One of the best things about working for Bill and at Bourke Accounting is making mistakes. That didn’t come out right. One of the best things about working for Bill is that, when I make a mistake, I’m told: Hey, this is wrong, don’t do it again. And that’s it. He doesn’t mention it again and he doesn’t hold it against me.

Wouldn’t it be nice if everyone was like that?

We all have people in our lives who seem to love nothing more than bringing up our past bad decisions, blunders and mad dog dumb actions. Many of us believe that these people are part of a petty, passive aggressive group who, to make themselves feel better, constantly mention the foibles of others. As you can tell, I’ve dealt with this sort before and I clearly didn’t like it.

But what if we’re wrong about these people? What if there is a benevolent motivation behind this compulsion to remind us of the past? What if this person “may have a misguided belief that reminding you of your past mistakes is making you a better person” (Goodmenproject.com)? These people are the equivalent of an Employees Must Wash Hands sign in a restaurant bathroom. They don’t seem to be judging as much as just giving a well-intentioned reminder to not give anyone hepatitis today.

I suppose this practice could also be an indication of concern on the part of the other person. Perhaps they bring up past bad activities because they would hate to see a return to former reckless behavior. Let’s say you used to be a real wild one, but you’ve settled down into a calm civilian life. This might be hard for some “to accept that you are changing, so they continue to remind you of your past” (Goodmenproject.com). They don’t know that you’ve stopped doing stupid things, so it’s up to you to quietly show the world that you’re doing all right.

Of course, this is not to say that every person who mentions naughty things past has our best interests at heart. For instance, I went to a party a few years ago and ran into someone I used to know. She wasn’t looking her best, was in the middle of a messy divorce and, generally, didn’t seem very happy. She made a beeline for me and began to tell everyone within earshot about something stupid I did in high school. I believe her motive was to “embarrass or control” me (Goodmenproject.com). Furthermore, I don’t think that she liked that I was healthy and content. Finally, perhaps she wanted to keep me “feeling shame” (Goodmenproject.com) to sort of sabotage the good in my life. I pitied her, but it didn’t keep me from making a snarky comment regarding the futility of living in high school memories.

No matter where a person’s true intention lies, it’s never fun being reminded of mistakes. Most of us have those middle-of-the-night, oh, my God, I can’t believe I did that moments. We’re hard enough on ourselves, we don’t need a contract guilt-er. Best thing to do when someone starts in? Smile, say, yup, that was me then and walk away.

Like I said, Bourke Accounting professionals are very forgiving. A Bourke Accounting expert will point out your mistake, fix it and move on. No matter what financial transgressions you have committed, your Bourke Accounting specialist will mention it one time and one time only. And with the best tax preparers and bookkeepers around, if you listen to your Bourke Accounting pro, your mistakes will be nonexistent.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

As much as I love working for the talented people at Bourke Accounting, this will be my last blog. I have enjoyed telling you about the wonderful things that a Bourke Accounting tax preparer or bookkeeper can do for you. I have loved being associated with the most intelligent, ethical and interesting folks in the business. My two weeks’ notice is waiting in my email’s draft folder and, when I’m done with this, I shall hit “send.”

I am going off the grid.

Basically, “going off the grid” means that “you don’t rely on the main power grid for your electricity…water and sewer” (Investopedia.com). Beyond that, it means waking up to utter peace and solitude in a pristine forest somewhere, far from the stressors of modern life, politics and bad news. It means going back to a simpler, albeit harder, way of life. I am ready.

First things first. Off-Grid.net tells me that money is a requirement. I am advised that I am “going to have to save [and] scrimp” to make my dream a reality. Livingoffgridguide.com suggests that for property and shelter, I can expect to spend around $175,000. Okay, I’ll simply have to find a way around this.

There are a lot of unused corners of the world; I’ll just pick one. While this might not be exactly legal, who is going to notice one short woman living in their woods, am I right? Shelter is definitely going to be a priority, though. Shareable.net talks about a man who built a 14 ft. X 14 ft. house for $2,000. However, I just found a yurt on Amazon for $339.00. That would work just as well, wouldn’t it?

