I think I told you that Bill has involved his Bourke Accounting employees in a book club (the new book is Jen Sincero’s, “You Are a BadA*s”). Last week, at our meeting, the question was raised: Do you forgive easily? Most everyone answered that yes, in fact, they do forgive easily. There’s no point in staying angry when it doesn’t hurt anyone but yourself, we’re all mature here, let it go, let it go, let it go.

I just might be the resident rebel agent provocateur, but when the question was posed to me, I honestly replied that I do not forgive easily (if ever). Vanessa Delgado hurt my best friend 20 years ago – if she was on fire, I wouldn’t even…uh, put her out. Ermes Vallencio broke my heart 17 years ago; I’m still waiting for the chance to remove his. Bill tore apart one of my blogs so thoroughly, I was bleeding ink for a week.

Before I get to the touchy-feely optimistic part, let me just say that I don’t necessarily agree that forgiving easily is such a great thing. The longer one holds a grudge, the less likely one is to fall prey to another charlatan. We live and learn and, in my case, hold deep-seated grudges out of a strange self-preservation instinct.

But. Forgiveness is good for you. Psychology Today tells us that forgiving reduces “anger…depression and stress.” Also, if you’re a forgiving sort, you’ll suffer “fewer general health problems and lower incidences of the most serious illnesses – including heart disease.” Yeah, it’s not enough that you’re a sweeter person than me, now you’re healthier, too.

However, speaking for the grudge holders, it’s not really our fault. Johns Hopkins Medicine reveals that “studies have found that some people are just naturally more forgiving.” And wouldn’t you know it? These Pollyannas “tend to be more satisfied with their lives” than someone like yours truly. Ok, so you’re not just healthier, you’re happier, too.

Because I want to be healthy and happy, I did a little bit of research on how one can learn to forgive. From what I’ve read, it’s about as easy as learning to fly by flapping my arms a lot. Some sites told me esoteric stuff about making pals with my inner forgiving goddess. Right, yeah, I’m on it. Psychology Today actually had better advice. One of their concepts is that you should “acknowledge the growth you experienced as a result of what happened.” I have to say, every time that I’ve been hurt, I did learn something. Hard lessons are the ones that teach the most.

Another thing that Psychology Today emphasizes is the point of view of the person who hurt you. The author invites the reader to understand that “the other person was trying to have a need met.” Furthermore, the reader is asked to question what that need was and “why did the person go about it in such a hurtful way?” Like with everything else, once understanding and communication are established, it’s easier to look at the other person as an actual person and not some demonized version of someone we used to like.

I’m not going to learn how to forgive in one day. However, working with the crew at Bourke Accounting, maybe I can learn how to “let it go” a bit; they really are a forgiving group. Show up a little late for your appointment? Our Bourke Accounting professionals won’t make you stand in the corner. Made some bad investment decisions? Bourke Accounting experts won’t even say “I told you so,” they’ll just quietly get your financial life back on track. Bourke Accounting associates might just be The Saints of the P&L.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

You just got married? How nice for you! Your new husband is great; he’s smart and sweet, caring and good-looking. He’s good to your family and he’s good to your dog. All in all, he’s the total package…except for one thing: he didn’t exactly tell you how bad his debt was before you happily said, “I do.” Oh, and he also neglected to mention that he is addicted to buying expensive vintage toys (although his house should have told you that).

I don’t know why I’m surprised that there’s a proper name for this, but there is. It’s called “financial infidelity.” It’s rather self-explanatory, but this is when one partner is “making significant financial moves without the knowledge of the other” (Thesimpledollar.com). This includes everything from opening secret bank accounts, lying about paying bills to spending vast sums of money, while hiding the bills. According to NPR.org, “41% of American adults admit to” engaging in financial infidelity and it seems that the trend is on the rise.

According to an ABC7 news report, “Millennials are more likely than other age group to lie” to their significant others about their finances. These lies could be fairly harmless, such as telling partners that they have less money than they actually do. ABC7 suggests that this is because they want a “Freedom Fund,” in case the relationship fails. Obviously, it’s a lot worse when it goes the other way and there isn’t enough money in the bank to pay for a bagel, let alone pay the mortgage.

