Whether you force art or a fart, the result is the same: you end up with s**t – Someone Smart

A tax return prepared by Bourke Accounting follows a linear script: W2 wages, interest income, child credit, etc. If you end up owing $17,000, your Bourke pro will feel bad, but those capital gains will still shine proudly on your Schedule D. Likewise, you probably won’t attempt to claim your healthy – but unemployed and TikTok addicted – 30-year-old son as a dependent because it wouldn’t make sense to the storyline. Even though we might want it to go a different way, sometimes the story is just the story.

For example, Old Yeller has a terribly sad ending. The book would be pointless if, instead of a shotgun blast, Yeller got a rabies shot and everyone had a picnic. PETA might complain about the trajectory of events, but Old Yeller would mean nothing without the poignancy of reluctant responsibility and loss.

Art and breathing have a lot in common: forcing or restricting either results in catastrophic events. With this in mind, it’s plain that the recent rules implemented by The Academy of Motion Picture Arts and Sciences are just, well…bad. Recently, the Academy has released a list of requirements that movies will have to adhere to if they want to even be considered for an Oscar during the 2024 season. However, these rules have nothing to do with masterful dialogue, interesting plots or innovative cinematography. Sadly, these rules have nothing to do with art at all.

Dumping artistic integrity like a murder victim on the side of the highway, the Academy has introduced an alternative concept of censorship. Starting with the 96th Oscars, movies with dreams of winning best picture will have to “meet inclusion standards both on camera and behind the scenes” (NYTimes.com). At first glance, this sounds good: everyone’s invited to the party! Sadly, it’s not like that. Let’s say you’ve written a heartbreaking, well-written screenplay about four Irish boys growing up hard in South Boston. Well, unless one of those boys is a girl or an Alaskan Native, don’t even bother trying for the gold because you haven’t a chance.

Don’t despair! You still have a chance with your four Irish boys if your storyline is “centered on an underrepresented group” (Etonline.com). So, if you make one boy “deaf or hard of hearing” (Oscars.org), you meet the A3 Academy Standard for Main Storyline! You only have to meet two of the four requirements, so if the deaf kid is also gay (A2 General Ensemble Cast requirement), you have a contender right there! You can argue that your story has nothing to do with a gay, deaf Irish boy, but if you want that naked gold guy, it does now.

Inclusion is a beautiful thing; holding visual artistry and autonomy hostage is the exact opposite. When external forces dictate guidelines for acceptable art, the organic nature of the thing is destroyed. Art should not have politics or agendas and, sometimes, you just can’t shoehorn a blind Amish transsexual into a coming of age buddy film.

Boycott the Oscars. Boycott the attempted murder of art.

Bourke Accounting bookkeepers and tax preparers don’t tell nonsensical stories. Bourke Accounting professional stick to the truth and don’t care who has a problem with it. If you want returns and payrolls that mirror reality, come to Bourke Accounting. If you want forced documents that were created under duress, the Academy’s number is in the book.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

No, no, no. Bourke Accounting will not bombard you endlessly with holiday talk for the next three months. You’ll be getting enough of that soon and Bourke doesn’t want to be part of the problem. And yet, and yet there is one more little thing to think about regarding the upcoming festivities…

A lot of Americans have been experiencing less than lucrative states lately. When funds are tight, it’s never more obvious or stress-inducing than when the gift-giving season rolls around. Even during normal years, most of us don’t seriously muse, “Hmmm…I got Chad the Jag last year…I guess I’ll just have to go with the Tesla this year.” Because disposable income has become an endangered species, we have to make our present choices really count. Meaningful and inexpensive gifts take imagination, but it is not an impossible effort. To make it a little easier, Bourke Accounting would like you to contemplate the gifts that you should absolutely, under no circumstance, never, never, ever consider:

1) Adult, intimate, fun-time bedroom accessories (when you are not one of the invited guests). No matter how desperately you’d like a grandchild, there is no good possible outcome with this choice. At best, you’ll get a surprised/embarrassed giggle, followed by, “Oh, you are so bad,” further followed by awkward silence. At worst, the recipients might actually use your contribution out of misplaced obligation. And they will, no doubt, however briefly, think of you. If that’s your goal, you have more issues than a simple accounting blog can assist with. A gift of this sort does not make you quirky and unpredictable – it makes you creepy. Don’t be the creepy, would-be grandparent.

