What was the last comedy you watched?

Are you a 40-Year-Old Virgin fan? Or did you watch Blazing Saddles on an old movie channel? Maybe you like Girls’ Night Out. What about stand-up comedians like Richard Pryor, Robin Williams and Chris Rock?

No matter what flavor you prefer, it’s good to laugh.

Scientists, psychologists and numerous websites tell us this. Laughing can help our immune system, our mental well being and even our hearts (according to Helpguide.org).

Whatever it is that tickles your funny bone, you would be missing out on quite a few laughs if not for Lenny Bruce.

Lenny Bruce wasn’t just a dirty mouthed 1950s historical figure: he was an activist and satirist. He was a writer and the vanguard introducing a new way for Americans to get their chuckles. Yes, he used some four-letter words, but Lenny Bruce helped to change the face of comedy. After listening to quite a bit of Lenny Bruce (and reading his 1967 released “How to Talk Dirty and Influence People”), he was clearly ahead of his time. No offense, Henny Youngman, but it’s hard to laugh at “Take my wife – please,” when there’s a counterculture rebel on stage.

Not only did Bruce talk about the hot-button issues of the time (including racism, sexism and the draft), he was an introspective poet with a hatred for censorship. During the turbulent ‘50s and ‘60s, Bruce reflected the changing social mores of the people.

Well, some of the people, anyway.

Lenny Bruce was often arrested on obscenity charges. His performances were called, by a New York State court in 1964, “obscene, indecent, immoral and impure” (CBDLF.org). That was just before being sentenced to 4 months in the workhouse (Wikepedia.com).

Sadly, before his unexpected death in 1966, Bruce seemed to lose the thread. Instead of making his audience think and laugh, he became obsessed with his numerous court cases. This is very apparent in “How to Talk Dirty…”. While some funny anecdotes and social commentary are in residence, a lot of his book tends to revolve around his court concerns. In addition, his stand-up routines began to swirl around his legal difficulties.

Lenny Bruce was and continues to be a national treasure. So much so that, in 2003, Governor George Pataki (NY) gave Bruce the “state’s first posthumous pardon.” Pataki called it “a declaration of New York’s commitment to upholding the First Amendment.” [MTSU.edu]

Bourke Accounting associates are funny (you should hear some of our weekly meetings). And if you get to know them well enough (and ask nicely), some of their humor can border on the blue. However, no matter what is going on in the world, our Bourke Accounting experts are through and through professionals; their biggest concern and priority is you. Bourke Accounting pros never lose the thread.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

When I first came to Louisville, I got a job at a popular chain liquor store. As my boss thought it would be interesting to see what sort of salesperson I was, he would challenge me to get patrons to buy rather obscure items. Challenge accepted (and won).

I know the holidays are coming soon, so let me offer some gift giving and entertainment options for the season. In no particular order, here are three of my favorite things that I sold and still enjoy to this day:

1) Apothic Red Wine. This is a red blend of Zinfandel, Syrah, Merlot and Cabernet Sauvignon (Wine.com). I think it goes well with whatever dish you happen to be making and it’s very affordable. We’re talking $8.98 at Walmart affordable. However, don’t think that the low price means that this is a rotgut bathtub sort of wine. This is something you’d be proud to serve to your judgmental in-laws. While it’s mellow at first, as most reds are, it takes a sudden and subtle backbite left turn at the end. Your tongue tingles slightly and you’ll find yourself reaching for another glass.

2) Lucid Absinthe. Maybe it’s because I like to pretend to be Oscar Wilde, but I love this stuff. This is “the first genuine absinthe made with real Grande Wormwood to be legally available in the United States in over 95 years” (Drinklucid.com). If that’s not an enticement, I don’t know what is. I think it’s better as an after-dinner liqueur and conversation piece. First, it’s great for digestion. Second, imagine pulling out the sugar cubes and your pretty slotted spoon to the confusion and amazement of your friends. Yes, there is an art to drinking absinthe. I think Lucid tastes rather like licorice and I adore the iridescent green shimmer after the water is added. The one drawback is that you can expect to spend around $60.00 a bottle. Oh, and no, you won’t see little pink elephants everywhere.