At this point, the divorce rate for financial infidelity is lower compared to the divorce rate for the more visceral type of infidelity. However, studies say that, for those affected, “76% reported that it harmed their relationship and 10% said that it resulted in divorce” (Investopedia.com). Even if the suffering spouse forgives, I would imagine it would always be a theme running through her/his head: What else don’t I know about?

Most of the literature advises that couples speak candidly with each other before their upcoming marriage regarding debt – there should only be a few surprises on the wedding night, and they should be fun ones. Logically, and in most states, “you are not legally responsible for bills racked up before getting married” (Badcredit.org). In “common law” states, “debts incurred by one spouse are usually that spouse’s debts alone” (Nolo.com). However, if you decide to open a joint account, no matter who blew the money, both spouses are liable (Incharge.org). Most experts agree that, although someone might get their feelings hurt, it’s probably for the best to maintain separate accounts and credit cards.

And since you’re already going to be hurting your intended’s feelings, Foxbusiness.com suggests a pre or postnuptial agreement to further protect yourself. It’s not very romantic, granted, but it might keep you afloat if your spouse develops a nasty gambling addiction.

Getting married is a big deal. Staying married is an even bigger deal. If you’re suffering from financial infidelity, why don’t you and your spouse meet with a Bourke Accounting pro? A Bourke Accounting specialist won’t take sides or encourage you to do weird marriage counsler-like exercises, but I wouldn’t be over-reaching when I say that a Bourke Accounting rep might be able to provide the tools to save your marriage.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Since starting work at Bourke Accounting on September 30th, I have never arrived late. I am a grownup and know how both punctuality and alarms operate. I don’t know the repercussions for lateness (I could read the Bourke handbook, but I like surprises), and unless something catastrophic occurs, my perfect record will remain and I will have no need to know about repercussions.

Not everyone is like your humble narrator (here, I’ll help you pat me on the back). For example, when I was working HR, there was an employee who only managed to arrive on time about once a week – she was so proud of herself when she did. She had an astounding array of excuses: flat tire (no receipt), doctor appointment (no note), many bats flying around inside her house (um), etc., etc. When she was finally given a one-day suspension, she flipped out. Although I had copies of every warning issued to her, along with the company’s attendance policy, she still felt that I was somehow persecuting her. Our boss had allowed her to slide so often, that she felt that she was above the rules.

According to Forbes.com, a YouGov poll reported that “one in five Americans (19%) arrive late for work at least once a week while just under half (48%) are never late.” That’s a pretty sad statistic. In addition, “businesses lose over $84 billion each year to absenteeism” (Businessnewsdaily.com). This is due, of course, to the fact that absent workers are rarely productive. Also, other workers are forced to take up the slack. Finally, if management isn’t consistent regarding consequences, morale could be seriously damaged or workers may conclude that promptness isn’t a priority.

Some articles I’ve read suggest that, if an employee is consistently late because of something like a conflict with daycare, the employer should contemplate changing the employee’s schedule (SBA.thehartford.com). I don’t believe that to be a viable option. When an employee is interviewed, work hours are discussed; it is the employee’s responsibility to mention the issue at that time, not after being late for the 10th time in a month. I’m not saying that accommodations should never be made, I’m just saying that an employee should be truthful from the beginning about what is required.

Although some employees show up late because of naughty, nighttime habits or just out of plain laziness, there’s an additional reason that’s fairly depressing. According to Mitrefinch.com, “if [the employee] feels undervalued and underappreciated…do not be surprised when he submits a letter of resignation.” Oddly, this becomes more prevalent if your employee “belongs to your creative department.” Apparently, we sensitive types are, well, sensitive. Again, I’m not saying that a business should bend over backwards to accommodate a temperamental artist (feel free to do that for me, Bill), but when a worker expresses concerns about something, perhaps you should give said worker a forum to talk it out.

Working is an evil necessity. In my opinion, if you’re being paid to come to work, you should show up at the time that was agreed upon. I might be a bit liberal, but I also have a sense of fair play.

