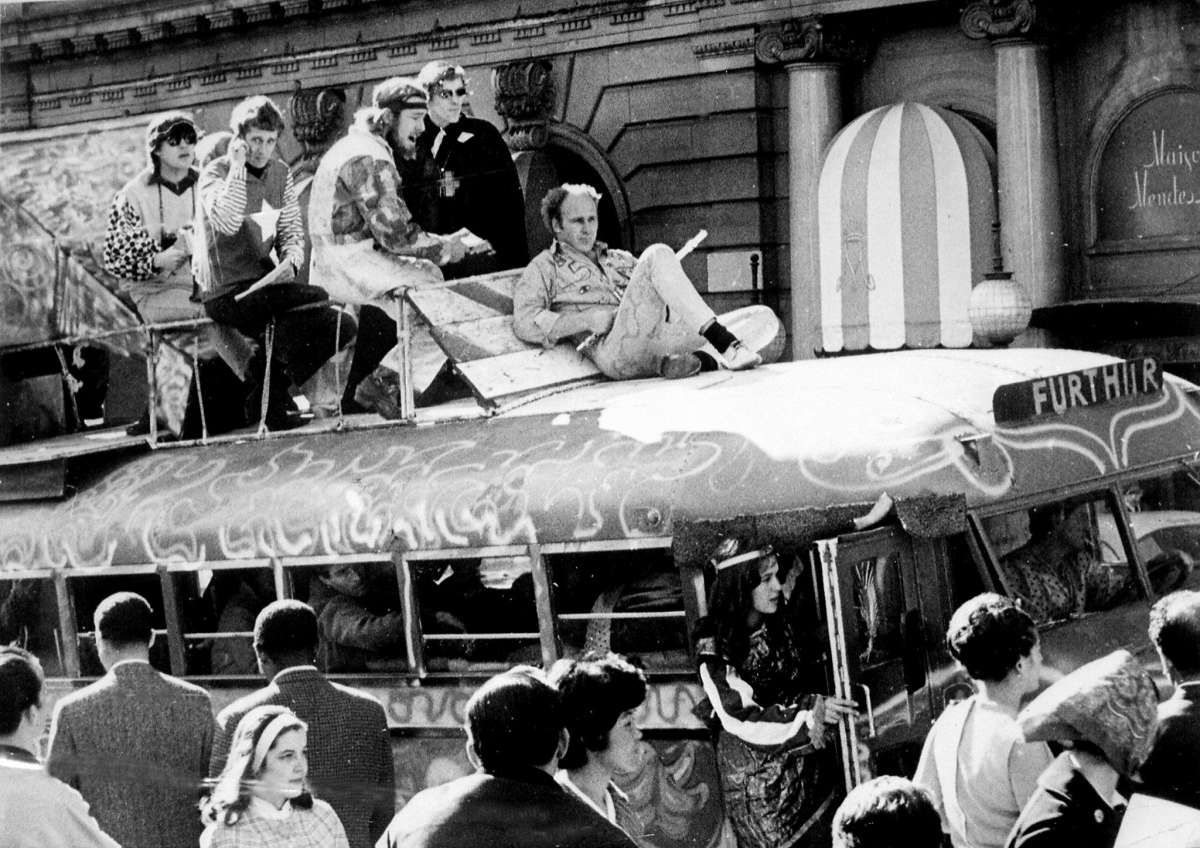

You’re either on the bus or off the bus. If you’re on the bus, and you get left behind, then you’ll find it again. If you’re off the bus in the first place — then it won’t make a damn. – Ken Kesey as quoted in The Electric Kool-Aid Acid Test, Thomas Wolfe

Bourke Accounting is populated by the open-minded. This could be because we respect the fact that not all people think the same. It could also be because being judgmental is very time-consuming and we have other things to do. For whatever reason, we tend to truly listen to ideas before deciding on the validity of it. However, this doesn’t just stand for home decorating and politics – we’re willing to entertain new healthcare concepts, as well. For example, when Oregon recently legalized psilocybin, the chemical that makes magic mushrooms magic, the majority of Bourke natives weren’t appalled.

Let’s just get a few things straight. First: your favorite Bourke pro doesn’t spend all day tripping and staring at M.C. Escher lithographs. Second: Oregonian psilocybin is only “legal for mental health treatment in supervised settings” (CNN.com). At this point, there won’t be dispensaries in Portland advertising buy-one-get-one ‘shroom sales and it is not legal for recreational use. In order to get mushroom treatment, the patient must be 21 and can only take it at a licensed facility with a certified therapist present (ScientificAmerican.com).

