2018 marks the first year of filing tax returns using 500 plus pages of tax code changes passed into law in late 2017. To help you plan for the new rules, here are the four biggest changes and their potential impact on your return.

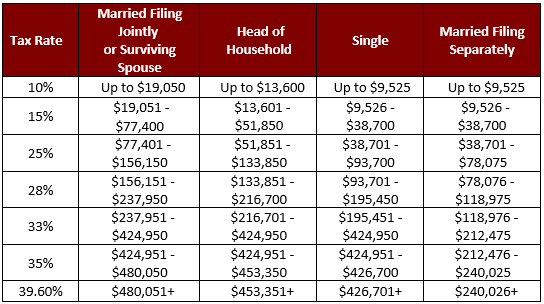

Tax rates are lower. While five of the seven tax rates drop by 2 to 4 percent, the income ranges of these new rates fluctuate quite a bit. Review where your income now fits using this tax rate chart.

Exemptions are gone. The $4,050 income reduction for each exemption is now set to zero. Yes, zero. So your taxable income is now that much higher for each personal exemption you took in 2017.

Standard deductions are virtually doubled. To offset the loss of the personal exemption, the standard deductions are now higher: $24,000 for a married joint filer and $12,000 for single filers.

A Child Tax Credit for everyone. The popular Child Tax Credit is now doubled to $2,000 and with higher phase outs. Virtually every taxpayer with a qualified child under the age of 17 will see this credit on their tax return.

Everyone will be impacted by the new tax changes. Please be prepared to see these new rules applied to your tax return this year. At Bourke Accounting we are encouraging our clients and prospective clients to come in and see us so we can let you know exactly how this years filing will look. Give us a call at 502-451-8773 or stop by for a visit. See you soon!

At Bourke Accounting we find that to be a good accountant you have to be a good listener…and listen we do during tax time and our monthly bookkeeping meetings with clients. Most clients like to talk about more than just tax, so we find we must know much about everything. One of our clients is a programmer for a dating app and I asked him what he has learned. Here is the scoop in a nutshell….

- Women are more thorough than men

Women tend to spend more time examining a guy’s profile -they care about what you studied, what your hobbies are, they actually read the descriptions. Guys just look for women who they find attractive. They started putting more effort into their profile as they thought these things actually didn’t matter, but they do.

- Love is basically a math problem

When you start to work on it and see the data, you realize how statistical love is. There is no one true love: you could end up with this person versus that person , but it doesn’t mean that other combinations wouldn’t have been compatible too – it’s just a numbers game.

- Most people don’t really know what they want

A user might say they want someone who does yoga and is 5-foot-5. But based on the data the programmer sees, a lot of these specifics don’t translate to connections. Some of the things people look for are just pulled out of thin air – maybe they like yoga and had an ex that was 5-foot-5. These things are hardly ever make-or-break when it comes to making a connection.

At Bourke Accounting we talk about everything but are really good at your tax and accounting needs. Give us a call at 502-451-8773 or come by for a visit…. in between time on your dating app of course. See you soon!

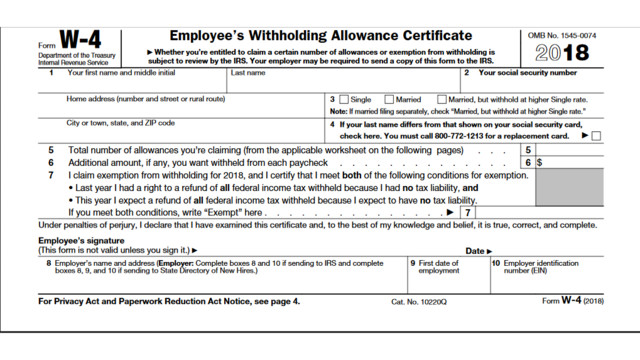

In case you missed it, the Internal Revenue Service published the new 2018 W-4 form in March. As you know, accurate withholding is meant to get individuals close to their true tax liability at the end of the year. However, the new tax code, passed into law in December, made significant changes to calculations for income tax liability. Employers and employees alike need to reexamine withholding needs to ensure precision. The IRS intended that tax withholding under the new law should work with the 2017 W-4 form. This required revisions to retain components such as personal exemptions, which are no longer in the tax code. The 2018 W-4 retains the personal exemption because those still using the previous year’s for need to have it. Here are the highlights from the changes:

Exemption from withholding

The IRS changed instructions for claiming exemptions form withholding. Now you must indicate that for both 2017 and current year 2018 you had or expect no tax liability.

The IRS releases its withholding calculator. the W-4 instructions state that if you use the withholding calculator, you don’t need to complete any of the worksheets for Form W-4. This was not stated on the previous W-4. It may indicate that the withholding calculator is the most reliable method to get your withholding closest to your tax liability.