Bourke Accounting specialists won’t deride you for arriving late to your appointment; however, they’d appreciate it if you were punctual – it keeps the schedule intact. If you find yourself consistently showing up late for work, though, you might want to analyze the reasons behind it. Bourke Accounting isn’t an employment agency, but our reps might be able to help you to stack up your money if you’re thinking of a job change. Taking the plunge might be difficult, but with Bourke Accounting on your side, you might find it well worth it.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Bourke Accounting doesn’t think for you. In fact, our Bourke Accounting tax preparers and bookkeepers don’t want to think for you. They simply share their knowledge, honestly tell you how things stand and allow you to make your own decisions. They might offer an opinion, but at the end of the day, they will neither pressure you nor expect you to blindly follow.

Wouldn’t it be nice if everyone was like that?

I know we’ve spoken about influencers before, but just past the innocuous, pretty people frolicking in nightclubs, there’s a dark side that should be explored. What happens when influencers become so popular that their fans no longer think for themselves? Do influencers have a responsibility to their followers or is it a matter of caveat emptor?

For example, there is an Irish rapper named Blindboy who has a brand-new show on English television called “Blindboy Undestroys the World.” His show is designed “to expose celebrities and influencers for endorsing products that they don’t actually use” (Foxnews.com). In order to underscore his point, he set up a little prank.

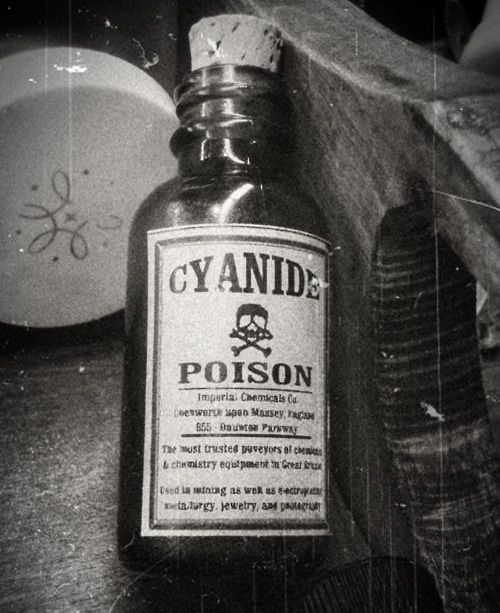

Reality show, and now internet, stars Lauren Goodger, Mike Hassini and Zara Holland were all offered the “opportunity” to peddle a new weight-loss water called “Cyanora.” The influencers were “told testing of the product was not available until its launch in a few months” (Dailydot.com) so trying it at the moment would not be possible. All three agreed to filming short promos for the product, where they were invited to read the list of ingredients.

One of the ingredients listed happened to be hydrogen cyanide (Dailydot.com). Why does that sound familiar? Oh, right. Isn’t that a deadly poison? I believe a certain group in the 1940s used this chemical a lot. After reading the list of ingredients on film, Mike Hassini quipped, “from what I know, that all looks pretty natural” (Dailydot.com). Well, he isn’t wrong – cyanide does “occur naturally in plants and processed foods” (NCBI.nlm.nih.gov)….

Holland’s agent was the only one who “insisted that [Holland] would have to…try the drink before promoting it” (Delish.com). The other two didn’t seem to have an issue with slinging unknown products. When asked if she had a problem endorsing a line that she wasn’t familiar with, Goodger boasted that “she’s never tried Skinny Coffee, a brand that she’s promoted on Instagram” (Delish.com).

When the truth was revealed, everyone involved went straight into panic mode – agents lost jobs and back peddling self-defenses were thrown around like birdseed at a wedding. After all, it was the TV show’s fault for setting them up.

Bourke Accounting specialists know that you aren’t stupid. Bourke Accounting wants you to use your own reason when coming to a conclusion that will affect your financial well-being. Good advice is one thing, but Bourke Accounting reps want you make informed decisions using the easily understandable information that is provided to you. You know your own mind, we’re just here to make sure that you know all of the facts, too.

Don’t drink Cyanora and come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

A few nights ago, as part of Bourke Accounting’s bimonthly seminar program, we hosted Marianna Perry, proprietor of AEDs & Safety Services, LLC. Generally, when we think of safety in the workplace and defibrillators, we don’t get real excited (unless there’s an investigation being conducted by a governmental agency). However, Ms. Perry changed that for her gathered audience.

A few nights ago, as part of Bourke Accounting’s bimonthly seminar program, we hosted Marianna Perry, proprietor of AEDs & Safety Services, LLC. Generally, when we think of safety in the workplace and defibrillators, we don’t get real excited (unless there’s an investigation being conducted by a governmental agency). However, Ms. Perry changed that for her gathered audience.