3) Calypso Spiced Rum. This is another insanely affordable beverage. Generally, this costs about $13.99 a gallon. I think it goes very well with Vernors Ginger Soda and a splash of water. While it’s not a fancy sort of rum, it goes down smooth and has a lovely vanilla aftertaste. In addition, who doesn’t want to play at being pirates? Finally, there’s a very interesting story printed on the label about Calypso and a certain guy called Odysseus.

I know that the holidays can be stressful. Gift buying, decorating and cooking are all enough to lead anyone into the depths of delirium. And the fun doesn’t stop after the holidays. After the holidays, there are taxes.

While Bourke Accounting associates can’t hold your hand while you negotiate around a crowed shopping mall, they can offer you peace of mind that your finances are fully taken care of. After the holiday season, when you’re feeling exhausted, come see your Bourke Accounting professional for a bit of solace. Our Bourke Accounting experts will gently guide you through your tax and bookkeeping needs.

And after all of that, you can go home, raise a glass of absinthe to your Bourke Accounting expert and know that all is right in your world.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

The Holidays are coming.

As most of us are wading through crowds at the mall and looking online for impossible presents for that impossible cousin, I’d like to pause for a moment to pity all of the business owners out there.

Not only do business owners have to think of clever gifts for their families, they also have an extra, ill-defined figure to worry about: The Client.

Business owners know that it makes good sense to give gifts to clients; they want to demonstrate to the client that their business has been appreciated. Not only that, a good businessperson wants to make sure that the service they offer is in the forefront of a client’s mind. So, when Grace’s toilet backs up, she’ll look at that lovely bouquet that Joe Dokes Plumbing gave her and who do you think she is going to call?

While it’s great to be looked upon as grateful and generous, as a business owner, you have to be a little conservative. That is, if you’d like to survive until next year. The IRS only allows you “to deduct no more that $25 of the cost of business gifts you give directly or indirectly to each person during your tax year.” That means, if you were to buy Client Ted a ticket costing $165 for San Francisco’s Beach Blanket Babylon, you’d have a loss of $140. Even though you paid $165, you would only have that $25 as a deductible expense. 25 bucks seems like a fairly paltry sum, right? That could be because, according to Nolo.com, it was established in 1954. Hey, in 1954, 25 dollars was a pretty good amount of money!

In the old days (as in 2016), if you were to accompany Client Ted to Beach Blanket Babylon, you would have been able to deduct 50% of that monetary amount (as long as you talked business a bit). However, with the new Tax Cuts and Jobs Act, Marketwatch.com advises us that, “starting in 2018, the costs of entertainment expenses will no longer be deductible.” Even dinner is a gray area if you don’t talk business all evening. And I do mean all evening.

As a business owner – and this sounds mercenary – you have to prioritize. If you haven’t worked with a client for 3 years, why send that meat and cheese gift basket from Harry & David? However, if Client Ted put thousands of dollars into your coffers this year, maybe that $140 Beach Blanket Babylon ticket loss is well worth it.

Whether you have enough clients to fill a teacup or enough clients to fill the entire dimensions of an airplane fuselage, you have to know what sort of gift giving works for you and your budget. Bourke Accounting associates can help you this holiday season. While they want you to continue to be financially solvent, they also understand Plautus’ belief that “you must spend money to make money.”

Our Bourke Accounting experts not only can help you with you accounting and bookkeeping needs, they can offer solid advice regarding appropriate gifts to bestow upon your clients. Bourke Accounting can analyze what would work in the long run as you show gratitude and keep your head above water in the process.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