Calculating personal allowances

The 2018 W-4:

- Removed the reference to dependents whom you can claim on your tax return.

- Changed the calculation for the child tax credit to reflect the new amount and the significant increase in the phase-out amounts.

- Added the credit for non-child dependents to factor into allowances.

Changes to Deduction, Adjustments and Additional Income Worksheet

The IRS changed:

- The estimate of itemized deductions to reflect the new tax law referencing the $10,000 cap on state and local taxes (including property and income taxes) and the change to medical expenses in excess of 7.5 percent.

- The wage thresholds and amounts for the Two-Earners/Multiple Jobs Worksheet to reflect the dynamic of the new tax code on these taxpayers.

If you have any questions on how to figure your W-4 please give Bourke Accounting a call at 502-451-8773 or stop by for a visit. See you soon!

As Bourke Accounting continues to grow and expand we often need to update our equipment. Our current dilemma is the need for a combo copy machine/fax/scanner etc. So do we buy or lease? I think leasing may be the best option considering the price of the machines today…

When I talk to people about leasing a copier or MFP (multifunction printer) it doesn’t take long to get to the bottom line: How much is it going to cost to lease a copier for my business? The “How much does it cost?” question is a sensible one, but it’s a lot like asking : “How much will my mortgage cost?” You need to supply some additional information. How long is the loan? How big is the house? Where is it located? You get the idea! Understanding the costs associated with leasing a copier or multifunction printer invokes some significant associated questions. Here are just a few:

- Is it black and white or color?

- How fast does it need to be? (What is the desired print/copy speed?)

- Do you need finishing options like a sorter, hole-punch, an automatic stapler or the ability to saddle-stitch documents like small pamphlets?

- How much paper do you need to load? Do you require additional trays and paper capacity?

- What is the lease term?

Deciding the Lease Term

Lease terms are typically 36 or 60 months. Like a car loan, this is the duration for which the value of the lease (often retail value) is amortized. Unlike a car loan (but very much like a car lease), you typically do not own the copier when the lease is up. You will need to either send the unit back (often at your expense) or buy it at the then-current value as determined by your lease paperwork.

The Calculated Lease Amount

There’s no magic in calculating your lease amount, you simply need to know all the variables. Your lease company will include all of the options you desire as part of the copier you are leasing (finishing units, paper trays, fax options, software upgrades etc.). This, along with the amortization table and associated fees, make up your lease payment.

A typical lease amount can be estimated somewhere in the neighborhood of $25 for $1000 in the price f the copier or MFP for a five year lease. This means a device costing $12,000 will run you, roughly, $300 per month.

Trouble-free Service Contracts or Maintenance Agreements

There’s another factor we need to add into the equation of leasing a copier and that is the service contract. This service contract typically exists separately from the lease. This is kind of like buying a plan to keep your car in new tires and oil for the life of the lease. And, like a vehicle service contract, it also covers any required maintenance-and does so in-house. That means you’re never sending the unit out for repair. As you can imagine, for larger offices this peace of mid is why service contracts are so popular. About the only thing a service contract doesn’t cover is paper and electricity.

The way a service contract works is on a “per click” basis. A “click” is a single one-sided print or copy. The service contract is an estimated amount of copies or prints you will make monthly and typically runs between $0.01 and $0.02 per click for black and white and between $0.05 and $0.09 per page for color. This can vary a lot depending upon the amount of pages you print each month.

What to do…

I figure if I give up my gym membership and focus on my steps to the copier daily, that can save us some money. Either way, at Bourke Accounting we always want to use state of the art equipment as it helps us service our clients in a more efficient and professional way, which gives us more time to focus on you. Come by and see us soon!

It’s a question humans have been trying to answer for millennia. but over the past several decades, behavioral scientists have made huge strides in determining the basic building blocks of joy and contentment. Primary among them? The quality of your relationships. A study of adult development has found that close relationships, with both family and friends, help keep people happy throughout their lives. Health matters, too, as does creative work and freedom from mind numbing routine. But the small day-today stuff matters as well. The frequency of events that trigger happiness is a better predicator of satisfaction than the intensity of such events. In other words, the person who has several positive experiences throughout the day – a pleasant exchange with a friend or boss, a compliment from a spouse – is likely to be happier overall than an isolated person who wins a major award.

Does money help?

Yes and no. A 2010 study found that happiness levels increase up to an annual salary of $75,000, but after that, higher earnings have little to no effect. Another study, conducted in 2015, concluded that higher incomes can be useful for reducing sadness but not for enhancing happiness. But more recent research has determined that money can indeed buy happiness – if you know how to use it.