Ms. Perry is a very well-appointed, impressive woman. When she walked in, I figured her to be some sort of ex-special forces branch of the military. She was extremely charming, but I had the suspicion that she knew how to break bones that I didn’t even know I possessed.

As it turns out, I was almost correct: Ms. Perry is a former police officer. Let me rephrase: Ms. Perry was part of the “Narcotics and Organized Crime [unit] for 6 years assigned to the Special Investigations East Division of the KSP and then General Investigations assigned to a KSP post for a year and a half” (Personal correspondence, 1/23/20). Yes, she was an undercover narcotics officer. When asked why she left the force, she cited the fact that she had two young children. “There was a .38 in the diaper bag,” Ms. Perry said and went on to say that that was no way to raise kids.

In addition, Ms. Perry was an EMT, holds a Master’s degree, is a Certified Protection Professional and a Certified Protection Officer Instructor. Yeah, all that and two kids.

Ms. Perry has been associated with AEDs & Safety Services, LLC for about 2 and half years. So, what do they do? The short answer is that AEDs & Safety Services, LLC “is a locally-owned, small business that specializes in helping you save lives” (AEDssafetyservices.com). A more specific answer is that they “teach CPR/AED and First Aid classes and sell Cardiac Science AEDs…[and] First Aid Cabinets and First Aid Supplies” at reasonable prices.

In case you aren’t aware, an “AED” is a “automated external defibrillator.” You’ve seen these on doctor shows where a patient suffers a cardiac arrest, the doctor holds paddles, says “Clear!”, the patient jerks, opens his eyes and says “Thanks.” However, technology has come a long way since then. Ms. Perry demonstrated using a Cardiac Science G3 AED on her CPR-AED training manikin, Chuck (I named him). This gadget is impressive. As soon as you open the case, an authoritative voice advises to “Keep calm.” It then instructs, step by step, exactly what to do. Chuck didn’t jump and jive when the G3 hit him with the juice, though. We now have a gentler AED! Perry stressed the importance of having an AED on hand at the workplace, as heart disease kills more than all types of cancer combined (1/23/20 Perry presentation). She also strongly emphasized that, during an episode like this, every second counts.

Do you want to protect your workers? Give Ms. Perry a call at 502-693-2421 and ask for a demonstration. AEDs & Safety Services LLC supplies information and products to residential customers as well as commercial locations. I can’t tell you enough how much we enjoyed Ms. Perry discussing her passion.

Bourke Accounting wants you around for a long time. No, not just because we want to furnish you with the best in bookkeeping and tax preparation services; Bourke Accounting professionals like you. Because of this, Bourke Accounting is not only offering you superb solutions to all of your financial issues, we are offering worthwhile seminars to better your life. Don’t miss Tyler Bell discuss WSF Productions on March 25th!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

At Bourke Accounting, Bill and Tim will not allow me to touch the thermostat (someone tell me if this is a guy thing). I am encouraged to bring a sweater if I get chilly. So far, I haven’t been able to convince Bill that a bulky sweater will just ruin my cute blouse and patterned leggings outfit, so I am bundled up. To be fair, the temperature is kept at 70, so I might just be a Complaining Carol.

At Bourke Accounting, Bill and Tim will not allow me to touch the thermostat (someone tell me if this is a guy thing). I am encouraged to bring a sweater if I get chilly. So far, I haven’t been able to convince Bill that a bulky sweater will just ruin my cute blouse and patterned leggings outfit, so I am bundled up. To be fair, the temperature is kept at 70, so I might just be a Complaining Carol.

I can’t blame my stalwart bosses, though. According to Electricitylocal.com, the average “monthly commercial electricity bill in Kentucky is $458.” However, Energy.gov tells us that, just by setting that dial down by 10-15 degrees, we can save 5-15% on heating bills. I really hate to admit it, but just like Bourke is helping me to overcome my shyness, I am starting to bring their advice about temperature home, too: I have been setting my thermostat to 69 and wearing my Snuggie lately.

