You can say a lot of unkind things about the Internal Revenue Service and the assorted financial powers that be. However, you can’t say they’re not thorough and you can’t say they’re not fast (when they want to be). For example, in mid-March, when most of us were searching for toilet paper and looking down the barrel of layoffs, the IRS was busily writing guidance plans regarding the Coronavirus Aid, Relief and Economic Security (CARES) Act.

Minutes after being furloughed, people with Individual Retirement Accounts were, no doubt, uneasily eyeing those accounts and doing some sacrificial arithmetic. Considering house, car and child expenses, looting that IRA would have seemed the only option to keep the bigger wolves from the door. However, if under the age of 59 ½, these folks would have had to resign themselves to not only paying a 10 percent early withdrawal penalty, but then also having these premature funds included in their gross income (IRS.gov). Many reluctant fingers dialed financial institutions intending to cash out – needs must when the Devil drives, after all.

And right about here is where the IRS’ thorough contingency planning comes into play. Even before the virus descended, the IRS wasn’t completely heartless; there were certain situations that allowed for taxpayers to go unpenalized after early withdrawals of retirement money. For example, if a taxpayer became disabled, adopted or gave birth to a child, had to pay for tuition or unexpected medical bills, the IRS was willing to forgo that 10% penalty (IRS.gov). Now that Corona has disrupted day-to-day living, the IRS is offering even more altruism.

For “qualified individuals,” the rules have changed. If you have been diagnosed with COVID-19, have a spouse/dependent diagnosed or have been suffering monetary consequences as a result of the VID (laid off, lost child care, reduced hours, etc.), you count as a qualified individual (EA Journal, Vol. 39, No.5) and are eligible for free prizes! Under the CARES Act, you can now take an early distribution of up to $100,000 with no penalty in sight. This money will be counted as income, but “ratably over a three-year period,” unless elected otherwise. In addition, this money won’t be subject to the mandatory and normal 20 percent withholding rule (EA Journal, Vol. 39, No.5). Of course, you are welcome to voluntarily withhold, which would probably make things more orderly in the long run.

Another neat addition within the CARES Act has to do with required minimum distributions. Before these exciting times, those required to take a distribution (age 72 for 2020), HAD to take a distribution. If you didn’t take that cold, hard cash before December 31 of each year, you got bopped with a “50% excise tax on the amount not distributed” (Mintz.com). Depending on your account, that could be quite a wrist-slap. However, seeing as our stock market has been taken to the woodshed, the CARES Act is waiving RMD requirements for this year. But what if you’ve spent the last year on a tropical island paradise, far away and unaffected by the travails of the virus? That’s all right! You do not have to be a “qualified individual” to make use of this perk – this is available to everyone required to take a distribution.

Whatever your opinion of our financial authorities might happen to be, you must give credit where credit is due. During these desperate times, guidance and safety nets have been constructed. Your house and your retirement are safe for now, so at least that’s one thing you can stop worrying about.

The IRS is quick, but your Bourke Accounting tax preparers and bookkeepers are keeping up. As soon as a new regulation makes the scene, your Bourke Accounting pro knows about it. When you sit down with a Bourke Accounting expert, rest assured that the facts are known and the advice is solid.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

In today’s hectic and ever changing tax world I get many questions and asked about specific circumstances that you would hope would be an easy answer. Not always. A recent question reminded me of all the rules for divorced and separated parents – so I thought I’d share.

A client lives with her “significant other” and their 10-month old daughter. He is the baby’s father. She would like him to claim the child tax credit (CTC) on his return. Can she use Form 8332 to release the daughter’s CTC benefits to her boyfriend and keep the other tax benefits (earned income tax credit (EIC), etc? Or can they just agree between themselves to split the beneifts?

So the answer is – YES – they can use Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent and is used (potentially) by couples who are not married but there is an additional requirement….the couple may not live together during the second half of the year.

So there are special rules for divorced and separated parents…

Under the special rule of S152(e) for divorced and separated parents, a custodial parent may release a child’s exemption to a noncustodial parent if:

- One or both parents provide more than one-half of the child’s support.