While this might seem a drastic move, seeking enlightenment through the use of hallucinogens is nothing new; ancient people in every geographical location have utilized these plants and fungi to gain insight. Even our own CIA conducted experiments under their mind control program, Project MK-Ultra. Perhaps one of the CIA’s most illustrious alumni was Merry Prankster and writer, Ken Kesey, who volunteered through his college in the 1950s (ScientificAmerican.com). Rumor has it that Kesey finagled a doggie bag to take home (or outright helped himself) and then introduced his artist friends to this new kick. No one can say that Kesey’s psilocybin experimentation caused the writing of One Flew Over the Cuckoo’s Nest, but then, no one can say that it didn’t.

Oregon’s interest in day tripping for better mental health is not coming out of left field. Recently, Johns Hopkins University published their findings regarding the treatment of “major depressive disorders with synthetic psilocybin” (ScientificAmerican.com). In this study, it was found that “71% of patients experience a clinically significant response and 54% met the criteria for total ‘remission of depression’” (ScientificAmerican.com). In addition, these effects were long-lasting. Finally, many researchers have seen positive results with psilocybin when faced with incorrigible anorexia, PTSD, crushing anxiety and depression caused by long-term illnesses. So, it’s not like Jerry Garcia is sitting behind “The Doctor is In” sign.

Could hallucinogens effectively treat sufferers? Maybe. It can’t be any worse than Prozac and its string of antidepressant-caused murders and suicides. If done in a controlled environment with learned doctors acting as guides, perhaps returning to the natural world really can help us to live happier and saner lives. Hey, no one would have believed that mold was capable of changing the world…

Bourke Accounting bookkeepers and tax preparers don’t need Owsley’s Acid to think outside of the box. No matter what your financial issue might be, your Bourke expert is innovative enough to offer beneficial options that will fit you. If money woes are getting you down, come see your Bourke Accounting professional before making that trip to Oregon. Bourke Accounting won’t open your third eye, but they will put you on a righteous, economic path just the same.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Last Wednesday, I was having a good day. Bourke Accounting gets into the holiday season in a big way – we’ve been receiving little presents, an hour is reserved daily for holiday-themed games and the lunches are catered. Driving home, jacked up on candy canes and tacos, I felt good. Yes, traffic was light, the sun was shining and all was momentarily right in my corner of existence.

I was in in the left lane. Earlier, I had noticed a car in the right lane swerving gently, but besides thinking “texting idiot,” I didn’t give it much thought. That is, until I felt the impact and heard the crunch. Bursting out of my vehicle, I was met with the formerly swerving car, now straddling both lanes. I’d like to say that I calmly inquired after the driver’s health. I did not. I’d like to say that I said, “Accidents happen, let’s exchange information.” No, I didn’t do that, either. Instead, I cast aspersions on the driver’s sobriety and intelligence – at a very high decibel. I threw my arms around like a Wacky Waving Inflatable Arm-Flailing Tube Man outside of a pawn shop. It was only after observing another motorist filming that I acquiesced to the driver’s request that we move our cars to a safer location.

Exchanging insurance information was the first obstacle, as my assailant didn’t have any. She then offered me $30 if I didn’t call the police. While waiting for the police to answer, she questioned why I was so angry (“It’s just a car”) and emptily observed that “at least no one was hurt” (I could have happily remedied that). Well, the cops advised that they weren’t sending an officer since no one was injured and recommended that I get her information. I copied her license number, etc. and offered some very specific wishes for her future.

I am not alone. About 13 percent of drivers on the road are careening into each other without insurance (NatLawReview.com). This is a problem because, for those of us who follow the law, we end up paying “for a portion of the costs for others who choose to disobey the law” (Content.NAIC.org). For example, in 2013, the average insurance claim for “bodily injury was $15,506” (PolicyGenius.com). If you, as an uninsured person, damaged someone’s car and spine, how would you go about paying that? If you had no assets, you could sadly shake your head, mutter something about not getting blood out of a stone and go on your way, right? No. If the courts decide that you’re to blame and can’t afford the medical bills, you could go to jail or have your paychecks garnished (PolicyGenius.com). So, you know, insurance is kind of a big deal.

Since I’m still paying on my car and, therefore, don’t really own it, I called my insurance company. The rep told me that they’d fix my car and then try to get reimbursement from the other driver. However, Kentucky is one of a handful of states that is considered a no-fault state. Basically, this means that, in order to avoid lengthy “she said/she said” arguments, it doesn’t really matter who caused the accident (Nolo.com). One of the big drawbacks of no fault is that, even though I didn’t cause the accident, the claim money is still coming from my insurance company (NoFaultInsuranceQuotes.org). However, if I had been seriously injured, I’d still have the right to go after more damages from the other driver’s insurance company (Nolo.com). It’s nice no one was hurt, but my premium will probably be going up.

