You just got married? How nice for you! Your new husband is great; he’s smart and sweet, caring and good-looking. He’s good to your family and he’s good to your dog. All in all, he’s the total package…except for one thing: he didn’t exactly tell you how bad his debt was before you happily said, “I do.” Oh, and he also neglected to mention that he is addicted to buying expensive vintage toys (although his house should have told you that).

I don’t know why I’m surprised that there’s a proper name for this, but there is. It’s called “financial infidelity.” It’s rather self-explanatory, but this is when one partner is “making significant financial moves without the knowledge of the other” (Thesimpledollar.com). This includes everything from opening secret bank accounts, lying about paying bills to spending vast sums of money, while hiding the bills. According to NPR.org, “41% of American adults admit to” engaging in financial infidelity and it seems that the trend is on the rise.

According to an ABC7 news report, “Millennials are more likely than other age group to lie” to their significant others about their finances. These lies could be fairly harmless, such as telling partners that they have less money than they actually do. ABC7 suggests that this is because they want a “Freedom Fund,” in case the relationship fails. Obviously, it’s a lot worse when it goes the other way and there isn’t enough money in the bank to pay for a bagel, let alone pay the mortgage.

At this point, the divorce rate for financial infidelity is lower compared to the divorce rate for the more visceral type of infidelity. However, studies say that, for those affected, “76% reported that it harmed their relationship and 10% said that it resulted in divorce” (Investopedia.com). Even if the suffering spouse forgives, I would imagine it would always be a theme running through her/his head: What else don’t I know about?

Most of the literature advises that couples speak candidly with each other before their upcoming marriage regarding debt – there should only be a few surprises on the wedding night, and they should be fun ones. Logically, and in most states, “you are not legally responsible for bills racked up before getting married” (Badcredit.org). In “common law” states, “debts incurred by one spouse are usually that spouse’s debts alone” (Nolo.com). However, if you decide to open a joint account, no matter who blew the money, both spouses are liable (Incharge.org). Most experts agree that, although someone might get their feelings hurt, it’s probably for the best to maintain separate accounts and credit cards.

And since you’re already going to be hurting your intended’s feelings, Foxbusiness.com suggests a pre or postnuptial agreement to further protect yourself. It’s not very romantic, granted, but it might keep you afloat if your spouse develops a nasty gambling addiction.

Getting married is a big deal. Staying married is an even bigger deal. If you’re suffering from financial infidelity, why don’t you and your spouse meet with a Bourke Accounting pro? A Bourke Accounting specialist won’t take sides or encourage you to do weird marriage counsler-like exercises, but I wouldn’t be over-reaching when I say that a Bourke Accounting rep might be able to provide the tools to save your marriage.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Since starting work at Bourke Accounting on September 30th, I have never arrived late. I am a grownup and know how both punctuality and alarms operate. I don’t know the repercussions for lateness (I could read the Bourke handbook, but I like surprises), and unless something catastrophic occurs, my perfect record will remain and I will have no need to know about repercussions.

Not everyone is like your humble narrator (here, I’ll help you pat me on the back). For example, when I was working HR, there was an employee who only managed to arrive on time about once a week – she was so proud of herself when she did. She had an astounding array of excuses: flat tire (no receipt), doctor appointment (no note), many bats flying around inside her house (um), etc., etc. When she was finally given a one-day suspension, she flipped out. Although I had copies of every warning issued to her, along with the company’s attendance policy, she still felt that I was somehow persecuting her. Our boss had allowed her to slide so often, that she felt that she was above the rules.

According to Forbes.com, a YouGov poll reported that “one in five Americans (19%) arrive late for work at least once a week while just under half (48%) are never late.” That’s a pretty sad statistic. In addition, “businesses lose over $84 billion each year to absenteeism” (Businessnewsdaily.com). This is due, of course, to the fact that absent workers are rarely productive. Also, other workers are forced to take up the slack. Finally, if management isn’t consistent regarding consequences, morale could be seriously damaged or workers may conclude that promptness isn’t a priority.

