There are many “Words of wisdom” out there: Don’t run with scissors. Don’t take a bath with a toaster. Don’t eat green chicken. These all make a lot of sense. In these new and interesting times, I think one really important concept is overlooked: Don’t Tattle on Yourself. This is pretty similar to don’t air your dirty laundry in public. Or even, to a lesser extent, ol Ben Franklin’s: Three can keep a secret if two of them are dead. Considering the advent of social media, I think we all need a second to reflect on what we shouldn’t offer up to the world.

When social media first came out, it was fairly harmless. People were posting about sitting in Starbucks, how they bought new shoes and, oh, look, here’s a picture of a baby! Now, it seems that folks are being way too open about other, perhaps naughty, activities that they might be engaged in. For example, Dr. Phil had an episode a while ago that featured a woman who lost a job at ESPN before she even started because of what was discovered on her Facebook page. Let’s just say that what she posted did not exactly align with ESPN’s concepts.

Paradoxically, I almost didn’t get a job a few years back because I had (and still have) no presence on social media. Seriously, my prospective employer thought that I must have been hiding something, as I didn’t have a Facebook page. I explained, no, I’m not hiding anything, I simply don’t believe last night’s dinner needs validation from strangers. I was met with a wary and suspicious stare.

So, in such interesting times as these, I am offering three tips regarding social media:

1) DON’T post anything that you wouldn’t want your grandmother to read. This includes how you had [redacted] with a stranger Friday, how you smoked [redacted] Saturday night, how you would like to [redacted] your neighbor with a crowbar. Family functions are difficult enough. Don’t make it worse.

2) DON’T post any pictures of yourself doing anything illegal, don’t talk about doing anything illegal on social media. In 2017, abc7chicago.com reported that “50 [were] arrested after Chicago police infiltrate[ed] Facebook groups selling guns, drugs.” One of those detained happened to be a school teacher. This is not the only instance of arrests made because of social media. I found around 20 articles with titles like “7 People Sent to Prison because of Social Media.” So. Don’t do that.

3) DO have social media. I know, right? We can’t win here. If you have social media, you will be judged. If you don’t have social media, you will be judged. Have a public page with lots of friends from your knitting circle and pictures of bunnies. Have a private page (if you really must) about your thoughts regarding the Zombie Apocalypse.

So what happens if you posted something ill-advised on social media and now have the IRS rap, rap, rapping on your door? Well, a good accountant would be a handy asset. I’m not promising that the experts at Bourke Accounting can save you from yourself, but they can offer you valuable insight and advice. The associates at Bourke Accounting are here to help, even if it appears to be a Sisyphean endeavor. Bourke Accounting won’t give up on you.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I landed my first job at 13. I worked every day after school and on Saturdays for $5.00 an hour at a dry-cleaners. Looking back, I don’t know why I was so anxious to join the workforce. Looking back, with a bit more experience, I’m fairly certain that my employers and I were engaged in something illegal. Child labor and whatnot.

I have always liked the concept of work. “Daytime is work time,” I’ve espoused numerous times. I rather thought everyone felt the same way. But. If everyone felt the same way, why am I reading horror stories about hiring Millennials?

First, let me say that I don’t have a problem with Millennials. Honestly, I don’t know enough of them, personally, to have any sort of feeling at all. All I know about Millennials is that my outdated computer didn’t recognize “Millennials” as a properly spelled word. Also, ad execs feature them in order to peddle deodorant and energy drinks to me on my television. Apparently, if I apply the right deodorant, while drinking the right energy drink, I will be a sexy 20-something.

Doing some cursory research, it seems that there are two schools of thought regarding Millennials in the workplace. According to Forbes.com, “the great thing about Millennials is that they bring fresh ideas and fresh perspectives to your workplace.” What’s more, Millennials are generally more open to a diverse workplace environment. These are two great qualities. From what I’ve been reading, office drama will be cut down as Millennials are less likely to discriminate based on gender, sexual orientation, race, etc.

Let’s sign ’em up!

Oh, but wait. There’s a dark side.

According to thebalancecarreers.com, you should avoid trying to keep Millennials away from social media during work hours. According to them, “a no Facebook rule in the office is a death sentence [for Millennials]. One-third considers social media freedom a higher priority than salary.” Look, I like reading trashy romance novels, but I realize that I probably shouldn’t do that at work.