2) Household appliances. Unless the beneficiary has expressed an undying need for a touchscreen toaster, don’t do it. The problem with buying appliances for someone (this is especially true for significant others) is the unspoken expectation that the recipient will eventually use it to benefit you in some capacity. By mid-January, that misplaced obligation will kick in again and you will receive a cake or your overgrown hedges will be magnanimously trimmed. However, there might also be a little bit of resentment thrown in with your lemon raspberry sugar cookies. Appliances simply scream responsibility and effort; don’t give gifts that, by their very nature, require work.

3) Clothes. Unless you really know the taste and size of your intended receiver, avoid something as subjective as clothing. If you buy too big, you run the risk of offending; if you buy too small, you could potentially humiliate the person. In a worst-case scenario, the person could then strive to fit into this inappropriate garment – again, avoid gifts that carry responsibility. Even if you know the size, are you sure about the style? Are you sure you’re buying something the recipient would like or are you unconsciously buying what you think would look good? Most people are too polite to say they hate a gift. In addition, these same people will wear an article when they know the giver will be in attendance. Don’t do this to your loved ones. They never asked for hot pink/fluorescent green argyle.

We all know that it’s the thought that counts; anyone you so generously give to should accept the offering with grace. However, wouldn’t it be nice to give a gift that will really be appreciated? Know your audience and don’t get freaky.

Bourke Accounting doesn’t know what to get you this year. Since we don’t know your size, Bourke Accounting will just have to settle with giving you the best bookkeeping and tax preparation services in Louisville. Although financial security is great all year ‘round, Bourke Accounting knows that it’s most appreciated during the holidays – stop in today and see what Bourke can do for you.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Even for the uninitiated, raising a kid looks like hard work. In earlier years, parents had to make sure their kids didn’t stick anything too metallic into anything that held too much electrical conductivity. Now, parents have to keep kids safe from predators, real and virtual, protect them from unseen viruses and try to explain just what is going on in the world (without scaring them into agoraphobia). No doubt about it, parents have a lot on their plate.

But all is not lost! Because the IRS puts people first, it has created child credits, tax breaks and guidance for parents out there claiming kids. In fact, there must be a group of IRS agents sitting in a room right now deciding how to address every contingency known to humankind. Here are just a few examples of how the IRS is working for parents at this very minute:

1) Kidnapped children. Since no one wants to think about kidnapped kids, the IRS has done it for us. Naturally, the first thing a taxpayer will consider, after receiving a ransom note, is the tax implications of their child’s dependent status. However, if two requirements are met, tax breaks are available with ease. The first condition is that the child must be kidnapped by a non-family member; local law enforcement can help with this. Note that little Billy following the Grateful Dead with your brother, Uncle Freedom Stone, won’t count. The second requirement is that, before the date of the abduction, the child would have had to live with the parent for more than half of the year (EITC.IRS.gov). If both conditions are met, the parent is eligible for the regular child exemptions. So, uh, yeah. There’s that.

2) The American Opportunity Tax Credit (AOTC). We know the importance of educating our future professionals and this credit helps to ensure that kids are in the know. The program allows a credit of 100% of the first $2,000 of education expenses paid for each eligible student and 25% of the next $2,000 (IRS.gov). While this is helpful, there are, of course, stipulations in place. For example, the student must be working towards a degree or some other credential, the student must be enrolled at least part time, ATOC can’t be claimed for more than four years and the student must not have a felony drug conviction at the end of the year (IRS.gov). So, if little Billy (he gets around) engaged in some sexy bank robbery, he’s good to go. However, if Billy sold a couple of funny cigarettes to a narc, well, no school for you, Billy. While no one believes in rewarding bad behavior, it’s rather interesting that assault, stalking, etc., are not considered deal breakers, but dust in a baggie is. It would seem that non-violent offenses don’t warrant second chances. The IRS perhaps made a mistake here – as education is one of the only deterrents against criminality, maybe they’d like to revisit this issue.

