What’s happening now

IRS web-sites. The IRS is establishing two web sites. One to help ensure you will get your Child Tax Credit if you are a non-filer and a second one to opt out of the monthly payments. Both can be accessed from the following IRS webpage;

The monthly payments are automatic. Beginning Mid-July you will begin receiving payments for ½ of your projected 2021 Child Tax Credit if:

- You filed a 2019 or 2020 tax return and claimed the credit. OR

- You gave information in 2020 to receive the Economic Impact Payment using the IRS non-filer tool. AND

- The IRS thinks you are eligible. AND

- You did not opt-out of the early payments.

The Opt-out option

Not everyone should look forward to receiving payments each month for ½ of their Child Tax Credit. Here’s why;

You do not qualify for the credit. The IRS is using past tax returns to estimate who should get advance payments of this credit. They are going to often be wrong. If your 2021 income is too high, you may need to pay back the advance payments when you file your tax return.

You need the large credit. If you use this credit to balance out your year-end tax bill, you may find yourself owing money at the end of the year. If the early payments are gone, this could create a tax bill hardship. For example:

With two kids you might be eligible for a $6,000 credit, with $3,000 paid to you in advance. When you file your tax return in April 2022, your unclaimed credit on the return will be $3,000 (you already received $3,000). Last year your tax return credit was $4,000. If you saved some of the advance payment, you will not have a problem. If it is spent, you now have $1,000 less of a credit to offset your other income on the return and may have to come up with some cash to pay your tax bill.

Your circumstances change. If your tax life changes, advance payments of the credit will complicate things. For example, if you are in the midst of a separation or divorce, the advanced payments could become a big conflict.

Action to take NOW!

Look for notices. The IRS is sending out notices in the mail to those they think should receive the Advance Child Tax Credit payments. If you have not received one, the IRS may not think you should receive payments. So follow-up to ensure you are on their radar by reviewing your most recent tax returns (2019 and 2020). But don’t fret, if you are owed the credit you will receive it when you file your tax 2021 tax return.

Opt-out. The Opt-Out portal is new and recently set up by the IRS. So if you do not want the early Child Tax Credit payments go to this site immediately and opt-out of the payments. No one is sure how efficient this will be, so you need to stay on top of this.

Keep track of payments. You will need to know how much you receive in advanced payments when you file your tax return next year. Do not assume the IRS is going to accurately keep track of this for you.

Forecast the impact. Moving from $2,000 to as much as $3,600 per child is a big change in most families’ tax bill. Know what the change does to yours and look to adjust withholdings to account for this change.

It is fully refundable. Finally, remember the Child Tax Credit is now a fully refundable credit. So if you know of anyone that does not pay income tax and has children, tell them. The new Child Tax Credit may be helpful to them.

If you need any help drop by Bourke Accounting or give us a call at 502-451-8773.

The American Rescue plan signed in March, 2021 requires the IRS to pay out ½ of enhanced Child Tax Credits (CTC) to eligible taxpayers beginning this month. A tall order, and one filled with land mines. If you have children or know of anyone who has children, here is how you can help:

What’s happening now

IRS web-sites. The IRS is establishing two web sites. One to help ensure you will get your Child Tax Credit if you are a non-filer and a second one to opt out of the monthly payments. Both can be accessed from the following IRS webpage;

The monthly payments are automatic. Beginning Mid-July you will begin receiving payments for ½ of your projected 2021 Child Tax Credit if:

- You filed a 2019 or 2020 tax return and claimed the credit. OR

- You gave information in 2020 to receive the Economic Impact Payment using the IRS non-filer tool. AND

- The IRS thinks you are eligible. AND

- You did not opt-out of the early payments.

The Opt-out option

Not everyone should look forward to receiving payments each month for ½ of their Child Tax Credit. Here’s why;

You do not qualify for the credit. The IRS is using past tax returns to estimate who should get advance payments of this credit. They are going to often be wrong. If your 2021 income is too high, you may need to pay back the advance payments when you file your tax return.