Location and shelter – check and check. What next? Water, I’ve read, is important. According to Geekprepper.com, “finding the ideal location where one can get plenty of water makes your self-sustaining lifestyle 50% complete.” All of these sites talk about digging wells (and the expense involved), but what if I just put my $339.00 Amazon yurt next to a stream? I can “learn how to create a makeshift water filter using common items found in the wild” (Geekprepper.com)! I’ll already be in the wild, so water is covered, too!

This is going to be easier than I thought. On to food. Inhabitat.com says that perennials should be planted, including “fruit and nut trees, berry bushes and even mushroom patches.” In addition, perennial vegetables, “like sorrel, asparagus and sylvetta arugula” will round out an off the grid diet nicely. I’m not a vegetarian, but I’ve seen Bambi, so I guess vegetarianism will be the law of my off-grid land.

This is going to be great! Wait. Where will I go to…um…you know? The cheapest concept in off the grid toilets seems to be something called a “honey bucket.” Anoffgridlife.com tells me that this is a plastic bag lined bucket with a seat and a little kitty litter thrown in. That one is required to empty. Every day.

Oh, no! What happened? My two weeks’ notice email just mysteriously disappeared!

Bourke Accounting has indoor plumbing. There’s heat and A/C, too. In addition, Bourke Accounting has Bourke Accounting expert tax preparers and bookkeepers. If you’re planning on going off the grid, a visit with your Bourke Accounting pro will mean the difference between a proper toilet and a honey bucket. I think we all want to avoid the honey bucket.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

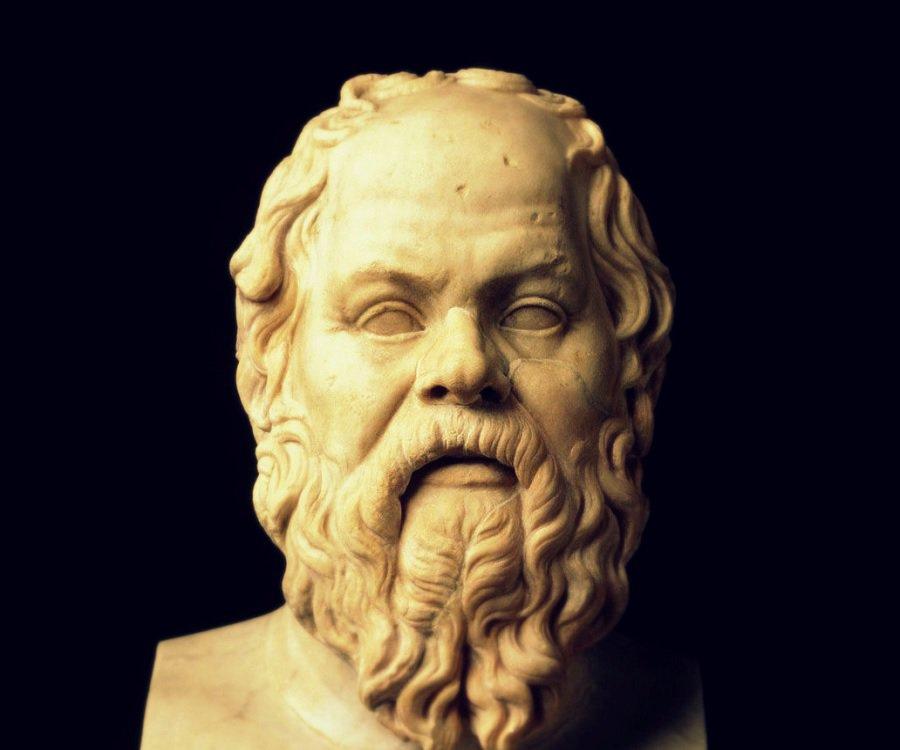

The unexamined life is not worth living – Socrates

Wal-Mart…do they, like, make walls there? – Paris Hilton

Bourke Accounting bookkeepers and tax preparers are fairly deep. Bill can talk about most art movements of that last 700 years. Tim can hip you to a lot of historical facts that you probably wouldn’t have ever stumbled across. Want to discuss indie “intellectual” films that leave you feeling slightly soiled and haunted after viewing? Stop by my desk.