Saving money and energy are important. For example, we all know that if you’re going to leave your house for an extended period, you shouldn’t have your heat turned up to 80. However, is it a good idea to turn it all the way off? The answer is a flat “no.” Turning your heat off completely is a bad option according to Mason Harshbarger from Air Masters (courtesy of WUSA9.com). Mr. Harshbarger says that, when you turn your heat on and off, “your system will have to work extra hard for extra long to get the temperature back up.” So, turn it down, not off, when you venture out into the world.

Since I am a wealth of energy saving tips today, let’s talk about furnace filters. I confess that I am guilty of ignoring my filters. I change it only when I remember that it exists. Oddly enough, I am then utterly confused when my heat isn’t acting quite right; take it from your humble narrator, changing your filter every few years just doesn’t work. UShomefilter.com suggests that you change your filter about every 90 days. Of course, if you have animals, a very full house or babies (not that babies are dirty, they just need cleaner air), you’ll want to change it more often. LG&E suggests that every time you get your energy bill, take a look at your filter. A dirty filter will cost you money as your system is working harder to keep you comfortable.

Finally, if it’s a bright, sunny day, keep your shades and curtains open. Usually, the Greenhouse Effect is not a good thing. When it comes to saving money on your heating bill, though, it is fantastic. At night, my dad always told me, close your shades to keep the heat in (and save your neighbors from having to bear witness to you parading around in your skivvies).

Energy bills are never pleasant to receive, but they’re a sad fact of life. Since it’s only January, we have a few more months to contend with cold wind in the eaves and shivery nights. If you change just a few little habits, you might find that you save money and resources. And that might make your bills a little easier to handle.

Don’t touch the thermostat at Bourke Accounting. However, if you ask, Bill and Tim will bump up the heat for you; Bourke Accounting professionals are strict, but compassionate, after all. Our Bourke Accounting specialists know every trick in the book to help you save money and protect the money you already have. Bourke Accounting reps hate to see wasted reserves and offer every solution to make sure you know how to make every dollar count.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Years ago, I wanted to visit a pal in Philadelphia. Living in NYC, I didn’t have a car. My friend suggested that I take a Greyhound bus (except he called it “The Dirty Dog”). The fare was unbelievably cheap and the station was conveniently located. Finally, it was only about 2 hours to Philly. I assured myself that I could deal with anything for 2 hours.

Once on the bus, a gentleman sat next to me. He had an eyepatch and, as soon as he was settled, he took off his shirt. And then he started talking. I was annoyed, as I had planned to stare vacantly out of the window. However, after the first 5 minutes, I found myself completely engaged in his life. 10 siblings in a 2-bedroom house, Marine, Hell’s Angel, transporter of illegal powdered goods, this man had quite the backstory.

As we were saying “goodbye,” I finally asked him what happened to his eye. He flipped up his patch to reveal a completely normal eye. “I think it looks cool,” he said, giving me a slow wave and melting into a crowd of weary travelers.

He was right. It did look cool.

Traveling long distances by bus might not appeal to some. You have no control over your seatmate, the bathroom is less than hygienic and a lot of bus stations are in rather rough neighborhoods. In addition, there have been Greyhound horror stories of violence (the most famous happened in 2008. I’m not including a link, as it’s seriously grisly) both inside busses and in stations. Finally, there is the stigma that Greyhound bus patrons are either crazy or on heavy drugs – sometimes both.

I think The Dirty Dog should be a rite of passage for all. This is not travel in a pristine airplane with fresh smelling recirculated oxygen. You don’t simply close your eyes in one city only to wake up in another brightly lit airport. No, not at all. On the bus, food breaks take place in seemingly abandoned truck stops, one can’t help but to make the acquaintance of different people and, most importantly, one will witness the world. There is something fascinating in watching the vegetation change, seeing the slow, but obvious, shift from one region to another. Even the billboards change!

Is bus travel dangerous? Let’s face it: all travel is dangerous; pirates sank boats and highwaymen robbed trains. With a little vigilance, a bus trip will be fine. Make sure you keep your bags with you, don’t flash a lot of money, don’t fall asleep on the bus if the guy next to you is drooling and pointedly staring at your throat while continuously muttering, “Gonna get ‘em all.” But the experience is worth it. Get off the bus with a cynical and mysterious air and know the journey was the important part.

