I’ve mentioned before that some of us don’t have retirement plans. Because of this, a few members of our elite demographic may not be aware of the difference between a Traditional IRA and a Roth IRA (I’m not even getting into backdoor, SEP or SIMPLE IRAs here). In case you don’t know (and this will be vaguely important later), let’s get real quick and dirty:

An individual retirement account (IRA) allows you to save money for retirement in a tax-advantaged way. – Fidelity.com

Traditional IRA: you pay taxes when you retire and withdraw the funds. – Theblance.com

Roth IRA: you pay the taxes now, before you contribute to your plan. – Thebalance.com

What these two retirement plans have in common is that, while you can withdraw your cash at any time, you could get dinged with a “10% penalty and a tax bill if you take out your money before age 59-1/2” (Nerdwallet.com). Like every rule in the book, there are certain exceptions. For example, you might be able to avoid penalties for early withdrawal if you use the cash for medical bills, higher education, first time home buying and disabilities (Thebalance.com). However, to claim an exemption for a disability, you must “have your doctor certify that you are completely and permanently disabled” (Thebalance.com) and unable to work enough to support yourself.

In 2018, Kathryn Gillette tried to test out the disability exception with the US Tax Court. Ms. Gillette had been a soldier, worked as a firefighter, owned rental properties and was married to a cop. Kind of seems like an upstanding, law-abiding couple, right? And they probably would have stayed that way, but then Ms. Gillette was diagnosed with Restless Leg Syndrome. To combat her affliction, she was put on medication (Accountingweb.com). According to The Mayo Clinic, these medications “increase dopamine in the brain.” One of the short-term side effects of the increase causes “impulse control disorders, such as compulsive gambling.”

And did Ms. Gillette gamble? Let’s just say she was worse than Worm in the 1998 film, “Rounders”. For example, early one day, she won $162,000. By the end of that day, it was gone. Her rental property fees went to casinos, she hit up friends (and didn’t pay them back), she stole from her husband and, finally, she withdrew money from her IRA in 2012 (Accountingweb.com).

When it came time to file her tax return, Gillette maintained she wasn’t responsible for the IRA penalty because of her affliction (Accountingweb.com). The Tax Court decided that “her condition didn’t prevent her from doing regular activities” (The Kiplinger Tax Letter, Vol. 95, No. 3). Earning and losing $162,000 in a day isn’t exactly regular, but I get their point. Also, the Tax Court said that her “disability” was of a short-term nature: stop with the drugs and you’re A-OK, basically.

Chances are, you won’t suffer from drug-induced impulse control issues this year. However, emergencies happen and you might be tempted to cash out your IRA early. Before facing penalties, why not meet with your Bourke Accounting tax preparer or bookkeeper? Bourke Accounting doesn’t have a magic word to make your troubles disappear, but they can offer knowledgeable insight into ways to avoid touching your retirement.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

If you or someone you know has a gambling problem, please call the Nation Problem Gambling Helpline at 800-522-4700.

Bill at Bourke Accounting doesn’t dye his hair. He’s gray and he’s proud. Some of Bourke Accounting’s bookkeepers may or may not dye the gray – I will not divulge who does, as that seems indelicate and dangerous. As for me, I’m at a stage where I’m not sure if I want to lose the gray or not (my hair is three different colors now, so I should probably make a choice).

We know that as we age, we lose some of the cool attributes we had in younger years (no, I’m not going to talk about shifting body parts again). We kind of assume that, around 40, those little wiry, white buggers are going to start popping up. What if it’s not just the aging process that’s forcing us to buy stock in L’Oreal, though?

I know you’ve seen horror movies where the victim sees the ghost/monster in the basement and in the next scene, poof! A full head of white hair has replaced the shiny brunette locks from previous scenes. We say, hey, cool effect, but it’s such an old wives’ tale that fright makes white. Maybe not so much.

Recently, Harvard University conducted a study focused on the effects of stress. At first, the scientists studied “cortisol, the ‘stress hormone’ that surges in the body” when we go into a fun “’flight or flight’ response” (Healthline.com). This makes sense, as stress is even used as a descriptive for the hormone. However, as it turns out, we have more than one aspect of our physiology that contributes to flight or fight: the sympathetic nervous system.

