My best friend in high school volunteered at a soup kitchen. Because she was my best friend, when she asked me to lend a hand, I agreed.

I’m not going to lie. When I first started, 14-year-old me was frightened by some of the people. There were folks with mental difficulties, some didn’t smell very good and some had clear drug addiction issues. Also, the people who ran the kitchen encouraged us to listen to customers who wanted to talk.

So, I did.

I learned patience, as some of the stories I was told didn’t make much sense. I learned empathy because the stories that did make sense were heart-breaking. I learned how to work hard. I also learned that just because these people were down, didn’t mean that they were out. I learned to treat people with respect, regardless of the amount of cash in their bank account.

In all, I was helped by helping.

Getting kids to volunteer is important. Of course, there is the mercenary reason that volunteer work looks good on a college application. Beyond that, Handsonmaui.com mentions studies that “show that children and teens who volunteer are more likely to do better in school, avoid engaging in risky behavior, and even graduate from college.” Finally, doing volunteer work shows children that the world does not revolve around them and that they have a responsibility to their community.

A lot of parents might not feel comfortable with their children volunteering at a soup kitchen and I understand that. However, there are many other volunteering options out there. Parents.com suggests that families volunteer together and offers a list of “10 Ways Kids can Help.” These are kid suitable choices that can really bring a family together.

For example, one recommendation is visiting nursing homes and hanging out with the elderly. This is volunteer work at its finest; no money required, just companionship. They also suggest helping at animal shelters (I couldn’t do this. I’d end up with 30 dogs before my second week).

Naturally, one shouldn’t force their child to volunteer – that would come across as a punishment for a crime the child doesn’t even remember committing. A parent should broach the subject of volunteering and make it a fun, bonding time.

Bourke Accounting associates give a lot of their free time to good causes. Sadly, when you have your tax preparation and bookkeeping needs met by one of our Bourke Accounting specialists, you will be charged. However, when you experience the level of Bourke Accounting’s professionalism, the double-checking, the endless questions in your best interest, you will feel that you have been the recipient of an altruistic, national charity.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I have never been to prison (Tim and Bill were shocked, too!), but from what I’ve read, it’s not a very nice place. All the documentaries on TV really paint prison as the ultimate uncomfortable living situation: one must constantly meet new people, there is no autonomy regarding bedroom décor and, you know, sometimes one gets stabbed with a sharpened toothbrush.

While reading The Kiplinger Tax Letter recently, another drawback of prison living was brought to my attention: filing tax returns. Kiplinger mentioned “an ex-basketball player in prison for running a Ponzi scheme [who] got a big pension payout from the NBA.” The ex-basketball player said that he couldn’t file his return, as “he had no access to his tax records.”

Kiplinger didn’t mention the ball player’s name and, since I am a bit of a yenta (and not a big sports fan), I looked around the Internet a bit.

It turns out that the gentleman’s name is Claude Tate George and he was a player for the New Jersey Nets and Milwaukee Bucks. In 2013, according to Courant.com, George was sentenced to nine years after being found guilty for a real estate Ponzi scheme “in which investors lost $2.55 million.”

Also, in 2013, “the NBA paid George a $208,111 pension distribution” (Marketwatch.com). When George didn’t file a return that year, “IRS officials took it upon themselves to file the return.” Eventually, the IRS said that George “had a $28,696 unpaid tax balance.”

George appealed, saying that if he had done his own return, he could have shown deductions that the IRS wasn’t aware of. Strangely, the Internal Revenue Service wasn’t sympathetic and the decision regarding his unpaid tax stood, complete with penalties.

Most incarcerated people won’t experience the same situation. In general, most incarcerated people won’t have to file a tax return at all, as prison jobs don’t pay enough to warrant one. However, as the Malta Justice Initiative points out, if the inmate is “receiving other forms of income from investments, income earned before [being] incarcerated” or filing a tax return with a working significant other, a return would need to be filed.

From all that I’ve been reading about filing from prison, Claude Tate George didn’t make a very strong argument. Most state penitentiaries offer free tax forms, enough jailhouse accountants to fill, well, a jail and mail service. Furthermore, most states allow visitors to bring tax forms for an inmate’s signature.