An even greater indictment comes from Michael Levin, a Daily News contributor, when he states “As God is my witness, I will never hire a millennial again as long as I live.” Eeeee. I was even uncomfortable retyping that. However, Levin shares some Millennial-hire experience which gives some credence to his statement. It seems that his biggest complaint is that Millennials grew up in a time “where everyone was made to feel special. You didn’t have to put forth an effort to win a ribbon…showing up was good enough.” Levin cites laziness, entitlement, wanting too much without paying one’s dues, and on and on. Okay, you get it. He really doesn’t like Millennials.

My thought is that you shouldn’t base your entire opinion, on an entire generation, on a few bad experiences. If you do, wouldn’t you be engaged in stereotyping? There are lazy and entitled folks in every generation. Simply because the lady at the grocery store failed to hold the door for me, doesn’t mean that every Baby Boomer is selfish.

If you’re an HR exec or a business owner, evaluate every applicant on their merit, not by their date of birth.

Here at Bourke Accounting, you won’t be judged. I was going to expand regarding race, religion, age, but I can stop with: Here at Bourke Accounting, you won’t be judged. Our associates want to help you with your financial endeavors, your IRS issues and your future well-being. Gen X-er, Millennial, Baby Boomer, all are welcome at Bourke.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Years ago, I was walking by a “hole in the wall bar” on St. Mark’s Place. The misspelled sandwich board outside advertised David Johansen playing TOONIGHT ONLY! What?! David Johansen? The New York Dolls front man, the godfather of punk, the man, briefly (and for his sins) known as Buster Poindexter?

I paid my five bucks and went inside.

He put on a good show and, after, I was able to get to the storage closest that was his dressing room. I knocked, he allowed me entrance and all of my sycophantic utterances dried up in my mouth. The man looked depressed. He told me to sit and proceeded to tell me about the death of his 13 year old cat that morning.

This was not how I thought I would meet the man who has been referenced in countless books about punk, New York City and Andy Warhol. I was taken aback that this, this deity, this over-the-top superstar, this historical figure had the same problems that I had. We commiserated over lost pets, I drank a few shots of his peppermint schnapps and went on my way, a more enlightened person.

Naturally, this got me thinking. Every time someone snipes at a celebrity behind a computer screen, that person is saying terrible things about a real, viable and living, human being. Some “keyboard warriors” type things that they’d never have the audacity to say to their worst enemy in real life.

Why? What makes us think that, simply because of one’s occupation, that person isn’t as feeling as the rest of us? Take, for example, accountants. Accountants go through a number of years of schooling, have to pass the Uniform CPA Examination, have to participate in continuing education and basically, be on the up and up all of the time. Accountants have families and friends, hopes, dreams, fears, just like the rest of us. So why would some people think it’s all right to ask their accountant to take part in sordid practices?

Number three on Inc.com’s list of “3 Things to Never Ask Your Accountant” is: Never ask your accountant to bend the rules. Ominously, the article predicts that “it will eventually come back to haunt you, and you’ll pay a heavy price for that act in the future, even if you don’t get caught.” I’m wondering if there is a special, ethical accountant mafia out there. Ask your accountant to launder money and you’ll wake up with the head of Rosette The Purple Unicorn beanie baby under the 1,000 thread count in your bed?

The professionals at Bourke Accounting know what they’re doing. They can protect you from the dark side of accounting. However, as tax season draws near, please remember that your Bourke Accounting professional is a real person with real feelings; don’t ask them to do anything too crazy. Rosette might be a real threat.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

I think, that for renters, the almost impossible dream at the end of the day, is home ownership. There is something attractive about a little corner of the world that belongs to you. After five years of renting a place, there is a letdown when one is left with only a myriad of sagging boxes and a denial of a security deposit refund for a fabricated reason.

There are some perks to renting, of course. If the toilet backs up, you get to call and complain. Snow removal is something generally handled by a maintenance team. There is no responsibility for the day to day upkeep. But. Even with our lavatorial needs addressed, sometimes we want more.