The sympathetic nervous system is that skin deep tattletale that makes some of us bad at poker or utterly useless at talking to the cute person behind the register. It’s responsible for such lovely reactions as extreme sweating, blushing and high heart rates during stressful times (Britannica.com). The sympathetic nervous system also pumps out norepinephrine during these moments.

What happens then almost seems like a horror movie itself: your “sympathetic nerves branch out into each hair follicle on the skin” (Sciencedaily.com) and when you get stressed, this norepinephrine “causes pigment producing stem cells to activate prematurely, depleting the hair’s ‘reserves’ of color” (Healthline.com). And once those reserves of color are gone, they are gone, daddy, gone.

Of course, stress is a necessary evil for our continued existence. As Bing Zhang (researcher involved with the Harvard study) points out, “acute stress, particularly the fight or flight response, has been traditionally viewed to be beneficial for an animal’s survival” (Sciencedaily.com). Like Joseph Heller said: Just because you’re paranoid doesn’t mean they aren’t after you.

So, like other folk beliefs, this one is true (just like folding bedsheets indoors is bad luck). Now that we know it’s true, there are a few things that you can do to slow down your graying progress, if not actually stop it. Calm down, for one. Yes, I’m talking about meditation, breathing exercises, drum circles, pretty much anything hippie. Also, quit smoking, stay out of the sun, take vitamin B-12 and eat walnuts and fatty fish (Healthline.com). Doing these things won’t restore your raven tresses, but you might feel better when you discover you’re more pepper than salt for a longer duration.

One great way to start on the Road of Calm is to meet with your Bourke Accounting tax preparer or bookkeeper. Knowing that your finances are in capable hands may go a long way to easing at least some of the stress in your life. Your Bourke Accounting pros will join the drum circle while providing you with the best service anywhere (and helping you keep that hair of your youth).

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

The crew at Bourke Accounting has been working really hard this tax season. Because of this, I am suggesting a team building vacation to Bill: I say we throw our swimsuits, beach blankets and SPF 30 into a duffel and head out to the beaches of Antarctica.

The crew at Bourke Accounting has been working really hard this tax season. Because of this, I am suggesting a team building vacation to Bill: I say we throw our swimsuits, beach blankets and SPF 30 into a duffel and head out to the beaches of Antarctica.

I’ve read that Antarctica is absolutely beautiful and, as The Week reported in their latest issue, “the temperature…reached its highest in recorded history on Feb. 6” (Vol. 20, Issue 963) at 64 degrees. In Antarctica. Obviously, this is a bit out of the norm. Generally, the temperature in February can range between a low of 4 degrees and a high of 27 degrees (Weatherspark.com). There’s something happening here.

Let me just say that I don’t want to get into any sort of political debate. For those of you who don’t believe in climate change, please suspend your disbelief for just a moment and just go with the premise that 64 degrees in Antarctica is kind of strange. Moving on.

That Antarctica is warming up is not surprising to scientists. For example, “the Antarctic lost 40 billon tons of melting ice to the ocean each year from 1979 to 1989” (Sciencealert.com). As scary as that is, starting in 2009, “that figure rose to 252 billion tons” (Sciencealert.com) per year. These findings are leading the folks in the know to deduce that there are problems with our environment. Besides hotter summers, we’re looking at “more frequent droughts…storms and other extreme weather” (Sciencealert.com). And all of these neat changes could, eventually, culminate in the seas rising nearly “three feet globally by 2100 if the world does not sharply decrease its carbon output” (Sciencealert.com).

As individual civilians, what can we do? We’ve all been taught about recycling, the dangers of throwing away plastic straws, old phones and CRT televisions. We’ve been bringing our own reusable bags to the supermarket. We’ve been doing our part, right? Eh, well, yes and no….

It’s time to start walking, guys. According to the EPA, as reported by Lemonade.com, “the #1 sector responsible for greenhouse gas emissions in the US is transportation, and cars account for 82% of this” (electricity is second). Because we do everything bigger over here in the States, no one should be shocked that we’re “responsible for the highest number of emissions…[with the] highest carbon footprint per capita” (Lemonade.com). Why can’t we be known for having the coolest and nicest people in the world?

Another thing we can do is plant trees. Since 3rd grade Science class, we’ve known that trees provide us with oxygen while taking away carbon dioxide. Plan a fun family, couples or friend day and plant trees around your house. After that, why not donate a few bucks to Onetreeplanted.org? This is a Vermont-based non-profit organization that plants a tree for every dollar donated around the world and over here.