Some articles I’ve read suggest that, if an employee is consistently late because of something like a conflict with daycare, the employer should contemplate changing the employee’s schedule (SBA.thehartford.com). I don’t believe that to be a viable option. When an employee is interviewed, work hours are discussed; it is the employee’s responsibility to mention the issue at that time, not after being late for the 10th time in a month. I’m not saying that accommodations should never be made, I’m just saying that an employee should be truthful from the beginning about what is required.

Although some employees show up late because of naughty, nighttime habits or just out of plain laziness, there’s an additional reason that’s fairly depressing. According to Mitrefinch.com, “if [the employee] feels undervalued and underappreciated…do not be surprised when he submits a letter of resignation.” Oddly, this becomes more prevalent if your employee “belongs to your creative department.” Apparently, we sensitive types are, well, sensitive. Again, I’m not saying that a business should bend over backwards to accommodate a temperamental artist (feel free to do that for me, Bill), but when a worker expresses concerns about something, perhaps you should give said worker a forum to talk it out.

Working is an evil necessity. In my opinion, if you’re being paid to come to work, you should show up at the time that was agreed upon. I might be a bit liberal, but I also have a sense of fair play.

Bourke Accounting specialists won’t deride you for arriving late to your appointment; however, they’d appreciate it if you were punctual – it keeps the schedule intact. If you find yourself consistently showing up late for work, though, you might want to analyze the reasons behind it. Bourke Accounting isn’t an employment agency, but our reps might be able to help you to stack up your money if you’re thinking of a job change. Taking the plunge might be difficult, but with Bourke Accounting on your side, you might find it well worth it.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Bourke Accounting doesn’t think for you. In fact, our Bourke Accounting tax preparers and bookkeepers don’t want to think for you. They simply share their knowledge, honestly tell you how things stand and allow you to make your own decisions. They might offer an opinion, but at the end of the day, they will neither pressure you nor expect you to blindly follow.

Wouldn’t it be nice if everyone was like that?

I know we’ve spoken about influencers before, but just past the innocuous, pretty people frolicking in nightclubs, there’s a dark side that should be explored. What happens when influencers become so popular that their fans no longer think for themselves? Do influencers have a responsibility to their followers or is it a matter of caveat emptor?

For example, there is an Irish rapper named Blindboy who has a brand-new show on English television called “Blindboy Undestroys the World.” His show is designed “to expose celebrities and influencers for endorsing products that they don’t actually use” (Foxnews.com). In order to underscore his point, he set up a little prank.

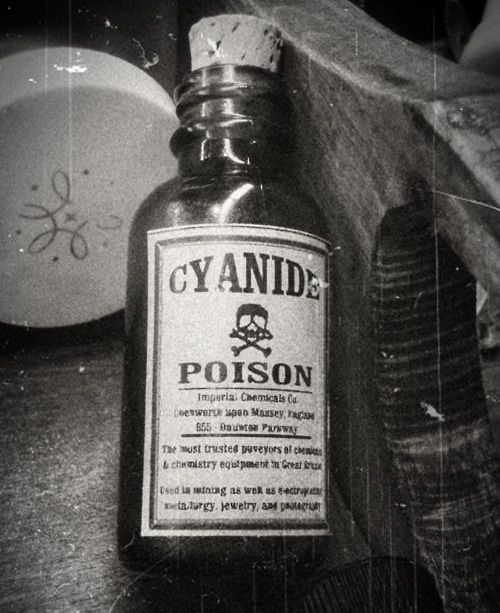

Reality show, and now internet, stars Lauren Goodger, Mike Hassini and Zara Holland were all offered the “opportunity” to peddle a new weight-loss water called “Cyanora.” The influencers were “told testing of the product was not available until its launch in a few months” (Dailydot.com) so trying it at the moment would not be possible. All three agreed to filming short promos for the product, where they were invited to read the list of ingredients.