With this in mind, I phoned up T.A., a realtor at Push Pin Rentals out of Brooklyn, NY (in NYC, even the realtors are too hip for last names). I wanted to know his tips for, very green, first time home buyers. During our October 21st conversation, he had this to offer:

1) Understand the tax implications of any purchase.

This is actually pretty useful. Realestate.usnews.com points out that home ownership makes one eligible for quite a few tax breaks. According to Realestate.usnews.com, “a major benefit of home ownership is that you can deduct your mortgage interest on your taxes.” In addition, your real estate taxes can be used as a deduction, as well. For someone used to renting, it’s nice to know that all of your hard work will be rewarded.

2) Invest in markets you know and understand.

At first I wasn’t sure what T.A. meant by this. He then mentioned that, “even though you found a steal of a house, you might not really want it”. For example, in Housely.com’s article, “The 10 Most Dangerous Neighborhoods In Detroit,” the “median real estate price $26,318” for the area of Mack Avenue and Helen Street. This is great! I can buy a house today! Oh, wait. There are a number of abandoned properties, most workers commute long distances and, well, the wages aren’t very good. I get it, T.A. Know and understand the market.

3) Have a good accountant.

I think I understand this one. According to T.A., “just like going through a realtor is safer and easier than buying a house from the actual owner, figuring out your new tax status is safer and easier if you work with a reputable accountant.”

No matter if you are making your first home purchase or if you’ve been buying properties for years, Bourke Accounting can help navigate the ins and outs of your new financial situation. The experts at Bourke Accounting will make sure that you are reaping the benefits of being a home owner. Don’t be shy, though, they can also help all of you renters and sub-letters! So why not stop by, talk with a Bourke Associate, and maybe also get some really neat decorating advice?

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I did it. I finally did it!

I feel like I bumped into Gandhi at Walgreens. I feel like I sat down at Bull McCabe’s and shared a drink with Richard Hell. This is the level of coolness regarding my latest experience.

I met a former Chippendales dancer.

For those of you unaware, Chippendales was a place where, mostly women, could objectify half-naked and dancing men. Growing up in the 80s, a lot of movies called attention to this phenomena: 1984’s Bachelor Party, 1987’s Summer School, just to name a couple.

So, having met a Chippendales dancer in the wild, I, naturally, had a lot of questions. Were the women as predatory as in the movies I grew up with? How was the pay? Did you see a chiropractor if you threw your pelvis out? Sadly, he had to go and I was left with unanswered queries.

But it got me thinking. I’ve done a bit of research and it seems that there are still Chippendales reviews going on. Las Vegas has a few and, oddly, there are shows all over Germany this coming November (secure your tickets now!). But it seems like these are just kitschy and possibly ironic throwbacks to older times. Sure, there are a few around Manhattan proper, but no longer are there barkers making my ma blush and asking if she’d like to see real beefcake.

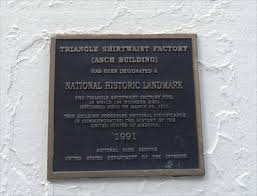

I hate change. I hate feeling nostalgic for events I’ve never experienced. I hate the way cities bulldoze over their history as soon as it happens. Take, for instance, the Triangle Shirtwaist Factory. If you were to walk around Greenwich Village in Manhattan, you might see a tiny little plaque on an NYU building commemorating the deaths of over a hundred women and the dawn of labor law change. Chances are you would miss this plaque completely if you weren’t looking for it. That’s it. A tiny little plaque:

Personally, I like cities like Savannah, Georgia. If you live in the Historic District, and want to change the outside of your house, you have to “receive a Certificate of Appropriateness before a building permit can be obtained” according to the Metropolitan Planning Commission. This can be annoying, but it can also protect the history and aesthetic flow of the architecture of a given area.

I think we should always be willing to learn from our past, the good, the bad, the ugly and the shaved chests. If we, as a species, mean to progress, we need to study the historical footprints of our ancestors.

And this is why I like working for accountants. Tax laws might change, but the concept of accounting does not. If you made $5 dollars and spent $6, well, pal, you’re not doing it right – it doesn’t matter if it’s 1955 or 2055. Here at Bourke Accounting, our experts are looking towards the future with their toes firmly based in a rich and traditional past. Bourke Accounting professionals are well versed in the newest law changes, but they also know good old fashioned arithmetic.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

P.S. If I go AWOL for a minute, you can find me, front row, at a certain little show in Las Vegas.