- The child is in the custody of one or both parents for more than half the year, and

- The child’s parents are

- Divorced or leagally separated under a decree of divorce or separate maintenance, or

- Separated under a written separation agreement, or

- Living apart at all times during the last six months of the year.

Getting a divorce when you don’t have kids is tough enough, but throw kids into the mix and the intesity is ramped up. Yet there are many rules to help you navigate what to do tax-wise. Give us a call at Bourke Accounting as we have the answers and can help you navigate these murky waters. Call us at 502-451-8773 or stop by for a vist.

Sometimes, the Universe seems to gently nudge us in the direction it wants us to go. Like, if a flat tire kept you from attending a party where everyone got Salmonella, you’d say, “Whew! The Universe looked out for me.” Whether the Universe was playing favorites or not, you avoided four straight days in the bathroom, so the end result is the same.

Since the IRS might have an inflated view of itself, it engages in these same practices. For example, the IRS insists that citizens who make their money illegally must report it on their returns. The IRS even offers a vague assurance that it won’t tip off other enforcement authorities. More importantly, it’s insinuated that, no matter how tough the DEA is, the IRS bites harder – so be honest, outlaws!

There is no clearer example of the IRS sheepherding us through the corrals of taxes than filing status. If one chooses to file married and jointly, there are a ton of free prizes involved. However, the lack of free prizes associated with married filing separately almost seems like a punishment. Is this because the IRS is lazy and would prefer to process only one return per couple? Is it because the IRS is playing marriage counselor? Either way, separately filing lovebirds get the short end of the stick.

If you’re going through a messy divorce, you’d rather not meet with a Bourke Accounting pro in the same room as that cheating so-and-so. In fact, you’d prefer to forget the whole failed marriage and move on. Obviously, the IRS designed the filing separately option for events such as that. Another motivation not to file with your spouse is if you think the love of your life might be up to some shady dealings. If there’s a suspicion of tax evasion, it will benefit you to steer clear of that return and not be associated with criminality (Investopedia.com). Of course, if you don’t trust your spouse enough to file with her/him, you probably need to reevaluate the relationship.

What about if you’re just an independent person who likes to handle things on your own? That’s cool, but, again, don’t expect the Feds to reward your autonomy. While joint filers are eligible for credits and breaks, separate folks really are left out. For example, the Earned Income Tax Credit is a benefit designed to help working stiffs who aren’t reality tv host “billionaires”. If you meet the requirements, this will reduce the amount of tax owed and might score you a refund. To be eligible to receive this credit, you can file as any status, except – you guessed it – married filing separately. Although you don’t need a child to use this credit, you do need another human being willing to go halfsies on a return with you.

Another example of the IRS’ questionable rule-making is the Premium Tax Credit. This is another program for hard-working folks and it helps people to afford health insurance bought through the Health Insurance Marketplace. When you get your insurance, the Marketplace can either figure out an estimated credit paid to the insurance company to lower your monthly premiums or you can “get all of the benefit of the credit” (IRS.gov) when you file your return. What’s great about this is that if the amount of the credit is larger than what you own in taxes, the difference is a pretty little refund. Everyone’s happy! Everyone but those poor, ignored married citizens with only one name on their 1040.

Perhaps the IRS thinks there is something inherently dishonest about married filing separately filers. Obviously, if your SO makes a million a year and you only make 15 grand, you don’t need help with insurance. Since the IRS doesn’t trust us to voluntarily play by the rules, a little nudge makes everyone honest.

Your Bourke Accounting tax preparer can help you decide which filing status is ideal for you. Bourke Accounting pros can explain the drawbacks and advantages involved and offer your best bet. At Bourke Accounting, understanding your options and making an informed decision is the most important aspect.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Recently, a reality television host and “billionaire” has been accused of not paying his federal income tax for years. Civilian taxpayers roll their eyes, think “how stupid/greedy can one guy be?” and move on to the next article. Wealthy celebrities in tax trouble aren’t new; we’ve witnessed rich folk like Wesley Snipes and Willie Nelson fall into the same trap with stunning regularity. However, when tax-evading mug shots are splashed across the front page, we rarely think of the repercussions for the professionals behind those erroneous returns.