We are not snobs, elitist, highbrow prigs over at Bourke Accounting, but we are fairly deep. But is that a good thing?

Who remembers when we couldn’t escape Paris Hilton? Whether it was her dubious starring film roles, her reality television shows, small animals in Gucci handbags, she was everywhere. If I never hear the phrase “That’s hot” again I’ll be satisfied. Paris was the epitome of “being famous for being famous.” She didn’t seem to say or do anything of substance, but she sure looked like she was having a good time.

Naturally, that got me thinking. While I don’t know Paris Hilton (I met her once, but that’s another story), she seemed to cultivate shallowness and superficiality into an art. And, as I said, it seemed like a blast. Beyond the money and the VIP parties, is there a happiness to be found in shallowness?

Short answer: yes. According to Learningmind.com, deeper thinkers (this is a subjective term) tend to make themselves a little crazy. However, “the less you understand, the more carefree and…happy you are” (Learningmind.com). In addition, the less you pay attention to global problems, political conflicts or other issues that you can’t possibly solve, the more satisfaction you’ll feel in your life.

Another problem with deeper thinkers is that there is a tendency to “seek something bigger – a pattern, a meaning, a purpose” (Learningmind.com). It’s not enough to have a good job and a happy family, there is a need to justify your continued existence to the universe. While a shallower person will accept a raise without qualms, a deeper thinker will overthink the same occurrence. They will question if the raise is actually deserved, they will wonder if they are up to the task and, inevitably, make themselves miserable.

Overthinking isn’t always a bad thing. Sometimes, you want an overthinker in your corner. When you make an appointment with a Bourke Accounting bookkeeper or tax preparer, you know that every detail regarding your personal or business financial issue will be addressed and solved. Bourke Accounting experts will deep think you right out of the clutches of the IRS, and, overthinkers or not, Bourke Accounting pros are really fun at parties.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Announcer: From Generation X, the generation that brought you Grunge, wholesale tattoos, piercings and a cynical world view, let’s all welcome a complete lack of retirement plans!

Audience of Gen Xers: Yaa – wait, what’d he say?

Bill over here at Bourke Accounting randomly gives me interesting articles. Yesterday, he gave me one that hit close to home. This one was from The Week (2/14/20 edition) entitled “Slacking on Retirement.” The plight of the non-retirement saving Gen Xer was exposed in less than two paragraphs, but the repercussions are far more wide-reaching, I’m sorry to say.

First off, if you didn’t know, Generation X encompasses everyone born between 1965 and 1980. Gen X was known for stripped down music, social consciousness, a loveless relationship with materialism and, yes, slamming pieces of metal into places they weren’t intended. We questioned our parents’ life choices and were left cold by the idea of cubicle work. And, I must admit, the “slacker” stereotype seems to be haunting us, still.

According to Fool.com, “50% of Gen Xers don’t have a retirement saving account.” What’s more, the 13% who do have one don’t contribute to it. However, this is not just a simple matter of slackers being slackers. While this generation does work, there are other obstacles standing in the way of viable retirement plans. These obstacles are, most notably, “inadequate income…housing costs, supporting other family members and health care” (Marketwatch.com). Furthermore, some are trying to put kids through college while also taking care of aging parents. We have to ask ourselves: did we wait too long to start planning?

Yes. Yes, we did. A scary concept is that a lot of Gen Xers are vaguely planning on living off Social Security when they retire. Cool story, but Social Security is “reportedly on track to be depleted by 2034” (Forbes.com). Which is probably why “more than half of Generation X plans to work in retirement” (Marketwatch.com). This, of course, is probably going to prove a hardship to the generations coming up. I’m not suggesting that we of the healing nose ring scars should move out of the way because, really, we can’t. Sorry, Millennials.

So, what do we do? We start saving now. It’s going to be a quick and dirty mad dash to retirement, but it’s our only choice. Does your company have a 401(k)? Utilize that. Can you cut corners regarding purchases? Cut away, brethren, cut away. It’s a little late in the day, but Money.com suggests putting money into the stock market. While this is generally meant for younger workers, as “even if there is an economic downturn there will be plenty of time” (Money.com) for investments to grow, it could work for us, too. Some of us are looking at 20 plus years more of employment, after all.