It’s illegal to drive without insurance. Moreover, it’s unethical. If you can’t afford insurance then, guess what? You can’t afford to drive. Even if you’re the safest driver in the world, you can’t predict when you’ll hit a slick spot in the road or swerve to avoid a woodland creature. Protect yourself and others: get insurance.

A Bourke Accounting bookkeeper or tax preparer is a lot like having car insurance. Although you’re not planning on being audited by the IRS, if you have a Bourke expert on your side, you’re protected if it happens. Moments after advising your Bourke pro that you’ve been notified, your documents are looked at and a plan of action in is place. Sure, you can have an audit without Bourke at the table, but do you really want to roll them bones?

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

I didn’t sell out, Son, I bought in. Keep that in mind – Dad, SLC Punk!

Bourke Accounting bookkeepers and accountants like numbers. Bourke Accounting professionals also like money. It is because of these harmonious interests that our experts enjoy coming to work in the morning. In addition, these mathematically minded individuals are never asked to do anything unethical or demeaning; in short, Bourke Accounting folks are able to support themselves without the humiliation of “selling out.”

Since 2020 has been a rotten year anyway, it wasn’t surprising that LG Electronics made it a little worse. Last month, LG introduced an ad campaign which features an altered version of singer Old Dirty Bastard’s song, “Baby, I Got Your Money” for their WashTower washer/dryer. Dementedly happy washing machine users are shown bopping along with a vocalist who continuously insists “I got your laundry.” As ODB’s original song was not a “G” rated work, the use of this changed song is both laughable and disheartening; in addition, and as a special achievement, ad execs were also able to successfully declaw a bad boy rapper in his grave.

Since ODB is deceased, he can’t be blamed for this tacky travesty. Instead, we can only rail against insensitive advertising agencies and the money-hungry individuals who control the music rights. Unfortunately, this is cold and unsatisfying comfort. Well, at least we don’t have to worry about our living legends peddling their passions like pro lovers on 5th Street…right?

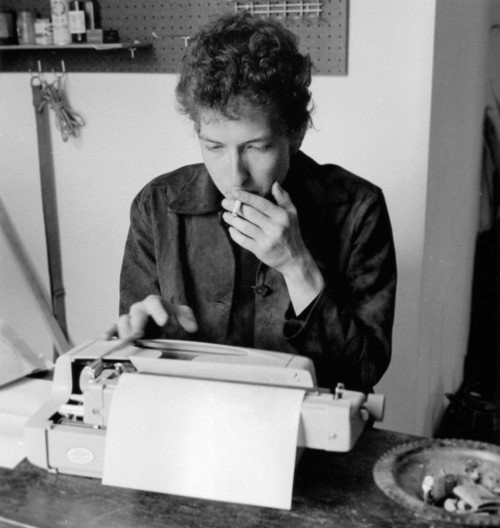

Not right, as a matter of fact. On Monday, Bob Dylan donned the telltale fishnet stockings and sold himself to the Universal Music Publishing Group. For an estimated $400 million, Dylan laid back, thought of God and country, and sold his “entire songwriting catalog – over 600 songs spanning six decades” (Vice.com). Dylan – the only songwriter to win a Nobel Prize for Literature (NobelPrize.org), the bringer of unrest and change, the snappy dresser, the pal of luminaries, the gravelly voiced sage – sold out.

Should we blame him? While Dylan is worth an estimated $350 million, he also has six kids and two ex-wives (Wikipedia.org). Also, the virus has wreaked havoc on income and portfolios all over the world; perhaps Dylan just wants to ensure that his family is well provided for. If that’s the case, he’s not alone: even ultimate hippie David Crosby has announced that he’ll be selling his catalogue as a measure to take care of his family and mortgage after being affected by Corona (APNews.com). Maybe it’s not selling out, maybe it’s just pragmatic future planning.

Except it’s not. No, Dylan’s new adventure in betraying his values is simply a base money grab. Dylan changed lives with his protest songs, now he’s sold his ideals to a heartless corporation; worse, Dylan just sold our shared history. While Universal now has the ability to decide where Dylan’s songs appear, experts speculate that Universal will avoid making choices that will cause Dylan to publicly object (APNews.com). Somehow, that doesn’t make it better.

It can be argued that Dylan’s newly commercialized music will introduce new generations to his genius – but it’s highly unlikely that, when “Just Like a Woman” is played during a showcase of feminine hygiene products, the kids will flock to find Bob Dylan. Some things should be sacred, but Bob doesn’t care about the implications of slinging the sublime from the back of a van. Poor form, Bob. Truly poor form.