I’m pretty sure that Bill won’t agree to us playing Beach Blanket Bingo in Antarctica, but that doesn’t mean you shouldn’t check out the world. Plant a tree and then take a nice walk to meet with your Bourke Accounting tax preparer or bookkeeper. Considering the superb services your Bourke Accounting pro can provide, a trip to Antarctica may be closer than you think.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

You know, as a self-proclaimed rebel, I am actually very conservative when it comes to working. I like being at Bourke Accounting because, if I show up every week and do my job, there’s a paycheck in my account come Friday. Same hours, same pay, no surprises. How did I become so boring?

This is also exactly why I couldn’t be a server. Servers often bust their butts for hours, do everything right and still walk away with an 80-cent tip and a snarky smirk when the transaction is completed (reminder: tip your servers well). No, sir, that is not the life for me. This, of course, is also why I couldn’t be a part of the gig economy.

Remember that holiday office party when you had a little too much joy and had to call an Uber? That Uber driver was part of the gig economy. The gig economy is “based on flexible, temporary, or freelance jobs, often involving connecting with clients…through an online platform” (Investopedia.com). Why am I always surprised when a new term is introduced to define something familiar? I guess “gig economy” sounds fancier than freelancer.

Gig economy workers have steadily increased over the past few years. According to Naco.org, the number increased “by over 19 percent from 2005 to 2015.” In addition, it is expected that people involved in the gig economy will grow “from 3.9 million Americans in 2016 to 9.2 million by 2021” (Naco.org). Naco.org explains that these freelancers get involved with this sort of work for the “flexibility, freedom and personal fulfillment” they experience. They are able to set their own hours, set their own workload and avoid being tethered to a timeclock.

If you’re the adventurous, free-spirited type, this seems like a pretty good deal. However, and problematically, the business that hired you isn’t responsible for withholding your taxes. For example, a survey from Taxfoundation.org reported that “34 percent [of gig economy workers] did not know that they may be required to make quarterly estimated payments to the IRS.” Also, while it’s recommended that these workers plan on “paying 25-30 percent of each of their paychecks for taxes in order to not owe the IRS” (WGU.edu) at tax time, a lot of them aren’t doing it. Whether it’s out of ignorance or believing that underreporting will go unnoticed, they’re causing themselves quite a few problems.

Another feature of the gig economy that people don’t think about is the social aspect. First, there’s the isolation. “Some workers may find the remote, removed life of the gig economy a problem” (WGU.edu), as there are no shared weekend stories or banter around the copier. In addition, gig economy is self-employment. If no one is calling for your services, well, you’re not exactly employed. Finally, the hiring companies don’t provide benefits, so, unless you’re a good budgeter, you “may end up consuming more county social services” (Naco.org).

Depending on what sort of person you are, being a freelancer might be a great option for you. For a lot of us, though, there are too many moving and mysterious parts to make for a peaceful work experience. As a personal aside, I also don’t want a stranger losing his lunch in Henrietta (my car) no matter how expensive that lunch might have been.

I’m not trying to talk anyone out of working the gig economy, there are just a few things to consider. The initial step should be speaking with your Bourke Accounting bookkeeper or tax preparer. They can set up a quarterly tax payment schedule for you and keep you from owing thousands at the end of the year. They can also help you sort out a budget to keep you fed through lean times. Finally, a Bourke Accounting pro can recommend a good car detailer if the extremely icky happens to your leather interior.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

You can easily judge the character of a man by how he treats those who can do nothing for him – Malcolm Forbes

I have worked for Bourke Accounting since September. In that time, I have yet to experience an entitled Bourke Accounting client. Everyone who has walked through the door has treated Bourke bookkeepers, tax preparers and yours truly with respect. At other corporations, I’ve been viewed as a vaguely useful appliance, so it’s very nice that Bourke clients remember that we’re fellow humans, too.

Betterhelp.com describes an entitled person as one who has “an unrealistic, unmerited or inappropriate expectation of favorable living conditions and favorable treatment at the hands of others.” I define an entitled person using somewhat coarser language, but either way, we all know the type. This is someone who angrily asks to speak to the manager because her 4-month expired coupon can’t be honored. He’s the guy who will shove you out of the way to scramble into the cab that you flagged down. In short, these are the people who believe that they deserve free stuff, first position in line and attention right now, no matter how many people have already been waiting.