A lot of us Gen Xers messed up, but it’s not too late to save yourself and your money. Come see a Bourke Accounting bookkeeper or tax preparer and let them lead you to a happy and secure retirement. A Bourke Accounting professional can help with your newfound love of planning for the future and, if you’re very nice, maybe they’ll show you their tattoos.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Did you overdo it this weekend? Did you spend your Sunday rearranging furniture? Maybe, to get ready for your appointment with your Bourke Accounting tax preparer or bookkeeper, you were forced to stand under hot water until the broken glass in your back melted. Maybe you uttered attractive moans and groans while you put your shoes on. Don’t worry, Bourke Accounting professionals will wait while you get your feet under you.

But. Are we getting old?

After feeling the repercussions of doing something stupid, like lifting with your back and not your legs, you can repeat my mantra: I am not 18, I am not Wolverine. This is meant to be a reminder that we won’t bounce back the way we used to, so we should probably stretch before doing something physically difficult. Does that mean I’m old, too? And, wait a second, in these more sensitive times, am I even allowed to use the adjective “old”?

I don’t mind being called “middle-aged” or “old.” After the stuff I did in my ill-spent youth, I wear it as a badge of honor (my chiropractor was very curious as to what the X-Ray of a former punk rock stage diver’s spine looked like. He was not disappointed). However, I seem to be in the minority. According to The Week (Vol. 20, Issue 961), because a lot of our more mature (?) citizens are in good health and bopping along well, they “hate such traditional terms as ‘senior’ and ‘elderly’.” In addition, calling people old is believed to deny them their “right to have ambitions and plans for the stretch of their life that’s still ahead of them” (The Week).

AARP.org reports that “the public associates aging almost exclusively with decline and deterioration.” Well, sure. I can promise that, even though I used to be able to go to work after an hour’s worth of sleep, I would be utterly useless if I tried that now. NPR.org suggests that “older adults” is perhaps the least hateful term in use. However, the moniker “super adult” is another option in descriptive choices. Um. Super Adult. Yeah, no, thank you.

There is also a push to use the term “elder,” which I like. It brings up visions of an experienced and wise person, willing to use their sage-like advice to guide another generation. In addition, I feel that it’s a term of respect. I might not be at the elder stage yet, but I’m holding the name for when I need it.

I don’t think it matters what we call someone over the age of 65. If someone calls you old in a derogatory way, just remind them that, if all goes well, they’ll get there, too. Your body parts might not be where you kept them when you were 18, but, hey, they’re still there.

Your age isn’t an issue to your Bourke Accounting tax preparer or bookkeeper. Of course, throughout your entire financial life, certain ages require different handling. Are you starting a family? Your Bourke Accounting professional can offer advice. Are you about to retire? Your Bourke Accounting expert can lead you down a happy road. Do you prefer to be called a “senior”? No problem. Do you want to be called a Super Adult…no. Just no.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

We have to read two sections of the Bourke Accounting Book Club selection, Jen Sincero’s, “You Are a Bada*s” by Wednesday. I haven’t read it yet. The book is sitting on my table. I walk by it every day and promise: I’ll read it when I get home. Annnd then, when I get home, I watch M*A*S*H because it’s an episode that I haven’t seen since I was ten. Maybe I just stare into space for a while. Very important stuff, to be sure.

Why do we procrastinate? Sometimes it’s because we’re required to do something icky, like clean up dog poop around the yard. Sometimes it’s because it seems like a boring and arduous job that isn’t that important, like organizing a seldom-used closet. Or maybe some of us are just lazy (my hand is in the air).

Mindtools.com offers a legitimate out, though. For some of us, procrastination is “more than a bad habit; it’s a sign of a serious underlying health issue.” Anxiety, depression, attention deficit disorder – all of these afflictions can play a role in why we wait until the last minute to complete some task. Of course, according to Mindtools, if you wait around to do something, you will only end up increasing your own stress levels. So, even if you didn’t have these disorders before, procrastinate long enough and you will.