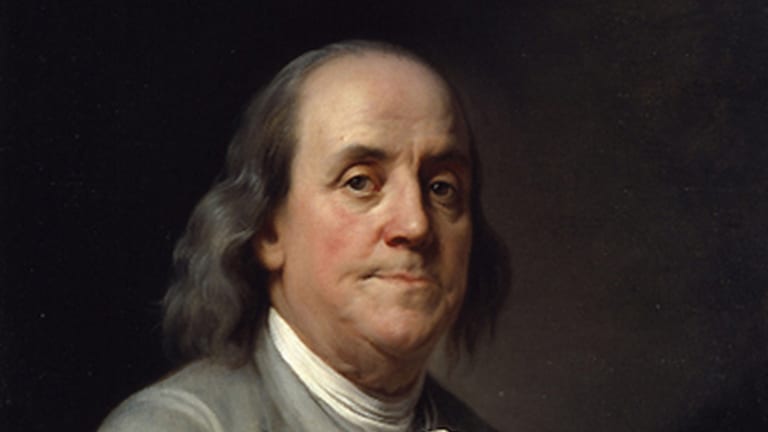

We learned about Benjamin Franklin in grade school; keys, lightning and the Declaration of Independence. We were taught his pithy and interesting quotes – my favorite is “Three can keep a secret, if two of them are dead.”

Our 3rd grade teachers informed us, with great pride, that Benjamin Franklin was a patriot, writer, newspaper man, inventor and ambassador.

Benjamin Franklin was like a wise and cuddly uncle, sternly, but lovingly, looking out from the pages of our paper bag covered history books.

He was quite an accomplished person during the dawn of a new and rebellious country.

Besides his many achievements, Benjamin Franklin also liked older women, younger women and esoteric secret societies.

Oh, and he enjoyed sitting naked in front of open windows, in clear view of neighbors (Listverse.com). He said it was because fresh air was good for the health, but I question if that was his only reason.

While Benjamin’s membership in the Freemasons wouldn’t have been such a big deal in 1730, being a member of the Hellfire Club probably might have been frowned upon.

Depending on the source, the Hellfire Club was either a place guys went to get drunk with their mistresses or something a little more sinister. Weebly.com alludes to members being engaged in occultism, sacrifice and um…very exotic practices with a lot of people in their birthday suits.

Franklin’s membership in The Hellfire Club, also known as the Medmenham Monks, is debated. According to Ranker.com, “his actual membership cannot be confirmed or denied, [but] historians point out Franklin had close friendships with some of the club’s most notorious members.” I’m not going to say Ben was involved, but I’ll put it this way: everyone I know who likes to play sports tends to play sports with other people who like to play sports.

And the ladies! Oh, my, Ben sure did like his ladies. Biography.com mentions how he often extolled the virtues of older ladies, as they’ll take care of you when you’re sick and, “you can’t really tell who’s old or young when you’re in the dark.” However, this is not to say that Ben didn’t like the younger ladies, too. It’s rumored that he fathered somewhere around 15 illegitimate children (Ranker.com).

I like a story, so I always did well in history class. Looking back now, though, I think I would have done better on my tests if the truth had been taught. When you truly learn about historical figures, warts and all, they become more interesting. They become more like real people and not just noble effigies of a forgotten time.

I really hate to disappoint everyone, but in 100 years, Bill and Tim are not going to be associated with any naughty clubs or acts. The gentlemen at the helm of Bourke Accounting are utterly professional. While they can unravel any sort of tax mishaps you might encounter, our Bourke Accounting tax professionals will never be implicated in anything close to misbehavior. Now, our amazing Bourke Accounting bookkeepers? Well, they might be another story. Why don’t you come meet them, too, and find out?

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I know you are all law-abiding citizens.

You are about as likely to underreport your income this tax season as you are to take a jacuzzi with a plugged-in toaster.

However, sometimes accidents happen (and I don’t mean with toasters). Maybe you moved, forgot about the few months you worked a temp job last year and never received that W-2. So, you file your return, in good ignorant faith, and now the IRS says you have some explaining to do.

While it’s highly doubtful you’d see the inside of Folsom Prison for this oversight, it could cause you more than just a little headache.

First off, the Internal Revenue Service will catch this unreported income. They use a dandy little tool called the Information Returns Processing system (IRP). According to Debt.com, “this is a huge database that reviews the earnings you report (or don’t report).” The IRS compares what you say you earned to “the information third parties provide.” These are going to be banks, your job, pension services, etc. And here’s the neat thing: if something doesn’t quite add up, an IRS agent is going to be a little curious.