You need the large credit. If you use this credit to balance out your year-end tax bill, you may find yourself owing money at the end of the year. If the early payments are gone, this could create a tax bill hardship. For example:

With two kids you might be eligible for a $6,000 credit, with $3,000 paid to you in advance. When you file your tax return in April 2022, your unclaimed credit on the return will be $3,000 (you already received $3,000). Last year your tax return credit was $4,000. If you saved some of the advance payment, you will not have a problem. If it is spent, you now have $1,000 less of a credit to offset your other income on the return and may have to come up with some cash to pay your tax bill.

Your circumstances change. If your tax life changes, advance payments of the credit will complicate things. For example, if you are in the midst of a separation or divorce, the advanced payments could become a big conflict.

Action to take NOW!

Look for notices. The IRS is sending out notices in the mail to those they think should receive the Advance Child Tax Credit payments. If you have not received one, the IRS may not think you should receive payments. So follow-up to ensure you are on their radar by reviewing your most recent tax returns (2019 and 2020). But don’t fret, if you are owed the credit you will receive it when you file your tax 2021 tax return.

Opt-out. The Opt-Out portal is new and recently set up by the IRS. So if you do not want the early Child Tax Credit payments go to this site immediately and opt-out of the payments. No one is sure how efficient this will be, so you need to stay on top of this.

Keep track of payments. You will need to know how much you receive in advanced payments when you file your tax return next year. Do not assume the IRS is going to accurately keep track of this for you.

Forecast the impact. Moving from $2,000 to as much as $3,600 per child is a big change in most families’ tax bill. Know what the change does to yours and look to adjust withholdings to account for this change.

It is fully refundable. Finally, remember the Child Tax Credit is now a fully refundable credit. So if you know of anyone that does not pay income tax and has children, tell them. The new Child Tax Credit may be helpful to them.

Randomly, someone will ask for my Facebook username. When I respond that I’m not on Facebook, I am met with a look that suggests that I might be a visitor from another dimension. Likewise, people find it odd that I work for Bourke Accounting and distrust the stock market. To me, there is no difference between high stakes Vegas roulette and stock trading. Even if you know a company and have tracked its progress for years, it’s still a gamble; all it takes is a CEO’s indictment or a natural disaster and the stock is worthless.

Much like my distaste for Facebook (and the broken relationships and altercations caused by the platform), I realize that my avoidance of the stock market isn’t completely logical. Generally, if you know what you’re doing, have a good financial professional in your corner and don’t do anything too risky, it’s possible to create an impressive portfolio. However, that important detail of understanding what stock trading entails is ignored by some new investors.

Studies have discovered that Millennials have gotten involved in the market in a big way, with nearly seven in ten currently invested in something (NYPost.com). While it’s great that this generation is planning ahead, it doesn’t always end with young investors sailing off into the sunset on a brand-new yacht.

On June 12th, the parents of 20-year old Alexander Kearns found a post-it note inviting them to turn on his computer. On the computer, they found a suicide note. Kearns had been using Robinhood, a trading app, and, when he saw a negative cash balance of $730,165 (CNBC.com), he did something very rash. In his note, Kearns questioned why Robinhood would allow a kid with no income to become so heavily in debt. Kearns also admitted that he had no idea what he was doing (Businessinsider.com). To make a tragic story worse, Kearns didn’t understand what he was looking at. While Robinhood can’t give the details of Kearns’ account, he didn’t owe almost a million dollars; his balance was “due to complex options trades,” which would have settled over the following days, but left a temporary balance in the meantime (Businessinsider.com).

Kearns’ family has vilified Robinhood for not offering an explanation or customer service options when Kearns received the negative balance notification (Businessinsider.com). In addition, Robinhood has been accused of making an app that resembles a video game as opposed to a stock trading tool with real-life repercussions. For example, every time a trade is completed, users get a little party, complete with confetti shooting all over (Kiplinger.com). Regarding customer service, users say that they’ve waited weeks for an answer in the Help section, it’s nearly impossible to get a person on the phone and emails go unanswered (Businessinsider.com). While a seasoned trader could probably get by with this level of customer service, rookies like Kearns are left to flounder in the dark.

