At Bourke Accounting we find that to be a good accountant you have to be a good listener…and listen we do during tax time and our monthly bookkeeping meetings with clients. Most clients like to talk about more than just tax, so we find we must know much about everything. One of our clients is a programmer for a dating app and I asked him what he has learned. Here is the scoop in a nutshell….

- Women are more thorough than men

Women tend to spend more time examining a guy’s profile -they care about what you studied, what your hobbies are, they actually read the descriptions. Guys just look for women who they find attractive. They started putting more effort into their profile as they thought these things actually didn’t matter, but they do.

- Love is basically a math problem

When you start to work on it and see the data, you realize how statistical love is. There is no one true love: you could end up with this person versus that person , but it doesn’t mean that other combinations wouldn’t have been compatible too – it’s just a numbers game.

- Most people don’t really know what they want

A user might say they want someone who does yoga and is 5-foot-5. But based on the data the programmer sees, a lot of these specifics don’t translate to connections. Some of the things people look for are just pulled out of thin air – maybe they like yoga and had an ex that was 5-foot-5. These things are hardly ever make-or-break when it comes to making a connection.

At Bourke Accounting we talk about everything but are really good at your tax and accounting needs. Give us a call at 502-451-8773 or come by for a visit…. in between time on your dating app of course. See you soon!

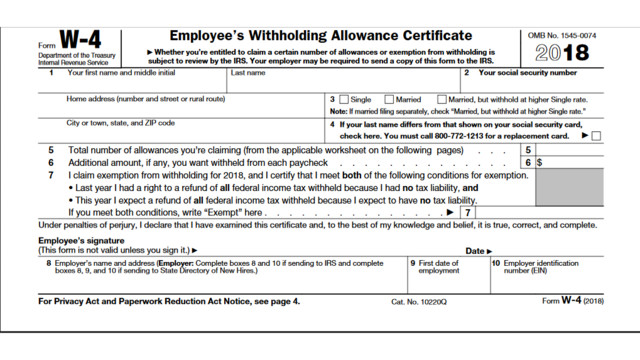

In case you missed it, the Internal Revenue Service published the new 2018 W-4 form in March. As you know, accurate withholding is meant to get individuals close to their true tax liability at the end of the year. However, the new tax code, passed into law in December, made significant changes to calculations for income tax liability. Employers and employees alike need to reexamine withholding needs to ensure precision. The IRS intended that tax withholding under the new law should work with the 2017 W-4 form. This required revisions to retain components such as personal exemptions, which are no longer in the tax code. The 2018 W-4 retains the personal exemption because those still using the previous year’s for need to have it. Here are the highlights from the changes:

Exemption from withholding

The IRS changed instructions for claiming exemptions form withholding. Now you must indicate that for both 2017 and current year 2018 you had or expect no tax liability.

The IRS releases its withholding calculator. the W-4 instructions state that if you use the withholding calculator, you don’t need to complete any of the worksheets for Form W-4. This was not stated on the previous W-4. It may indicate that the withholding calculator is the most reliable method to get your withholding closest to your tax liability.

Calculating personal allowances

The 2018 W-4:

- Removed the reference to dependents whom you can claim on your tax return.

- Changed the calculation for the child tax credit to reflect the new amount and the significant increase in the phase-out amounts.

- Added the credit for non-child dependents to factor into allowances.

Changes to Deduction, Adjustments and Additional Income Worksheet

The IRS changed:

- The estimate of itemized deductions to reflect the new tax law referencing the $10,000 cap on state and local taxes (including property and income taxes) and the change to medical expenses in excess of 7.5 percent.

- The wage thresholds and amounts for the Two-Earners/Multiple Jobs Worksheet to reflect the dynamic of the new tax code on these taxpayers.

If you have any questions on how to figure your W-4 please give Bourke Accounting a call at 502-451-8773 or stop by for a visit. See you soon!