3) Kids in contention. So, you have one kid and two parents who think each is deserving of the neat tax prizes. The kid stayed an equal amount of time with each parent. Both parents paid an equal amount for the child’s upkeep. The parents hate each other and won’t agree to an alternating year compromise. Who gets the kid? The parent with the most money. If everything is equal, the parent with the highest adjusted gross income is the tiebreaker winner (IRS.gov). One would think that the less affluent parent would be victorious, but no. If you hate your ex, this should be incentive enough to ask for that raise…

As hard as parenting is, aren’t you glad there’s a Nanny McPhee-type helper in the IRS office? For every scenario, there is a tax regulation and your IRS representative is eagerly awaiting your query!

If you’d like to avoid the three-hour hold time, your Bourke Accounting expert has the answers, too. Bourke Accounting tax preparers are well-versed in child exemptions and the rules to utilize them. Not only that, but your Bourke Accounting representative offers hospitality, cookies and Red Bull, things suspiciously absent when dealing with the Internal Revenue Service.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Keeping up, non-obsessively, with current events is a good thing. Considering that both the IRS and government seem to get their kicks from shaking things up daily, this is especially true for Bourke Accounting pros. However, Bourke Accounting experts aren’t solely watching the dry world of finance – they keep an eye on everything. Hence, Bourke staff meetings are lively affairs.

Recently, the story of (former) Judge Dawn Gentry’s removal from the bench was the topic of conversation. If you don’t know, Gentry was a family court judge who was stripped of her office after being found guilty of ten misconduct charges (Local12.com). Some of Gentry’s interests included sexual harassment, booze in chambers, favoritism and actively being a terrible person.

Not matter how skeptical we have become, Americans would like to believe that people in such positions of power are impartial and immune to the baseness of civilian humanity. Since we hold judges to a higher standard, the Gentry story has been dissected endlessly over popular media. However, is this notoriety based on a judge’s disgrace or does the real interest lie in the fact that Gentry is a woman? While America has witnessed numerous instances of male perpetrators, a woman in such a predatory role is still novel enough to give pause.