Don’t go to prison this tax season. But, if you happen to find yourself in a precarious jail-ish position, your Bourke Accounting professional is there for you. I’m not saying that your Bourke Accounting associate will love visiting you at the Blackburn Correctional Complex, but they will. If you did something, let’s say, untoward, your Bourke Accounting tax preparer doesn’t want you to compound it with IRS troubles, too!

Come see us any time (you’re on the outside). Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

My brother couldn’t sleep. When we were kids, he would wake me up in the middle of the night and request that I tell him stories until he could. I think I started writing because of my insomniac brother.

There is nothing worse than having a sleepless night. The rest of the world slumbers in peaceful oblivion and you’re left behind, staring at the ceiling.

Maybe you’re worried about all the things you have to do at work tomorrow. Maybe you have a condition that causes you pain. Maybe someone said something rude to you and you just can’t let it go (after-the-fact, middle of the night “I wish I had said that” comebacks drive us all insane). No matter what the reason, insomnia is evil. The next day, you don’t only feel tired, you feel angry, nauseous and just not all together together. Like the insomniac narrator in Fight Club said, “when you have insomnia, nothing’s real. Everything is far away. Everything is a copy of a copy of a copy.”

I have it on good authority (my mom) that one way to combat insomnia goes like this: if you are unable to fall asleep within 15 minutes, get up, go to another room with soft lighting and read a book. Don’t turn on the television or any sort of music. Reading a book will take your mind off the irritating things of the day and, hopefully, calm you. You don’t want to watch television or play on your iPad because, as Sleep.org tells us, “electronics emit a particular type of blue light that is capable of triggering the brain to stop making melatonin.” Melatonin, if you didn’t know, is a neat little hormone that helps you sleep.

I stay in bed when I can’t sleep. I take deep breaths and picture a blank wall (I usually color it a gentle hue). I pretend that I’m in an art gallery, actually. When thoughts about work or my infuriating boss (Hi, Bill!) intrude, I visualize velvet ropes and focus on the blank wall. I keep distressing thoughts at bay and give myself a self-esteem boost by being a virtual VIP.

Of course, there’s also warm milk. It’s not just an old wives’ tale that warm milk helps people fall asleep. Tuck.com informs us that “milk contains tryptophan.” You know when you get tired after Thanksgiving dinner? Yup, the same chemical present in turkey is also in milk, warm or cold. So before you try Tylenol PM, give a nice glass of milk a try.

There is a myriad of things that can keep you up at night. However, if you meet with one of our wonderful Bourke Accounting specialists, at least one of those things can be taken off your Hit Parade of Stress. Seeing a Bourke Accounting associate means that you won’t have to worry about your financial affairs. Our Bourke Accounting experts won’t tuck you in at night (well…), but knowing that your bookkeeping and accounting needs are in very capable hands should give you some very restful nights.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon and pleasant dreams!

Written by Sue H.

I wanted to buy a motorcycle this year.

I had visions of being Dennis Hopper in Easy Rider – the wind in my hair, that outlaw sense of freedom, giving curt nods to people walking down the street. It was going to be awesome.

There are two reasons why I cannot buy a motorcycle this year:

1) I don’t know how to ride a motorcycle.

2) My mother won’t let me (I like her a lot, she threatened to disown me and she kind of scares me).

With that in mind, and in the spirit of sour grapes, here are some reasons you, too, should avoid purchasing a motorcycle this year:

1) Depreciation. According to Brainbucket.rumbleon.com, “a brand-new motorcycle’s value drops nearly 20 percent during the first two years of ownership and this figure doesn’t even include mileage or overall condition.” It doesn’t matter how well you have maintained your bike, that value is just going to drop, and you can’t stop it. Another thing that can affect the depreciation is the number of models that were made, Motorcyclehabit.com tells us. Lots and lots of bikes means less and less money for you if you decide to sell it.

2) Bugs. It’s a beautiful summer day, you’ve been riding for a few hours. You think a few bugs have hit you, but you are not aware of the damage, so you stop at a diner. You smile coolly at the server. The server recoils in horror. You’re an attractive person, but you have the entire entomological stratum lodged between your teeth. We’re talking wasp wings, bee legs, maybe even a butterfly proboscis or two. Is that a dragonfly stuck to your forehead? Kentucky doesn’t require helmets, but if if you’re in a state that does, then you just laid an insect cemetery of protective headwear right down where you are about to eat a grilled cheese and bacon. Gross.