Psychologytoday.com (shrinks really give the benefit of the doubt) lends a sympathetic view to entitled people. They suggest that “a sense of entitlement can emerge from feelings of being mistreated or not getting what we need.” That’s nice, but just because someone cut you in line last week, is that a reason to abuse a restaurant server this week? Clearly, there is a difference between standing up for yourself and deciding that the entire world exists simply to serve you.

Quickanddirtytips.com isn’t quite as understanding. In fact, I detect a hint of resentment. A definitive aspect of the entitled person is, if s/he perceives someone to be “below them, like service workers or customer support, they’re rude and go out of their way to show they’re dominant and superior.” I’ve seen this! I’ve been treated terribly by people who, upon seeing me behind a desk in the waiting room, decide that I’m only two steps away from working as a Lady of the Night. And probably not that bright, either. I could explain that I graduated college with honors, but what would be the point?

Everyone is a little entitled sometimes. Every once in a while, yes, I will take the nacho with the most cheese. However, I don’t make a habit of it. Honestly, I feel bad for people who can only be happy if they’re “better” than someone else. Quickanddirtytips.com points out that the entitled “care deeply about approval.” Although they tend to shout their greatness to the world, “deep down they feel insecure about measuring up to those grandiose standards.” To vigilantly protect a fragile ego at all times seems an uncomfortable way to live. While the entitled people of the world scream themselves hoarse for faster service, can the rest of us just calmly wait for our turn? Trust me, it’s better for the blood pressure.

Bourke Accounting bookkeepers and tax preparers are not entitled. They have sacrificed and worked hard to get where they are. They don’t just expect clients to come to them and they don’t have to scream their worth (tell me the last time you’ve seen Bill dancing around with bad CGI on a late night commercial). They prove their merit with their superior knowledge and skills. Even if you happen to be an entitled person, see a Bourke Accounting bookkeeper or tax preparer and, I promise, you won’t ask to speak with the manager.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

One of the best things about working for Bill and at Bourke Accounting is making mistakes. That didn’t come out right. One of the best things about working for Bill is that, when I make a mistake, I’m told: Hey, this is wrong, don’t do it again. And that’s it. He doesn’t mention it again and he doesn’t hold it against me.

Wouldn’t it be nice if everyone was like that?

We all have people in our lives who seem to love nothing more than bringing up our past bad decisions, blunders and mad dog dumb actions. Many of us believe that these people are part of a petty, passive aggressive group who, to make themselves feel better, constantly mention the foibles of others. As you can tell, I’ve dealt with this sort before and I clearly didn’t like it.

But what if we’re wrong about these people? What if there is a benevolent motivation behind this compulsion to remind us of the past? What if this person “may have a misguided belief that reminding you of your past mistakes is making you a better person” (Goodmenproject.com)? These people are the equivalent of an Employees Must Wash Hands sign in a restaurant bathroom. They don’t seem to be judging as much as just giving a well-intentioned reminder to not give anyone hepatitis today.

I suppose this practice could also be an indication of concern on the part of the other person. Perhaps they bring up past bad activities because they would hate to see a return to former reckless behavior. Let’s say you used to be a real wild one, but you’ve settled down into a calm civilian life. This might be hard for some “to accept that you are changing, so they continue to remind you of your past” (Goodmenproject.com). They don’t know that you’ve stopped doing stupid things, so it’s up to you to quietly show the world that you’re doing all right.

Of course, this is not to say that every person who mentions naughty things past has our best interests at heart. For instance, I went to a party a few years ago and ran into someone I used to know. She wasn’t looking her best, was in the middle of a messy divorce and, generally, didn’t seem very happy. She made a beeline for me and began to tell everyone within earshot about something stupid I did in high school. I believe her motive was to “embarrass or control” me (Goodmenproject.com). Furthermore, I don’t think that she liked that I was healthy and content. Finally, perhaps she wanted to keep me “feeling shame” (Goodmenproject.com) to sort of sabotage the good in my life. I pitied her, but it didn’t keep me from making a snarky comment regarding the futility of living in high school memories.