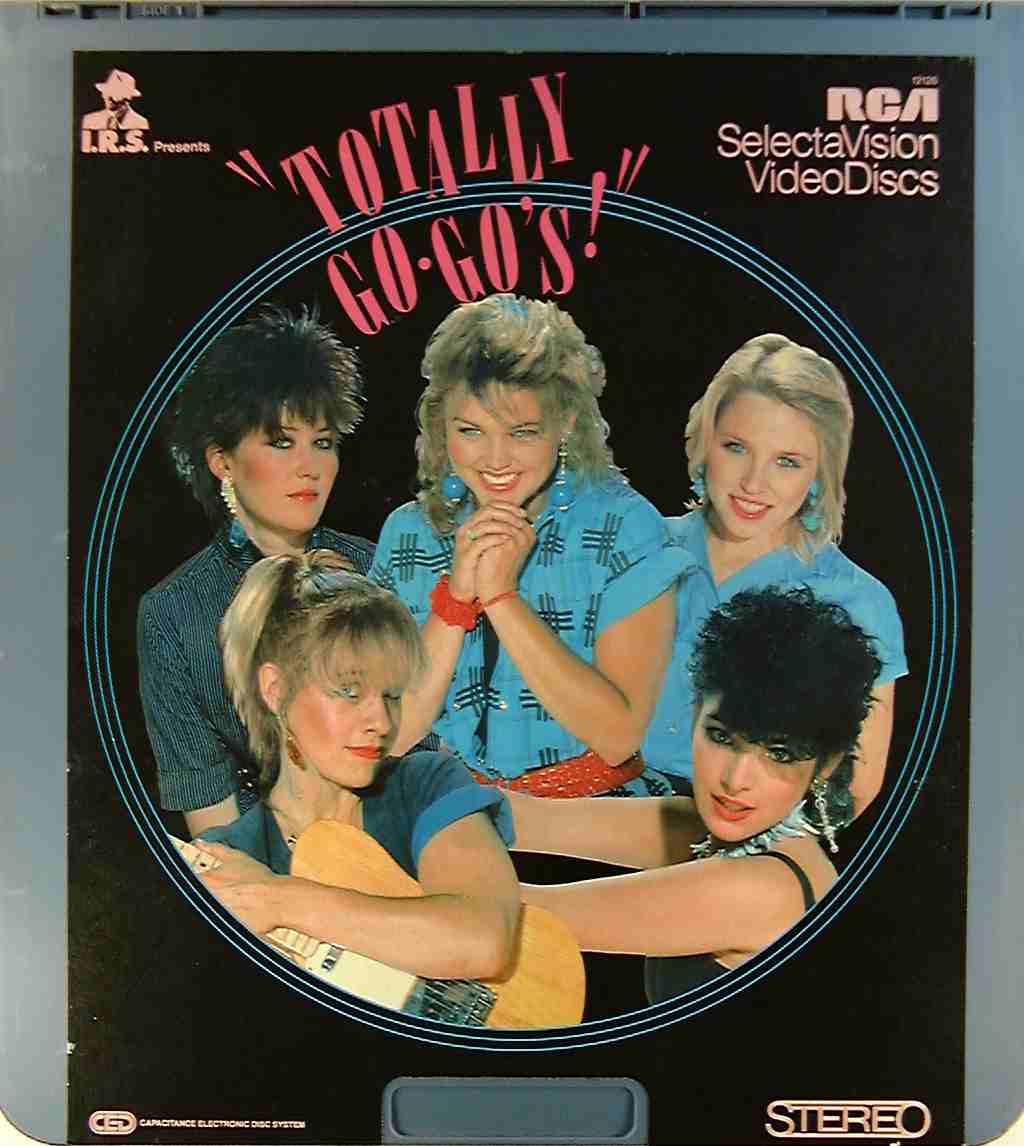

Take, for example, “girl” super group, The Go-Go’s. It’s hard to think of the ‘80s without humming a few bars of “Our Lips are Sealed.” Oh, yes, The Go-Go’s were such a happy, sweet girl group! Considering the lack of raunchiness in their music, one would think these people were either nuns or built as anatomically correct as Barbie. From mischievous, tom-boy-pixie guitarist, Jane Wiedlin to the cherubic, Campbell’s Soup kid innocence of Belinda Carlisle, this band was totally and completely harmless!

Except they weren’t. First, The Go-Go’s started life in 1978 as a punk band (Billboard.com). Keep in mind that ‘70s punk was not similar to the defanged, mall-punk of today; punk used to be a “take a bottle to the face, take you home for a brief love affair, create great art after” scenario. So, our safe Go-Go’s had a hardcore pedigree – like they say, you can douse the woman in pop, but you can’t scrape away the punk.

Contrary to their songs, The Go-Go’s were musicians. When they hit No. 1 on the charts, they were the first all-woman band to write their own stuff and play their own instruments (SanDiegoUnionTribune.com). Guitarist Charlotte Caffey was also one of the only ones to be thrown out of Ozzy Osbourne’s dressing room for being too “rowdy” (Twitter.com). In addition, stories related by groupies after a night with “the girls” are told with pride mixed with slight PTSD. The Go-Go’s weren’t any different from their male counterparts. And yet, there are numerous documentaries, articles and books that explore the “scandalous” behavior of these women. Of course, this could be because their Day-Glo music belied their nature, but it stands to reason that it’s really because of that double X.

Women, men, non-binary, we’re all the same. There is no “gentler” sex, there is no “logical” sex. We are all apes running around creating havoc. It’s unfair to hold one sex to a standard that is largely ignored by another. At the end of the day, let’s just treat each other with respect and consideration and call it good.

You won’t find wild parties at Bourke Accounting. And, sadly, if you’re an accounting groupie, you will be disappointed in your Bourke Accounting representative. However, if you require efficient and accurate financial services, Bourke Accounting bookkeepers and tax preparers are the people to call – female, male or non-binary.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

It’s September! And you all know what that means, right?! It’s time to deck the halls, light the menorah and plan your Karamu menu! It’s time for stores and car companies to fast forward through time and space (past the less lucrative holidays) to get to those sweet, sweet December festivals! While Bourke Accounting isn’t the type of establishment to stock scary Halloween masks next to brightly lit Christmas trees, there is something you should know about the upcoming months.

In the not too distant future, you are going to start receiving pleas from established charities and benevolent organizations – and, whether you’re religious or not, giving to those less fortunate is always in season (especially during the cold months). However, since the virus has touched down, there’s more people who could benefit from charities rather than finance them. Is there a way to help everyone all at once this holiday season? Maybe a little.

At this point, you know that the Tax Cuts and Jobs Act raised the standard deduction to the point where it doesn’t make sense for most Americans to itemize their deductions; in fact, less than 15% of citizens receive any sort of benefit from itemization now (TheConversation.com). For those who aren’t going to exceed $24,800 (married filing jointly) or $12,400 (single filer) in deductions this year, there is now an added incentive to give a little this season.