One of the ingredients listed happened to be hydrogen cyanide (Dailydot.com). Why does that sound familiar? Oh, right. Isn’t that a deadly poison? I believe a certain group in the 1940s used this chemical a lot. After reading the list of ingredients on film, Mike Hassini quipped, “from what I know, that all looks pretty natural” (Dailydot.com). Well, he isn’t wrong – cyanide does “occur naturally in plants and processed foods” (NCBI.nlm.nih.gov)….

Holland’s agent was the only one who “insisted that [Holland] would have to…try the drink before promoting it” (Delish.com). The other two didn’t seem to have an issue with slinging unknown products. When asked if she had a problem endorsing a line that she wasn’t familiar with, Goodger boasted that “she’s never tried Skinny Coffee, a brand that she’s promoted on Instagram” (Delish.com).

When the truth was revealed, everyone involved went straight into panic mode – agents lost jobs and back peddling self-defenses were thrown around like birdseed at a wedding. After all, it was the TV show’s fault for setting them up.

Bourke Accounting specialists know that you aren’t stupid. Bourke Accounting wants you to use your own reason when coming to a conclusion that will affect your financial well-being. Good advice is one thing, but Bourke Accounting reps want you make informed decisions using the easily understandable information that is provided to you. You know your own mind, we’re just here to make sure that you know all of the facts, too.

Don’t drink Cyanora and come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

At Bourke Accounting, Bill and Tim will not allow me to touch the thermostat (someone tell me if this is a guy thing). I am encouraged to bring a sweater if I get chilly. So far, I haven’t been able to convince Bill that a bulky sweater will just ruin my cute blouse and patterned leggings outfit, so I am bundled up. To be fair, the temperature is kept at 70, so I might just be a Complaining Carol.

At Bourke Accounting, Bill and Tim will not allow me to touch the thermostat (someone tell me if this is a guy thing). I am encouraged to bring a sweater if I get chilly. So far, I haven’t been able to convince Bill that a bulky sweater will just ruin my cute blouse and patterned leggings outfit, so I am bundled up. To be fair, the temperature is kept at 70, so I might just be a Complaining Carol.

I can’t blame my stalwart bosses, though. According to Electricitylocal.com, the average “monthly commercial electricity bill in Kentucky is $458.” However, Energy.gov tells us that, just by setting that dial down by 10-15 degrees, we can save 5-15% on heating bills. I really hate to admit it, but just like Bourke is helping me to overcome my shyness, I am starting to bring their advice about temperature home, too: I have been setting my thermostat to 69 and wearing my Snuggie lately.

Saving money and energy are important. For example, we all know that if you’re going to leave your house for an extended period, you shouldn’t have your heat turned up to 80. However, is it a good idea to turn it all the way off? The answer is a flat “no.” Turning your heat off completely is a bad option according to Mason Harshbarger from Air Masters (courtesy of WUSA9.com). Mr. Harshbarger says that, when you turn your heat on and off, “your system will have to work extra hard for extra long to get the temperature back up.” So, turn it down, not off, when you venture out into the world.

Since I am a wealth of energy saving tips today, let’s talk about furnace filters. I confess that I am guilty of ignoring my filters. I change it only when I remember that it exists. Oddly enough, I am then utterly confused when my heat isn’t acting quite right; take it from your humble narrator, changing your filter every few years just doesn’t work. UShomefilter.com suggests that you change your filter about every 90 days. Of course, if you have animals, a very full house or babies (not that babies are dirty, they just need cleaner air), you’ll want to change it more often. LG&E suggests that every time you get your energy bill, take a look at your filter. A dirty filter will cost you money as your system is working harder to keep you comfortable.

Finally, if it’s a bright, sunny day, keep your shades and curtains open. Usually, the Greenhouse Effect is not a good thing. When it comes to saving money on your heating bill, though, it is fantastic. At night, my dad always told me, close your shades to keep the heat in (and save your neighbors from having to bear witness to you parading around in your skivvies).

Energy bills are never pleasant to receive, but they’re a sad fact of life. Since it’s only January, we have a few more months to contend with cold wind in the eaves and shivery nights. If you change just a few little habits, you might find that you save money and resources. And that might make your bills a little easier to handle.