For example, when you hand over your documents to a Bourke Accounting tax preparer, your expert is reasonably sure that you are an honest person. And although you may be as pure as the driven snow, your tax preparer would be remiss if s/he didn’t double check a few things. If you were to claim a few children for the Child Tax Credit, for instance, it’s second nature for your tax preparer to make sure that each child has a Social Security number. This is not an indictment against your honesty, or the existence of your child, but a due diligence requirement according to the IRS.

Because tax benefits, like the Child Tax Credit, are of particular interest to the IRS, tax preparers must be vigilant. The IRS is so interested, in fact, that they actively seek out returns “with a high chance of errors completed by the same preparer” (EITC.IRS.gov) and might decide to schedule a little audit visit. When the agent meets with the preparer, actual proof that the credits were justified are demanded. These include due diligence records, questions answered by the client, worksheets and client provided documents” (EITC.IRS.gov).

If it is discovered that the preparer didn’t ask the right questions and gave an undeserving person credits/refunds, the preparer is slapped with a penalty of $530 per mistake. Not only that, but these mistakes could also result in a suspension or termination of e-filing privileges (EITC.IRS.gov). As the IRS strongly recommends e-filing, and clients like the convenience, this would put a mildly disgraced preparer at a disadvantage.

In addition to penalties for not obtaining the right back-up documentation, tax preparers also have their noses slapped for carelessness. If your preparer doesn’t sign a return – BAM! – that’s a fine of $50 per return. If the preparer forgot to furnish you with a copy of your return? That’s another $50. And if the preparer didn’t remember to save a copy of your return? Well, that’s $50, too. On a good note, the IRS won’t charge your preparer more than “$26,500 in calendar year 2020” (IRS.gov) for these sorts of infractions.

Besides the little fines for being absent-minded, tax preparers also have to protect your sensitive information. If a preparer is found guilty of “knowingly or recklessly disclosing” (IRS.gov) anything about your return, s/he can be fined $1,000, a year in prison, or both (plus court costs) (IRS.gov). This is why preparers (and their wonderful assistants) keep client records locked up tight and out of sight.

For a preparer like the one the “billionaire” used, the penalties might be a little steeper. If wrongdoing is proven, that preparer could be fined for lovely things like willful or reckless conduct. Basically, if the preparer knew the information was questionable, but created the return anyway, the possibility of total disbarment and heavy prison time could become the reality.

The relationship between a client and a tax preparer is special. The preparer trusts you to furnish legit paperwork and you trust that the preparer won’t getting imaginative with your legit paperwork. All in all, it’s a good, symbiotic relationship for everyone.

Bourke Accounting experts haven’t been disbarred, nor do they plan to be. Your Bourke Accounting specialist makes sure to play by the rules – for their good, as well as yours. When you sit down for a Bourke Accounting appointment, rest assured that everyone in the room is in good standing with the IRS.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Although it might not feel like it this year, we are heading into the festive season. At Bourke Accounting, some of us are already avoiding fast food and introducing healthier habits into our lives. You might be doing the same thing right now – we all want to look nice in our Halloween costumes, holiday photos and socially distanced family gatherings. However, even with the best of intentions, there is danger lurking just around the corner! Danger, I tell you!

Although it might not feel like it this year, we are heading into the festive season. At Bourke Accounting, some of us are already avoiding fast food and introducing healthier habits into our lives. You might be doing the same thing right now – we all want to look nice in our Halloween costumes, holiday photos and socially distanced family gatherings. However, even with the best of intentions, there is danger lurking just around the corner! Danger, I tell you!

While it is certainly cliché, the old adage about “too much of a good thing” being bad serves as a fair warning. For those of you about to get off the couch, beware that, if you’re not careful, the practices you are embarking upon can end up hurting you:

1) Black Licorice. People attempting to lose weight will often turn to black licorice: it’s fat free, it tastes good, it freshens your breath and helps with digestion. But. It also contains glycyrrhizic acid, a harmless chemical in small quantities that can lead to death in heavier doses. Recently, a 54-year-old Massachusetts man lost his life as a direct result of licorice. Perhaps in the interest of healthier living, the man switched from eating several packages of fruit-flavored candy to several packages of licorice a day. Sadly, he passed out in a restaurant and died the next day. The glycyrrhizic acid in his “healthier” licorice is known to cause a “drop in potassium levels… high blood pressure…abnormal heart rhythms and even heart failure” (CNN.com). While most people don’t eat this much licorice a day, just two ounces of black licorice every day can cause heart issues, especially for people over 40 (Livescience.com).