After the introduction of the TCJA, there was a noticeable decline in charitable donations from taxpayers (Kiplinger.com). Although this makes one question the concept of genuine altruism, it seems that some lawmakers have realized that just asking for charitable help isn’t going to cut it during the age of Corona. So, in March, the Coronavirus Aid, Relief and Economic Security (CARES) Act changed the rules a bit. Now, even non-itemizers are allowed to write off $300 ($600 for jointly filed returns) for charity donations.

Before anyone gets any fancy ideas, this write-off is meant for cash gifts only (Philanthropy.com) – so don’t try to donate a broken $15 scooter and expect the full deduction. Also, even though the IRS has been busy recently, don’t think that our bean-counting pals aren’t still watching. Like always, donations must be given to qualified charitable organizations; this means that giving your adult brother pizza and beer money won’t count. Also, and, just for kicks, make sure that you save your documentation reflecting the gift amount. The chances that auditors will bother to investigate a $300 deduction are slim, but you can never predict when there will be a slow day in the IRS office.

Although this new rule is an enticement to give, it’s not going to alter anyone’s tax return very much. Marc Goldwein, senior policy director for the Committee for a Responsible Federal Budget, points out that, for those in the 10% tax bracket, the difference would be about $30 (CNBC.com). We all know that it’s better to give than to receive, but, sadly, there aren’t that many Americans who will be able to make use of this incentive this year.

If you can donate this year, that’s great – you’ll help a lot of people. Keep in mind, however, that a lot people can also be helped with time and talent, too. It’s not always about money…

Bourke Accounting believes in charity and helping their fellow people. Bourke Accounting also believes in knowing all of the new regulations that can alleviate some tax burdens. During good times and bad, your Bourke Accounting tax preparers and bookkeepers are the professionals with the big hearts. Happy (Premature) Holidays!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

From top celebrities to grade schoolers, a lot of people are feeling…not quite right; some of you aren’t sleeping well, some of you have lost interest in the things you loved and a lot of you are finding it difficult to control your emotions. Magically and overnight, some have been transformed (to varying degrees) into Jack Torrance, keeping company with vengeful entities at the Overlook Hotel.

And, obviously, some of you are not making it easier on yourselves. Alcohol sales are up, narcotic rates are as high as the people partaking and there’s an increase in people beating each other up in public. Clearly, stress is not being handled in positive ways. Since no one can’t make everything better just by wishing, here are a few more simple tricks to alleviate the malaise and maybe bring a certain kind of peace:

1) Stay off social media/news feeds. You’ve heard it before, but it might be falling on deaf ears. Just because technology has made bad news accessible at the moment it occurs, doesn’t mean anyone should willingly absorb it all. There is a vast difference between being informed and wallowing in heartbreaking details. Give yourself five minutes to skim headlines and then move along. It might sound stupid, but set an alarm and shut your device off when the time is up – no excuses. Also, now is not the time to find that you and your loved ones have differing leanings. Everyone is feeling passionate about a lot of situations and people might say things that aren’t really meant. If you spend too much time on social media, you will discover someone close to you doesn’t agree with your take on things. Don’t end a relationship over a meme. Remember that no one is at their very special best.

2) Get out. Instead of stewing over the state of things, pump up the music, slap a leash on the dog (cat/neighbor’s kid) and get to walking. Acknowledge that the world is still here. Trees and bumble bees still exist, squirrels are still dancing in their questionable fashion. We, as a species, are still here. After unleashing the neighbor’s kid, clean the gutters, sweep the driveway, sing along to Olivia Newton-John. Do anything, as long as it’s mindless and exhausting. Sit outside at night and appreciate the tune of cicadas, relish the slight change in temperature, howl at the moon. Get out.

3) Force yourself to do the things you’ve forgotten you love. Stop giving yourself permission to be miserable. You are not an entitled toddler and it’s time to stop treating yourself as such. The holidays are on the horizon – have you even started Aunt Clarice’s sweater? No, you have not. When was the last time you picked up a book? You love reading, you haven’t been reading and now you’re surprised that you feel weird? It doesn’t matter if you’re tired. It doesn’t matter if you don’t feel like it. When you’re hyper-focused on the negative, it’s as if you’re constantly staring through a microscope – it’s no wonder the edges have gone dark. Embrace the things that give your life meaning; those things have been patiently waiting for you.