Bourke Accounting wants you to have new and exciting experiences. However, your tax preparation and bookkeeping encounters should be kept on the fairly dull side. While our Bourke Accounting experts are intriguing individuals, their talent, knowledge and honesty will leave you with very few surprises. This is not to say that a Bourke Accounting pro isn’t adventurous enough to bus hop with you, but let’s get your return done first.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I have a friend who lives next door to an apartment complex that houses predominately Section 8 tenants. Once, she came home to someone’s worldly possessions on the lawn and a sheriff standing by for an eviction. In the middle of the night, occasionally, she’ll look out her window and see the revolving lights of LMPD cars gathered in the complex’s courtyard. She’s lived in the neighborhood for over 5 years and, generally, hasn’t had many problems.

I have a friend who lives next door to an apartment complex that houses predominately Section 8 tenants. Once, she came home to someone’s worldly possessions on the lawn and a sheriff standing by for an eviction. In the middle of the night, occasionally, she’ll look out her window and see the revolving lights of LMPD cars gathered in the complex’s courtyard. She’s lived in the neighborhood for over 5 years and, generally, hasn’t had many problems.

“I didn’t even know it was Section 8 until someone told me,” she said. “Usually the only trouble we see is teenagers being stupid.”

My friend is ambivalent towards the Housing Choice Voucher Program, also know as Section 8. However, there are a lot of residents and landlords out there who aren’t quite as sure that Section 8 is a good idea for anyone. In case you don’t know, this is a government program that assists “very low-income families, the elderly, and the disabled to afford decent, safe…housing in the private market” (HUD.gov). Housing agencies pay the majority of the rent directly to the landlord and the tenant is responsible for making up the difference.

Many landlords don’t like the program. One reason is that there is an inspection done by the prospective tenant’s caseworker. Everything must be in tip-top functioning order before the tenant can move in. However, when the tenant’s lease is up, there is no exit inspection done by the agency (biggerpockets.com). Many landlords complain that the subsidized tenants don’t take care of the property and cost them thousands of dollars in damages. Landlords also say that some Section 8 tenants move friends and family members into properties, which is a lease violation.

Residents around Section 8 housing insist that crime follows subsidized tenants. They cite a lack of parental control, unmowed lawns, trash and violence as reasons for their reluctance to accept these new neighbors. In some cases, they feel that there is a lack of fair play: why should I pay $1,500 a month when these guys can live in the same place practically for free? I understand why this could annoy some residents, but there’s a greater purpose behind Section 8 that should perhaps be considered:

Section 8 helps families. Section 8 gives people with lower incomes the chance to leave blighted neighborhoods. It gives families the opportunity to enroll their children in better schools with more resources. Basically, it’s a program that is attempting to uplift people, not destroy neighborhoods. Perhaps if the housing authority insisted on exit inspections (with compensation for damages), landlords wouldn’t be so wary of renting to voucher recipients. Perhaps if we worked harder to create quality after school programs and community centers, the kids wouldn’t be acting up out of boredom.

Like all controversial issues, Bourke Accounting doesn’t care what side you’re on. A Bourke Accounting expert’s only concern is you. Bourke Accounting wants you to be financially stable and reasonably happy. We want you to be the recipient of the best tax advice and bookkeeping services possible. Give us a try and see the possibilities that Bourke Accounting can offer you.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

You ordered a cheeseburger, fries and a Coke. What you received was 4 large milks, a ketchup packet and a blank stare when you complained. And these guys want more pay?

Well, yeah, kinda.

Minimum wage jobs usually aren’t very fun. In the minimum wage world, a worker can look forward to hard work, rude customers, backward bosses and, that’s right, a paltry paycheck. At this point, we know that the minimum wage does not keep up with inflation. We also know that minimum wage is not synonymous with living wage. So, what do we do?

There has been a lot of talk recently about increasing the minimum wage to $15.00 an hour by 2025. At first glance, this sounds great: people will have more money to spend, worker morale will go up, maybe more preventive care appointments will be made. In short, the wolves will be kept at bay and peace and happiness will reign throughout the land, forever and ever.