Written by Sue H.

At Bourke Accounting, we have a mandatory lunch meeting every week. Management buys food, I eat, I look interested and wait to hear my name. It’s actually very pleasant. It was at one of these meetings that Tim and Barbara discussed the concept of Unclaimed Property and Funds in Kentucky.

Barbara (come see her, you will love her) mentioned that after her mother passed, it turned out that there was quite a bit of money owed to the estate as a result of an insurance plan. You know the interesting thing? The insurance company hadn’t contacted Barbara or her family. Nope, it was up to Barbara to track down this money. Thankfully, Barbara is a smart lady, she did her research and, I’d like to think, she spent the money on a gold plated toilet.  After doing a little of my own research, it looks like taxpayers have an ally in Kentucky State Treasurer, Allison Ball. According to Insiderlouisville.com, Ms. Ball has been described as ” a big believer in property rights and loves to return money to people.” Maybe this is laying it on a bit thick, but it must be conceded that Ms. Ball has “reunited citizens statewide with about $70.2 million”. This is important as, citizens have a finite time to claim their rightful property. “After about three years, banks and other financial institutions turn over the unclaimed property to the Kentucky State Treasury,” Insiderlouisville.com reports.

After doing a little of my own research, it looks like taxpayers have an ally in Kentucky State Treasurer, Allison Ball. According to Insiderlouisville.com, Ms. Ball has been described as ” a big believer in property rights and loves to return money to people.” Maybe this is laying it on a bit thick, but it must be conceded that Ms. Ball has “reunited citizens statewide with about $70.2 million”. This is important as, citizens have a finite time to claim their rightful property. “After about three years, banks and other financial institutions turn over the unclaimed property to the Kentucky State Treasury,” Insiderlouisville.com reports.

What do you do if you think that there’s some cash out there, floating in the ether, with your name on it? Naturally, there’s a website for that. At first, I thought Missingmoney.com might be a scam; it sounds scam-ish. However, if it’s not on the up and up, then Treasury.ky.gov has been duped, too, as they cite this site (hee!) as a valuable resource. Missingmoney.com invites one to enter a name and a location, then checks around various databases to see if there is anything connected to the entered name.

As it turns out, no one, not in THREE different states, owes me money. I was pretty sure that I didn’t have a deceased, affluent and mysterious uncle out there, but it was worth a try. You might want to give it a go for yourself. Like the New York Lottery (which I’ve never played) reminds us: Hey, you never know.

You might have lost money out there. Chances are, and let’s face it, you don’t. But, brethren, you don’t need lost money if you have an accountant who understands the tax law. Your tax professional at Bourke Accounting might be able to recommend money saving options regarding your 2019 tax return and other financial holdings.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Hey, you never know.

Written by Sue H.

My pal used to run a construction business. As it turned out, it wasn’t as lucrative as he would have hoped and he closed it down. Hey, what can you do? It was worth a shot, better luck next time, no harm, no foul, right? He filled out paperwork to dissolve the business, got a different job and went on with his life.

Fast forward a few years. While a passenger in a friend’s car, the friend ran a red light and was pulled over. The police officer, seeing two tired men at the end of a hard day, decided to cut the driver some slack. Just for kicks, he asked my pal for his identification and ran it through the system.

Ten minutes later, my buddy was handcuffed in the back of the squad car.

What happened?

Failure to file Occupational Taxes.

I just know that the armed robbers and gang leaders were shaking when he walked into the cell: My God, Dead Eye, this guy didn’t file Occupational Taxes! He is crazy, boys! I betcha he filled out his 1040 with a grape-scented marker, the psycho….

So okay, why did this happen? Undeliverable mail. Both the IRS and the city of Louisville had been sending notices to an address where my friend hadn’t resided in over five years. While he had been filing his returns with current addresses, both agencies neglected to make note of either his address change or the fact that his business had been shut down. Friend filled out the proper dissolution forms and thought that he was doing everything by the book. He did not have an accountant (SEE?! Accountants matter!).