Nobody told you there’d be days like these, but no one ever promised you a rose garden, either. Reach out if you need support, reach out if you see someone suffering. You are not alone. We can either make things better or we can make things worse. It’s up to us to decide.

Bourke Accounting experts want to make things better. Your Bourke Accounting bookkeeper or tax preparer are good for a laugh and even better with a trial balance. At Bourke Accounting, curling into a ball is not an option. No matter how you’re feeling, your Bourke Accounting specialist are going to continue doing what they love. And they’re patiently waiting for you, too.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Paris, you ain’t a f*&%ing punk, yah tourist! – NYC Punk Rocker, upon seeing Paris Hilton wearing a Ramones shirt, 2001

If you think about it, tax preparers – like you’ll find at Bourke Accounting – are akin to musicians: they have to keep time with the song they’re playing, they must have a working knowledge of the rules and structure and, most importantly, they have to know how to be innovative without descending into a world of chaos (and penalties). Think of it like this: there is a huge difference between Tekashi6X9 and The Jimi Hendrix Experience. One is irritating noise that is technically music, one is life-changing art.

In 1974, popular music was pretty much nowhere. We had the soulless arena rock of Queen (yeah, I said it), there was the wanna-be sensitivity of The Eagles and the sanitized, over-produced offerings of Steely Dan (not to mention the one-step-away from feminine hygiene jingles of Barbra Streisand). In 1974, popular music had no meaning, no emotion and all of the charm of damp toilet paper stuck to the collective finger of America.

And then, when it seemed that there would be no stereophonic salvation, four funny-looking guys with an obsession for bubblegum pop convinced an NYC bar owner to let them play. The Ramones had arrived at CBGB’s to save the day (and our souls).

What was interesting about The Ramones was that they didn’t sing about “bands on the run” or how “you ain’t seen nothing yet.” No, no, no, The Ramones gave us autobiographical ditties that, at first listen, were cute and energetic. However, there was nothing cute about the confessional song, “53rd and 3rd.” This song depicted bass-player Dee Dee Ramone’s experiences as a professional lover on a well-known Manhattan corner. As it turns out, Dee Dee had a love for pharmaceuticals and no desire to get a proper job. Also, the upbeat song “Beat on the Brat” was Joey Ramone’s observations based on his neighborhood, illustrating children running wild and parents with a penchant for corporal punishment.

The hippie protest songs of the 1960s advocated rebellion against unfair higher powers with an inclusive, “we love everyone” vibe. Punk rock wasn’t quite as optimistic. Punks knew that just saying you love everyone didn’t make it true. Punks were cynical, learning at a young age that “heroes” who espoused “all you need is love” were often the same men who mercilessly abused their nearest and dearest. Punkers were honest in their nihilism and belief that the world really was as bad as a hippie with a peace sign and a clenched fist. Punk rock and The Ramones didn’t sugar-coat to make anyone feel better.

While there is a depressing, truthful element to punk and The Ramones, there is also an idealism that suggests that we will get through this, too. The thundering bass, the simplistic, war-like drums, the staccato singing and the screaming guitars all prove that where there is life, there is hope.

Critics have accused punk of being sloppy, undisciplined noise. They’re wrong. Punk is visceral and primal, sure, but it’s also real. Punk and The Ramones are the auditory personification of the Id; there are some of us who will always prefer authenticity to commercial studio representations of humanity.

Bourke Accounting bookkeepers and tax preparers are the punk rockers of accounting. Bourke Accounting pros know what they’re doing, but they won’t pretty up their findings for anyone. If you want an expert to tell you the truth and give you real options to save your back account, come see a Bourke Accounting representative today. Gabba gabba hey.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Whether I leave late or show up on weekends, I feel safe going to work at Bourke Accounting. There’s a guy across the street selling hot dogs, women power walk around the building during breaks (their arms wildly, maniacally swinging) and parents jog with aerodynamic baby carriages. There’s a civilized air about the area that – if I wasn’t a paranoid New Yorker – lends itself to leaving car doors unlocked. Judging by the calm, workaday neighborhood of Bourke Accounting, you would consider Louisville a very safe town. And you would be right. And wrong.