You don’t want a curious IRS agent.

For a mistake like the scenario above, chances are that you’d “likely be forced to pay the correct amount of taxes owed, as well as a penalty” (Sapling.com). Okay, that’s not great, but not the end of the world, either.

But, wait! What if the scenario wasn’t just an innocent teeny whoopsie? What if (and I know you wouldn’t do this) you intentionally set out to file a fraudulent tax return? What if you deliberately “forgot” a whole lot of income?

Hey, have you met Al Capone?

According to Sapling.com, “people who do not report income on their taxes seldom end up in jail.” However, it certainly does happen. Not only to Al, but Leona Helmsley, Wesley Snipes and a slew of reality television stars. The biggest consideration to the IRS seems to be intent. Accidents can be forgiven with a little money; deliberate “accidents” can be forgiven with a lot more money and a few years of your life.

If the worst case happens and you do find yourself being audited, the great thing about Bourke Accounting experts is that they aren’t intimidated by a curious IRS agent. Of course, Bourke Accounting professionals have a healthy respect for the IRS, but intimidated? No. They are willing to give it their all to protect you from a 6X8 extended stay residence. Having intelligent warrior accountants like the ones you’ll find at Bourke Accounting can really improve the view.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I once worked with a crew that, to put it mildly, had dirty mouths. However, we had worked together for years and we knew what we could and couldn’t get away with. One of us would say something improper and someone else would inevitably shout: HR Nightmare!

I once worked with a crew that, to put it mildly, had dirty mouths. However, we had worked together for years and we knew what we could and couldn’t get away with. One of us would say something improper and someone else would inevitably shout: HR Nightmare!

We had fun. Of course, it wasn’t G-Rated and work appropriate, but it was fun. We were all adults, we got our tasks completed and no one left with hard feelings.

We’ve already talked about what an employer can’t ask during a job interview. However, the interview is just the first step. As an employer, you also have to recognize boundaries once that person is a part of your team. Employees, too, must recognize what is appropriate to say to an employer.

As the employer, you know that you shouldn’t comment on an employee’s personal appearance. Unless the employee is breaking a dress-code rule, any mention of appearance is generally frowned upon. You might have the best of intentions, but your compliment might be misconstrued as flirting. The same rules apply as an employee. Although you might think it’s funny to make your boss blush by talking about how that sweater makes s/he look sexy, you could be making that person incredibly uncomfortable. Basically, unless someone has broccoli stuck in their teeth, don’t mention anything regarding physicality.

Another thing to avoid talking about is the wild time you had last night. Your boss does not want to know who you took home and what happened later. You might be very proud of yourself – and good for you! – but, I promise you, the person you’re relating this information to is cringing. This is not your friend or your diary. In these sensitive times, you should be aware that you are opening yourself to a lawsuit by graphically describing your exploits.

Finally, know your audience. If you’ve worked beside someone for 15 years, fell into each other’s arms at the company Christmas party and sympathetically cried over each other’s divorces, you can probably get away with a dirty joke or two. Chances are, this didn’t happen with most of the people you’re working with. Until, and unless, you really get to know your workmates, keep things on the emotional and verbal level of a soft drink.

Bourke Accounting associates are not saints (I’ve heard some of Bill’s jokes). However, Bourke Accounting associates are professionals. If you come to see one of our experts and happen to drop a 4-letter word, no one will give you the evil eye. Our Bourke Accounting professionals can accommodate you. Whether you are someone who swears with every breath or more along the “Gee, Whillikers” variety, our Bourke Accounting specialists will make you feel completely at ease while they address all of your bookkeeping, taxation and payroll needs.

Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

My dad is an accountant, but he’s a good artist.

Bill is an accountant, but he’s a good writer.

Tim is an accountant, but he’s also a philosopher.

I have just mentioned three artists who have become accountants. But. Did you know there are a lot of trained accountants out there who have become artists?

When most of us think of accountants, we think of a slight man, with a haggard expression, hiding behind a mountain of files beneath poor lighting. Wouldn’t it be kind of strange if it was Mick Jagger hiding behind that mountain of files?