Don’t touch the thermostat at Bourke Accounting. However, if you ask, Bill and Tim will bump up the heat for you; Bourke Accounting professionals are strict, but compassionate, after all. Our Bourke Accounting specialists know every trick in the book to help you save money and protect the money you already have. Bourke Accounting reps hate to see wasted reserves and offer every solution to make sure you know how to make every dollar count.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Years ago, I wanted to visit a pal in Philadelphia. Living in NYC, I didn’t have a car. My friend suggested that I take a Greyhound bus (except he called it “The Dirty Dog”). The fare was unbelievably cheap and the station was conveniently located. Finally, it was only about 2 hours to Philly. I assured myself that I could deal with anything for 2 hours.

Once on the bus, a gentleman sat next to me. He had an eyepatch and, as soon as he was settled, he took off his shirt. And then he started talking. I was annoyed, as I had planned to stare vacantly out of the window. However, after the first 5 minutes, I found myself completely engaged in his life. 10 siblings in a 2-bedroom house, Marine, Hell’s Angel, transporter of illegal powdered goods, this man had quite the backstory.

As we were saying “goodbye,” I finally asked him what happened to his eye. He flipped up his patch to reveal a completely normal eye. “I think it looks cool,” he said, giving me a slow wave and melting into a crowd of weary travelers.

He was right. It did look cool.

Traveling long distances by bus might not appeal to some. You have no control over your seatmate, the bathroom is less than hygienic and a lot of bus stations are in rather rough neighborhoods. In addition, there have been Greyhound horror stories of violence (the most famous happened in 2008. I’m not including a link, as it’s seriously grisly) both inside busses and in stations. Finally, there is the stigma that Greyhound bus patrons are either crazy or on heavy drugs – sometimes both.

I think The Dirty Dog should be a rite of passage for all. This is not travel in a pristine airplane with fresh smelling recirculated oxygen. You don’t simply close your eyes in one city only to wake up in another brightly lit airport. No, not at all. On the bus, food breaks take place in seemingly abandoned truck stops, one can’t help but to make the acquaintance of different people and, most importantly, one will witness the world. There is something fascinating in watching the vegetation change, seeing the slow, but obvious, shift from one region to another. Even the billboards change!

Is bus travel dangerous? Let’s face it: all travel is dangerous; pirates sank boats and highwaymen robbed trains. With a little vigilance, a bus trip will be fine. Make sure you keep your bags with you, don’t flash a lot of money, don’t fall asleep on the bus if the guy next to you is drooling and pointedly staring at your throat while continuously muttering, “Gonna get ‘em all.” But the experience is worth it. Get off the bus with a cynical and mysterious air and know the journey was the important part.

Bourke Accounting wants you to have new and exciting experiences. However, your tax preparation and bookkeeping encounters should be kept on the fairly dull side. While our Bourke Accounting experts are intriguing individuals, their talent, knowledge and honesty will leave you with very few surprises. This is not to say that a Bourke Accounting pro isn’t adventurous enough to bus hop with you, but let’s get your return done first.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I have a friend who lives next door to an apartment complex that houses predominately Section 8 tenants. Once, she came home to someone’s worldly possessions on the lawn and a sheriff standing by for an eviction. In the middle of the night, occasionally, she’ll look out her window and see the revolving lights of LMPD cars gathered in the complex’s courtyard. She’s lived in the neighborhood for over 5 years and, generally, hasn’t had many problems.

I have a friend who lives next door to an apartment complex that houses predominately Section 8 tenants. Once, she came home to someone’s worldly possessions on the lawn and a sheriff standing by for an eviction. In the middle of the night, occasionally, she’ll look out her window and see the revolving lights of LMPD cars gathered in the complex’s courtyard. She’s lived in the neighborhood for over 5 years and, generally, hasn’t had many problems.

“I didn’t even know it was Section 8 until someone told me,” she said. “Usually the only trouble we see is teenagers being stupid.”