Recently, Louisville has experienced an increase in gun violence; as of August 5, there have been 407 shootings compared to 208 at this time last year (WLKY.com). The most horrifying aspect of this is that many of the victims have been kids or innocent bystanders. According to Norton Healthcare, 16 children have been admitted between March and July of this year with injuries attributable to stray bullets, a 78 percent increase from last year (Wave3.com). Just a couple of more kids who will never get to fall in love, never get to be cool.

City officials point to gang warfare as the driving force behind these murders. Metro Council President David James suggests that half of the shootings are gang related, with many of the issues originating from social media. James says that, when these virtual wars spill over into real life, they are subsequently followed by retaliatory killings (WDRB.com). And so on and so on.

As if children being shot wasn’t bad enough, the perpetrators of these crimes are often little more than children themselves – nationwide, the typical age range of gang members is between 12 and 24 (Nonprofitrisk.org). As a child’s brain isn’t fully developed until the age of 25 (URMC.Rochester.edu), it is heartbreaking that these kids are throwing their lives away before they can totally control themselves or understand the repercussions of their actions. So, why are these kids getting involved in, very adult, gang games?

Blame movies like Scarface (the awful Pacino version, not the original), but kids think they’re going to make a lot of money by joining a gang. Let’s see…as an “average gang leader,” one can expect to make about $58,750 per year (Comparably.com). While you do have to worry about the Feds and violent coups, at least you don’t need a Bachelor’s degree. Of course, a subway operator makes $62,730 a year without college, too. And how much will you make as an entry level gang member? According to a paper by Steve D. Levitt and Sudhir Alladi Venkatesh, that number is between $6 and $11 per hour. Super glamourous.

If it’s not the money, it must be the loyalty of a family you’ve chosen yourself, right? Let’s just remember rapper and tough guy Tekashi 6ix9ine. When he was indicted for aiding in an attempted murder, etc., he promptly “snitched” on members of his gang and walked (Insider.com). That is some kind of loyalty. Keep in mind that Martha Stewart did her time without involving anyone. A woman known for making Pom-Pom Animals is clearly the real gangster.

As with most things, education is the answer. When we offer critical thinking and marketable skills, we offer a way out. If we teach the children to believe in a better future and to believe in their abilities, they are hardly going to be impressed with their pal’s duct-taped .22 and four-page arrest record.

Bourke Accounting might not be able to cure all of the world’s social problems, but we can definitely cure your financial ailments. If you’ve made a mistake concerning prior tax returns, a Bourke Accounting tax preparer can furnish you with the education to avoid such issues in the future. Bourke Accounting knows that we’re all in this together and we have a obligation to help each whenever we can.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Bourke Accounting’s Bookkeeper Christina was giving me assignments the other day. After glancing at the clock, which read “11:11,” I knocked wood three times, made a wish and thanked the universe. As my Bourke Accounting co-workers know that I’m superstitious, Christina simply ignored my ritual and carried on.

I never fold sheets indoors. I have never “played” with a Ouija board and I have certainly never repeated “Bloody Mary” in a darkened room. Do I truly believe that Mary is going to reach out and touch me? No, not truly, but why risk it? While I don’t know if I believe in ghosts, I do believe in dignity and respect.

As any newcomer to Kentucky can attest, one of the first things locals like to share is the history of Waverly Hills Sanatorium. According to friends and hokey ghost hunting shows, the former tuberculous hospital is one of the most haunted places on earth. Adding to the already sad history, after being a TB hospital, the space was reincarnated as the Woodhaven Geriatric Center, a nursing home that was closed amid allegations of patient abuse (En.Wikipedia.org). It’s no wonder that with such a storied past, visitors swear that they’ve played ball with a little ghost kid and have seen the specter of a nurse who committed suicide. One friend told me that, after investigating “The Death Tunnel” (an underground walkway employees used to transport supplies and deceased patients), his apartment became so haunted that he was forced to move.

Call it self-preservation or superstition, but humans naturally fear locations where people have died. Whether you believe in an afterlife or not, there is something sobering about standing in the spot where others have breathed their last (of course, it doesn’t hurt that we also enjoy gruesome narratives). However, one of the saddest stories of Waverly is the way it is currently being used.