One quick question regarding this great proposal, though: who, exactly, is holding the big bag of money to finance this? Of course, giant corporations can simply raise the price of their products a few cents and all’s right with the world. However, that’s not going to be feasible for the smaller, Mom and Pop type of store. If the smaller businesses “can no longer compensate the same number of employees at a higher rate” (WhenIwork.com), they’re going to have to lay workers off. The cold, sad truth is that “while some employees may be making slightly more money, others will be left unemployed.” Well. That is not helpful.

Another aspect that I hadn’t thought about was rent and the greed of unscrupulous people. Thebalance.com warns that a higher minimum wage in an area could inspire some landlords to raise rent, “creating inflation.” Again, not helpful.

Jack Kelly, writing for Forbes.com, takes a more psychological approach to the subject. His premise is that low wage jobs “are not designed to provide for a family.” These types of jobs, Kelly maintains, are suitable as a first job or for a “temporary port in the storm.” He believes that, if the minimum wage is raised, more people will become complacent with lower skilled employment and never move on to “bigger and better things.” His idea, which I agree with, is to “allocate money to train people to enter areas in which there are shortages of workers, such as the trades.” In addition, Kelly is a big fan of continuing education to arm employees with the tools to become upwardly mobile.

We deserve a fair wage for a fair day’s work, that’s obvious. At this point, though, I’m not sure how we can accomplish this without creating other troubles that might be worse than the original one. Like most of the social ills in our society, money is the problem, the solution and then maybe the problem again.

Bourke Accounting would like it if you were paid as much as you’re worth. If you aren’t, Bourke Accounting can offer strategies for you to make the most of the dollars you do get. In addition, your Bourke Accounting expert can help you design a workable budget that will definitely improve your future financial outlook. Bourke Accounting is a lot more than just tax preparation, but you knew that!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

We don’t talk about religion, sex or politics at work – Bill

I once worked with a woman who was very religious. Walking into her office was like walking into the gift shop at the Vatican. One time I said the “d” word in front of her (get your mind out of the gutter, I mean the “d” word that rhymes with “sham”) and she scolded me. I felt like I was standing in front of Sister DeNunzio, getting detention again. So, I watched my language around her, as “cussing” disturbed her sensibilities and I can go 10 minutes without swearing (I just don’t want to).

I asked my boss why he allowed her to have so many religious objects in her office when I wasn’t allowed to hang my Hieronymus Bosch calendar. He looked at me as though I was a half-stupid and possibly dangerous hamster. “Yeah, because I really need a lawsuit right now,” he snorted and walked away.

I thought he was being dramatic. As it turns out, he was just being very cautious: according to Harvard Business School, “the number of religious discrimination complaints has increased by more than 50 percent in the past 15 years.” In addition, “settlement amounts have more than doubled.” It didn’t matter that my coworker’s office looked like 10 churches decided to throw Religious Rave 2000, she was protected under the law.

The Equal Employment Opportunity Commission addresses this subject under Title VII (of the Civil Rights Act of 1964). Besides all the good stuff regarding the illegality of discrimination based on religion, it mentions that “religious observances…[including] displaying religious objects” are protected. However, Title VII also vaguely suggests that employers, if a consistent policy is in place, may allow religious iconography in private offices, but prohibit them in common areas. Like with everything else, there is a caveat to this rule: hardship.

If accessories of the employee’s faith “pose an undue hardship,” (EEOC.gov) on the business, the employer can restrict them. For example: Jack works around heavy machinery. Jack wears loose necklaces proclaiming his faith. Jewelry of any kind is strictly banned around the heavy machinery due to safety concerns. If OSHA found Jack wearing jewelry, the company could be fined. In a case like this, the employer would have the right to limit Jack’s religious attire.

Religion, if used properly, is very nice; some find peace and direction through faith. However, religion is also a hot-button issue with many people. I agree with Bill (how did that happen?!) that religion is a subject best not discussed at work. Let’s face it, there are regions in the world that have been kicking each other for eons over religion. Believe whatever makes sense to you. I might not agree with your point of view, but that’s why we have chocolate, vanilla and strawberry, after all.

Which celestial team do you play for? You know what? Bourke Accounting doesn’t care. Bourke Accounting also doesn’t care about your sexuality, your race or the kind of car you drive. Bourke Accounting will care if you forget your W2s and 1099s when you sit down for your appointment, though, so don’t do that. Your Bourke Accounting pro just wants to help you, religious or not.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.