My friend is ambivalent towards the Housing Choice Voucher Program, also know as Section 8. However, there are a lot of residents and landlords out there who aren’t quite as sure that Section 8 is a good idea for anyone. In case you don’t know, this is a government program that assists “very low-income families, the elderly, and the disabled to afford decent, safe…housing in the private market” (HUD.gov). Housing agencies pay the majority of the rent directly to the landlord and the tenant is responsible for making up the difference.

Many landlords don’t like the program. One reason is that there is an inspection done by the prospective tenant’s caseworker. Everything must be in tip-top functioning order before the tenant can move in. However, when the tenant’s lease is up, there is no exit inspection done by the agency (biggerpockets.com). Many landlords complain that the subsidized tenants don’t take care of the property and cost them thousands of dollars in damages. Landlords also say that some Section 8 tenants move friends and family members into properties, which is a lease violation.

Residents around Section 8 housing insist that crime follows subsidized tenants. They cite a lack of parental control, unmowed lawns, trash and violence as reasons for their reluctance to accept these new neighbors. In some cases, they feel that there is a lack of fair play: why should I pay $1,500 a month when these guys can live in the same place practically for free? I understand why this could annoy some residents, but there’s a greater purpose behind Section 8 that should perhaps be considered:

Section 8 helps families. Section 8 gives people with lower incomes the chance to leave blighted neighborhoods. It gives families the opportunity to enroll their children in better schools with more resources. Basically, it’s a program that is attempting to uplift people, not destroy neighborhoods. Perhaps if the housing authority insisted on exit inspections (with compensation for damages), landlords wouldn’t be so wary of renting to voucher recipients. Perhaps if we worked harder to create quality after school programs and community centers, the kids wouldn’t be acting up out of boredom.

Like all controversial issues, Bourke Accounting doesn’t care what side you’re on. A Bourke Accounting expert’s only concern is you. Bourke Accounting wants you to be financially stable and reasonably happy. We want you to be the recipient of the best tax advice and bookkeeping services possible. Give us a try and see the possibilities that Bourke Accounting can offer you.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

We don’t talk about religion, sex or politics at work – Bill

I once worked with a woman who was very religious. Walking into her office was like walking into the gift shop at the Vatican. One time I said the “d” word in front of her (get your mind out of the gutter, I mean the “d” word that rhymes with “sham”) and she scolded me. I felt like I was standing in front of Sister DeNunzio, getting detention again. So, I watched my language around her, as “cussing” disturbed her sensibilities and I can go 10 minutes without swearing (I just don’t want to).

I asked my boss why he allowed her to have so many religious objects in her office when I wasn’t allowed to hang my Hieronymus Bosch calendar. He looked at me as though I was a half-stupid and possibly dangerous hamster. “Yeah, because I really need a lawsuit right now,” he snorted and walked away.

I thought he was being dramatic. As it turns out, he was just being very cautious: according to Harvard Business School, “the number of religious discrimination complaints has increased by more than 50 percent in the past 15 years.” In addition, “settlement amounts have more than doubled.” It didn’t matter that my coworker’s office looked like 10 churches decided to throw Religious Rave 2000, she was protected under the law.

The Equal Employment Opportunity Commission addresses this subject under Title VII (of the Civil Rights Act of 1964). Besides all the good stuff regarding the illegality of discrimination based on religion, it mentions that “religious observances…[including] displaying religious objects” are protected. However, Title VII also vaguely suggests that employers, if a consistent policy is in place, may allow religious iconography in private offices, but prohibit them in common areas. Like with everything else, there is a caveat to this rule: hardship.

If accessories of the employee’s faith “pose an undue hardship,” (EEOC.gov) on the business, the employer can restrict them. For example: Jack works around heavy machinery. Jack wears loose necklaces proclaiming his faith. Jewelry of any kind is strictly banned around the heavy machinery due to safety concerns. If OSHA found Jack wearing jewelry, the company could be fined. In a case like this, the employer would have the right to limit Jack’s religious attire.