No matter where a person’s true intention lies, it’s never fun being reminded of mistakes. Most of us have those middle-of-the-night, oh, my God, I can’t believe I did that moments. We’re hard enough on ourselves, we don’t need a contract guilt-er. Best thing to do when someone starts in? Smile, say, yup, that was me then and walk away.

Like I said, Bourke Accounting professionals are very forgiving. A Bourke Accounting expert will point out your mistake, fix it and move on. No matter what financial transgressions you have committed, your Bourke Accounting specialist will mention it one time and one time only. And with the best tax preparers and bookkeepers around, if you listen to your Bourke Accounting pro, your mistakes will be nonexistent.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

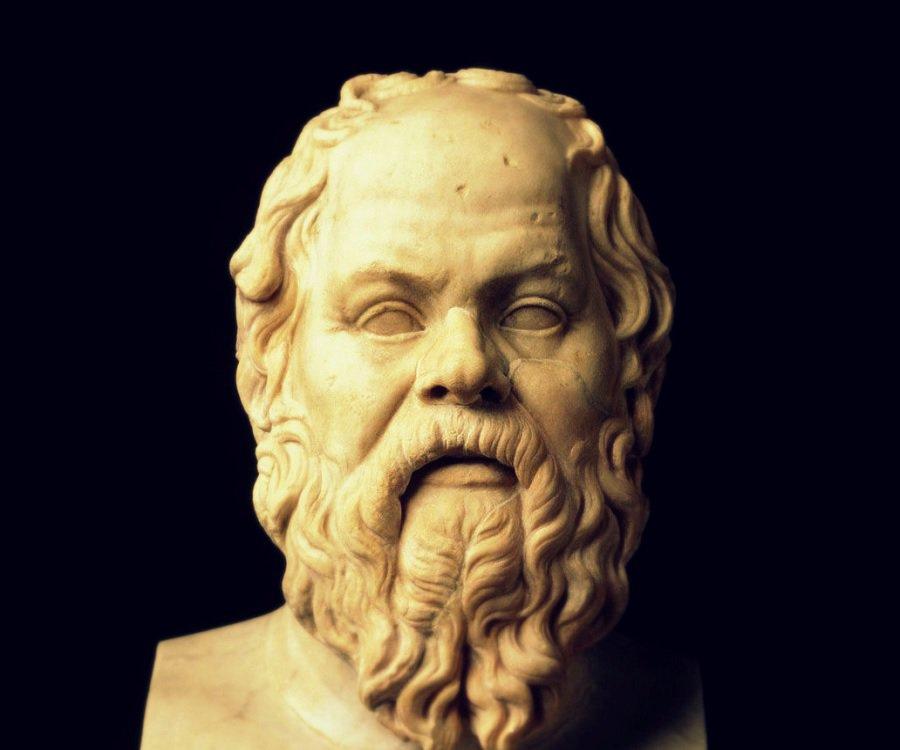

The unexamined life is not worth living – Socrates

Wal-Mart…do they, like, make walls there? – Paris Hilton

Bourke Accounting bookkeepers and tax preparers are fairly deep. Bill can talk about most art movements of that last 700 years. Tim can hip you to a lot of historical facts that you probably wouldn’t have ever stumbled across. Want to discuss indie “intellectual” films that leave you feeling slightly soiled and haunted after viewing? Stop by my desk.

We are not snobs, elitist, highbrow prigs over at Bourke Accounting, but we are fairly deep. But is that a good thing?

Who remembers when we couldn’t escape Paris Hilton? Whether it was her dubious starring film roles, her reality television shows, small animals in Gucci handbags, she was everywhere. If I never hear the phrase “That’s hot” again I’ll be satisfied. Paris was the epitome of “being famous for being famous.” She didn’t seem to say or do anything of substance, but she sure looked like she was having a good time.

Naturally, that got me thinking. While I don’t know Paris Hilton (I met her once, but that’s another story), she seemed to cultivate shallowness and superficiality into an art. And, as I said, it seemed like a blast. Beyond the money and the VIP parties, is there a happiness to be found in shallowness?

Short answer: yes. According to Learningmind.com, deeper thinkers (this is a subjective term) tend to make themselves a little crazy. However, “the less you understand, the more carefree and…happy you are” (Learningmind.com). In addition, the less you pay attention to global problems, political conflicts or other issues that you can’t possibly solve, the more satisfaction you’ll feel in your life.

