through the paperwork and discuss a viable plan of action to get the most out of your good deed in hiring. Just like your Bourke Accounting pro might be your new best friend, your ex-offender employee might be the best and most trustworthy worker you’ve ever had.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

The crew at Bourke Accounting has been working really hard this tax season. Because of this, I am suggesting a team building vacation to Bill: I say we throw our swimsuits, beach blankets and SPF 30 into a duffel and head out to the beaches of Antarctica.

The crew at Bourke Accounting has been working really hard this tax season. Because of this, I am suggesting a team building vacation to Bill: I say we throw our swimsuits, beach blankets and SPF 30 into a duffel and head out to the beaches of Antarctica.

I’ve read that Antarctica is absolutely beautiful and, as The Week reported in their latest issue, “the temperature…reached its highest in recorded history on Feb. 6” (Vol. 20, Issue 963) at 64 degrees. In Antarctica. Obviously, this is a bit out of the norm. Generally, the temperature in February can range between a low of 4 degrees and a high of 27 degrees (Weatherspark.com). There’s something happening here.

Let me just say that I don’t want to get into any sort of political debate. For those of you who don’t believe in climate change, please suspend your disbelief for just a moment and just go with the premise that 64 degrees in Antarctica is kind of strange. Moving on.

That Antarctica is warming up is not surprising to scientists. For example, “the Antarctic lost 40 billon tons of melting ice to the ocean each year from 1979 to 1989” (Sciencealert.com). As scary as that is, starting in 2009, “that figure rose to 252 billion tons” (Sciencealert.com) per year. These findings are leading the folks in the know to deduce that there are problems with our environment. Besides hotter summers, we’re looking at “more frequent droughts…storms and other extreme weather” (Sciencealert.com). And all of these neat changes could, eventually, culminate in the seas rising nearly “three feet globally by 2100 if the world does not sharply decrease its carbon output” (Sciencealert.com).

As individual civilians, what can we do? We’ve all been taught about recycling, the dangers of throwing away plastic straws, old phones and CRT televisions. We’ve been bringing our own reusable bags to the supermarket. We’ve been doing our part, right? Eh, well, yes and no….

It’s time to start walking, guys. According to the EPA, as reported by Lemonade.com, “the #1 sector responsible for greenhouse gas emissions in the US is transportation, and cars account for 82% of this” (electricity is second). Because we do everything bigger over here in the States, no one should be shocked that we’re “responsible for the highest number of emissions…[with the] highest carbon footprint per capita” (Lemonade.com). Why can’t we be known for having the coolest and nicest people in the world?

Another thing we can do is plant trees. Since 3rd grade Science class, we’ve known that trees provide us with oxygen while taking away carbon dioxide. Plan a fun family, couples or friend day and plant trees around your house. After that, why not donate a few bucks to Onetreeplanted.org? This is a Vermont-based non-profit organization that plants a tree for every dollar donated around the world and over here.

I’m pretty sure that Bill won’t agree to us playing Beach Blanket Bingo in Antarctica, but that doesn’t mean you shouldn’t check out the world. Plant a tree and then take a nice walk to meet with your Bourke Accounting tax preparer or bookkeeper. Considering the superb services your Bourke Accounting pro can provide, a trip to Antarctica may be closer than you think.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

You can easily judge the character of a man by how he treats those who can do nothing for him – Malcolm Forbes

I have worked for Bourke Accounting since September. In that time, I have yet to experience an entitled Bourke Accounting client. Everyone who has walked through the door has treated Bourke bookkeepers, tax preparers and yours truly with respect. At other corporations, I’ve been viewed as a vaguely useful appliance, so it’s very nice that Bourke clients remember that we’re fellow humans, too.

Betterhelp.com describes an entitled person as one who has “an unrealistic, unmerited or inappropriate expectation of favorable living conditions and favorable treatment at the hands of others.” I define an entitled person using somewhat coarser language, but either way, we all know the type. This is someone who angrily asks to speak to the manager because her 4-month expired coupon can’t be honored. He’s the guy who will shove you out of the way to scramble into the cab that you flagged down. In short, these are the people who believe that they deserve free stuff, first position in line and attention right now, no matter how many people have already been waiting.

Psychologytoday.com (shrinks really give the benefit of the doubt) lends a sympathetic view to entitled people. They suggest that “a sense of entitlement can emerge from feelings of being mistreated or not getting what we need.” That’s nice, but just because someone cut you in line last week, is that a reason to abuse a restaurant server this week? Clearly, there is a difference between standing up for yourself and deciding that the entire world exists simply to serve you.

Quickanddirtytips.com isn’t quite as understanding. In fact, I detect a hint of resentment. A definitive aspect of the entitled person is, if s/he perceives someone to be “below them, like service workers or customer support, they’re rude and go out of their way to show they’re dominant and superior.” I’ve seen this! I’ve been treated terribly by people who, upon seeing me behind a desk in the waiting room, decide that I’m only two steps away from working as a Lady of the Night. And probably not that bright, either. I could explain that I graduated college with honors, but what would be the point?