Religion, if used properly, is very nice; some find peace and direction through faith. However, religion is also a hot-button issue with many people. I agree with Bill (how did that happen?!) that religion is a subject best not discussed at work. Let’s face it, there are regions in the world that have been kicking each other for eons over religion. Believe whatever makes sense to you. I might not agree with your point of view, but that’s why we have chocolate, vanilla and strawberry, after all.

Which celestial team do you play for? You know what? Bourke Accounting doesn’t care. Bourke Accounting also doesn’t care about your sexuality, your race or the kind of car you drive. Bourke Accounting will care if you forget your W2s and 1099s when you sit down for your appointment, though, so don’t do that. Your Bourke Accounting pro just wants to help you, religious or not.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Who knows what evil lurks in the hearts of men? The Shadow knows….

But the IRS does not.

That’s right, friends and neighbors, because of budget cuts, controversies, employee terminations and heavier workloads (for surviving employees), your chances of being audited this year are actually rather slim. To compound the issue, the IRS reports that “up to 31% of remaining [IRS] workers will retire within the next five years” (WSJ.com). I don’t want to compare the IRS with The Mary Celeste but, when the entire crew disappears, all you’re left with is an abandoned ship.

To put it in perspective, “roughly 1 out of every 220 taxpayers were audited last year. A decade ago, those odds were closer to 1 in 90” (CNBC.com). This is mostly because the biggest budget restrictions “have been in funding for enforcement, which includes audits” (CNBC.com). That means that there are billions of dollars out there that the IRS would have collected if they had enough people to get out there. Which they don’t.

Not surprising, the two groups who are most likely to get audited, even now, are the very poor and the very rich. Because of so many fraudulent claims, the IRS takes a hard look at those who claim earned income tax credit (Nolo.com). The lack of IRS staff comes into play here, as well: honest lower-income taxpayers who are audited can expect to wait for over a year before receiving their tax refund (Propublica.org). There just aren’t enough agents to go around.

While the rich still have a higher instance of audits compared to the general populace, the numbers are declining, there, too: between 2015 and 2018, audits for the wealthy dropped from 9.5% to 2.21% (Nolo.com). It seems that the safest place to be in these harsh times is smack dab in the middle. From everything I’ve gleaned from the media, middleclass taxpayers are the least likely to be audited (yes, IRS audits are random. Mostly).

This is not an invitation to all would-be criminals out there to try their hand at tax fraud, money laundering or any other nefarious tax-related crime. I might be a little bit of a rebel, but even I acknowledge that our tax dollars fund schools, roads, firefighters and police. Imagine if you called to report a fire and the dispatcher said: Due to employee cuts, no one can come to your fire. I think we have a Super Soaker in the back you can borrow. As much as I hate to admit it, we need our IRS agents.

Chances are, you won’t be audited this year. If you have a Bourke Accounting pro in your corner, those odds drop even more. However, if you do happen to be audited, your Bourke Accounting specialist will work tirelessly on your behalf. I’m not promising that, after an audit, you won’t have to wait a year to get your tax refund. But I can promise that the IRS will get so sick of hearing a Bourke Accounting voice on the other end of the line, they might just bump you to the front of the line (you have met Bill and Tim, right?).

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Between pedestrian-killing, self-driving Ubers, weird things that Amazon’s Alexa is known to say and robot cops that tell people to go away when a crime is reported (and then sing a little song), there are still a few kinks to work out with automation.

For example, the New York City subway once employed booth attendants at the entrance of every station. However, by 1997, attendants were being quietly replaced by fare-dispensing machines (Wikipedia.org). And crime, after a decades-long hiatus, has started to wake up again. Last year, The New York Times reported, “transit crimes were up 3.8 percent…according to the police.” Surely it couldn’t be because flesh and blood has been replaced by metal, right? That’s what riders believe. It stands to reason that when a live human, and first deterrent against crime, is switched out for a vending machine, things might go a little sideways.

With automation, the most important casualty is the human element. Walk into any Kroger Supermarket and you’ll, generally, see more self-checkout stations than human assisted ones. There will be a few bored looking workers standing by to help if you want to buy alcohol or if the scanner doesn’t recognize a banana, but they don’t seem to have much to do. According to Bizjournals.com, “retail has lost more than 140,000 jobs since January 2017 and is still declining despite…growth in nearly every other sector.”