As stated, Bourke Accounting bookkeepers and tax preparers aren’t prepared to sell out. Bourke Accounting pros don’t cut corners and they don’t break the rules for cash. Bourke experts are emotionally invested when practicing their arts and they will consistently work their hardest for your benefit. Anything else would be dishonorable.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

It can’t be stressed enough: tax season is a big deal for your accountant. At Bourke Accounting, we’re busy all year ‘round, but tax season? Tax season is the Big Show, Senior Prom and a heavyweight fight in Vegas all rolled into one. We start preparing for our time to shine way before you even receive your W2s; we send out reminders, buy office supplies and temporarily say “farewell” to our families and friends. Do we dig the busy time? We keep coming back, so we either love the excitement or we’ve lost the directions to the front door. Either way, your Bourke Accounting pros are gearing up from another numerological-fueled adrenaline rush.

Last tax season was confusing. Sadly, extended filing deadlines, delayed tax refunds, stimulus payment issues and noticeably MIA IRS clerks didn’t really foster much confidence during already turbulent times. However, this tax season is going to be smoother than the North Atlantic during the Titanic’s maiden voyage. We can feel it.

Just as Bourke Accounting natives are in the midst of preparations, you, gentle taxpayer, must do some legwork, too. As with normal years, you will need to collect your W2s, your interest statements, deductions (if you itemize), Social Security statements…basically just dump everything finance-related into a big bag and call it good. Keeping up with the chaos, however, you might just find that you have a few new and interesting documents to include in that Kroger bag this year.

Since virus precautions shut down many businesses, a lot of people found themselves furloughed or unemployed this year. All of a sudden, people used to consistently filing returns with only one W2 now have multiple forms to contend with. While this might seem a little self-explanatory, it’s important that you bring all of your W2s to your Bourke expert. Even if you only worked for a few months at a particular job, that W2 is still very important – the IRS already knows what you made and they don’t like asking for clarification regarding missing information. While it’s not a big deal if, after you file, you remember that you worked somewhere else for a few months, it’s an extra step. Remember that it’s always easier to file right the first time than it is to file an amended return.

Speaking of unemployment, if you received benefits after losing your job this year, you can expect to receive Form 1099-G by January 31st. Although your Bourke expert trusts you implicitly, it’s not enough to simply give a ballpark estimate of the compensation you received. Also, if you’re in a state that taxes unemployment, this form lets everyone know how much you paid. If you received unemployment and didn’t ask the agency to withhold 10% to cover your federal taxes (CNBC.com), just bringing your form will be enough to remind you that you very well might owe money this year. It’s a good idea to request withholding when you sign up for unemployment, but if you forget, you can fill out a Voluntary Withholding Request (Form W-4V) at any time to avoid being the recipient of an unhappy surprise at tax time.

Another exciting IRS form you might receive this year is Form 1099-INT, Interest Income. Because of the extended deadline, about 13.9 million taxpayers will get “a check averaging $18 on the interest on their refunds” (AARP.org). Last year, if you filed your return after April 15 but by July 15, you most likely received an interest payment from the IRS. While your $18 won’t even cover dinner and drinks, remember that any interest over $10 has to be reported (IRS.gov). Since the IRS sent you that cash, they’ll consider it a nice “thank you” gesture if you would be so good as to report it this year.

This tax season will be mellow. Everything will work just the way it was designed to work. There will be no bombshells to disrupt our mellow tax season. If we say this often enough, our dream can be reality. After all, positive thinking is the first step to a positive outcome!

If positive thinking doesn’t work, you still don’t have anything to worry about. No matter what the world or the IRS throws at your Bourke Accounting pros, they will lead you to financially safe shores. When you trust Bourke Accounting experts with your return, you can rest easy knowing that they are aware of what changes are transpiring and exactly how to address each one. Don’t forget to wish the accountants in your life a Happy Tax Season!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Recently, Bourke’s Super Podcast featured Phil, Bourke Accounting’s Administrative Executive. During his interview, Phil spoke about seeing The Black Crowes perform and marveled at how great they play live. The comment was made that it’s obvious who uses studio trickery when a band is left all alone in front of an audience – poor musicianship can’t be disguised with autotune when the engineer was left back at the studio. However, upon further reflection, this isn’t necessarily true.

Remember how America found out, after the record skipped during a “live” performance, that Milli Vanilli were just a couple of lip-synching finks? Or what about when Ashlee Simpson graced us with a bizarre little jig after her record malfunctioned during her appearance on Saturday Night Live? After these calamities, we had to acknowledge that, sometimes, recording stars get through performances with a little stereophonic assistance. We were betrayed, disgusted and just a bit more cynical; at the end of the day, we moved on without psychological damage.

While being lied to by celebrities isn’t fun, sometimes their shenanigans can actually cause us mental distress. Not only do these people mess with our minds, but they can also inspire us to be just as disingenuous as they are. Take, for example, Instagram.