Another problem with deeper thinkers is that there is a tendency to “seek something bigger – a pattern, a meaning, a purpose” (Learningmind.com). It’s not enough to have a good job and a happy family, there is a need to justify your continued existence to the universe. While a shallower person will accept a raise without qualms, a deeper thinker will overthink the same occurrence. They will question if the raise is actually deserved, they will wonder if they are up to the task and, inevitably, make themselves miserable.

Overthinking isn’t always a bad thing. Sometimes, you want an overthinker in your corner. When you make an appointment with a Bourke Accounting bookkeeper or tax preparer, you know that every detail regarding your personal or business financial issue will be addressed and solved. Bourke Accounting experts will deep think you right out of the clutches of the IRS, and, overthinkers or not, Bourke Accounting pros are really fun at parties.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Announcer: From Generation X, the generation that brought you Grunge, wholesale tattoos, piercings and a cynical world view, let’s all welcome a complete lack of retirement plans!

Audience of Gen Xers: Yaa – wait, what’d he say?

Bill over here at Bourke Accounting randomly gives me interesting articles. Yesterday, he gave me one that hit close to home. This one was from The Week (2/14/20 edition) entitled “Slacking on Retirement.” The plight of the non-retirement saving Gen Xer was exposed in less than two paragraphs, but the repercussions are far more wide-reaching, I’m sorry to say.

First off, if you didn’t know, Generation X encompasses everyone born between 1965 and 1980. Gen X was known for stripped down music, social consciousness, a loveless relationship with materialism and, yes, slamming pieces of metal into places they weren’t intended. We questioned our parents’ life choices and were left cold by the idea of cubicle work. And, I must admit, the “slacker” stereotype seems to be haunting us, still.

According to Fool.com, “50% of Gen Xers don’t have a retirement saving account.” What’s more, the 13% who do have one don’t contribute to it. However, this is not just a simple matter of slackers being slackers. While this generation does work, there are other obstacles standing in the way of viable retirement plans. These obstacles are, most notably, “inadequate income…housing costs, supporting other family members and health care” (Marketwatch.com). Furthermore, some are trying to put kids through college while also taking care of aging parents. We have to ask ourselves: did we wait too long to start planning?

Yes. Yes, we did. A scary concept is that a lot of Gen Xers are vaguely planning on living off Social Security when they retire. Cool story, but Social Security is “reportedly on track to be depleted by 2034” (Forbes.com). Which is probably why “more than half of Generation X plans to work in retirement” (Marketwatch.com). This, of course, is probably going to prove a hardship to the generations coming up. I’m not suggesting that we of the healing nose ring scars should move out of the way because, really, we can’t. Sorry, Millennials.

So, what do we do? We start saving now. It’s going to be a quick and dirty mad dash to retirement, but it’s our only choice. Does your company have a 401(k)? Utilize that. Can you cut corners regarding purchases? Cut away, brethren, cut away. It’s a little late in the day, but Money.com suggests putting money into the stock market. While this is generally meant for younger workers, as “even if there is an economic downturn there will be plenty of time” (Money.com) for investments to grow, it could work for us, too. Some of us are looking at 20 plus years more of employment, after all.

A lot of us Gen Xers messed up, but it’s not too late to save yourself and your money. Come see a Bourke Accounting bookkeeper or tax preparer and let them lead you to a happy and secure retirement. A Bourke Accounting professional can help with your newfound love of planning for the future and, if you’re very nice, maybe they’ll show you their tattoos.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Did you overdo it this weekend? Did you spend your Sunday rearranging furniture? Maybe, to get ready for your appointment with your Bourke Accounting tax preparer or bookkeeper, you were forced to stand under hot water until the broken glass in your back melted. Maybe you uttered attractive moans and groans while you put your shoes on. Don’t worry, Bourke Accounting professionals will wait while you get your feet under you.

But. Are we getting old?

After feeling the repercussions of doing something stupid, like lifting with your back and not your legs, you can repeat my mantra: I am not 18, I am not Wolverine. This is meant to be a reminder that we won’t bounce back the way we used to, so we should probably stretch before doing something physically difficult. Does that mean I’m old, too? And, wait a second, in these more sensitive times, am I even allowed to use the adjective “old”?