When Charlie and Tina Mattingly bought the Waverly, they had a notion to turn the space into a hotel and convention center. However, unable to get a loan, the Mattinglys came up with the idea of raising money by opening the space to the public (WDRB.com). For example, for $25, Waverly offers a two-hour paranormal guided tour (TheWaverlyHills.com). But wait, there’s more! For $1,000, visitors can roam freely and even spend the night (Eventbrite.com). And let’s not forget the annual Halloween haunted house! For a nominal fee, peanut-munching, mouth breathers can stomp unceremoniously through a space that should be shown reverence. After demonstrating nothing but disdain for lost lives, don’t forget to stop at the gift shop for a tee-shirt.

It’s not charming when a place of immeasurable heartbreak is used for nothing more than cheap entertainment. What’s next? A Lizzie Borden Bed and Breakfast…oh, never mind, that already exists (and, for $250, you can sleep where a woman was murdered). I’m not suggesting that we should wander in perpetual mourning, but tragic locations shouldn’t be treated as low-rent freak shows, either. We ought to honor our lost with dignity, not insult their memories with fake blood and spectacle.

Showing respect is free; perpetrating the disregard of our fellows actually costs money. The next time you’re touring a “haunted” location, spare a thought for our fallen brothers and sisters. They’re not just fictional characters designed to give us a thrill, they were people.

The Bourke Accounting office is not haunted. Bourke Accounting bookkeepers and tax preparers are so level-headed and focused that it wouldn’t matter if it were. Regardless of what is going on, when you sit down with Bourke Accounting pros, the only thing they care about is giving you the best service in Louisville.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Sarah: That’s not fair!

Jareth, The Goblin King: You say that so often. I wonder what your basis for comparison is.

Labyrinth, 1986

At Bourke Accounting, Bill has a sort of hands-off, trial by fire, mentoring approach. Consistent with this philosophy, he handed me a book chock full of the new tax changes birthed by the Tax Cut and Jobs Act of 2017. While Bill is, no doubt, charmed by my blogging abilities, I believe he is serious in his request that I learn a thing or two about taxation in general. More importantly, I have a suspicion that there will be questions later. So, I am reading The Book and taking notes.

Having worked for accountants in the past, one of my jobs was chasing down people with home offices and employee expenses. I was that chirping nuisance asking for square footage used, percentage of utilities, meals and entertainment, etc. So, imagine my surprise when The Book told me that W-2 employees are no longer able to deduct unreimbursed work-related expenses, including home office expenses, on their returns.

Before the TCJA, besides home office deductions, if employees had expenses in excess of 2% of their adjusted gross income, well, they could just write those right off (Barrons.com). It’s been argued that, since the TCJA increased standard deductions, most people wouldn’t be affected by this change, so it was nothing more than an academic argument anyway. Uh, yeah, sure, that might have been true – at least, before the virus made the scene.

Even with the relaxation of lockdown rules, there are still a lot of people working from home now. Whether commandeering playrooms or kitchen tables, out-of-pocket expenses have been incurred; after all, Special Princess Palace Kingdoms don’t just magically transform into 9-5 professional workspaces. Many employees have had to upgrade internet service, buy chairs that won’t destroy their backs and incidentals like printer ink. Would all these expenses top their standard deduction? Maybe, maybe not, but these employees are still using their own money to outfit a workable, satellite office. The standard deduction is great for a future tax return, but what about right now?

One option for these homebound employees is an accountable plan. With this sort of an agreement, employees can bill employers for their expenses. The employers can then deduct for expenses they pay back to the employees (Investopedia.com). However, there are no federal rules saying a company has to do this, unless these expenses push a “worker’s income to below the minimum wage” (Barrons.com). Another option would be for Congress to allow W-2 employees to specially deduct employee expenses for a limited time, separately and in addition to the standard deduction. It could happen…

The world is more unfair than usual these days and it’s up to the powers that be to do what they can to level the field a bit. Hey, Congress, let’s get creative and funky! As the workers are the economy, there should be incentives and rewards put into play.

With changes coming fast and heavy these days, it’s nice to know that your Bourke Accounting bookkeepers and tax preparers are keeping up. No matter what insane alterations are on the horizon, Bourke Accounting experts will have the answers to all of your questions. It’s probably a sick obsession, but – lucky you – Bourke Accounting specialists live for this stuff.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.