It’s no surprise that magazines airbrush their models to create perfect goddesses and gods. As soon as the very first photo was taken, no doubt someone was close behind with ideas on how to manipulate the image. For years, young people have been warned against comparing themselves to the unrealistic representations that fill the glossy pages, and for the most part, we see the charade for what it is. However, social media sites, like Instagram, seem to create and exacerbate disordered thinking. These sites tend to passively encourage users to one up each other by documenting exaggerated, glamourous lives peopled by the most stunning examples of human pulchritude. And, a lot of the time, it’s all a load of bull.

When you see an Instagram post of a Kardashian, you know that some editing chicanery is involved. Even if we’re not sure why someone is famous, we understand that the celebrity is the product and a certain look is expected. However, these editing techniques have bled into the lives of regular folk. For example, FStoppers.com recently announced that 13% of women admit to editing every selfie they post. What’s more, 34% of men confess to doing the same (FStoppers.com). So, instead of actually taking care of ourselves, we’re simply learning to edit better.

In a chilling move, the makers of the app FaceTune (this is the editing tool that makes people look like poreless aliens) have created a “version that’s focused solely on retouching faces in videos” (USAToday.com). Now, you can clear up your skin, shed a few pounds and puff up those lips, all in moving images. It’s rather frightening to wonder what the next step in technology will be.

False lives and false images are nothing to aspire to. While we all want to look nice, photoshopped butts shouldn’t have the power to decimate our self-esteem. It’s important to keep things in perspective and remember: everyone gets ingrown hairs, everyone gets boogers and a lie is never better than the truth.

Bourke Accounting bookkeepers and tax preparers always look nice, but they’re not perfect. While Bourke’s pros keep it genuine on social media, they are just as real with their clients. A Bourke Accounting expert will never make unrealistic promises and they don’t believe in excuses. When you sit down with Bourke reps, you sit with the most honest, arithmetically-gifted professionals in the business.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Good co-workers are like staple removers: they’re incredibly useful and, once you’ve experienced one, you can’t imagine ever going without. Take Bourke Accounting for example. If you were to step into Bourke’s breakroom, you’d be amazed at the amount of information going back and forth. Having relationship issues? There’s a co-worker to encourage you not to set fire to the offender’s car. Not sure if you should sign up for the company’s insurance plan? There’s someone to examine the ins and outs of the program with you (and also to remind you of the importance of health insurance). A good co-worker offers more than a Google search could ever dream of.

Good co-workers are like staple removers: they’re incredibly useful and, once you’ve experienced one, you can’t imagine ever going without. Take Bourke Accounting for example. If you were to step into Bourke’s breakroom, you’d be amazed at the amount of information going back and forth. Having relationship issues? There’s a co-worker to encourage you not to set fire to the offender’s car. Not sure if you should sign up for the company’s insurance plan? There’s someone to examine the ins and outs of the program with you (and also to remind you of the importance of health insurance). A good co-worker offers more than a Google search could ever dream of.

What usually makes co-worker advice the best kind is that the advice giver is a relatively objective participant. While the person (presumably) likes you, s/he doesn’t have the bias one would expect from an intimate friend or family member; the co-worker wants the best for you but doesn’t view you through rose-colored glasses. Because of this distinction, the counsel is generally based on logic and not emotion.

It could be argued that an innate desire for sound, logical advice led to the birth of the advice column. In 1690, The Athenian Mercury was the first newspaper to publish such a column and it was an instant and surprising success. It started with a group of fellas answering questions from readers about spirituality, careers and even the shape of animal poop (Wikipedia.org). By 1722, the concept had become so popular that even Benjamin Franklin was offering advice under the identity of “Mrs. Silence Dogood,” a witty, minister’s widow (USHistory.org). By the early 20th century, advice columns had left animal poop behind to delve into interpersonal personal relationships and etiquette. It’s probably not shocking that this evolution was caused by women and the cash they brought along with them.

At this point, the lives of women were changing. All of a sudden, women were educated, voting and working. When advertisers and publishers noticed that women were also reading publications that included these columns, well, it was a no-brainer to saturate the market with advice (Medium.com). These columns gave women a place where, unlike in other aspects of their lives, they “called the shots and controlled the conversation” (Medium.com). In an interesting turn, these columns also reflected and perhaps contributed to changing social norms and morals. For example, in 1942, a reader condemned career women and wondered how homemakers could protect their marriages from employed “homewreckers.” Columnist Dorothy Dix was quick to defend working women as simply trying to support themselves and instead blamed any “office flirtation squarely at the door of the male boss” (Medium.com).