You have received your W2s, 1099s, etc. They are neatly organized in a little folder. You’ve had these documents for a few weeks. Um, this is perhaps a personal question, but why haven’t you seen your Bourke Accounting tax preparer yet? When filing your returns, there are a few reasons you should lock your Procrastination Demon in the basement and come see us:

1. The longer you wait to file, the more “you increase your risk of tax identity theft” (CNBC.com). Hey, you know who doesn’t procrastinate? Bad guys. According to CNBC.com, the miscreants who send in fake returns, do it really early. So, by the time you get around to seeing your Bourke Accounting tax preparer, someone might have already been nice enough to file for you.

2. What if you owe money? If you wait until the last minute and – gasp! – find that you owe a substantial chunk of change to the good old IRS, do you have that cash stashed in your mattress? Give yourself enough time to prepare for an unfavorable scenario. Don’t count on a tax refund to get you through hard times and always rely on the fact that things can go sideways.

3. You’ve had all of your documentation for a while. Are you sure? It’s April 14th and, right in the middle of an appointment with your Bourke Accounting tax preparer, you remember that you worked for a few months somewhere before you landed your Forever Job. But where is that W2? Did you leave it in the car you sold last week? Did you even receive it? I guess you’re going to have to file an extension…

Bourke Accounting professionals don’t procrastinate, but you knew that. Our Bourke Accounting experts also won’t rush through your return because the deadline is looming. Whether you come in February 14th or April 14th, you will get incredible, comprehensive service. But for the sake of your mental well-being and your finances, why don’t you make your appointment sooner rather than later?

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

The other evening, after a busy Bourke Accounting tax season day, I didn’t feel like cooking (I don’t ever feel like cooking, but now I have a legitimate excuse). I stopped at one of my favorite take-out spots and was surprised to find a child behind the counter. She looked about 11 years old and she was courteous, accurate and efficient. I’ve been waited on by 30-year old adults who weren’t as together as this kid. As this has always been a family business, it finally dawned on me why people have kids in the first place. Free labor, right?

Actually, no. As it turns out, family businesses must pay their kids just like they would any viable person for the same work. However, as pointed out by The Kiplinger Tax Letter (Vol. 95, No. 2), there are some benefits to hiring your underaged offspring. Namely, “hiring your family can lower your payroll tax bill.”

If a wife-husband partnership hires their kids, there is no Social Security or Medicare tax due. In addition, “federal unemployment tax isn’t owed on their salaries until they reach 21” (Kiplinger). If the kids are under 18, these wages are “tax-deductible to your business, tax-free to [the children]…and you still get to claim [the children] as dependents” (Entrepreneur.com). That seems like a pretty sweet deal, actually.

Entrepreneur.com goes on to lend a vaguely sinister air to child labor when it is offhandedly stated that the IRS allows children as young as 7 to work for their parents. I would feel a little weird if a 7-year-old rang me up at the corner store (are 7-year-olds even potty-trained?), but according to the United States Department of Labor, this is indeed allowed. A parent can get their kids working at any age, as long as the job isn’t “mining, manufacturing or hazardous jobs” (Webapps.dol.gov).

Another interesting point about hiring family is that your better half and parents may also cut your payroll tax bill. According to the IRS, if you hire your spouse or parent, neither is “subject to the Federal Unemployment Tax Act.” While that’s a plus, I’m still left questioning the wisdom of hiring family.

I love my family, I really do, but working with/for them? Ah, thanks, no. I once played in a band with my brother and ended up threatening his physical person with a bass guitar, so you can see why this wouldn’t work for me. I’m not the only one who doesn’t think working with family is the best idea. USNews.com puts it very nicely: a round-the-clock viewing of your other half could transform the one you love into the one you can’t escape. Also, even with tax breaks, the headache of trying to convince your mother/employee that you’re not an infant anymore and that you know what you’re doing could be very trying.