3) Weather. If it’s too hot, you’re going to be a sweaty mess by the time you get to work. If it’s too cold, you could be suffering from hypothermia and frostbite during the Tuesday staff meeting. Oh, and if it rained during your morning commute? Your socks are going to squish all day. No one is going to hang out with you during breaktime because now you’re The Weird Squishy Sock Person.

Like I said, if I can’t have a bike, no one else should have one either.

However, if you are one of those people who bought a motorcycle this year, you will still be welcomed at Bourke Accounting. There is plenty of parking and I will even offer you a piece of Big Red gum to cover up that bug breath. Our Bourke Accounting experts can’t change the downward spiral of motorcycle depreciation, but they can offer advice to make up the financial difference. While I don’t condone the purchasing of motorcycles, talk to Bill about one. I have a sneaking suspicion he’s one accountant who has a leather jacket hiding behind the sweater vests.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

What was the last comedy you watched?

Are you a 40-Year-Old Virgin fan? Or did you watch Blazing Saddles on an old movie channel? Maybe you like Girls’ Night Out. What about stand-up comedians like Richard Pryor, Robin Williams and Chris Rock?

No matter what flavor you prefer, it’s good to laugh.

Scientists, psychologists and numerous websites tell us this. Laughing can help our immune system, our mental well being and even our hearts (according to Helpguide.org).

Whatever it is that tickles your funny bone, you would be missing out on quite a few laughs if not for Lenny Bruce.

Lenny Bruce wasn’t just a dirty mouthed 1950s historical figure: he was an activist and satirist. He was a writer and the vanguard introducing a new way for Americans to get their chuckles. Yes, he used some four-letter words, but Lenny Bruce helped to change the face of comedy. After listening to quite a bit of Lenny Bruce (and reading his 1967 released “How to Talk Dirty and Influence People”), he was clearly ahead of his time. No offense, Henny Youngman, but it’s hard to laugh at “Take my wife – please,” when there’s a counterculture rebel on stage.

Not only did Bruce talk about the hot-button issues of the time (including racism, sexism and the draft), he was an introspective poet with a hatred for censorship. During the turbulent ‘50s and ‘60s, Bruce reflected the changing social mores of the people.

Well, some of the people, anyway.

Lenny Bruce was often arrested on obscenity charges. His performances were called, by a New York State court in 1964, “obscene, indecent, immoral and impure” (CBDLF.org). That was just before being sentenced to 4 months in the workhouse (Wikepedia.com).

Sadly, before his unexpected death in 1966, Bruce seemed to lose the thread. Instead of making his audience think and laugh, he became obsessed with his numerous court cases. This is very apparent in “How to Talk Dirty…”. While some funny anecdotes and social commentary are in residence, a lot of his book tends to revolve around his court concerns. In addition, his stand-up routines began to swirl around his legal difficulties.

Lenny Bruce was and continues to be a national treasure. So much so that, in 2003, Governor George Pataki (NY) gave Bruce the “state’s first posthumous pardon.” Pataki called it “a declaration of New York’s commitment to upholding the First Amendment.” [MTSU.edu]

Bourke Accounting associates are funny (you should hear some of our weekly meetings). And if you get to know them well enough (and ask nicely), some of their humor can border on the blue. However, no matter what is going on in the world, our Bourke Accounting experts are through and through professionals; their biggest concern and priority is you. Bourke Accounting pros never lose the thread.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I don’t have to tell you that the holiday season is upon us. We have already tolerated the same 3 Christmas songs on a mind-bending loop as we have struggled through the mall (and every other public space). We have donated to well-meaning Santas collecting for well-meaning causes, we have bought some nice things for people we know very well.

And then, of course, we have run, face first, into a familiar obstacle: what do we give to people we don’t know very well?

Whether it’s a gift for a co-worker we’ve exchanged a single sentence with or for a distant cousin we’ve only met twice, we’re in trouble. How can we possibly know what is an appropriate gift for someone we don’t really know?