Besides encouraging tentative steps towards equality between the sexes, these columns also advocated sexual tolerance. In the 1960s, Pauline Phillips of “Dear Abby” fame was vocal concerning her beliefs regarding gay people. When a reader wondered what to do about her lesbian daughter, Phillips responded that the only thing to do was “accept her as she is and let her know it” (Medium.com). Phillips long lamented that the sole dysfunction of gay people was the stigma placed upon them by an ignorant society (Medium.com).

Advice columns give us a chance to anonymously ask potentially embarrassing questions. In addition, these columns prove that we’re not alone out here by showing that there are plenty of citizens going through similar situations. In short, advice columns are evidence that we’re all in the same boat and help is available.

Bourke Accounting bookkeepers and tax preparers are good at giving advice. Whether you have a quick withholding question or queries regarding the implications of a messy divorce, Bourke Accounting experts have the answer. Much like the best advice columnists, Bourke Accounting pros want you to have the best life possible and they’re willing to help you achieve that.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Bourke Accounting professionals are fairly civic-minded; we know that we don’t live in a vacuum and, as humans, it’s sort of our job to help each other. This is not to say that we’re over here, single-handedly saving the world, but we do what we can. This fact has become pretty apparent now that the giving season is lurking just around the corner: a good percentage of our daily mail is made up of donation reminders from charitable organizations.

Even with the CARES Act allowing non-itemizing taxpayers to deduct up to $300 of donations on tax returns, many of us will find ourselves unable to donate this year. Reduced work hours or total job loss mean that there is less “extra” money available to help those in need. Although monetary donations help charities continue their good work, we can still perform good deeds this year without ever opening our wallets. After all, money isn’t everything.

One suggestion is that we all become organ donors. The coronavirus has affected nearly all aspects of our lives, including creating a shortage of donatable organs. For example, 33% of donated organs originate from traffic accidents and, because of lockdowns and travel restrictions, we’ve seen a 23% decrease in these accidents (Forbes.com). After accidents, strokes and heart attacks are the second and third most common ways in which we receive organs. However, more people are passing at home instead of hospitals right now, making their organs unusable as a result of lost blood flow (Forbes.com). While it’s hoped that your benevolence doesn’t come to fruition for many years, your donation can potentially save multiple lives and it only takes a minute to sign up as a donor.

Another non-financial way to help is by donating bone marrow. Obviously, this is more involved than signing a check, but it’s worth it. Bone marrow donations help people with illnesses such as leukemia, sickle cell anemia and immune deficiency disorders (HopkinsMedicine.org). Right now, only 2% of our population is currently on the national registry for marrow donation (IJ.org); with around 18,000 people who could benefit from this gift each year (BloodStemCell.HRSA.org), we need to step it up. While bone marrow donation does entail an actual medical procedure, it’s very safe: considering the more than 35,000 people who have donated, there has never been a single recorded death (IJ.org). Documented side effects include hip and muscle pain, fatigue and headache (BetheMatch.org). Of course, no one likes side effects, but donors agree that these side effects, while annoying, are not severe and are fairly short-lived. As one donor stated, “Yeah, my body hurt for a while, but what’s that compared to a kid being at her 8th birthday party” (Personal conversation with donor)?

If you don’t want to think about your internal bits and pieces, what about donating hair? There are many organizations that want your hair to make free/low-cost wigs for people living with maladies such as chemotherapy and Alopecia. A quick trip to your stylist can mean the world to an afflicted person by providing “self-confidence, strength and hope” (Cancer.net). With very little effort on your part, you can prove that no one is ever really alone.

There are a lot of worthy causes out there. In general, but specifically now, we should give what we can to help each other. Whether you’re able to donate money, time or even just a sympathetic ear, let’s remember that it’s the giving season. And keep in mind: studies have shown that there’s a link between generosity and happiness!

Bourke Accounting bookkeepers and tax preparers are givers. Bourke Accounting reps will go far out of their way to make sure that you’re always satisfied. To Bourke Accounting experts, half a job is no job at all and their work proves this to be true. At Bourke Accounting, there is no such thing as an unhappy customer.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Can you feel that? There, right there! Surely you must have felt that…no? That’s okay, Tax Season is coming whether you’re ready or not!

Last Tax Season disappointed the experts over here at Bourke Accounting. The extended deadline robbed them of the drama and adrenaline-driven urgency they’ve come to crave. There were no last minute, anguished calls from clients, desperately trying to file hours before the11th hour. We didn’t work late – we didn’t even work on weekends! Yes, last Tax Season can be chalked up as an all-around disappointment. Hopefully, this Tax Season will fulfill Bourke Accounting’s expectations.

Thanks to the CARES Act, it seems that this year’s tax returns are shaping up to be a little more interesting than usual. For example, some people have wondered if they’re going to be taxed on that stimulus check we received a few months ago. While taxpayers need to report the stimulus payment on their 2020 return, it’s being treated as a fully refundable tax credit and, therefore, not included in gross income or subject to taxes (Barrons.com). So, for anyone who was worrying: you don’t have to.