Can we work on being happy?

Absolutely. Though some psychologists maintain that we have a “set point” of happiness – one that we return to time and again throughout our lives, even after a trauma or a lucky break – experts increasing argue that contentment is something we can cultivate and increase with a set of learned skills.

How can a challenge make you happy?

Setting and achieving goals is a key part of working toward happiness, research has found. Your brain releases dopamine – also know as the “feel good” neurotransmitter – every time you accomplish a task you’ve lined up for yourself. One way to hack that process is to give yourself small, achievable goals, so that you trigger dopamine hits as you work your way through a to-do list. But for this to be effective, it’s key to set specific goals that you know you can accomplish.

Are some happiness factors out of our control?

Genes and age do play a role. Studies of identical twins who were separated at birth show that they reported similar levels of happiness far more frequently than fraternal twins did, suggesting that some level of satisfaction might be hereditary. Global surveys from more than 70 countries show that happiness tends to decline as people move into middle age and bottoms out around age 44, and then steadily rises in the 50s, 60s and 70s. and there are several possible reasons. It could be that as people get older, they learn to care less about what others think, or that they become more adept at avoiding situations they don’t like. It could also be the experience has taught them that happiness isn’t something that just happens, and that there are ways to set a course for a happier life.

Happiness and finances…

At Bourke Accounting we will work with you through life’s changes; those that are expected and those that are not. Our focus is on tax preparation and bookkeeping services, but our personalized service and dedication brings our clients back year after year. Give us a call at 502-451-8773 or stop by for a visit as we want to help! See you soon.

Your Social Security benefits are calculated based on how much you earned during your top 35 working years, but at the age at which you first file for those benefits can impact the amount of money you receive each month. If you wait until your full retirement age (FRA) to take benefits, you’ll get the full monthly amount you’re entitled to based on your earnings record. FRA is a function of your year of birth, and for today’s workers, it’s either 66, 67. or 66 plus a certain number of months.

That said, you actually get an eight-year window to file Social Security that begins at age 62 and ends at age 70. If you file ahead of FRA, you’ll reduce your benefits depending on how early you jump the gun. On the other hand, if you hold off on taking benefits past FRA, you’ll accrued delayed retirement credits that boost your payments by 8% a year. Because this incentive runs out at age 70, that’s generally considered to be the latest age to file for Social Security — even though you’re technically not required to do so.

Still there’s a lot to be gained by taking benefits as late as possible and growing them to the maximum extent. So why is it that only 3% of men and 5% of women wait to claim Social Security at 70, while all other beneficiaries file before that point? Here are a few reasons why…

- They need the money sooner. One major reason why so many seniors take Social Security before age 70 is that they are forced to retire sooner.

- They want the money sooner. While most Americans are behind on building their nest eggs, there are also those who are saving quite nicely, but for the latter the money comes in handy.

- They’re afraid Social Security is going broke. There have been rumors for years that Social Security is going broke — but those are just rumors. While the program IS facing financial difficulties, it is virtually impossible for Social Security to go broke because its funding comes for payroll taxes. Therefore, as long as we have a workforce, the program will keep getting money to pay beneficiaries.

So what should you do? When should you file?

The answer is that it really depends on your personal circumstance. Let Bourke Accounting help you figure this out; we are a master at all matters financial. Give us a call at 502-451-8773 or stop by for a visit. See you soon!

A young woman was waiting for her flight at a big airport, so she decided to buy a book to read and a packet of cookies to snack on. She sat down in an armchair in a VIP lounge to relax and read in peace.

A man sat down in the next seat , opened his magazine and started reading. When she took out the first cookie, the man took one also, She felt irritated but said nothing. She just thought, “What nerve! I’d like to punch him for being so rude!”

For each cookie she took, the man also took one. This infuriated her but she didn’t want to cause a scene. When only one cookie remained, she thought to herself, “What will this rude man do now/”

Then the man, taking the last cookie, divided it into half, giving her one half. That was too much. She was really angry now.

In a huff, she took her book, the rest of her things and stormed off to board the plane. When she sat down in her seat on the plane, she looked into her purse to take out her reading glasses, and to her surprise, her packet of cookies was there, untouched and unopened.

She felt so ashamed. She realized that she was wrong.

The man had shared his cookies with her willingly, while she had been very angry, thinking that he was helping himself to her cookies. And now there was no chance to explain herself, nor to apologize.

Have you ever lost your cool and then realized later that you were wrong? I’m sure that most of us have. Let’s save ourselves some embarrassment and make sure that we are in possession of all of the facts before reacting.