There are some gifts that we know aren’t appropriate. For example, we’re not going to give Shelly-I-Don’t-Know-Her-Last-Name in Accounting a puppy. Also, we know to avoid [Blank] of The Month Gifts. That first shipment of Granny Smith apples will be appreciated; 6 months later, that pile of kumquats on the table and the fruit fly infestation won’t be. Finally, underwear. No, no, no, we’re not giving intimate underclothing to our mail carrier (at least I’m not).

So. Where does that leave us?

Well, that really depends.

If you’ve had a conversation about books with your doorman, a gift card to Carmichael’s Bookstore isn’t a bad idea. Likewise, if you’ve spoken about craft beer, a six-pack with a bow is thoughtful. We’re not trying to fulfill lifelong dreams with these presents; we’re simply telling the recipient that they are appreciated.

A lot of people find scented candles a nice, innocuous gift. There is really nothing offensive about a Holiday Evergreen Cinnamon Surprise candle, after all. Also, scarves, gloves and coffee mugs are okay. Anything a person can use on a day-to-day basis makes a nice gift (I would avoid toilet plungers, though. Useful, yes. Kind of gross, totally).

When buying for a virtual stranger, I would suggest that you learn at least one thing about the recipient to make the gift a bit more personal. Does Marie in Sales only wear neon colors? Hey, look! Here are some retina-scratching neon bangle bracelets! Paul in bookkeeping talks about Harry Potter all the time. Wouldn’t he just love this Hagrid bobblehead for his desk?

You don’t have to buy your Bourke Accounting associate gifts – your smiling, shining faces this season are the only presence required (I know, I know. I couldn’t resist). However, the gift our Bourke Accounting experts will give you will benefit you throughout the year. Not only will our Bourke Accounting professionals make sure that you stay financially solvent, they will take the time to answer any questions you may have. And let me tell you, the personalized service you receive from your Bourke Accounting specialist will outshine any candle you receive from Rhonda in Project Management.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

The Holidays are coming.

As most of us are wading through crowds at the mall and looking online for impossible presents for that impossible cousin, I’d like to pause for a moment to pity all of the business owners out there.

Not only do business owners have to think of clever gifts for their families, they also have an extra, ill-defined figure to worry about: The Client.

Business owners know that it makes good sense to give gifts to clients; they want to demonstrate to the client that their business has been appreciated. Not only that, a good businessperson wants to make sure that the service they offer is in the forefront of a client’s mind. So, when Grace’s toilet backs up, she’ll look at that lovely bouquet that Joe Dokes Plumbing gave her and who do you think she is going to call?

While it’s great to be looked upon as grateful and generous, as a business owner, you have to be a little conservative. That is, if you’d like to survive until next year. The IRS only allows you “to deduct no more that $25 of the cost of business gifts you give directly or indirectly to each person during your tax year.” That means, if you were to buy Client Ted a ticket costing $165 for San Francisco’s Beach Blanket Babylon, you’d have a loss of $140. Even though you paid $165, you would only have that $25 as a deductible expense. 25 bucks seems like a fairly paltry sum, right? That could be because, according to Nolo.com, it was established in 1954. Hey, in 1954, 25 dollars was a pretty good amount of money!

In the old days (as in 2016), if you were to accompany Client Ted to Beach Blanket Babylon, you would have been able to deduct 50% of that monetary amount (as long as you talked business a bit). However, with the new Tax Cuts and Jobs Act, Marketwatch.com advises us that, “starting in 2018, the costs of entertainment expenses will no longer be deductible.” Even dinner is a gray area if you don’t talk business all evening. And I do mean all evening.

As a business owner – and this sounds mercenary – you have to prioritize. If you haven’t worked with a client for 3 years, why send that meat and cheese gift basket from Harry & David? However, if Client Ted put thousands of dollars into your coffers this year, maybe that $140 Beach Blanket Babylon ticket loss is well worth it.

Whether you have enough clients to fill a teacup or enough clients to fill the entire dimensions of an airplane fuselage, you have to know what sort of gift giving works for you and your budget. Bourke Accounting associates can help you this holiday season. While they want you to continue to be financially solvent, they also understand Plautus’ belief that “you must spend money to make money.”