2) Water. We all know you gotta stay hydrated. Drinking water flushes out toxins, leads to better skin and keeps our brains good and wet. Too much water can also lead to death. In 2007, a California radio station ran a contest, “Hold Your Wee for a Wii.” Contestants were asked to drink large quantities of water and the last person to use the bathroom was named the winner of the video game system. 28-year-old Jennifer Strange didn’t win the Wii, but she did win hyponatremia and, tragically, death (Theregister.com). When humans drink too much water, the kidneys can’t process it quickly enough and water builds up in the bloodstream. With nowhere to go, the water then moves into the cells, which can prove deadly when it flows into the brain and causes swelling (Dripdrop.com and Scientificamerican.com). While water intoxication isn’t that common, it pays to watch what you drink.

3) Nutmeg. Speaking of watching what you drink, be careful around eggnog. Like almost everything in moderation, the nutmeg in eggnog won’t hurt you in normal doses. However, it only take about 2-3 teaspoons for nutmeg to change from a nice warm, spice into a bad trip. Nutmeg contains a chemical called myristicin which, in large doses, causes hallucinations, grogginess, heart palpitations and, in extreme cases, organ failure (Healthline.com). While fatal nutmeg intoxication is rare, if your little Johnny keeps asking you for tins of nutmeg, you might want to question what happened to all of his “baking” experiments.

It’s hard to keep track of what’s healthy now; one day something is good for us, the next, it’s the Devil incarnate. The main thing to remember is that there is nothing, absolutely nothing, in huge quantities that is ever good for us. Eat clean, healthy food, but don’t say “no” to a doughnut here and there.

Bourke Accounting tax preparers and bookkeepers make sensible choices both with their bodies and with your paperwork. For example, Bourke Accounting pros know that your two dependents are good for a credit, but your 23 dependents are good for an IRS audit. Bourke Accounting will always let you know when you’re trying to have too much of a good thing.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Fighting against authority can be a very good thing. If women and men hadn’t fought, slavery would still be practiced, women would still be property and the killing of those who love the “wrong” people would still be permissible. As an intelligent species, it is our duty to rise up and demand fair treatment from the powers that be; we have an obligation to protect the vulnerable and to condemn injustice. However, fighting against atrocities using similarly evil tactics is getting us nowhere.

Yesterday’s grand jury decision regarding Breonna Taylor left people angry and confused. How could it be that no one will be held accountable for the taking of an innocent woman’s life? Former officer Brett Hankison’s indictment for wanton endangerment, as a result of recklessly shooting into apartments, was a first step – now what about the officer who shot into Ms. Taylor? Obviously, the grand jury has more work to do.

Regardless of the flawed decision, the shooting of two Louisville police officers last night is inexcusable. While both officers are expected to live and a suspect is in custody (charged with wanton endangerment, no less), this is not the way. Much like Ms. Taylor, these officers were innocent.

Recent vitriol promotes the belief that, as soon as one puts on that blue uniform, that one is automatically transformed into a racist, violent fascist. F**k The Police. All Cops Are B******s. Defund the Police. These sentiments clearly reflect legitimate anger and fear, but these sentiments are also myopic, dangerous and unfair. The fact that Derek Chauvin, George Floyd’s killer, had received 18 brutality and misconduct complaints over a 19-year career was stark evidence that changes must be made within law enforcement. As events have proven, there is no coherent reason for a department to continually release an unhinged, aggressive officer upon the population.

While changes must be made and enforced, it is naïve to call for the complete dismantlement of the police force. Since we just can’t keep our hands to ourselves, our society needs police. We are forced to submit to a cracked-out squad of Jiminy Crickets simply because we refuse to stop hurting each other; when we erase the necessity for Big Brother, Big Brother will cease to exist. Until that time, we must protest in ways that don’t lead to further bloodshed.