If not for fate, that’s exactly the accountant you would encounter this year when filing your tax return.

Mick Jagger, Robert Plant, Janet Jackson and even Kenny G. studied accounting. If the enticement of rock and roll hadn’t lured these would-be accountants away, the musical landscape would now be a very different place.

Mick Jagger, Robert Plant, Janet Jackson and even Kenny G. studied accounting. If the enticement of rock and roll hadn’t lured these would-be accountants away, the musical landscape would now be a very different place.

Accountancy’s loss is popular artistry’s gain, one could say. One could question if there is a connection between the mind of an accountant and success. I would hazard a guess that the answer is an unqualified “yes.” According to Topaccountingdegrees.org, Kenny G. “credits his accounting degree with helping him manage his finances early on in his career.” It doesn’t matter if you like Kenny G. or not, the man speaks the truth; Celebritynetworth.com reported that Kenny G.’s most recent net wealth stood at 50 million dollars. I don’t believe that amount of money came about just because of his smooth, elevator music-style contemporary jazz.

Although I am a huge Stones fan, I wonder what sort of changes in accountancy we would be experiencing right now if, instead of “Paint it Black,” we had Mick writing letters to the IRS on our behalf. Just imagine Mick walking into a meeting with an IRS auditor. I’m having fun picturing it and – if you try – so will you.

Much to the detriment of the arts, Bourke Accounting keeps Tim and Bill occupied. I apologize, but we aren’t letting them go. So, if you want an accountant with the heart of a poet, the passion of a 1980s hair band and the intellect of Plato, you should really come on over and meet our accounting artisans. Tim and Bill aren’t the only virtuosos Bourke Accounting has to offer, though! Our bookkeepers are not only the best in the business, but they give Tim and Bill a run for their artistic money (you should see the wreaths these people made for their office doors this holiday season!).

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Being a New York City transplant, I was a bit skeptical about what sort of dining experiences could be had in Louisville, Kentucky. Without knowing much about the place, I (with my snarky NYC attitude) decided that I would probably starve without sympathetic pals sending me palatable supplies from home.

I can admit when I’m wrong and I take back every word. Louisville offers some of the most amazing restaurants that I have ever had the pleasure to frequent. According to Zomato.com, there are 202 restaurants in St. Matthews alone and 2,362 in the surrounding areas. If you can’t find something insanely great to eat in Louisville, you’re not trying.

So, in no particular order, here are three places that I just can’t live without in my new hometown:

1) Asahi Japanese Restaurant. Located in St. Matthews, this place offers fairly traditional Japanese food. Every entrée comes with miso soup and a really fresh salad with ginger dressing (this is the only dressing I eat). I don’t like sushi, but I’m told by people who do, that it’s incredible. I order the Shrimp Yakisoba with a hot sake. On Tuesdays, you can generally get two for one big bottles of the rice wine. However, if you’re not used to sake, you’d better start with a small.

2) Silvio’s Italian Restaurant. Located in a strip mall, this unassuming place has fed me the best Italian food since my grandma. Reasonably priced and offering huge portions, Silvio’s makes you believe that you’ll never have to eat again. The calamari appetizer is light and perfect, the fettucine alfredo is the best you’ll have and don’t forget to take some cannoli home for later. It’s also neat that the chef/owner Bill Silvio Melillo walks around the tables to shake hands. However, make sure you make a reservation. The place is tiny and popular.

3) The Irish Rover. Located on Frankfort Avenue and surrounded by exotic little stores, this place is perfect for a cold winter day. After holiday shopping, stop in for a Guinness (expertly poured) and the Cordon Bleu Fritters. If you’re still hungry after that, I suggest the Fish and Chips or Pub Burger. However, don’t fall for the server’s temptation of Bailey’s Cheesecake or else you won’t be able to walk out of there without some help.

If you’re a new transplant like me, you might not know about the culinary delights to be experienced in Louisville. Also, you might not know that Louisville has some of the best doctors, lawyers and tax preparers anywhere. For example, our Bourke Accounting experts will not be put off if you’ve just moved from another state; they are up on tax laws from here and far. In addition, our Bourke Accounting bookkeepers know how to keep you legal no matter where you came from. Yeah, they are that good.