Our Bourke Accounting experts not only can help you with you accounting and bookkeeping needs, they can offer solid advice regarding appropriate gifts to bestow upon your clients. Bourke Accounting can analyze what would work in the long run as you show gratitude and keep your head above water in the process.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

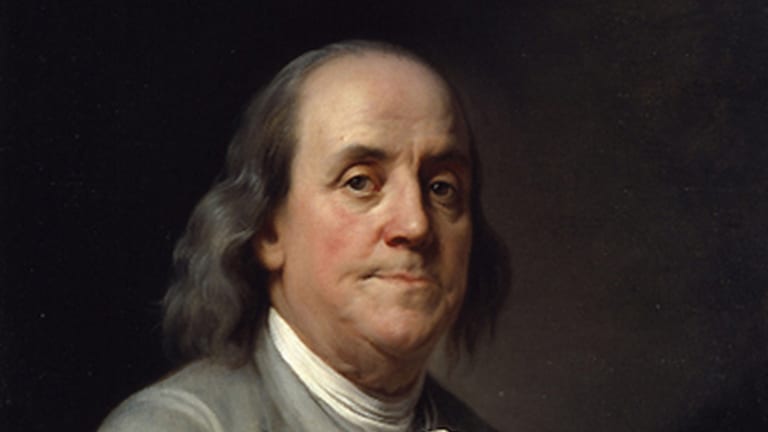

We learned about Benjamin Franklin in grade school; keys, lightning and the Declaration of Independence. We were taught his pithy and interesting quotes – my favorite is “Three can keep a secret, if two of them are dead.”

Our 3rd grade teachers informed us, with great pride, that Benjamin Franklin was a patriot, writer, newspaper man, inventor and ambassador.

Benjamin Franklin was like a wise and cuddly uncle, sternly, but lovingly, looking out from the pages of our paper bag covered history books.

He was quite an accomplished person during the dawn of a new and rebellious country.

Besides his many achievements, Benjamin Franklin also liked older women, younger women and esoteric secret societies.

Oh, and he enjoyed sitting naked in front of open windows, in clear view of neighbors (Listverse.com). He said it was because fresh air was good for the health, but I question if that was his only reason.

While Benjamin’s membership in the Freemasons wouldn’t have been such a big deal in 1730, being a member of the Hellfire Club probably might have been frowned upon.

Depending on the source, the Hellfire Club was either a place guys went to get drunk with their mistresses or something a little more sinister. Weebly.com alludes to members being engaged in occultism, sacrifice and um…very exotic practices with a lot of people in their birthday suits.

Franklin’s membership in The Hellfire Club, also known as the Medmenham Monks, is debated. According to Ranker.com, “his actual membership cannot be confirmed or denied, [but] historians point out Franklin had close friendships with some of the club’s most notorious members.” I’m not going to say Ben was involved, but I’ll put it this way: everyone I know who likes to play sports tends to play sports with other people who like to play sports.

And the ladies! Oh, my, Ben sure did like his ladies. Biography.com mentions how he often extolled the virtues of older ladies, as they’ll take care of you when you’re sick and, “you can’t really tell who’s old or young when you’re in the dark.” However, this is not to say that Ben didn’t like the younger ladies, too. It’s rumored that he fathered somewhere around 15 illegitimate children (Ranker.com).

I like a story, so I always did well in history class. Looking back now, though, I think I would have done better on my tests if the truth had been taught. When you truly learn about historical figures, warts and all, they become more interesting. They become more like real people and not just noble effigies of a forgotten time.

I really hate to disappoint everyone, but in 100 years, Bill and Tim are not going to be associated with any naughty clubs or acts. The gentlemen at the helm of Bourke Accounting are utterly professional. While they can unravel any sort of tax mishaps you might encounter, our Bourke Accounting tax professionals will never be implicated in anything close to misbehavior. Now, our amazing Bourke Accounting bookkeepers? Well, they might be another story. Why don’t you come meet them, too, and find out?

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I know you are all law-abiding citizens.

You are about as likely to underreport your income this tax season as you are to take a jacuzzi with a plugged-in toaster.

However, sometimes accidents happen (and I don’t mean with toasters). Maybe you moved, forgot about the few months you worked a temp job last year and never received that W-2. So, you file your return, in good ignorant faith, and now the IRS says you have some explaining to do.