If you own your own business, the idea of hiring family could be very attractive. However, before you do that, why not talk to a Bourke Accounting professional first? Perhaps, when your Bourke Accounting tax preparer and bookkeeper show you ways to save money that don’t include your payroll tax, you might rethink the pros and cons of working with your blood. Bourke Accounting experts aren’t family counselors, but listen to their advice and you probably won’t need one.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

You already know that Bourke Accounting professionals hate thieves. Whether it’s identity thieves, scammers preying on the uninformed or flat-out take the money and run types, Bourke Accounting has no stomach for the whole evil lot. However, there’s another group out there that might be more insidious than the rest. This group takes advantage of the vulnerable and desperate, all under the guise of legality.

Ladies and Gentlemen: let me introduce you to Payday Loans.

In case you are unaware, a payday loan, as defined by Consumerfinance.gov, is “usually a short-term, high cost loan, generally for $500 or less, that is typically due on your next payday.” I know you’ve driven past places that offer these sorts of loans: little building, lots of glass and, out front, there’s a “wacky waving inflatable arm flailing tube man” (Wikipedia.org) swaying in the breeze. And we all know that nothing says “legit” like a wacky waving inflatable arm flailing tube man.

Is it possible that I have a problem with these payday loans? Yes, yes, it is. I’ve seen hardworking people practically crushed under the weight of the fees, interest and penalties because they fell on hard times and even harder strip mall loan sharks. These businesses prey on individuals who have just run clean out of options.

Most of these places charge between $15 and $30 in fees for every $100 borrowed. So, if you get a two-week $500 loan at $15, “that works out to an annual percentage rate of almost 400%” (Creditkarma.com). But the fun doesn’t stop there. On top of the original fee, one can also look forward to nonsufficient funds charges that can occur if you don’t have enough in your bank account when the “lenders” try to cash your check. Then there’s late fees and rollover fees (fees charged “on top of the original loan and initial fee to push back your loan’s due date” – Creditkarma.com). According to Nomoredebts.com, a lot of people avoid defaulting on their loan by renewing it, and in some cases, “the loan gets renewed so many times that borrowers can end up paying almost as much as the loan itself in just fees alone.”

Another sweet part of a payday loan is the fact that, once you’ve signed on the dotted line, “you can’t back out” (Creditcards.com). It doesn’t matter if it has only been two seconds since the ink dried, you are on the hook. Even the Devil is willing to give you an opportunity to win your soul back.

So, no. I don’t like payday loans; taking advantage of scared and hopeless people is about as low as kicking puppies. Thankfully, there are now 13 states where “payday lending is illegal or made not feasible by state laws” (Creditcards.com). Hopefully, this trend will spread.

Bourke Accounting hopes that you never find yourself a victim to one of these disgraceful establishments. However, if you find that that’s just what happened, see a Bourke Accounting expert for advice on how to free yourself from the leeches. Your Bourke Accounting specialist wants nothing more than to make your financial journey painless and parasite-free.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

We all know about The Five-Second Rule. You drop a cookie on the floor, look around, pick it up (maybe blow on it) and eat it. If someone else is in the room, you shout: Five-Second Rule! Generally, the other person shrugs and concedes. I mean, come on. Five-Second Rule.

The Five-Second Rule doesn’t apply solely to dropped food, though. For example, after I interviewed at Bourke Accounting, Bill sent me an email offering me a job. It only took five seconds for me to decide: Yes, a job would be very nice right now. In that small timeframe, I started down an unexplored path that is turning out to be very pleasant.

Think about every substantial thing that has occurred in your life. I am willing to bet that the biggest changes happened within five seconds. Let’s say your significant other broke up with you after many years. To be fair, you knew things hadn’t been going well: arguments over money, snide comments, what have you. The break-up conversation lasted for hours, but the important part was that tiny little bit of time when s/he sadly said, “This isn’t working” and your life was drastically altered.

Yes, yes, that was depressing (I’m sorry), but it works the other way, too: you’ve been trying for a long time to have a baby. After almost giving up, your partner presents you with a card that says: Hi, Daddy. In the time it took to read that, everything is different. While you’re hugging and kissing and randomly thinking of names, you think to yourself: I wasn’t doing this five seconds ago…

Since our regular lives are very fragile, it’s important to realize just how much can change within an instant. This is an especially crucial fact to remember while driving. We’ve all seen the commercials advising against texting and driving, yet we still do it. While not intentionally trying to hurt anyone, each time we look down to respond, “See you soon, LOL,” we’re putting others at risk. Everyone who has ever been in an accident can attest to the fact that it was over before they even knew it began. So, please, when you get in the car: seatbelt on, phone off and hands at 10 and 2.