No one is saying that these current acts of violence should be ignored. However, there is a vast difference between peaceful protest and legislation change and mindless violence. Ruth Bader Ginsburg accomplished a lot with intelligence and calm determination. She is now lying in state. Valerie Solanas, who accomplished nothing, shot Andy Warhol as retaliation for sexism. She died of pneumonia on the street. There is a difference.

We are living in turbulent times. It’s up to us to decide where we go from here and how history remembers us. 2020 can be remembered as The Year of Disease and Hate. Or, or…2020 can be celebrated as The Year of Change. We’re running out of time to choose.

“Moderation in all things” is a concept practiced at Bourke Accounting. If your Bourke Accounting pro must engage with the IRS on your behalf, that pro won’t vilify the agent. Even if the laws are nonsensical, Bourke Accounting understands that no good will come from giving Ex-Lax brownies to the agent across the table.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

The year Ruth Bader Ginsburg made it to the Supreme Court, I had a hip, young, Converse-wearing math teacher. He delighted in telling his female students that we could be anything: if a door closed in our faces, we were made to kick it down, no man-made barriers could hold us back, the world was ours. After a particularly frustrating day of algebra, when I had decided to quit school and join the carnival, he put a hand on my should (in a non-sexual harassing way) and said, “It’s all right, Sue, we just gotta get you to a “D”. Girls don’t go in for math and science anyway.”

The saddest part was that he meant well. He tried to ease my angst by pointing out that women just didn’t “get” math, so I shouldn’t be so hard on myself. While he wasn’t mean-spirited, he was thoughtlessly demeaning. And his remark wouldn’t fly today because of the efforts of a dead woman.

Since Justice Ruth Bader Ginsburg’s death last week, we have been inundated with her resume and achievements – at this point, we know if she preferred two-ply or one. Because of this, I’m not going to rehash what she did for women, minorities and the fight for equality. I’m more interested in some very curious reactions to her passing.

It wasn’t surprising that Republican Rep. Doug Collins tweeted a callous sentiment regarding Justice Ginsburg’s history of defending women’s autonomy. Ah, yes, the people who care so much about what’s going on in strange wombs very rarely spare a thought to the sentient individuals once out of the womb (i.e. clinic bombings, doctor murders). No, no, we aren’t shocked when this caliber of person negates a woman’s entire existence simply because he would have preferred her to be quiet, demure and preferably close to the stove. What is passing strange is some other views on the matter.

For example, Erin Monahan, writing for Medium.com, denied Justice Ginsburg’s legacy, as well. Monahan wrote that she felt nothing upon learning of Justice Ginsburg’s death because Ginsburg “failed to advocate for all women.” Monahan continued by intimating that Justice Ginsburg will be responsible for any potential murders or assaults of Indigenous women as a result of a gas pipeline under the Appalachian Trail (J. Ginsburg ruled against environmentalists trying to stop the construction). After Monahan accused Ginsburg of sitting “happily on her capitalist throne,” she railed against the elitist, non-inclusive “white feminism” that was Justice Ginsburg. Furthermore, if you grieved at all for Justice Ginsburg, that simply “reveals internalized white supremacy” on your part. Well, duh! Ginsburg had it so easy! What with being both female and Jewish, she would have just been handed a spot on the Supreme Court.

Hey, Ms. Monahan, without people like Justice Ginsburg, you’d still have articles published, sure, but your editor would have put a “Mr.” in front of your name.

Ruth Bader Ginsburg made mistakes. However, her contributions far outweighed those mistakes. It is disingenuous to denigrate an illustrious life and career over not seeing eye to eye on every matter . Justice Ginsburg will serve as an inspiration and a glimpse into a better, equitable possibility.

Bourke Accounting hires women for positions of authority and responsibility. Bourke Accounting, unlike my math teacher, believes that women can do anything when given the opportunity. Why don’t you sit down with a Bourke Accounting bookkeeper or tax preparer and let them show you how it’s done?