As Bourke Accounting continues to grow and expand we often need to update our equipment. Our current dilemma is the need for a combo copy machine/fax/scanner etc. So do we buy or lease? I think leasing may be the best option considering the price of the machines today…

When I talk to people about leasing a copier or MFP (multifunction printer) it doesn’t take long to get to the bottom line: How much is it going to cost to lease a copier for my business? The “How much does it cost?” question is a sensible one, but it’s a lot like asking : “How much will my mortgage cost?” You need to supply some additional information. How long is the loan? How big is the house? Where is it located? You get the idea! Understanding the costs associated with leasing a copier or multifunction printer invokes some significant associated questions. Here are just a few:

- Is it black and white or color?

- How fast does it need to be? (What is the desired print/copy speed?)

- Do you need finishing options like a sorter, hole-punch, an automatic stapler or the ability to saddle-stitch documents like small pamphlets?

- How much paper do you need to load? Do you require additional trays and paper capacity?

- What is the lease term?

Deciding the Lease Term

Lease terms are typically 36 or 60 months. Like a car loan, this is the duration for which the value of the lease (often retail value) is amortized. Unlike a car loan (but very much like a car lease), you typically do not own the copier when the lease is up. You will need to either send the unit back (often at your expense) or buy it at the then-current value as determined by your lease paperwork.

The Calculated Lease Amount

There’s no magic in calculating your lease amount, you simply need to know all the variables. Your lease company will include all of the options you desire as part of the copier you are leasing (finishing units, paper trays, fax options, software upgrades etc.). This, along with the amortization table and associated fees, make up your lease payment.

A typical lease amount can be estimated somewhere in the neighborhood of $25 for $1000 in the price f the copier or MFP for a five year lease. This means a device costing $12,000 will run you, roughly, $300 per month.

Trouble-free Service Contracts or Maintenance Agreements

There’s another factor we need to add into the equation of leasing a copier and that is the service contract. This service contract typically exists separately from the lease. This is kind of like buying a plan to keep your car in new tires and oil for the life of the lease. And, like a vehicle service contract, it also covers any required maintenance-and does so in-house. That means you’re never sending the unit out for repair. As you can imagine, for larger offices this peace of mid is why service contracts are so popular. About the only thing a service contract doesn’t cover is paper and electricity.

The way a service contract works is on a “per click” basis. A “click” is a single one-sided print or copy. The service contract is an estimated amount of copies or prints you will make monthly and typically runs between $0.01 and $0.02 per click for black and white and between $0.05 and $0.09 per page for color. This can vary a lot depending upon the amount of pages you print each month.

What to do…

I figure if I give up my gym membership and focus on my steps to the copier daily, that can save us some money. Either way, at Bourke Accounting we always want to use state of the art equipment as it helps us service our clients in a more efficient and professional way, which gives us more time to focus on you. Come by and see us soon!

Your Social Security benefits are calculated based on how much you earned during your top 35 working years, but at the age at which you first file for those benefits can impact the amount of money you receive each month. If you wait until your full retirement age (FRA) to take benefits, you’ll get the full monthly amount you’re entitled to based on your earnings record. FRA is a function of your year of birth, and for today’s workers, it’s either 66, 67. or 66 plus a certain number of months.

That said, you actually get an eight-year window to file Social Security that begins at age 62 and ends at age 70. If you file ahead of FRA, you’ll reduce your benefits depending on how early you jump the gun. On the other hand, if you hold off on taking benefits past FRA, you’ll accrued delayed retirement credits that boost your payments by 8% a year. Because this incentive runs out at age 70, that’s generally considered to be the latest age to file for Social Security — even though you’re technically not required to do so.

Still there’s a lot to be gained by taking benefits as late as possible and growing them to the maximum extent. So why is it that only 3% of men and 5% of women wait to claim Social Security at 70, while all other beneficiaries file before that point? Here are a few reasons why…

- They need the money sooner. One major reason why so many seniors take Social Security before age 70 is that they are forced to retire sooner.

- They want the money sooner. While most Americans are behind on building their nest eggs, there are also those who are saving quite nicely, but for the latter the money comes in handy.

- They’re afraid Social Security is going broke. There have been rumors for years that Social Security is going broke — but those are just rumors. While the program IS facing financial difficulties, it is virtually impossible for Social Security to go broke because its funding comes for payroll taxes. Therefore, as long as we have a workforce, the program will keep getting money to pay beneficiaries.