The Five-Second Rule is also in operation when dealing with people outside of cars. If someone is seriously rude to you, more than a few options quickly pop into your head regarding how to proceed. In a heartbeat, and if you choose poorly, your day can go from mildly annoying to devastatingly bad. If your choice is not to walk away, you get to participate in an immature name-calling match. If your choice is even worse than that, you get to spend the night in jail. Always be aware that your peaceful life can become chaotic if you let your baser instincts take control for even a little while.

Besides watching how you drive and deciding not to slap the discourteous clerk, other choices will have a huge impact, as well. When it’s time to seek a tax preparer or bookkeeper, Google will help you find names. And you may even have good luck with them. However, if you want a decision to really change your life for the better, and with no hassle, your only option is a Bourke Accounting professional. Not only will Bourke Accounting specialists listen to your concerns, they will offer solid advice for any situation you could possibly be in. Teaming up with a Bourke Accounting pro will give you the best results of your financial life. And you don’t even have to yell “Five-Second Rule!” if you drop a cookie. Bourke Accounting experts understand you and the Five-Second Rule.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Does the idea of Valentine’s Day fill you with wonder and anticipation? Have you been planning an elaborate spectacle for the last six months to prove your love? Perhaps you’re intending to propose to your intended. If that’s the case, the “Proposal of the Century Package” at the Langham Huntington in California is just the thing. This “plan includes private use of the Rose Bowl Stadium” with the entire Pasadena Symphony Orchestra nearby to set the mood while you bend a knee (CNBC.com)! All for the rock bottom price of $100,000!

Or you could be like me and everyone I know.

We don’t hate Valentine’s Day. We simply don’t want to be strong armed into lacy, pink expressions of affection. And psychologically speaking, this isn’t our fault. Livescience.com mentions that, “in marketing, there’s a notion called ‘resistance theory.’” This concept says that if folks “feel like they’re being asked to comply with a prescribed, prepackaged behavior, they’re unlikely” to go along with the program. Considering the very personal nature of love, it’s not surprising that some of us don’t want to be told by Hallmark how (and when) to express that love.

In addition, the history of Valentine’s Day is a little macabre, when you stop to think of it: an emperor in the third century thought marriage made for dreadful soldiers, so he banned all marriage. Valentine (before we knew him as “Saint”) decided to go ahead and perform marriages anyway. When Big Dog emperor found out, he imprisoned Val and sentenced him to death. Valentine fell in love with the daughter of one of his captors, wrote her a letter signed “Your Valentine” and shuffled off this mortal coil on February 14th (BBC.co). Wow. That story is about as romantic as “The War of the Roses”.

For those of you who enjoy Valentine’s Day, there’s no shame involved. So, you pull out all the stops, including an expensive dinner and googly eyes throughout. But then. Then, there are the serious Valentine’s Day superstars among you. Case in point: my friend’s grandfather wrote a book that had been out of print for over 50 years. Her partner hounded rare book dealers, followed up on leads, hit dead ends and, at last, found the book for $24 (plus shipping) and presented the book over a Brooklyn pizza. They’ve been married for the last couple of years. I like to think they’re happy.

Whether you love Valentine’s Day, are indifferent to it or hate it, can we all agree on one thing? Let’s band together to get Sweethearts Candy hearts (you know, the ones with the little sayings on them) back to the original recipe. You couldn’t find them last year and now, I’m told, they don’t taste the same when you can find them, as the company has been sold. I miss them. And people say I’m not a romantic.

Our Bourke Accounting experts run the gamut between loving VD Day and hating it. Some of our Bourke Accounting reps decorate their offices with hearts and bows, some give you a snort and a cocked eyebrow if you ask what their “love day” plans are. However, all of our Bourke Accounting specialists are solely dedicated to providing you with the most efficient, accurate and comprehensive service. And you know, I think they all might love you just a little bit…

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.