Besides stimulus payment questions, taxpayers are also speculating about their Paycheck Protection Program loans. The Paycheck Protection Program was designed to help small businesses attempt to survive in a Covid world by allowing them to borrow 2.5 times their monthly payroll costs (or $10 million, whichever was lower) (SmartAsset.com). As long as the money was used to pay for approved business expenses, such as payroll, rent and utilities, the loans will be forgiven. However, the IRS warns that “any expenses paid with money from those PPP loans cannot be deducted from taxable income” (DaveRamsey.com). In addition, in order for the loan to be forgiven, taxpayers must have a loan forgiveness application approved by the Small Business Administration (DaveRamsey.com). However, with the SBA “processing the applications for $525 billion in loans given to 5.2 million borrowers,” (DaveRamsey.com), authorities suggest getting comfortable, as application approvals are going to take a minute.

Another CARES Act change we’re going to see this year has to do with early distributions from retirement accounts. Usually, if you were to raid the 401(k) cookie jar before your 59 ½ half-birthday, you’d be slapped with a 10% penalty. However, the powers that be realized that it’s not too cool to penalize unemployed people for feeding their families with their own money and have temporarily waived the penalty. In order to avoid paying 10%, the reason for the distribution has to have something to do with the virus; job loss, quarantine, reduction in pay/hours or the closing of your business all count as coronavirus-related reasons for distributions (ConsumerFinance.gov). Remember: if you’re planning on an early, penalty-free distribution, you only have until December 31st of this year to make it happen!

These are just a few of the tax return/Corona-related modifications that we can look forward to this Tax Season. Trust me, there are more. It’s comforting to know that, even though 2020 has gone sideways, the IRS and Congress are still busily working on guidance to help tax preparers and taxpayers get through another bizarre Tax Season!

While Tax Season is far off in the distance to you, Bourke Accounting experts are getting ready. By the time you drop off your important documents, Bourke Accounting pros will already know how to handle any issue that might pop up. Bourke Accounting’s bookkeepers and tax preparers know that, without dedication and education, Tax Season is simply impossible.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Bourke Accounting professionals and Santa Claus have one important thing in common: they both know if you’ve been bad or good. Unlike judgmental Santa, though, if you’ve been bad, Bourke Accounting tax preparers won’t abandon you to your coal-filled fate. If you cashed out your 401(k) early to invest in a remake of Battleship Earth, you won’t hear lectures from your Bourke expert. You will, however, receive advice regarding the implications of that 10% early withdrawal penalty.

Bourke Accounting professionals and Santa Claus have one important thing in common: they both know if you’ve been bad or good. Unlike judgmental Santa, though, if you’ve been bad, Bourke Accounting tax preparers won’t abandon you to your coal-filled fate. If you cashed out your 401(k) early to invest in a remake of Battleship Earth, you won’t hear lectures from your Bourke expert. You will, however, receive advice regarding the implications of that 10% early withdrawal penalty.

Another similarity between Bourke financial geniuses and Santa can be found in personnel. Behind the scenes, Bourke is lucky enough to have top-tier receptionists and assistants who ensure that every process, from beginning to end, runs smoothly. And Santa? Santa has Elf on the Shelf.

In 2005, America was introduced to Carol Aebersold and Chanda Bell’s book, The Elf on the Shelf. This book, which tells the story of Santa’s “scout” elves, comes with a dead-eyed, grinning elf of your very own. The concept is that these elves stalk children and snitch to Santa if bad behavior occurs. One of the cardinal rules for The Elf on the Shelf is that children are prohibited from touching them – to do so will make the elf lose her/his magic (ElfontheShelf.com). Which, in effect, probably means that the elf dies. Charming and fun-filled childhood memories will be had by all, no doubt.

The Elf on the Shelf doesn’t just traumatize children; parents get their fair share of stress, too! You see, each night, the elves return to the North Pole to squeal to Santa about their 2nd grade victims’ behavior. When the elves land back home, they, naturally, land in a different place in the house. Yes, the parents are expected to move the creepy thing each night so that the subterfuge of a traveling, living elf continues. Not only do parents have to move these creatures, but they also have to make it look like their particular elf was actually doing something. Sometimes, the elf is naughty and can be found making angels in piles of flour. Sometimes, the elf is sweet, perhaps offering a small gift to her/his young hostage.

Since the holidays wouldn’t be the holidays without some controversy, mental health practitioners have weighed in on the potential dangers caused by the Elf on the Shelf. One school of thought is that the lie regarding the creature’s autonomy “threatens the trustworthiness of parents” (Childrens.com) and could later damage the parent/child relationship. In addition, these doctors predict that, when children learn the truth, they will forever wonder what else parents have lied about and live with low-grade, continuous suspicion for the rest of their lives.