While it’s highly doubtful you’d see the inside of Folsom Prison for this oversight, it could cause you more than just a little headache.

First off, the Internal Revenue Service will catch this unreported income. They use a dandy little tool called the Information Returns Processing system (IRP). According to Debt.com, “this is a huge database that reviews the earnings you report (or don’t report).” The IRS compares what you say you earned to “the information third parties provide.” These are going to be banks, your job, pension services, etc. And here’s the neat thing: if something doesn’t quite add up, an IRS agent is going to be a little curious.

You don’t want a curious IRS agent.

For a mistake like the scenario above, chances are that you’d “likely be forced to pay the correct amount of taxes owed, as well as a penalty” (Sapling.com). Okay, that’s not great, but not the end of the world, either.

But, wait! What if the scenario wasn’t just an innocent teeny whoopsie? What if (and I know you wouldn’t do this) you intentionally set out to file a fraudulent tax return? What if you deliberately “forgot” a whole lot of income?

Hey, have you met Al Capone?

According to Sapling.com, “people who do not report income on their taxes seldom end up in jail.” However, it certainly does happen. Not only to Al, but Leona Helmsley, Wesley Snipes and a slew of reality television stars. The biggest consideration to the IRS seems to be intent. Accidents can be forgiven with a little money; deliberate “accidents” can be forgiven with a lot more money and a few years of your life.

If the worst case happens and you do find yourself being audited, the great thing about Bourke Accounting experts is that they aren’t intimidated by a curious IRS agent. Of course, Bourke Accounting professionals have a healthy respect for the IRS, but intimidated? No. They are willing to give it their all to protect you from a 6X8 extended stay residence. Having intelligent warrior accountants like the ones you’ll find at Bourke Accounting can really improve the view.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I once worked with a crew that, to put it mildly, had dirty mouths. However, we had worked together for years and we knew what we could and couldn’t get away with. One of us would say something improper and someone else would inevitably shout: HR Nightmare!

I once worked with a crew that, to put it mildly, had dirty mouths. However, we had worked together for years and we knew what we could and couldn’t get away with. One of us would say something improper and someone else would inevitably shout: HR Nightmare!

We had fun. Of course, it wasn’t G-Rated and work appropriate, but it was fun. We were all adults, we got our tasks completed and no one left with hard feelings.

We’ve already talked about what an employer can’t ask during a job interview. However, the interview is just the first step. As an employer, you also have to recognize boundaries once that person is a part of your team. Employees, too, must recognize what is appropriate to say to an employer.

As the employer, you know that you shouldn’t comment on an employee’s personal appearance. Unless the employee is breaking a dress-code rule, any mention of appearance is generally frowned upon. You might have the best of intentions, but your compliment might be misconstrued as flirting. The same rules apply as an employee. Although you might think it’s funny to make your boss blush by talking about how that sweater makes s/he look sexy, you could be making that person incredibly uncomfortable. Basically, unless someone has broccoli stuck in their teeth, don’t mention anything regarding physicality.

Another thing to avoid talking about is the wild time you had last night. Your boss does not want to know who you took home and what happened later. You might be very proud of yourself – and good for you! – but, I promise you, the person you’re relating this information to is cringing. This is not your friend or your diary. In these sensitive times, you should be aware that you are opening yourself to a lawsuit by graphically describing your exploits.

Finally, know your audience. If you’ve worked beside someone for 15 years, fell into each other’s arms at the company Christmas party and sympathetically cried over each other’s divorces, you can probably get away with a dirty joke or two. Chances are, this didn’t happen with most of the people you’re working with. Until, and unless, you really get to know your workmates, keep things on the emotional and verbal level of a soft drink.

Bourke Accounting associates are not saints (I’ve heard some of Bill’s jokes). However, Bourke Accounting associates are professionals. If you come to see one of our experts and happen to drop a 4-letter word, no one will give you the evil eye. Our Bourke Accounting professionals can accommodate you. Whether you are someone who swears with every breath or more along the “Gee, Whillikers” variety, our Bourke Accounting specialists will make you feel completely at ease while they address all of your bookkeeping, taxation and payroll needs.

Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.