People shouldn’t expect to get rich overnight with the stock market. People should also know the very real risks associated with trading. Finally, new traders shouldn’t try to learn by trial and error – it never hurts to contact a professional with any problems. Perhaps the most disturbing factor of Alexander Kearns’ story is that, had he just asked questions, he wouldn’t be a cautionary tale now.

Bourke Accounting experts are no strangers to the stock exchange. While Bourke Accounting pros aren’t stockbrokers, they can explain the terms and implications to those just starting to invest. In addition, your Bourke Accounting tax preparer can help you to choose the right investment product for your unique situation. And, no matter what, remember that you’re a lot more important than the numeric value on your bank statement.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

No one likes to think about what would happen to them if rational decision making was no longer possible. An accident or the evil march of time can steal more than our physical mobility. At Bourke Accounting, everyone has a plan to make sure that their wishes are honored in a worst-case scenario (except for me, but I’m still pretty sure that I’m indestructible). While having a will is an important first step, it’s not the only step. Documenting what you want to happen after you’re gone is great, but what if you haven’t quite left the building yet?

Recently, I came across a weird article about the “Free Britney Spears Movement.” I assumed that Ms. Spears was facing arrest after maybe attacking another car with rain gear, but it’s more complicated than that. Beginning in 2007, Spears started to lose the thread – divorce, publicly shaving her head, losing her kids and ending up in rehab/psychiatric hospitals made for a few bad years. Because of her erratic behavior, Spears has been “held under a conservatorship since 2008,” with her father, Jamie Spears, originally appointed as sole conservator (Elle.com). Her father, who petitioned the court, has testified that she is suffering from early onset dementia (Yourtango.com), which, of course, could be a side effect of being sold to the Disney Channel at age 11.

If you don’t know, a conservatorship is a “form of legal guardianship of an adult” (Smartasset.com). These are granted when the courts decide that a person no longer understands what’s going on, can’t take care of basic needs and might harm her/himself or others. While there are a few different types, Spears is under a temporary (yeah, 12 years temporary), financial conservatorship, meaning that it’s meant to last for a specific time period and that she has no control over her estate or financial and personal assets (Businessinsider.com). As she is worth millions, Spears’ fans believe that the fair princess is being held captive by her nefarious and greedy father.

So now, as the stunning result, there are fans brandishing “#FreeBritney” signs outside of courthouses. As the internet is pure logic incarnate, fans are convinced that Spears is begging for help using hidden messages in her social media posts; they are decoding them and many have come to the conclusion that she is being held captive, as well as being trafficked (Yourtango.com). In one TikTok post, Spears twitches in and out of frame, twirls around and looks somewhat unhinged. Seriously, at any time, you expect her to turn into the scary little dead girl from The Ring. I’m sorry, Britney, but the others will have to save you – I’m just not understanding your message.

The Spears Saga is indicative of the importance of future planning. As Spears is experiencing, someone she wouldn’t have chosen has had power over her daily life for years. Don’t think this couldn’t happen to you if you fail to make decisions now (you know how your little brother spends all of his money on Hot Wheels cars? Yeah, he could be making your stock picks). Before the court makes a choice for you, it’s important that you have Power of Attorneys in place. A Medical POA will allow someone to decide how your medical treatment goes; likewise, a Financial POA will give a certain sober someone the authority to handle your cash and assets. And remember, you must be of sound mind to sign a POA, so avoid the rush and plan your future today!

Your life is your own. If you want to be extra-special sure that it stays that way, plan ahead. Not only will this protect your interests, it will ease the burden for your loved ones – no one wants a knock-down drag out in the emergency room.

Bourke Accounting experts can’t protect your from falling anvils, but they can offer you financial guidance. Besides being extraordinarily knowledgeable, Bourke Accounting pros have the sensitivity and time to act as a sounding board. Bourke Accounting specialists won’t make up your mind for you, but they will make all of your decisions a lot clearer.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I just realized that I have never gotten an internal parasite from eating lunch at Bourke Accounting’s weekly staff meeting. As internal parasites are one of my greatest fears (2nd only to bedbugs), I am pleased by this streak of good luck. However, since some of you may be traveling this summer, I decided that a public service message was in order. So, for everyone hitting that open road, here are three hitchhikers to avoid picking up:

1) Tapeworms. Tapeworm infections aren’t common in the US; the CDC estimates that fewer than 1,000 people are infected each year (Health.com). Since the longest worm ever found in a human was 82 feet long, it pays to be careful, though (Healthfacts.blog). Tapeworms may enter our bodies if we eat the undercooked meat of an infected animal. Then, they set up camp to share in our dinner plans. Interestingly, tapeworms have evolved their craft to the point where they, generally, don’t cause many symptoms; “when they do, it’s usually a stomachache, diarrhea or weight loss” (Health.com). If the worm and the human are able to get along, the worm lives “for up to a few years” (Health.com) and dies, whereupon the human’s body either absorbs the dead critter or passes it. However, the pork tapeworm is a different customer: this one can live in your brain, cause seizures and death (Health.com). This infection is caused by eating pork worm eggs “directly from infected human fecal matter” (Health.com). So, make sure you wash your hands and the hands of others. Often.

2) The Human Botfly. This fly lives in Central and South America and, while the fly itself doesn’t cause disease, her babies are evil. The botfly grabs a carrier (usually a mosquito), glues a bunch of eggs to her underside and lets her go (Wired.com). When the mosquito gets close to a human, the human’s body heat causes the eggs to hatch, allowing the babies to tumble onto the victim (Wired.com). The kids either slide down the hole the skeeter made or any other cuts that might be available (Wired.com). The baby then makes whatever hole bigger and shoves its face further in, “the opposite end barely pokes out the skin, allowing the larva to breathe” (Wired.com). They breathe out of their butts, I guess. As they get older, the host usually notices something’s up – botflies “rotate in their little burrows…creating this sort of intense shooting periodic pain” (Wired.com). Womenshealthmag.com suggests covering the botfly hole with bacon, nail polish or petroleum jelly to suffocate it before pulling it out. If you’d like to let it grow up in a good home though, let it be. After about three months, these guys will just sort of fall out and squish away (Wired.com).

3) Loa Loa. This is known as the “eye worm” (Businessinsider.com). Can you guess when it hangs out? If you get bitten by an infected deer fly in Africa, you’ve just made yourself a new pal! After Loa Loa gets inside of its victim, “the worm begins floating around tissue…until it stops and causes swelling and irritation in that spot” (Businessinsider.com). Your vision will usually be fine, but Loa Loa can “be painful when moving about the eyeball or across the bridge of the nose” (Web.stanford.edu). Besides being visible in the eye, they can also sometimes be seen slithering under the skin. Surgery can be used to get them out of eyes and there are medications available to clear up the entire little colony (CDC.gov). Oh, and by the way, they can live inside of you for up to 17 years (Businessinsider.com).

You know what? Don’t go anywhere. Don’t go anywhere, don’t eat anything – let’s just hide under the bed.

You won’t contract any of the above at Bourke Accounting. And if you must go traveling soon, make sure you see your Bourke Accounting pro first; filing your returns before July 15th with a Bourke Accounting expert will make your vacation so much more relaxing. Also, your Bourke Accounting prepared tax return refund will come in handy! Happy (and safe) travels!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I watched The Purge for the first time last year. I didn’t find it to be a charming story on film and the live-action version certainly isn’t any more endearing. We’re doing this wrong. From tips to toes, we are doing this entire thing all wrong. Protesting deplorable actions is a good thing. Police officers protecting bystanders and businesses is a good thing.

So, why is it that we’re getting everything wrong? The amount of violence in our streets is ridiculous. Peaceful protests are turning violent within seconds; police and protesters are ripping each other apart. Is this mob mentality taking control or is it simply stark evidence of deep-rooted resentment and hatred flowing through everyone involved? Or is it both?

For example, on May 30, eight young men brutally beat an unarmed woman with their fists and with 2X4s in front of a shop. There is clearly nothing that says “justice and equality” quite like a group of men punching a lone woman in the head. So, don’t you worry, Status Quo, not matter what social changes are made in the future, it will, most likely, still be permissible to humiliate and hurt women. After all, we can’t have too much progression at once.