Thanks for everything, Justice Ginsburg. You done good.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Sometimes, it’s good to show your political views. Going to the voting booth is a good way; donating money to your favorite candidate’s campaign is another. However, during these decisive times, passionately arguing for your side at social functions or at work should probably be avoided. Even at Bourke Accounting, where free expression is valued, we tend to avoid talk that is too political. Americans are sensitive at the moment and political discourse is capable of leading to – unintentional – hurt feelings and ill will.

While it may be ill-advised to voice your views during family gatherings, it seems that more people are desperate to share their particular position with the world. Recently, it’s been difficult to drive without being bombarded by scores of bumper stickers. With all of the conflicting views on display, one starts to experience a sort of dissociative identity disorder when out grabbing a gallon of milk.

Now, we are not only witness to stickers supporting Republicans or Democrats, but rather multiple, controversial topics: Pro-Mask, Anti-Mask, Black Lives Matter, Blue Lives Matter, Pro-Choice, Pro-Life…can’t we just go back to your kid being an honor student? Or, better yet, what about some nice Grateful Dead emblems?

So why this rise in car devaluation? Walter Goettlich, a doctoral student in sociology, suggests that when there’s a “feeling that peoples’ voices aren’t heard at a national or structural level,” (Rewire.org) we see an increase in individualized, public messages, like bumper stickers. When the world is screaming and we are hurting, it’s as though we are powerless to do anything but lend our voices to the cacophony. Think about it, when was the last time you saw a quiet prison scene in a movie? Or even a serene moment that took place in a mental institution? We are in Bedlam, bumper stickers included.

Problematically, a rise in bumper stickers could actually lead to more accidents and erratic driving. Psychologist William Szlemko performed a study in 2008 that showed people with bumper stickers are “16 percent more likely to be the aggressor in incidents of road rage” (ChryslerCapital.com). Crazy, right? However, Szlemko and his colleagues argue that, when a person puts her/his mark on a car, they are effectively marking their property and territory. Because of this, they are much more likely to react in a negative, aggressive way if they feel their territory has been violated (ChryslerCapital.com).

In addition to hostile drivers, our new wave of bumper stickers is leading to hostile pedestrians. For example, as early as 2016, a gentleman’s car was torched and vandalized with anti-That Guy in The White House graffiti. The burning Mustang’s only offense was having been accessorized with a Pro-That Guy bumper sticker. This instance was not the only one, sadly. Many people, on both sides, have experienced spray-paint, broken windows and slashed tires as a result of proudly acknowledging their political allegiance.

We deserve our freedom of speech. We also deserve to be left alone when we exercise it. Going to jail for destruction of property doesn’t get a point across in any logical way. We need to cast our votes and grow up! More so, we need to peacefully respect differing opinions – no matter how hard it is to do.

Bourke Accounting bookkeepers and tax preparers won’t judge your bumper stickers (the office doesn’t have a great view of the parking lot, anyway). In fact, your Bourke Accounting expert won’t judge anything about you. Bourke Accounting pros understand that there’s a reason they made chocolate, vanilla and strawberry and there’s room for all of us here.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H

Bookkeepers and tax preparers (like you’ll find at Bourke Accounting) fill a lot of different roles. Besides being financial experts, they are confessors, psychologists and peacemakers. Above everything else, they must be sensitive to their clients. However, tax pros can’t be too sensitive or else they’ll end up taking things personally – a customer with a large tax liability is capable of saying some hateful things.

As we’ve seen recently, the sensitivity line can be a little blurry. While we can agree that unarmed, incapacitated people shouldn’t be shot, that seems to be the only thing that gets the majority vote. Right now, America is divided between those who are willfully blind to injustice and those who believe that injustice is lurking in every aspect of everything. There must be a middle ground.

For example, a statement made by comic book creator Stan Lee has been making the rounds on social media again. In 2015, Sony rules regarding Peter Parker, AKA Spider-Man, were leaked. The guidelines stated that Spidey should remain a Caucasian, straight male (also included were rules prohibiting Spider-Man from using bad language, alcohol and needless violence) (TheGuardian.com). When asked about it, Spider-Man author Lee agreed with the rules saying, “I don’t see any reason to change the sexual proclivities of a character once they’ve already been established” (TheGuardian.com). What followed was a storm of accusations of racism and homophobia.