So what should you do? When should you file?

The answer is that it really depends on your personal circumstance. Let Bourke Accounting help you figure this out; we are a master at all matters financial. Give us a call at 502-451-8773 or stop by for a visit. See you soon!

A young woman was waiting for her flight at a big airport, so she decided to buy a book to read and a packet of cookies to snack on. She sat down in an armchair in a VIP lounge to relax and read in peace.

A man sat down in the next seat , opened his magazine and started reading. When she took out the first cookie, the man took one also, She felt irritated but said nothing. She just thought, “What nerve! I’d like to punch him for being so rude!”

For each cookie she took, the man also took one. This infuriated her but she didn’t want to cause a scene. When only one cookie remained, she thought to herself, “What will this rude man do now/”

Then the man, taking the last cookie, divided it into half, giving her one half. That was too much. She was really angry now.

In a huff, she took her book, the rest of her things and stormed off to board the plane. When she sat down in her seat on the plane, she looked into her purse to take out her reading glasses, and to her surprise, her packet of cookies was there, untouched and unopened.

She felt so ashamed. She realized that she was wrong.

The man had shared his cookies with her willingly, while she had been very angry, thinking that he was helping himself to her cookies. And now there was no chance to explain herself, nor to apologize.

Have you ever lost your cool and then realized later that you were wrong? I’m sure that most of us have. Let’s save ourselves some embarrassment and make sure that we are in possession of all of the facts before reacting.

Dale Carnegie said: “When dealing with people, remember you are not dealing with creatures of logic, but creatures of emotions.” At Bourke Accounting we find that when finances are thrown into the mix, emotions go out the window. We have tried to create an atmosphere of safety and calmness here at Bourke Accounting. Come on by and let’s talk tax or about any of your financial needs. Perhaps we can help.

The Internal Revenue Service is expected to refund disabled veterans an estimated $78 million that was wrongly withheld from their disability severance pay.

More than 133,000 may qualify for the tax refunds, according to the National Veterans Legal Services Program. In 2016, President Obama signed into law the Combat-Injured Veterans Fairness Act, which directed the Department of Defense to identify any severance payments to veterans with combat-related injuries paid after Jan 7, 991, from which the DOD withheld amount for tax purposes, and the individuals to whom the severance payments were made.

The DOD is supposed to provide each veteran with a notice of the amount of improperly withheld severance payments, along with instructions for filing amended tax returns to recover the amounts. The law extended the amount of time for filing a claim with the IRS for a credit or refund beyond the standard three-year limitation. Instead, Veterans will have up to one year after the DOD provides them with the information about the tax refunds to which they’re entitled. The DOD is also supposed to ensure under the 2016 law that the amounts aren’t withheld for tax purposes form DOD severance payments when the payments aren’t considered gross income.

The refunds will apply to veterans who received disability severance pay dating back to Jan 7, 1991, with taxes withheld and who also qualified for disability from the Veterans Affairs Department. The law aims to ensure that veterans who suffer service-ending combat-related injuries aren’t taxed on the severance they received from the DOD.

If you are a Veteran and need help come on in as we can help you with your tax filings. Bourke Accounting is a full service tax & accounting firm. Call us at 502-451-8773 or come in for a visit today. See you soon!

The passage of the new tax bill is a golden opportunity for you to convert your traditional individual retirement account into a ROTH IRA. Why? The bill reduced multiple individual income tax brackets, so if you convert your traditional IRA to a ROTH and immediately pay taxes on those funds, “you will be paying at a lower rate then before.” Contributions to traditional IRAs are tax-deductible now because you will pay income tax on them later, when you withdraw the funds. But withdrawals from ROTH accounts are tax-free, because contributions are taxed upfront at current tax rates. Settle your bill when it’s the lowest it’ll ever be…there will never be a better time than now.