What else? Oh, let’s not forget 77-year-old retired officer and security guard David Dorn, who, on June 2, was shot and killed by Stephen Cannon. What was the retired officer’s crime? He was responding to an alarm at the pawn shop he watched over. Mr. Dorn, who had nothing to do with the travesty that befell George Floyd, lost his life anyway. For what? Pawn shop trinkets?

Obviously, we must not ignore what the police have been up to. Who could forget Officer Vincent D’Andraia, NYPD’s Newest Hit Maker, shoving Dounya Zayer to the ground, causing a concussion. Naturally, he had to remind her that she’s a “stupid f——- b—-” (Businessinsider.com) as he pushed her. He showed her that standing peacefully won’t be tolerated on his watch.

And then there was the stellar performance of Buffalo, NY cops as they gracelessly pushed Martin Gugino, causing him to fall and hit his head. Mr. Gugino, bleeding in the video, “suffered a brain injury as a result” (NBCNewYork.com). Although the White House Bunker Squatter accused Mr. Gugino of being some super deadly “ANTIFA provocateur” (NYTimes.com), I’m not sure the 75-year-old man was posing enough of a threat to warrant brain damage, anarchist or not.

We’re doing this wrong. The police are causing violence to prevent violence; the people are causing violence to protest violence. We must realize that behind the badges and behind the protest signs are real humans, scared and angry. Not every cop is an evil tool of the devil and not every protester is a blood-thirsty criminal (and to be clear, it must also be noted that not everyone out in the streets are even legitimate protesters. Some are merely opportunists). It must also be remembered that the innocent bleed the same color as the guilty. We must stop burning each other down and start putting ourselves back together.

Bourke Accounting professionals share your confusion. At Bourke Accounting, we look forward to a peaceful future, changed for the better. Having your tax returns completed by July 15th isn’t going to erase the horrific images that are now playing, but consulting a Bourke Accounting specialist will ease any financial anxiety you may be feeling. If we can offer you even a tiny measure of security, it’s worth it.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. Stay Sane!

Written by Sue H.

Most people, including myself, keep repeating the same mistakes – William Shatner

Bourke Accounting associates are fairly civic-minded. We tend to drive the speed limit, recycle our metal and clean up after our pets. We hold doors for people, sneeze into the crook of our arms and wear masks when venturing out into the world. Of all the things that Bourke workers do, I am constantly surprised that our mask habit has proven to be the most provocative.

At this point, you can’t help but notice that masks have become politicized. Honestly, I’m a little confused; when I walk into the corner store to buy my coffee, I rarely get angry that the sign on the window warns: No Shirt, No Shoes, No Service. I simply put my shirt back on, get my large drip, 2 sugars, and go about my day. For some Americans, the mask controversy, and isolated acts of violence, is difficult to understand. And, by the way, it’s also a complete and total re-run.