Yes, Stan Lee was a racist. Stan Lee was so racist that, in 1966, after reading an article about the Lowndes County Freedom Organization (also known as Black Panther Party) with some of his pals, Lee created the first Black superhero (Library.wustl.edu). Before the Black Panther film (with Chadwick Boseman as lead) was released, Lee was questioned about creating the character. Lee simply stated, “a good many of our people…are not white. You’ve got to recognize that you’ve got to include them in whatever you do” (Library.wustle.edu). Clearly, Stan Lee was ready for his white hood fitting.

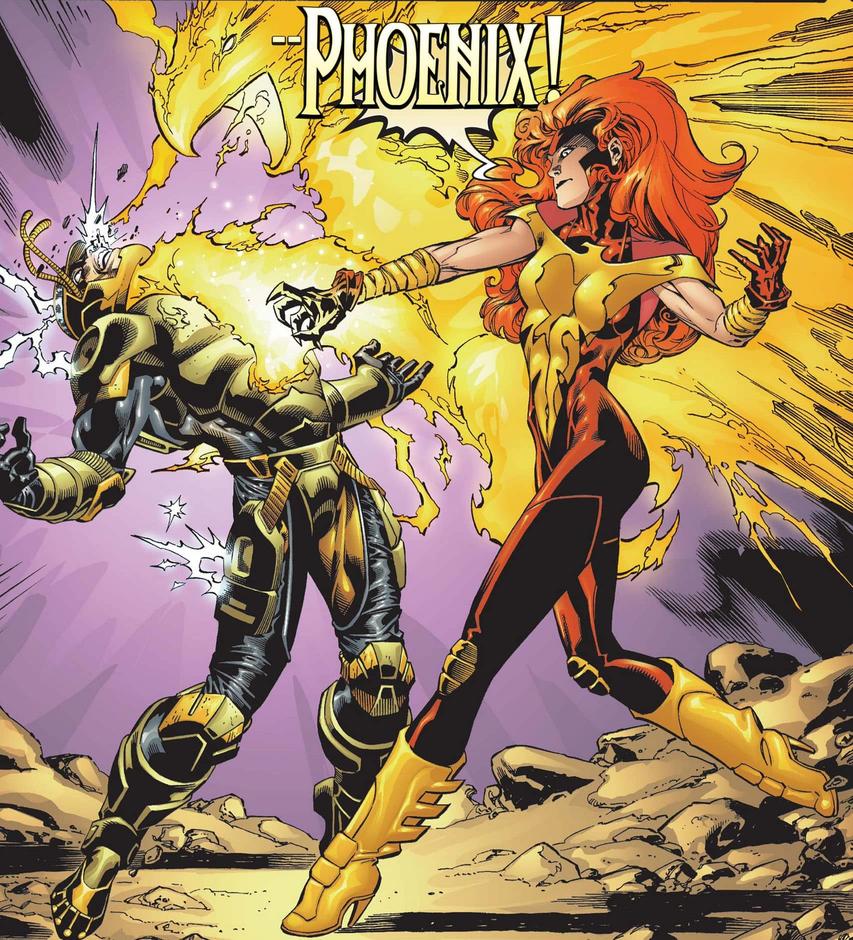

As if creating the first Black superhero wasn’t bad enough, in 1966, Lee was also responsible for introducing the world to the strong, wise, wheelchair bound superhero, Professor Charles Xavier. Professor X is the leader of a band of “mutant” heroes who, while being discriminated against, still save the populace on a daily basis. Among Prof. X’s X-Men are Beast, a genius who looks like a yeti and Jean Grey (AKA Phoenix, et al.), a fellow professor and, quite possibly, the most powerful of all the X-Men. So, while Stan Lee was a racist, he was also sexist and dismissive of the physically disabled. Yup, the evidence is evident.