As a newbie Louisvillian, I can only help you with a few restaurants, but why not see what a Bourke Accounting expert can do for you? They are native and Louisville strong. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Last year, your cousin’s ex-wife’s gardener’s brother’s dog-walker prepared your tax return.

And…it didn’t quite turn out the way you were expecting.

Perhaps your cousin’s ex-wife’s gardener’s, etc. accidentally added another zero to your charitable donations. Perhaps he/she forgot to include that $15,000 1099 income.

Either way, the IRS would now like to have a little talk with you.

But it wasn’t your fault! How could you know that this tax preparer didn’t exactly know what they were doing? You, in good faith, trusted this person. Sorry to say, but “if the IRS audits you and discovers that the preparer made mistakes – intentional or accidental – you’ll have to pay any penalties and fees.” (Wisebread.com)

If a reputable and professional tax preparer made the mistake, you might have some consolation. According to Investopedia.com, if the mistake “results in fees or penalties, the service provider will often compensate the customer directly.” However, this is not always the case. If a tax preparer requires you to sign a contract, you’d better watch the language of the document you’re signing. Some tax preparers include loopholes to exonerate themselves from paying for any mistakes.

Tax preparation is sort of like the wild, wild west. Anyone can obtain a PTIN (preparer tax identification number) in 15 minutes for $50. When the IRS “tried to implement competency requirements for all tax preparers in 2014,” (CNBC.com), they were told by District Courts that they didn’t have the authority to enforce anything like that.

It won’t help to say, “I told you so.” It won’t help to wonder why you didn’t ask for references from the tax preparer’s other clients. However, all is not lost. I have, in two words, useful advice for you:

Bourke Accounting has a long history of satisfied clients. Not only that, Bourke Accounting offers free consultations. If you’ve been the victim of a tax preparer who was either a little uninformed or downright criminal, your Bourke Accounting expert is available to offer advice. It doesn’t matter how much trouble you think you’re in, your Bourke Accounting professional is more than up to the task. In fact, they enjoy a good challenge (we all know how much accountants love excitement and adventure).

So, before you start thinking of running to a tropical island to escape the IRS, come see what a Bourke Accounting expert can do for you. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Divorce is hard.

According to Uhhospitals.com, stress from divorce ranks right up there with a loved one’s death, relocating and losing a job. Generally, no one takes The Vow with the intention of getting divorced later; we’re looking for our happily ever after, not a messy break-up.

As if divorce wasn’t traumatic enough, it seems that the new alimony tax law, under the Tax Cuts and Jobs Act, is about to make things just a little more difficult for splitting couples starting after December 31st.

Reading the new guidelines on IRS.gov, I was surprised. And that’s putting it very mildly.

Under the old law, the payer was able to deduct the maintenance payments to their formal spouse on their tax return. Ok, that sounds about right. Likewise, the payee had to include those payments on their tax return. Sure, that’s income received. It makes sense that taxes should be paid on it. A sort of balance had been achieved.

However, 77 years after this law was introduced [CNBC.com], it seems that we had to shake things up a bit. Under the new law, everything is different. According to IRS.gov, the new law “states that the alimony…payments are not deductible by the payer spouse or includable in the income of the receiving spouse.”

So just what does that mean to the person receiving payments? A lot less money, according to CNBC.com. Because the payments are no longer tax deductible, CNBC acknowledges that “the amount that’s going to be paid to you is a whole lot less.” In addition, this is probably going to affect how much money is given for child support. The adage is true: you can’t get blood from a stone.

It’s not all bad news, though. Although divorcing couples will have less financial wiggle-room, this new legislation will “raise an additional $6.9 billion over the next decade for the government [CNBC.com].”

If you’re going through a divorce, you have a lot to think about. Besides dividing your record collection, your finances are also going to need a good going over by a reputable expert. Bourke Accounting specialists are well-versed with the new tax laws. Moreover, they can explain the inexplicable in a patient and comprehensible way. Finally, your Bourke Accounting professional is sympathetic and easier to talk to than your favorite bartender.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.