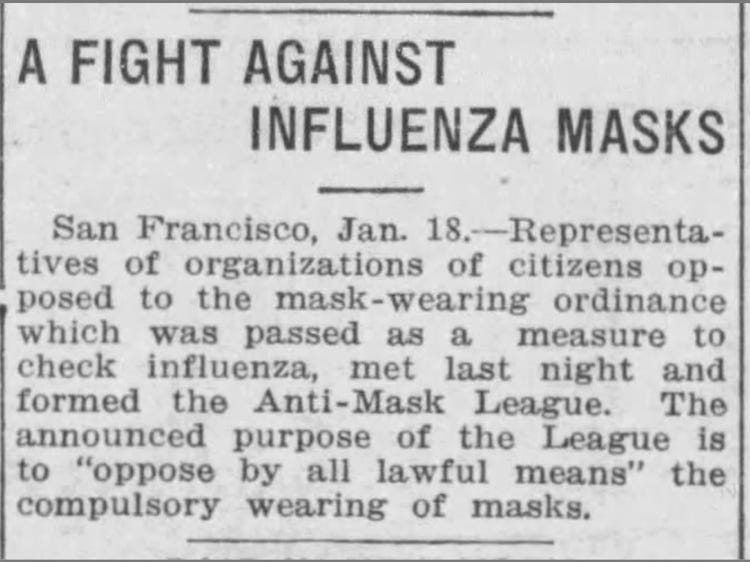

Welcome back to 1919, everybody! Many comparisons have been made between the 1918 Spanish flu pandemic and our own current situation: how transmission occurs, infection rates in heavily populated areas and, yes, even the mask controversy. While the Spanish flu was raging, the city of San Francisco “enforced the wearing of masks” (Businessinsider.com) and, while most people complied, it was by no means unanimous. Starting in January of 1919, an “Anti-Mask League” (calling themselves the “Sanitary Spartacans”) formed to protest masks (Businessinsider.com). The Spartacans argued that the masks were “unsanitary, useless and a threat to their constitutional rights” (Businessinsider.com).

Interestingly enough, when the Spanish flu first made the scene, the populace didn’t really have a problem wearing masks. Since World War I was still being fought, officials and health organizations reminded Americans that wearing masks was “patriotic” in nature and helped to protect the health of soldiers who might have to return to the frontlines (History.com). The Red Cross even released a public service message labeling those who failed to wear masks as “dangerous slackers” (History.com). Since red-blooded Americans didn’t want to be responsible for a lost war (or thought of as a slacker, dangerous or otherwise), the masks were an easy sell.

However, when the war ended in November of ’18, local administrations lost their primary bargaining chip. Without the fear of infecting soldiers, citizens bristled at the continued mask requirement (History.com). Much like today, individuals gathered to protest the perceived heavy-handed command. Also, much like today, some Americans did not like being forced to protect themselves and others; they argued that a “free” country should be just that – completely and unequivocally.

Obviously, mask wearing is a personal choice. I won’t shame anyone for not wearing one, just as I hope no one will shame me for sporting my stuffy face covering. While it is a choice, it must be noted that, after mask-wearing became enforced during the Spanish flu, San Francisco’s death rate was reduced by 25% (Businessinsider.com). So, you know, just saying.

As with everything else, Bourke Accounting is even making the mask-debate easy for you – we’re open for drop-offs and mail-ins exclusively. Since Bourke Accounting professionals want to see you again next year for a proper visit, we can only hope that you’re taking care of yourselves and your loved ones. And remember: as sad and as frustrating as this re-run is, it won’t last forever!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

The cool thing about humans is that we are good at improvising. For example, sitting at my desk at Bourke Accounting, I looked down and noticed that I had a small hole in my pants. This did not pose a problem. I colored my knee with a black Sharpie (it’s helpful that I wear a lot of black) and the hole was no longer noticeable. This is not the first time I’ve done this. It occurs to me that I should really check my clothes before I leave the house.

This little bit of improv is low on the spontaneity ladder, but it worked. Because of this instance, I started thinking of 1981’s Raiders of the Lost Ark and movies in general. So, here are a few times that ad-libbing paid off in the moving picture shows:

1) Raiders of the Lost Ark. I’m sure you remember the scene where Indy is running through the streets of Cairo and, all of a sudden, a guy dressed in black starts whipping a big sword around. Then, Indy, cool as all get-out, pulls out a gun and simply shoots the guy. That’s not how it was supposed to happen. Harrison Ford was suffering from dysentery (I had always heard it was a hangover, but whatever) and using the bathroom a lot. He decided it would be a lot easier if he didn’t engage in a drawn-out fight pitting sword against whip and came up with the pistol angle. Steven Spielberg probably realized Ford didn’t have much in him and, to avoid an icky trip to the laundromat, allowed the ad-lib to stay (Businessinsider.com).

2) Midnight Cowboy. So, there’s that scene where “Ratso” Rizzo (Dustin Hoffman) is walking down the street and a cab almost hits him. Hoffman bangs on the hood of the taxi and yells out: I’m walkin’ here, I’m walkin’ here! A very iconic scene and a total accident. Since director John Schlesinger was making the movie on a teeny tiny budget, he didn’t get a permit to block a busy New York City street. They were shooting “guerilla-style with a hidden camera in a van” (Bestmoviesbyfarr.com) and, even while almost being hit, Hoffman stayed in character. Honestly, I don’t know how much “in character” it was – if you spend any time in NYC, trust me, you will hit the hood of a cab at least once.