The passage of the new tax bill is a golden opportunity for you to convert your traditional individual retirement account into a ROTH IRA. Why? The bill reduced multiple individual income tax brackets, so if you convert your traditional IRA to a ROTH and immediately pay taxes on those funds, “you will be paying at a lower rate then before.” Contributions to traditional IRAs are tax-deductible now because you will pay income tax on them later, when you withdraw the funds. But withdrawals from ROTH accounts are tax-free, because contributions are taxed upfront at current tax rates. Settle your bill when it’s the lowest it’ll ever be…there will never be a better time than now.

Let Bourke Accounting help you will all of your financial needs. Need to talk about how an IRA will effect your taxes? Come on in and see us. Give us a call at 502-451-8773, or stop in for a visit. See you soon!

Severe flu season is here!

Cases of flu are already on the rise across the U.S., and health officials warn the worst is yet to come. The Centers for Disease Control and Prevention reports that symptoms associated with the seasonal virus are currently wingspread in 36 states across the country. Lab tests have shown that the dominant virus in circulation is the H3H2 influenza strain, which tends to cause more severe illness than other strains. And new research has shown that the main process for manufacturing the flu vaccine triggers mutations in H3H2 that render the antibody stimulant less effective. “The mutation just happened to be in a very bad spot on the virus to make it essentially be a mismatch for the vaccine,” explains the director of the National Institute of Allergy and Infectious Diseases. The combination of factors doesn’t bode well for the flu season in the coming months; the vaccine may prevent only about 10 percent of infections. But health officials are still urging Americans to get a flu shot, arguing that some protection is better than none.

At Bourke Accounting we are aware of infections in tax law and are here to help you maneuver thru any issues that may come up. Give us a call today at 502451-8773 and stop in so we can help. See you soon!

A group of grocery store employees teamed up for a very special delivery over the holidays – helping a customer give birth when she unexpectedly went into labor at their Fresno, California shop. After hearing the customer cry out in pain, two workers got down on the floor with the pregnant woman to help deliver her child. The butcher caught the baby in his apron, while the store owner cut the umbilical cord from around the baby’s neck. They said it happened in seconds and it was an example of total teamwork.

When an 8-year-old boy fell into a frozen pond, a Utah police officer dove right in to save him. The police officer was the first to arrive on the scene after the boy plunged into the freezing water. The officer was a trained rescue driver and wasted no time using his own body weight to break through the ice. Once in, he waded in frigid water up to his neck until he felt the boy and pulled him out. The officer didn’t think twice as he had made the decision to go in and get the boy. The boy spent several days recovering in the hospital and is now back home.

Often times when we feel the world is out to get us we need to hear stories like that and it can, sometimes, make us feel better about our circumstances. At Bourke Accounting we try to ease that financial worry about tax issues (or your business) by being there to work through whatever your financial needs may be…come in and see us, or give us a call at 502-451-8773. You work hard for your money, let us work smart to help you keep it!

Although new federal income tax tables and rates will take effect on January 1, there may be a delay in release of withholding tax guidance from the U.S Treasury Department for employers. In the meantime, the Internal Revenue Service (IRS) has explained that employers may use existing (2017) withholding tax tables and guidance until new guidance is released. According to a notice dated December 3, 2017, the IRS “anticipates issuing the initial withholding guidance (Notice 1036) in January reflecting the new legislation, which would allow taxpayers to begin seeing the benefits closely with the nation’s payroll and tax professional community during this process.”

The Act authorizes the Treasury Department to permit employers to apply existing wage withholding to rules and calculations throughout 2018, although this seems unlikely. According to H.R. 1 and the conference report:

“…the Secretary (of the Treasury) may administer the withholding rules under Section 3402 for taxable years beginning before January 1, 2019, without regard to the amendments made under this provision. Thus, at the Secretary’s discretion, wage withholding rules may remain the same as under present law for 2018.”

However, to avoid adversely affecting taxpayers, Treasury is likely to issue guidance as soon as possible, to align employer wage withholding calculations with the new income tax rates which will take effect on January 1, 2018.

Did you know at Bourke Accounting we process all types of payroll, even out of the country employers ? Let us help you! Give us a call at 502-451-8773 and come by for a visit. See you soon!