I don’t mind being called “middle-aged” or “old.” After the stuff I did in my ill-spent youth, I wear it as a badge of honor (my chiropractor was very curious as to what the X-Ray of a former punk rock stage diver’s spine looked like. He was not disappointed). However, I seem to be in the minority. According to The Week (Vol. 20, Issue 961), because a lot of our more mature (?) citizens are in good health and bopping along well, they “hate such traditional terms as ‘senior’ and ‘elderly’.” In addition, calling people old is believed to deny them their “right to have ambitions and plans for the stretch of their life that’s still ahead of them” (The Week).

AARP.org reports that “the public associates aging almost exclusively with decline and deterioration.” Well, sure. I can promise that, even though I used to be able to go to work after an hour’s worth of sleep, I would be utterly useless if I tried that now. NPR.org suggests that “older adults” is perhaps the least hateful term in use. However, the moniker “super adult” is another option in descriptive choices. Um. Super Adult. Yeah, no, thank you.

There is also a push to use the term “elder,” which I like. It brings up visions of an experienced and wise person, willing to use their sage-like advice to guide another generation. In addition, I feel that it’s a term of respect. I might not be at the elder stage yet, but I’m holding the name for when I need it.

I don’t think it matters what we call someone over the age of 65. If someone calls you old in a derogatory way, just remind them that, if all goes well, they’ll get there, too. Your body parts might not be where you kept them when you were 18, but, hey, they’re still there.

Your age isn’t an issue to your Bourke Accounting tax preparer or bookkeeper. Of course, throughout your entire financial life, certain ages require different handling. Are you starting a family? Your Bourke Accounting professional can offer advice. Are you about to retire? Your Bourke Accounting expert can lead you down a happy road. Do you prefer to be called a “senior”? No problem. Do you want to be called a Super Adult…no. Just no.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

We have to read two sections of the Bourke Accounting Book Club selection, Jen Sincero’s, “You Are a Bada*s” by Wednesday. I haven’t read it yet. The book is sitting on my table. I walk by it every day and promise: I’ll read it when I get home. Annnd then, when I get home, I watch M*A*S*H because it’s an episode that I haven’t seen since I was ten. Maybe I just stare into space for a while. Very important stuff, to be sure.

Why do we procrastinate? Sometimes it’s because we’re required to do something icky, like clean up dog poop around the yard. Sometimes it’s because it seems like a boring and arduous job that isn’t that important, like organizing a seldom-used closet. Or maybe some of us are just lazy (my hand is in the air).

Mindtools.com offers a legitimate out, though. For some of us, procrastination is “more than a bad habit; it’s a sign of a serious underlying health issue.” Anxiety, depression, attention deficit disorder – all of these afflictions can play a role in why we wait until the last minute to complete some task. Of course, according to Mindtools, if you wait around to do something, you will only end up increasing your own stress levels. So, even if you didn’t have these disorders before, procrastinate long enough and you will.

You have received your W2s, 1099s, etc. They are neatly organized in a little folder. You’ve had these documents for a few weeks. Um, this is perhaps a personal question, but why haven’t you seen your Bourke Accounting tax preparer yet? When filing your returns, there are a few reasons you should lock your Procrastination Demon in the basement and come see us:

1. The longer you wait to file, the more “you increase your risk of tax identity theft” (CNBC.com). Hey, you know who doesn’t procrastinate? Bad guys. According to CNBC.com, the miscreants who send in fake returns, do it really early. So, by the time you get around to seeing your Bourke Accounting tax preparer, someone might have already been nice enough to file for you.

2. What if you owe money? If you wait until the last minute and – gasp! – find that you owe a substantial chunk of change to the good old IRS, do you have that cash stashed in your mattress? Give yourself enough time to prepare for an unfavorable scenario. Don’t count on a tax refund to get you through hard times and always rely on the fact that things can go sideways.

3. You’ve had all of your documentation for a while. Are you sure? It’s April 14th and, right in the middle of an appointment with your Bourke Accounting tax preparer, you remember that you worked for a few months somewhere before you landed your Forever Job. But where is that W2? Did you leave it in the car you sold last week? Did you even receive it? I guess you’re going to have to file an extension…

Bourke Accounting professionals don’t procrastinate, but you knew that. Our Bourke Accounting experts also won’t rush through your return because the deadline is looming. Whether you come in February 14th or April 14th, you will get incredible, comprehensive service. But for the sake of your mental well-being and your finances, why don’t you make your appointment sooner rather than later?

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.