3) Goodfellas. Right, you know the scene with Joe Pesci’s rant, “I’m funny how? I mean funny, like I’m a clown? I amuse you?” During the scene, everyone at the table looks visibly uncomfortable. That’s some good acting. No, that was everyone’s legitimate response because they had no idea what was going on. Earlier, Pesci had told director Martin Scorsese how, while working at a restaurant, he had inadvertently offended a “connected” man by telling him he was funny. That entire tantrum was what the man had screamed at Pesci. Scorsese loved it and told Pesci to run with it, only informing Ray Liotta (Mentalfloss.com). Scorsese wanted genuine reactions and it worked.

The human animal is good at adapting and improvising. This is useful in day-to-day living, but absolutely wonderful in art. There are, I’m guessing, thousands of examples just like the ones above that are responsible for turning a good movie into a classic. As Bob Ross said, “We don’t make mistakes, just happy little accidents.”

Your Bourke Accounting bookkeepers and tax preparers are champs when it comes to improvisation. You know that when you sit down with a Bourke Accounting pro, they already know about new laws and changes to old ones. However, there is nothing you can possibly do that will throw your Bourke Accounting expert. Bourke Accounting specialists know how to amend a return and know how to make sure damages are kept to the minimum. They are that good – rehearsed or not.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

We have to read two sections of the Bourke Accounting Book Club selection, Jen Sincero’s, “You Are a Bada*s” by Wednesday. I haven’t read it yet. The book is sitting on my table. I walk by it every day and promise: I’ll read it when I get home. Annnd then, when I get home, I watch M*A*S*H because it’s an episode that I haven’t seen since I was ten. Maybe I just stare into space for a while. Very important stuff, to be sure.

Why do we procrastinate? Sometimes it’s because we’re required to do something icky, like clean up dog poop around the yard. Sometimes it’s because it seems like a boring and arduous job that isn’t that important, like organizing a seldom-used closet. Or maybe some of us are just lazy (my hand is in the air).

Mindtools.com offers a legitimate out, though. For some of us, procrastination is “more than a bad habit; it’s a sign of a serious underlying health issue.” Anxiety, depression, attention deficit disorder – all of these afflictions can play a role in why we wait until the last minute to complete some task. Of course, according to Mindtools, if you wait around to do something, you will only end up increasing your own stress levels. So, even if you didn’t have these disorders before, procrastinate long enough and you will.

You have received your W2s, 1099s, etc. They are neatly organized in a little folder. You’ve had these documents for a few weeks. Um, this is perhaps a personal question, but why haven’t you seen your Bourke Accounting tax preparer yet? When filing your returns, there are a few reasons you should lock your Procrastination Demon in the basement and come see us:

1. The longer you wait to file, the more “you increase your risk of tax identity theft” (CNBC.com). Hey, you know who doesn’t procrastinate? Bad guys. According to CNBC.com, the miscreants who send in fake returns, do it really early. So, by the time you get around to seeing your Bourke Accounting tax preparer, someone might have already been nice enough to file for you.

2. What if you owe money? If you wait until the last minute and – gasp! – find that you owe a substantial chunk of change to the good old IRS, do you have that cash stashed in your mattress? Give yourself enough time to prepare for an unfavorable scenario. Don’t count on a tax refund to get you through hard times and always rely on the fact that things can go sideways.

3. You’ve had all of your documentation for a while. Are you sure? It’s April 14th and, right in the middle of an appointment with your Bourke Accounting tax preparer, you remember that you worked for a few months somewhere before you landed your Forever Job. But where is that W2? Did you leave it in the car you sold last week? Did you even receive it? I guess you’re going to have to file an extension…

Bourke Accounting professionals don’t procrastinate, but you knew that. Our Bourke Accounting experts also won’t rush through your return because the deadline is looming. Whether you come in February 14th or April 14th, you will get incredible, comprehensive service. But for the sake of your mental well-being and your finances, why don’t you make your appointment sooner rather than later?