Sadly, this isn’t such a wild scenario. The Kiplinger Tax Letter (Vol. 94, No. 20, 10/4/19) tells us that, in 2018, “14.4 million pieces of mail were returned to the IRS.” While I get a sort of kamikaze thrill just knowing that these returned items cost the IRS $43 million, it’s a short lived thrill. First, how many people are in trouble and won’t know it until it’s too late? Second, you just know that we, as taxpayers, will eventually be footing the bill for all of that postage and return to sender stickers.

According to Procedurally Taxing, the government is not required “to search for a new address for a taxpayer in databases outside of the IRS” after receiving a returned item. However, as it is pointed out, the government makes “routine use of [motor vehicle and real property records] databases for other purposes (e.g., to locate assets upon which to levy).” I guess it’s just a matter of priorities, isn’t it?

I think that the IRS and local agencies have a duty to make sure that the taxpayers know what’s going on. I believe that five seconds of research isn’t too much to ask in order to save us from fines, penalties and jail.

I also think that everyone could do with an accountant.

No matter if you’re starting a business, closing a business or just a Regular 1040 Joe, Bourke Accounting can help make any financial transition easier. So why not stop by, talk with a Bourke Accounting associate, and make sure that you don’t spend tonight in jail.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Halloween is my favorite holiday. This has nothing to do with finances. It if gets past my handler/censor (Hi, Bill!), I hope you like it.

Once upon a time, there was a little girl who lived deep in the woods with her mother and father. She tried her hardest to be a good child. Her mother had never wanted children and blamed her daughter for her hard existence. Her father had never wanted children and blamed his daughter for his being saddled with a sullen wife and responsibility.

The mother had a very sharp tongue. She constantly berated the girl for being worthless and stupid.

The father, not the intellectual equal of his wife, used his fists on the girl.

The girl, not knowing any other way of life, believed that her parents loved her and that they were only punishing her for being a bad girl.

One morning, the mother sent the girl to collect berries by the riverside. The mother was going to bake a pie. The girl knew that she would never be allowed to taste the pie, but went cheerfully nevertheless. She was a very helpful child, even if no one (not even herself) knew it.

It had been raining all night and the river was more swollen than usual. With her bucket half full, the girl slipped on a rock and fell into the rushing river. She caught hold of a branch and called frantically for her parents. The water was cold and her fingers were already numb.

The mother, who had recently developed an enthusiasm for laudanum, stared dreamily out of the window. She heard her daughter’s cries, but didn’t stir. The silly little brat had, most likely, seen a snake. What of it?

The father, coming down the lane and surly (he had missed every deer he had aimed at and had resigned himself to a mean supper of bread and a silent and accusing wife), also heard his child’s desperate screaming. The spoiled idiot had probably been stung by a bee. What of it?

The girl tried to hold on. As her arms weakened and the water rushed into her mouth, she paused only to think about how much she loved her mother and father.

The girl didn’t come home that night. One less mouth to feed, the mother thought, chewing her bread and sneering at her husband. Good riddance, the father thought, ignoring his wife.

The girl knew that she hadn’t survived the river. Cold and wet, she dragged herself back to her home. The world looked different, hazy and insubstantial. She sat on the porch and wondered what to do.

Out of the fog, a beautiful and kindly looking woman walked towards her. She smiled at the girl. Say goodbye to your mother and your father and come with me, she told the girl. Her voice was warm honey on a summer’s day, her face radiated the gentleness of a blameless sky.

The girl ran happily into the house. Her parents were deeply asleep. The girl, leaning to kiss her mother, rested her hand gently on the mother’s throat. The girl went to her father’s side and kissed her fingers and put them to her father’s face (he never allowed the girl to kiss him).

The beautiful woman took the girl by the hand and led her out of the dark woods.

When the mother awoke, her throat was ice cold. When she looked into the mirror, she saw a red and angry little hand print on her skin. From that day until her death, the woman would go nowhere without a scarf. Was it because of her shame or because she was always so cold?

The father awoke to find a similar print marring his face. From that day until his death, he was never warm again.

Happy Halloween from everyone at Bourke Accounting!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. Hope to see you soon!