When Stan Lee said Spidey should stay light skinned and straight, he wasn’t being homophobic or racist; he just didn’t understand why a familiar character should be re-written into something he isn’t. Lee further elaborated, stating, “The Black Panther should certainly not be Swiss…I say create new characters the way you want to. Hell, I’ll do it myself” (TheGuardian.com).

There are a lot of bad things going on that warrant protestation. Stan Lee and his inclusive superheroes are not among them. It would be disingenuous to revamp Spider-Man; if we can accept that Peter Parker was bitten by a radioactive spider, can’t we accept that he’s heterosexual, too?

Bourke Accounting bookkeepers and tax preparers are sensitive. Bourke Accounting pros are also thick-skinned enough to handle your tantrums. When you’re ready to stop raging against the IRS, you’ll find that your forgiving Bourke Accounting specialist is supremely qualified, too.

Rest in Peace, Mr. Lee

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

The Bourke Accounting website declares that we think “tax and accounting work is fun” and you are invited to come play with us. If you’ve ever sat down with a Bourke tax preparer or bookkeeper, you know that this is true; our staff likes to laugh. From the music that constantly plays to the sleepy dogs in the corners, we offer a casual and welcoming atmosphere – the Commes des Garcons suit jackets and tasteful art seem to be the only indications that you haven’t stumbled upon a hippie commune.

While Bourke is relaxed (and relaxing), don’t let appearances fool you. When it comes to their calling, our specialists are deadly serious. At the end of your consultation, your associate will have already figured out at least two options to maximize your benefits and keep you on the up and up. Oh, and don’t let those nice personalities be mistaken for weakness: if the IRS wants to play, Bourke welcomes them, too.

Since restrictions have eased, many of you might be considering traveling now. Before you cuddle up to unfamiliar animals, keep in mind that – much like Bourke associates – there are a lot of things in this world that aren’t exactly what they seem:

1) Platypuses. What possible danger could this mishmash of fuzzy, duck-billed, web-footed, egg-laying mammal pose? As it turns out, venomous platypus feet are a thing. When the platypus boys get in the mood, the spurs by their cute lil toes fill up with venom. Much like drunken guys at last call, male platypuses will fight for love. Platypus venom isn’t lethal to humans, but the neurotoxin in it drops the victim’s blood pressure, causes cold sweats, nausea and excruciating, long-lasting pain (Slate.com); the pain is so bad that our painkillers can’t even touch it. If stabbed by a platypus, your doc will inject you with local anesthesia and you’ll get to wait it out (Slate.com). The upshot is that sometimes a wave is better than a cuddle.

2) Flannel Moth Caterpillars. In Kentucky, we know the snakes that should be avoided, but we don’t generally think chubby, lumbering caterpillars can make us hurt. This is exactly the problem when considering the tribble-reminiscent flannel moth caterpillar. While they’re not hunting humans on purpose, their bodies are covered with “hollow, venom-filled quills” (Lawnstarter.com). Brush up against one of these loveable creatures and the contact can lead to severe pain, swelling and intestinal problems (Lawnstarter.com). Problematically, every person reacts differently: while one individual can experience discomfort, another can end up in the hospital with organ shutdown (Insider.com). It pays to remember that not every caterpillar is Alice’s harmless and stoned philosopher.

3) Slow Loris. Imagine the cutest, big-eyed Disney creature in the universe. Then imagine the creature with poisoned elbows (pictured above). This Asian native is the only known venomous primate that can cause your death (Popsci.com). When slow lorises are threatened, they raise their arms over their heads, dance around like a cobra, lick the crooks of their arms (to activate their venom) and bite. The venom contains around 200 volatile components and, just for fun, “the structure of the venom is not yet known” (Bioweb.uwlax.edu). In addition, it smells really bad. Without medical intervention, Gizmo could end you.

Before canoodling with a strange, adorable creature, it pays to do research. Likewise, before diving into a relationship with an unknown professional, you should examine credentials – not every pro is a Bourke pro.

Bourke Accounting bookkeepers and tax preparers don’t have time for IRS investigations. Because of this, Bourke Accounting experts keep it simple by following the rules. While you can share a laugh with your Bourke Accounting envoy, rest assured that the advice you receive will never come with poison elbows or venomous feet spurs.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.