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

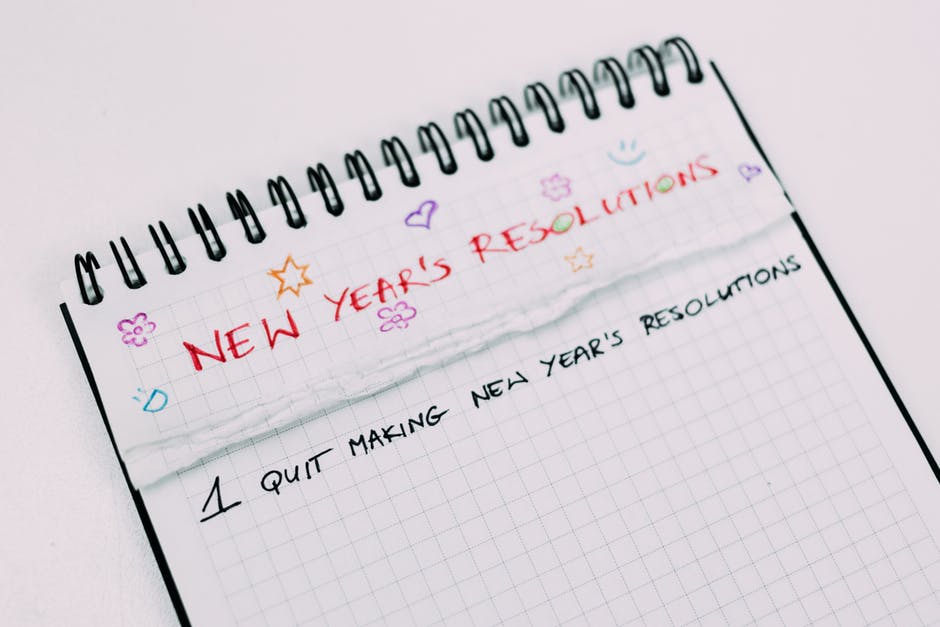

There’s no stopping it now. We are officially living in the new year. I am excited that, so far, I have only misdated one document (although, I wrote 1919 for the year, so I don’t know what that says). Most of us accidentally use the prior year before getting acclimated to a new January. Another thing a lot of us do is come up with New Year’s Resolutions.

I do not.

It’s not that I’m lazy with no understanding of discipline, I just find resolutions sort of self-defeating. Glimpsing January 1st in the distance, we feel this great optimism that this is going to be the year: we are going to lose weight, quit smoking, go hiking, get another job, etc., etc., ad nauseam.

And then here comes February 3rd and we haven’t made much progress. According to Businessinsider.com, “about 80% of people fail to stick to their New Year’s resolutions for longer than six weeks.” Well, that’s longer than I thought, but still. It’s very noble to want to erase bad habits and get into new, healthier ones, but you can’t expect to change your life overnight.

For example, Lifehack.org mentions that one of the biggest obstacles to lasting change is that “you’re trying too hard.” Considering weight loss, Lifehack.org tells us that the more you restrict a certain food, the “more you’re going to want it.” They suggest that you start by making small changes rather than dramatic ones. Let’s say that you really like greasy burgers and fries from the place down the street. Eat that, but also include a small salad and replace your soda with water. After a while, exchange your large order of fries for a small. Then, forgo the fries all together.

Baby steps, friends, baby steps.

There is nothing wrong with wanting to make positive changes in your life. However, putting pressure on yourself based on what the calendar says can really have the opposite effect. Quit smoking all at once, fling a pack of Post-Its at your boss’ head and you’ll be looking for a new job in the new year all right. Instead, and again, gradually take away the things that aren’t benefiting your life. After all, like Elbert Hubbard wrote: We are punished by our sins, not for them.

Another thing that Lifehack.org recommends is to track your progress. Be honest with yourself and legitimately document how many smokes you’ve had, how many sit-ups you’ve completed. If you’re actively trying and actively telling the truth, you might be surprised at how well you’re doing in just a little while.

The professionals of Bourke Accounting wish you all the best in the new year. They won’t tell you to put down the remote and go jogging, but a Bourke Accounting representative can help you to make better financial choices. A Bourke Accounting expert will offer advice on how to reduce nonessential expenditures and how to avoid visits from the Tax Man. Bourke Accounting can change your life, no baby steps required.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.