The final draft of the updated 2020 Form W-4 is slated to grace HR desks all over the US in November. Considering the Tax Cuts and Job Acts, it would make sense to have a new form. I understand that, but why does the IRS have to go and make it so complicated?

The IRS intimates that this is a new, gentler, Form W-4. According to IRS.gov, the 2020 W-4’s “new design reduces the form’s complexity and increase the transparency and accuracy of the withholding system.” I see. In that case, I personally just don’t understand what a “reduction in complexity” means.

For example, merely comparing the first page of the 2019 form to the 2020 form seems to contradict the IRS’ claim. The 2020 form has been described as “a mini-tax return” by Melanie Lauridsen, speaking to The Detroit Free Press. She’s got a point. Perhaps I’m just used to the old, quarter of a page design, but I don’t think that’s the only thing that’s going to be upsetting taxpayers.

On the first page of the 2020 Form, Step 4(a) invites one to enter the amount of other income. Again, as Ms. Lauridsen notes, “You wouldn’t want your employer to know [you’ve] got millions in [your] bank account. I could almost understand if Step 4(a) was sandwiched somewhere between the deductions worksheet and the annual taxable wage and salary table, but nope, it’s not. Smack dab in the center of the very first page, that’s where you’ll find it.

While it’s very nice that the standard deduction has now gone up to $12,000 and it’s also very nice that the Child Tax Credit has been elevated to $2,000, but did the IRS really need a “mini-tax return” to reflect these changes? I also wonder what kind of time, energy, money and psychological feng shui this new design consumed. Surely there was a better use of all of these commodities.

Unfortunately, Bourke Accounting can’t bring back the familiar and understandable 2019 Form W-4. However, Bourke Accounting can help you make sense of this very interesting new document. So why not stop by and let Bourke Accounting guide you through the new rules that will affect your financial life?

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Does your business need trustworthy and reliable employees? You may not have to look any farther than across the dinner table.

Strategy: Hire your spouse to work as an official employee. Why put your spouse on the payroll? Because you can gain five tax benefits:

- Build up tax-favored funds for retirement

If you meet the tax-law requirements, your company can deduct contributions made to a qualified retirement plan on your souse’s behalf. The annual limits are quite generous. If you company has a defined contribution plan, you can deduct contributions up to 25% of compensation or $54,000, whichever is less.

With a 401(k) plan, another dollar limit applies; Your spouse can defer up to $18,000 to the plan in 2017 (plus and extra $6,000 if he or she is 50 or older). Your company can match those contributions wholly or partially up to tax-law limits.

2. Shift taxable income away from the company

If you operate a C Corporation, any compensation you pay to your spouse would have to stay with the company. Assuming your corporation is in a higher tax bracket than your personal tax bracket, you’ll save tax overall if your spouse draws a salary. But don’t look for any income shifting tax benefit – possibly a drawback – if your company falls in a lower tax bracket than your personal bracket.

Note: S Corporation owners and sole proprietors don’t pay corporate income tax. You report business on your personal return whether or not you pay your spouse a salary. So this could be a wash.

3. Get more tax mileage from business trips

Generally, you can’t deduct the travel expenses attributed to your spouse if he or she accompanies you on a business excursion. However, if your spouse is a bona fide company employee and goes for a valid business reason, you may deduct his or her travel costs, including air fare, lodging and 50% of the meal expenses. The benefit also is tax free to your spouse.

4. Cure health insurance ills

If you’re already paying more to cover your spouse under your company health insurance plan, hiring him or her shifts the expense to your company. Typically, your company can deduct your spouse’s full health insurance costs.

Even self-employes can write off 100% of the cost under a so-called Section 105 medical reimbursement plan.

5. Join the employer-paid life insurance group

You’re spouse is entitled to the same group-term life insurance coverage as your other employees.

Key Point: The first $50,000 of employer-paid, group-term coverage is tax free to an employee.

However, one catch for S Corp owners: Generally, you can’t deduct fringe benefits, such as group-tern life insurance, for any employee who owns 2% or more of the company. By extension, that rule also applies to an employee-spouse.

At Bourke Accounting we are here to answer any questions you have on the ever changing tax laws. Give our office a call today to discuss your tax questions 502-451-8773.