Everyone is a little entitled sometimes. Every once in a while, yes, I will take the nacho with the most cheese. However, I don’t make a habit of it. Honestly, I feel bad for people who can only be happy if they’re “better” than someone else. Quickanddirtytips.com points out that the entitled “care deeply about approval.” Although they tend to shout their greatness to the world, “deep down they feel insecure about measuring up to those grandiose standards.” To vigilantly protect a fragile ego at all times seems an uncomfortable way to live. While the entitled people of the world scream themselves hoarse for faster service, can the rest of us just calmly wait for our turn? Trust me, it’s better for the blood pressure.

Bourke Accounting bookkeepers and tax preparers are not entitled. They have sacrificed and worked hard to get where they are. They don’t just expect clients to come to them and they don’t have to scream their worth (tell me the last time you’ve seen Bill dancing around with bad CGI on a late night commercial). They prove their merit with their superior knowledge and skills. Even if you happen to be an entitled person, see a Bourke Accounting bookkeeper or tax preparer and, I promise, you won’t ask to speak with the manager.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

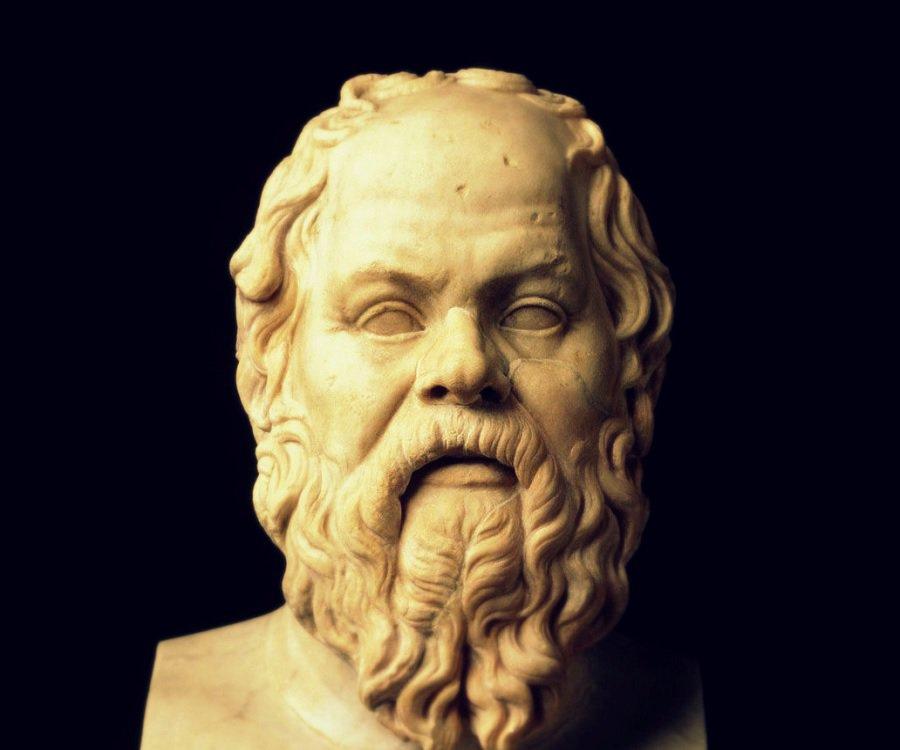

The unexamined life is not worth living – Socrates

Wal-Mart…do they, like, make walls there? – Paris Hilton

Bourke Accounting bookkeepers and tax preparers are fairly deep. Bill can talk about most art movements of that last 700 years. Tim can hip you to a lot of historical facts that you probably wouldn’t have ever stumbled across. Want to discuss indie “intellectual” films that leave you feeling slightly soiled and haunted after viewing? Stop by my desk.

We are not snobs, elitist, highbrow prigs over at Bourke Accounting, but we are fairly deep. But is that a good thing?

Who remembers when we couldn’t escape Paris Hilton? Whether it was her dubious starring film roles, her reality television shows, small animals in Gucci handbags, she was everywhere. If I never hear the phrase “That’s hot” again I’ll be satisfied. Paris was the epitome of “being famous for being famous.” She didn’t seem to say or do anything of substance, but she sure looked like she was having a good time.

Naturally, that got me thinking. While I don’t know Paris Hilton (I met her once, but that’s another story), she seemed to cultivate shallowness and superficiality into an art. And, as I said, it seemed like a blast. Beyond the money and the VIP parties, is there a happiness to be found in shallowness?

Short answer: yes. According to Learningmind.com, deeper thinkers (this is a subjective term) tend to make themselves a little crazy. However, “the less you understand, the more carefree and…happy you are” (Learningmind.com). In addition, the less you pay attention to global problems, political conflicts or other issues that you can’t possibly solve, the more satisfaction you’ll feel in your life.

Another problem with deeper thinkers is that there is a tendency to “seek something bigger – a pattern, a meaning, a purpose” (Learningmind.com). It’s not enough to have a good job and a happy family, there is a need to justify your continued existence to the universe. While a shallower person will accept a raise without qualms, a deeper thinker will overthink the same occurrence. They will question if the raise is actually deserved, they will wonder if they are up to the task and, inevitably, make themselves miserable.

Overthinking isn’t always a bad thing. Sometimes, you want an overthinker in your corner. When you make an appointment with a Bourke Accounting bookkeeper or tax preparer, you know that every detail regarding your personal or business financial issue will be addressed and solved. Bourke Accounting experts will deep think you right out of the clutches of the IRS, and, overthinkers or not, Bourke Accounting pros are really fun at parties.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.