Another issue is that this game teaches kids to turn off their critical thinking skills and inspires belief in concepts that don’t make much sense (PsychologyToday.com); Dr. David Kyle Johnson goes so far as to blame gullibility as a “contributing factor to the decline of American civilization” (PsychologyToday.com). And you thought it was just a game! These shrinks fail to mention that children will believe that they are under constant surveillance. It seems that possibly creating a paranoid personality disorder isn’t as detrimental as encouraging kids to be gullible. Finally, medical professions worry about the pressure parents might experience when trying to outdo the creativity of their friends on social media (Childrens.com). Seriously, parents could suffer from self-esteem degradation because their elf post didn’t get as many “likes” as their friends’ post.

While sort of menacing, The Elf on the Shelf is just a harmless and sort of cute new tradition. Maybe we don’t need to attach such importance to it; sometimes a creepy doll is just a creepy doll.

Bourke Accounting bookkeepers and tax preparers are just like Santa Claus, but better. Bourke Accounting assistants are just as vigilant as The Elf, but nowhere near as intrusive. If you want prizes for your good behavior this year, visit Bourke Accounting pros and see what they can do for you. We swear we’ll give your Elf on the Shelf ideas more “likes” than your Facebook friends!

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.

Like a lot of you out there, we at Bourke Accounting are changing our Thanksgiving plans this year. Most of us will be avoiding the road trips, with tinfoiled casseroles held precariously on knees, and relatives’ crowded tables. None of us made the decision lightly – and we are bummed – but at the end of it, staying home makes the most sense to us.

Officials all across the country are pleading with Americans to rethink their holiday plans. Last Tuesday, Kentucky’s Governor Beshear suggested that the guest list for food-related festivities be limited to people living in the same household (APNews.com). While it’s difficult to uninvite friends and family and break with long-held traditions, it’s important to face the facts: we’re sitting in the middle of a pandemic. The CDC, knowing it’s hard to tell us what to do, does offer advice for those having Thanksgiving as usual. Their guidance includes things like wearing masks the entire time, bringing your own plates, avoiding areas where food is being prepared, social distancing, designating one person to serve food and, if possible, staying outside for the duration (NBCNews.com). Yeah, no, none of that sounds fun.

So, if you decide on a very small Thanksgiving, remember that there are a few silver linings involved:

1) You don’t have to cook and clean as much. While most of us keep our houses presentable, not all of us keep things to Great-Aunt Marge’s white-gloved standards. Just think, you won’t have to clean behind the refrigerator or vacuum the driveway this year! Also, with a truncated guest list, you won’t have to spend as much time in the kitchen or be nearly as obsessed with perfection. Finally, you won’t even have to dress up. Depending on your situation, you don’t have to dress at all (Note: cooking devoid of clothing is not recommended)! Although you’ll miss the crowd, this could be the mellowest Thanksgiving of your life.

2) No chance of family squabbles. In these divisive times, the chances that you and your entire guest list lean the same way is highly unlikely. Although you might try your hardest to avoid ideological debates with family, it’s not always possible. Depending on your situation again, this could be the first Thanksgiving without a heated political debate resulting in a table flip. That’s right! You won’t have to scrape stuffing off of the walls because conservative Uncle Bob and liberal Cousin Cindy couldn’t see eye to eye on the election! And if you can’t escape controversy during a FaceTime session, you can always “accidentally” hang up and wait until everyone cools down. To summarize: mellow Thanksgiving.

3) It’s just one year. The pandemic won’t last forever and if we follow the rules today, we’ll all be together again next year. As scary as things are out there, it’s only natural to want to be surrounded and comforted by family. It’s tempting to pretend that everything is normal and forget about everything for a day. However, everything isn’t normal and if we act like it is, someone could get hurt. No one wants to be reminded that we’re living in dire times, especially during the holidays, but we don’t have any other choice. As much as it hurts, we have to alter our traditions this time ‘round and come together by staying apart.

In less than two months, we’ll be able to say “goodbye” to 2020. 2021 won’t be magically perfect, but at least the stigma of ’20 will be left behind. We’ve all sacrificed this year, but someday, hopefully soon, we’ll find ourselves stronger and in a better place. We can’t forget that we still have things to be thankful for.

Bourke Accounting tax preparers and bookkeepers will be thankful when they can shake your hand again. Until that time, your Bourke Accounting pros are available, using a myriad of methods, to ensure that all of your needs are met. Bourke Accounting experts are here for you, even if they’re not holding your hand right now.

Come see us any time. Our number is 502-451-8773 and don’t forget to visit our website at www.bourkeaccounting.com. See you soon!

Written by Sue H.