Dale Carnegie said: “When dealing with people, remember you are not dealing with creatures of logic, but creatures of emotions.” At Bourke Accounting we find that when finances are thrown into the mix, emotions go out the window. We have tried to create an atmosphere of safety and calmness here at Bourke Accounting. Come on by and let’s talk tax or about any of your financial needs. Perhaps we can help.

The Internal Revenue Service has advised taxpayers that in many cases they can continue to deduct interest paid on home equity loans.

Responding to many questions received from taxpayers and tax professionals (yep, that is us), the IRS said despite newly-enacted restrictions on home mortgages, taxpayers can often still deduct interest on a home equity loan, home equity line of credit (HELCO) or second mortgage, regardless of how the loan is labelled. The Tax Cuts and Jobs Act of 2017, enacted Dec 22 suspends from 2018 until 2026 the deduction for interest paid on home equity loans and lines of credit, unless they are used to buy, build or substantially improve the taxpayer’s home that secures the loan.

Under the new law, for example, interest on a home equity loan used to build an addition to an existing home is typically deductible, while interest on the same loan used to pay personal living expenses, such as credit car debt , is not. As under prior law, the loan must be secured by the taxpayer’s main home or second home (know as qualified residence), not exceed the cost of the home and meet other requirements.

For anyone considering taking out a mortgage, the new law imposes a lower dollar limit on mortgages qualifying for the home mortgage interest deduction. Beginning in 2018, taxpayers may only deduct interest on $750,000 of qualified residence loans. The limit is $375,000 for a married taxpayer filing a separate return. These are down from the prior limits of $1 million, or $500,000 for a married taxpayer filing a separate return. The limits apply to the combined amount of loans used to buy, build or substantially improve the taxpayer’s main home and second home.

At Bourke Accounting we receive updates as the law changes (or evolves as we like to say) and we pass them on to you by many means. If you have any questions or concerns on your financial wellness, come see us. Stop by today or give us a call at 502-451-8773. See you soon!

My favorite thing as a kid was watching the Olympics (whether it was Summer or Winter); my bothers and sisters and my Dad would gather around our small bulky TV and yelled with joy as the various sports were played out. We’d even bet on the outcome. My brother was a research fanatic and he would treat the Olympics like a horse race and pull up statistics on how often a skater would have fallen or a skier had crashed, and bet accordingly. Our Mom would allow us to stay up late or even miss school if our Olympic watching interfered with school. LOL

Today, now that I am an adult, we have a party for the opening and closing ceremonies supply friends and family with pizza and beer…. but since my brother lives out of town we don’t do the betting anymore.

There are a bunch of new events which is exciting. For the first time, Olympians will compete in mass-start speed skating, in which as as many as 24 skaters race simultaneously; mixes-doubles curling; mixed-team Alpine sking; and big air snowboarding, wherein competitors launch themselves off a 160-foot high ramp, the largest of its kind in the world.

All in all there will be 102 events across 5 sports, including bobsledding, figure skating, luge, and ski jumping. Another first this year: NBC, the official U.S. broadcaster of the Games, will feature live coverage of events during U.S. prime time across all time zones. Pyeonchang is 14 hours ahead of the East Coast and 7 hours ahead of West Coast, which means far fewer events on tape delay in which medal winners are already known.

Bourke Accounting has TV’s in our office so when you make your tax appointment, know that you won’t miss anything. We are open from 8am to 7pm so give us a call at 502-451-8773 and lets talk Olympics, or taxes…okay anything financial…see you soon!

In America, not getting enough sleep isn’t an issue plaguing a select segment of the population. As of 2013, 40 percent of Americans get less than the recommended amount of sleep each night, as opposed to 11 percent of the population in 1942.

The negative side effects of not getting enough sleep are well documented, but as it turns out it isn’t the duration of your snooze affecting your health. A recent study has shown a link between waking up during the middle of the night and an increase risk of developing Alzheimer’s.

The University of Illinois conducted a sleep study of 516 adults aged 71-78. The study found that the proteins associated with Alzheimer’s, known as bio-markers, were highest in the participants who suffered from respiratory sleep disorders which led to frequent sleep interruptions.

According to the Alzheimer’s Association, 20 percent of women and 30 percent of men suffer from sleep apnea, the most common respiratory sleep disorder.

This sleep interruption is much different than the average occasional jolt awake (which may be an evolutionary defense mechanism); individuals afflicted by respiratory sleep disorders have been known to wake up upwards of 60 times per night.

There are many issues that keep us at night: financial worries, family issues, work issues etc. At Bourke Accounting we can help with your financial issues, come see us. Give us a call at 502-451-8773 or stop by for a visit. See you soon!