However, it’s not just cashier jobs that are becoming obsolete. CNBC.com offers a bleak future for some of us when they report that “many food preparation, office administration (hey! What?!! That’s me!) and transportation jobs will be taken over by machines.” Creative, technical and other jobs that require “interpersonal skills and emotional intelligence” will most likely be safe. For now.

The arguments for automation are logical. Of course, there are lower operating costs after the initial investment, no missed time for sickness or broken hearts and no personality clashes among workers. Not to mention, the productivity of a machine far surpasses the output of a mere mortal, and with fewer errors (that is, if programmed correctly).

Perhaps I have watched too many robot horror movies, perhaps I fear the unknown. However. Just because the technology is becoming available to replace most of us in the workforce, I don’t know that it’s a very good idea. Let’s just take a second to remember psychotic Hal 9000 from 2001: A Space Odyssey, shall we?

Bourke Accounting doesn’t have receptionist robots. Bourke Accounting doesn’t have accountant robots. Accounting, after all, is one of those jobs that require “emotional intelligence.” A calculator or computer program will give you the right answer (maybe), but that’s it. A Bourke Accounting pro can give you solutions regarding any problem you might find yourself mired in. Your Bourke Accounting representative is both sensitive and capable of seeing the long view, which Alexa, at this point, is unable to do.

Come see us humans any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I once had a boss who berated me in a meeting for writing purchase orders wrong. When I pointed out that I, in fact, didn’t write purchase orders, he warned me to do it right the next time.

While I was working in HR, there was a woman who called out sick at least 4 times a month. That was bad enough, but then I was forced to listen to her cry over the phone about whatever new catastrophe had disrupted her life.

And now I work for Bill.

Bill, who has started an employee book club. Bill, who has started an employee book club that seems to revolve around self-help books. So far, I have read 1 and a half self-help books. Because I clearly have psychological expertise now, I have decided to take on the subject of difficult coworkers.

We’ve all experienced difficult coworkers (if you haven’t, then you just might be the difficult coworker…). There’s the lady who hides when a distasteful task comes up, there’s the guy who thinks it’s funny to repeat things told in confidence and then there are the negative people. The negative people are their own breed: you say, “good morning,” they remind you that it’s raining. You say that it’s great that everyone gets to go home a little early, they wonder loudly about the likelihood of a layoff.

I know it won’t surprise anyone, but we spend most of our time with people we have had no hand in choosing ourselves. If you can say that you are friends with your coworkers in real life, then you are a very, very lucky person. But what about the majority of the working world? Here are some tips that I’ve gleaned by being a regular work-a-day Jane:

1) Let it go. Sally said something offhandedly snotty. You brood and think about it days after it happened. Stop. You’re not affecting her and you’re hurting yourself. It is really not that important. Every time you start playing the incident over in your head in the middle of the night, think of a pink elephant instead.

2) Consider where your nemesis is coming from. There are not too many people who are inherently evil. Mike might be a defensive, overbearing so and so, but do you really know why? Maybe his home life isn’t the best, maybe his kid is going through bad times. Before you charge him as a bad person, remember that we all have our own perilous paths to wander.

3) Talk. If you have a coworker who is simply insufferable, I mean, no amount of Zen meditation will help insufferable, then talk. If you have to call in the human resources team, do it. If you have to call in your boss, do it. Generally, when people are forced to air their problems and discuss them in a civilized fashion, things get accomplished. If the meeting doesn’t go well, remember that beaning him in the head with a stapler still counts as assault.

I like my Bourke Accounting coworkers. Besides being talented and knowledgeable, Bourke Accounting experts are a pretty interesting group of folks. Not only are Bourke Accounting professionals willing to help and teach a fellow coworker, they go above and beyond with every client they handle. Hey, maybe your Bourke Accounting bookkeeper or tax professional will turn out to be your new best friend.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.